How to Launch your FCA compliant crowdfunding platform

Crowdfunding in the UK is regulated by the Financial Conduct Authority, and you need to have appointed representative license for crowdfunding or be directly authorized.

What is an Appointed Representative and what it means for your business?

Helps you comply with FCA regulations

A regulatory consultancy with its Principal Firms will review your company. Once accepted, the Principal Firm will take responsibility for your compliance so that you are exempted from the robust requirements of the FCA.

Allows you to operate a regulated platform

Working with an AR provider and reporting into one of its Principal Firms as an Appointed Representative, under their regulatory “umbrella” will enable you to run an investment platform in a matter of weeks, rather than a year or more.

Saves you time and money

Obtaining an FCA license for your crowdfunding platform can be daunting if you’re just starting out. Becoming an AR allows you to concentrate on the operational aspects of your business while saving time and money.

Why starting a crowdfunding platform as an appointed representative?

There are many reasons to build a crowdfunding platform and become an appointed representative depending on your business stage and requirements.

For example, if you’re launching an operational platform (MVP), running on a strict budget or currently exploring the regulatory framework an appointed representative can be your solid start to enter the crowdfunding market.

- Launch an MVP

- Register a platform

- Save time and money

- Explore the regulations

- Consult a professional firm

- Explore the market

How to set up a regulated crowdfunding platform in the UK

The FCA defines an appointed representative (AR) as a company or an individual who conducts regulated operations and acts as an agent for a company that is directly licensed by the authority.

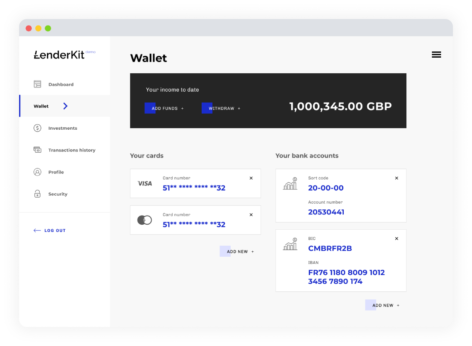

At LenderKit, we provide crowdfunding software tailored to your business model which you can use to apply for an AR license or register your platform directly with the FCA.