Automate your investment business in the USA

Launch a funding portal or broker-dealer platform under the Reg CF, Reg A/A+ or Reg D with LenderKit.

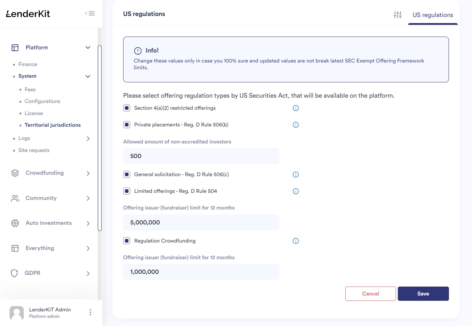

Build a USA regulations compliant crowdfunding platform

Title III Crowdfunding or Reg CF

Set up a crowdfunding portal for public fundraising of up to $5 million for non-accredited and accredited investors.

Reg A/A+ crowdfunding portal

Focus on Tier 1 or Tier 2 of the Regulation A and create a crowdfunding platform for real estate or startup investing.

Reg D private placement software

Empower your private investment management business and provide a unique platform for your clients.

Set up a Regulation Crowdfunding portal

Follow the SEC guide to register as a funding portal or broker-dealer while building your Regulation Crowdfunding platform with LenderKit.

You can start with a pre-built white-label crowdfunding solution and request customizations on demand to make your platform unique. We’ll set up a debt or equity crowdfunding platform to help you automate fundraising, investment management, transactions and reporting.

Create a Regulation A portal

Whether you focus on Regulation A Tier 1, Tier 2 or both, LenderKit provides an investment management software which can be tailored to the Reg A offering type requirements in your state of operations.

Depending on the stage of your business and its goals such as pitching to the board of directors with a proof of concept or launching a full-scale platform with custom functionality, we can help you set a funding portal or broker-dealer platform.

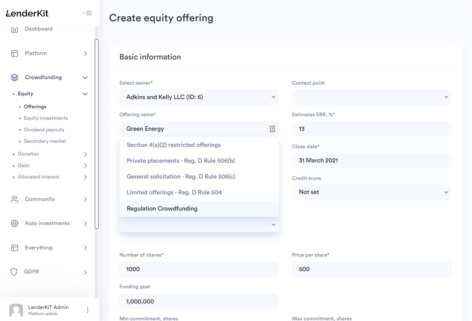

Launch a private fundraising platform

If you’re looking to set up a fundraising platform for accredited investors under the Regulation D we can help with that. LenderKit fits both public and private fundraising and allows a capital raising company or the admin of the platform choose the offering type and regulation under which the fundraising is happening.

The regulation selection allows to build transparency on your platform and facilitate filing and reporting requirements.

LenderKit software solutions

Marketing website

A website is what investors and fundraisers find in search, so it has to be fast, SEO-friendly and stylish. We provide several pre-built layouts to help you get started quickly.

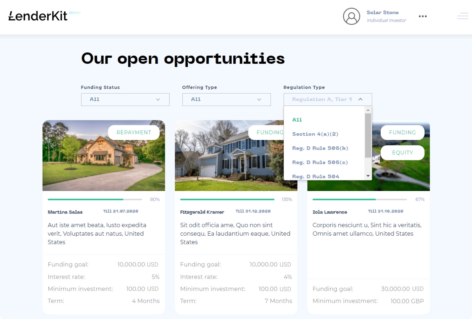

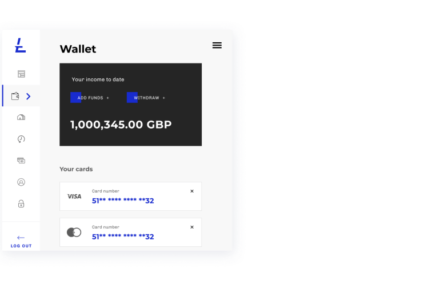

Investor portal

An investor portal is the account area where investors can allocate interest and invest and fundraisers can create new offerings. Investor portal is where users go after they register through the website.

Admin back-office

The admin area is suitable for individual and corporate use. The role-based access to the platform’s analytics and functionality ensures security and allows teams to manage transactions, investments, users, offerings and more.