European Cross-Border Crowdfunding Rules

The set of European cross-border crowdfunding rules had been in development for quite some time – the first thesis regarding this activity was released in 2018 in European Business Organisation Law Review. The official publication of the regulation, however, occurred pretty recently – in November 2020.

The Regulation on European Crowdfunding Service Providers for Business (ECSP) applies to both lending-based crowdfunding and investment-based crowdfunding, but does not cover donation- and reward-based platforms. The rules govern campaigns that aim to raise up to €5 million, while any fundraisers that do intend to reach a higher goal are regulated by MiFID II and Prospectus Regulation.

ECSP was put forth by The European Parliament’s Committee on Economic and Monetary Affairs (ECON). The Regulation essentially erases the crowdfunding borders between all of the EU Member countries. Instead of following each state’s individual protocol, they are now presented with a single set of rules to go by, responding to ECON.

Here are some highlights for cross-border crowdfunding platforms:

- Service providers will not be allowed to take deposits from the public (unless explicitly authorised)

- In addition to classic P2P lending platforms, the Regulation covers other crowdfunding services, including risk assessment of crowdfunding projects

- When it comes to equity crowdfunding, the Regulation permits services related to transferable securities as well as the more standard equities

- Service providers are obligated to have a policy in place to ensure the transparency of project selection on the platform

What you will learn in this post:

The need for cross-Border crowdfunding in Europe

Up until recently, each state of the European Union only had its own domestic rules and regulations. However, what they all have in common is that foreign crowdfunding platforms and investors are not allowed to operate on the grounds of any given country.

Take the example of Italy – the European Crowdfunding network emphasises:

In accordance with applicable Italian laws, foreign Equity- based Crowdfunding Platforms cannot directly operate in the Italian market without the prior obtainment of relevant authorisation by CONSOB, unless the platform is granted a MiFID EU licence which will allow the performance of the activity in Italy through the establishment of a local branch, or directly without any establishment of a local branch, or through an agent established in Italy.

Hence, the only situation in which another European crowdfunding platform is able to operate there is if it’s granted a special license and a local branch is established. There are a number of weaknesses that such an approach creates for the economy:

- Invisible bureaucratic barriers put FDIs off from investing large sums and starting their businesses. Although the paperwork states that the process should only take a couple of days, in reality it can last weeks.

- Smaller member states, like Luxembourg and Ireland, are put at a disadvantage, with the majority of projects centered in larger and more advanced locations. In countries such as France and Germany, their large populations make crowdfunding a more economically feasible activity. This draws foreign investors and potential towards them, leaving other states behind.

- The EU is the largest hub for foreign investments in the world, but many smaller countries of the Union are experiencing losses in FDI amounts due to underdeveloped infrastructure. Breaking down the walls between the crowdfunding segments in each of the countries could aid not only in intra-European trade & investment, but also in attracting foreign capital.

Benefits of cross-border crowdfunding for SMEs

Cross-border crowdfunding already has a niche set aside for it on the European fintech market – it’s only a matter of time before it becomes a common practice. Once that happens, the industry will unleash a number of long-acting benefits:

- Promote sustainable development in line with the 2030 Sustainable Development Goals. By opening up opportunities for international crowdfunding, European countries make a step towards sustainable development, such as putting an end to poverty, creating new jobs and establishing economic growth, and building up innovation and infrastructure.

- Expand the available financing opportunities and broaden the pool of investors for countries with small populations that don’t have a large “crowd”. By giving access to investments not only from home-based backers, but from those from all over the union, fundraisers from countries like Ireland and Luxembourg will be able to acquire the finances that were previously only accessible through traditional banking.

- Strengthen the economy of the entire union collectively by reinforcing international trade and relations. Cross-border crowdfunding provides a foundation for a more transparent and risk-free exchange between parties.

- Narrow the economic inequality gap. Since SMEs constitute the majority of any country’s ecosystem, supporting them and helping them flourish in smaller countries boosts the overall economy and ultimately leads to an increase in GDP. This evens out the income levels across all of the European countries and improves financial stability.

The obstacles for European cross-border crowdfunding

In the early days of every financial endeavour there are unavoidable impediments and risks, especially when it’s applied on such a massive scale as the whole of the European Union. Potential crowdfunding service providers need to be aware of some acute issues cross-border crowdfunding will be facing in the future:

Digitalisation

Digitalisation, as opposed to traditional crowdfunding, presents the Member States and the parties within the crowdfunding system with new challenges.

In particular, data privacy is of special concern among both backers and fundraisers. This raises the issue of the lack of trust between the crowdfunding service provider, the authorities and the service users.

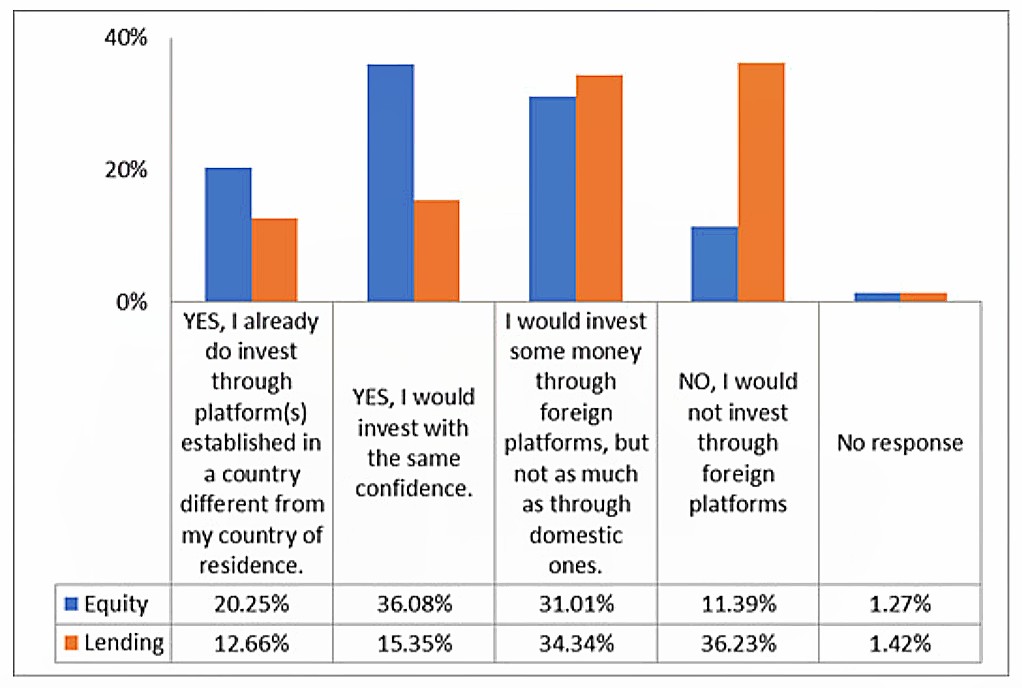

For example, a survey by the European Commission has already demonstrated that only 36% of equity crowdfunding users would be willing to invest in foreign crowdfunding platforms, and as little as 15% of debt crowdfunding users support the idea. The key to resolution lies in meticulous security protocols, open communication between all the parties and updates to the Regulatory framework in order to introduce more detail.

Market expansion costs

Since the cross-border crowdfunding segment is completely new, the initial costs required to create and expand the market make up a potential obstacle.

Regulatory barriers

There are a number of regulatory barriers arising due to unavoidable legal uncertainty. Despite the Committee’s best attempts to create a single sandbox, EU legislation and national laws create a certain disparity that might make the rules unclear and introduce confusion.

How to license a cross-border crowdfunding platform

In order to establish yourself as a crowdfunding service provider, you must apply to your local European Member State authority rather than ECON. The application details are listed in Chapter 3, Article 12 of ECSP.

Upon submission, the review of the application takes 25 days.

In case it is accepted, the applicant is notified, followed by a three month period of further analysis. The assessment evaluates all the basic aspects of the crowdfunding services to be provided, including their scale and complexity.

The application can be rejected if the local authority sees a threat to the business continuity and client consideration of the potential platform, but in all other cases the project may come through.

Naturally, there is no requirement for the physical presence of the service provider on the territory of any of the Member States.

Final thoughts

In the EU, crowdfunding has become one of the most crucial financing routes for small businesses and startups due to its flexibility and a liberal approach as opposed to traditional bank loans. Not only is it an accessible way of funding, it also provides numerous non-financial benefits, including networking and promotion. However, traditional sets of regulations state that backers only invest in domestic projects, which limits the amount of capital that enters the country’s economy.

Cross-border crowdfunding is an entirely new entity that has recently been approved in the EU. It holds a lot of promise for small and medium businesses, opening up opportunities for international networking and larger pools of potential investors.

LenderKit can give the necessary push for an aspiring service provider to pioneer in this exciting area. Since we aren’t a Software as a Service company, we can allow the flexibility that is essential to adapt to this new market niche. Our white-label crowdfunding software can be customized and poses a great alternative to a less pliable provider such as Sharein. Moreover, our substantial expertise on the British and European fintech markets gives us an advantage of knowing the nitty-gritty of the legal and business environments.

For advice on crowdfunding in European countries and to find out about our products, contact us at hello@lenderkit.com.