Top 5 Investor Concerns About Crowdfunding Platforms

“You need to treat crowdfunding schemes as fun purchases”, “most crowdfunding platforms are not entirely honest”, “the sites claim to do due diligence, they don’t” – things you can hear on Q&A platforms like Reddit in crowdinvesting-related threads.

Although the main risk and concern for crowdfunding investors “will I ever get my money back?” remains the same, there are also other questions keeping investors awake at night. Shares reselling, tax incentives, lock-up periods – to name a few.

Let’s see what investors think about crowdfunding and how platforms reply to such requests.

Investor thoughts on crowdfunding

Alternative financing opens a lot of new avenues for retail investors, but for some reason, investors are sceptical about crowdfunding. Especially backers-newbies and those who once failed.

For example, GowerCrowd says that in 2020, 60K real estate backers participated in deals out of an enormous number of investors registered on crowdfunding platforms.

RealtyMogul says last year 200K+ potential backers signed up only for their platform.

So what stops sponsors from donating to crowdfunding pitches?

We’ve researched some of the investment forums and Q&A platforms to find out how backers understand the risks and how crowdfunding platforms respond to the investor concerns.

What you will learn in this post:

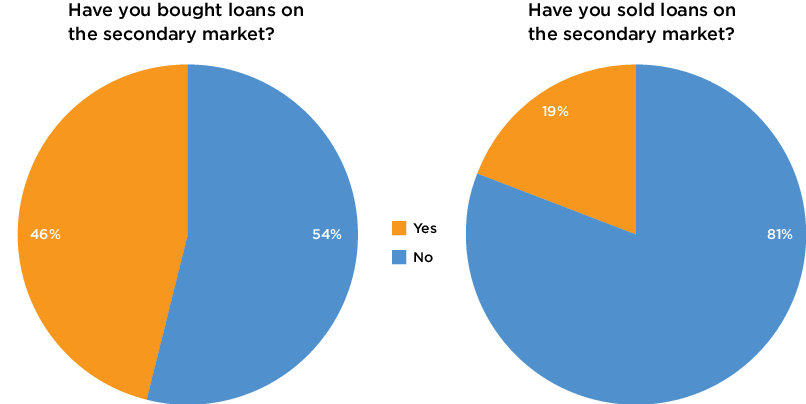

Has anyone ever sold shares?

Every other investor-to-be wonders if their peers have ever sold shares purchased from crowdfunding platforms.

The point is that in most cases equity investors buy shares of early-staged companies that are at the pre-IPO stage.If a company supported by investors becomes successful, backers can sell shares during the IPO stage or get dividends on their shares.

Some platforms have a lock-up period after the IPO during which you can’t redeem your shares, others suggest selling them on the secondary market.

The same situation happens with p2p loans: lenders tend to choose the platform with a secondary market for loans or their fractions in case of the borrower’s default.

Here are a few crowdfunding platforms that offer an “exit strategy” for investors.

Microventures has a lock-up period (90-180 days) that prevents shareholders/insiders from selling their stocks right after the IPO. Microventures offers private late-stage secondary investment opportunities only for accredited backers.

FundingCircle also has a built-in secondary market for reselling loans and parts of them. For now, the secondary market is closed due to the COVID-19 situation.

Charm Impact warns clients that when the loan is fully funded, it’s impossible to assess the invested money. Also, there’s no secondary market for undesired loan commitments.

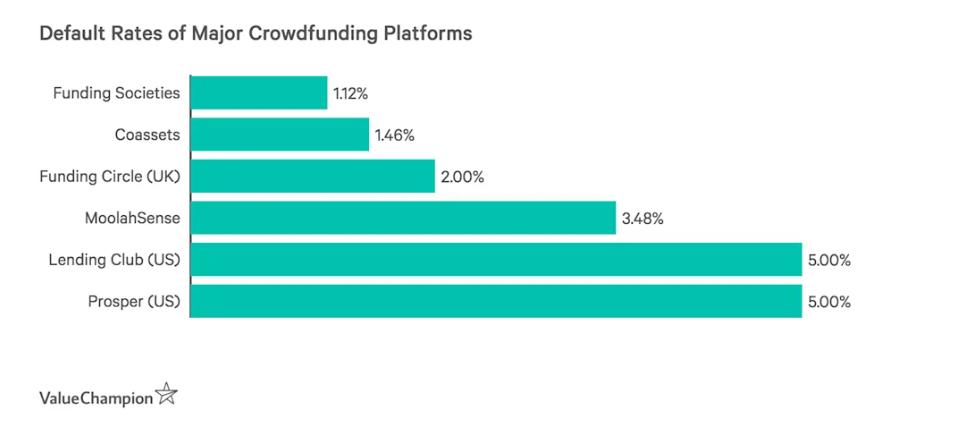

Are crowdfunding deals really vetted or shady?

Although regulators oblige crowdfunding platforms to run due diligence checks to protect investors, some of them may not do their job very thoroughly. And when they do, they provide extremely low rates that may not be worth taking the risk. This problem is extremely acute when it comes to business to business crowdfunding.

Logically, those investors who are willing to splurge big money, are very concerned about this.

Crowdcube conducts thorough due diligence using leading third-party providers such as Creditsafe, Experian and Onfido. They take into account any claims about business made by partners, counterparties, clients. The company keeps improving the due diligence processes and updating statements when changes are made.

Crowdstreet conducts due diligence on the business and deal level by the Capital Markets team who review potential sponsors with institutional-quality deals. Out of every 100 deals, approx. five pass the procedure. During the evaluation, Crowdstreet runs a background check, track record review, and sponsor designation.

Before onboarding a borrower, the Charm platform assesses its suitability. The procedure includes team and business model assessment, audited financial history review and track record check. In-person visits are made for double-check.

Am I in a good company?

When privately-owned companies with a seemingly good proposition reach out to the squad of retail backers, it looks and feels alarming.

Why don’t the fundraiser pitch to professional investors whose job is to build crowdfunding venture capital?

Freshmen in investing believe that businesses do it for “heavy marketing”, and “collecting seed capital at a cheaper price”, and even “to offer something of low cost that isn’t worth the attention of “smart money”.

Certainly, crowdfunding campaigns with institutional investors involved are more appealing to the crowd since they’re to deliver stable returns.

Some players work with both types of backers, among them are:

Auxmoney is a European-based online marketplace dealing with private and institutional investors giving money to pre-approved borrowers of different score classes.

LendInvest partners with professional and everyday backers. Although opportunities for both groups differ (institutions can donate through opportunity funds and secure bonds), the platform is considered to be in good standing.

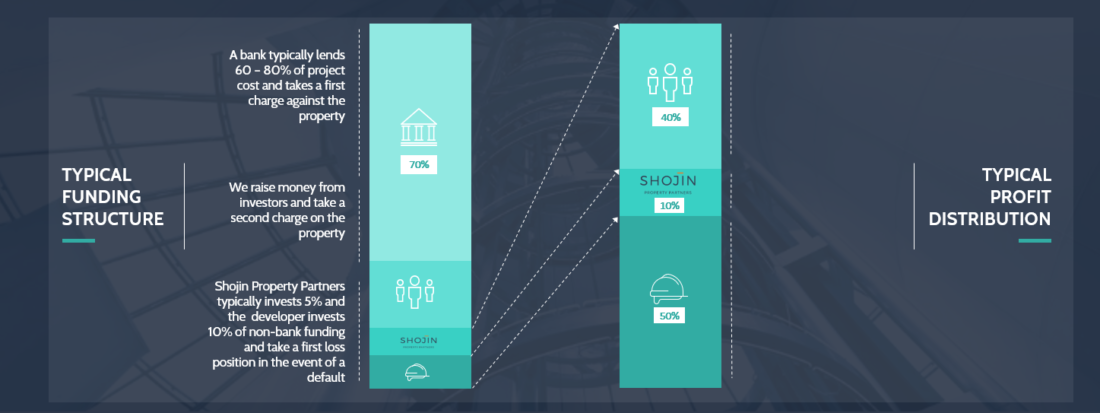

With Shojin, you can co-invest in property offerings with an expert community of professionals and the platform itself to share the risks and profits. It’s a great example of how crowdfunding platforms attract investors.

How do I manage taxes in crowdfunding?

One of the hot questions on investment forums is – “what are tax consequences of equity crowdfunding?”

In the UK, The Enterprise Investment Scheme (EIS) has many benefits for investors, in particular, financial risks mitigation.

EIS is based on a set of rules determining the type of company that can qualify for the scheme, annual investment limit, the purpose of money exploitation, limitation on trading activities, etc.

In the US, the Tax Cuts and Jobs Act created “opportunity zones” (OZs) and provided tax breaks as investment incentives.

Backers are encouraged to invest in opportunity zones by delayed or exempted capital gains tax payments after certain years.

For example, some industry players like Fundrise, RealCrowd, and Crowdstreet started crowdfunding projects to buy properties eligible for the OZ tax breaks. By doing this, they force retail backers to enter the real estate crowdfunding domain.

Platforms anticipating EIS-like schemes post the info on tax reliefs and incentives for backers in Help Centers, FAQs and their blogs. Do your homework before rushing with money in your fist to a random offering.

Please consult your tax advisor if you have any concerns regarding investments you’re going to make.

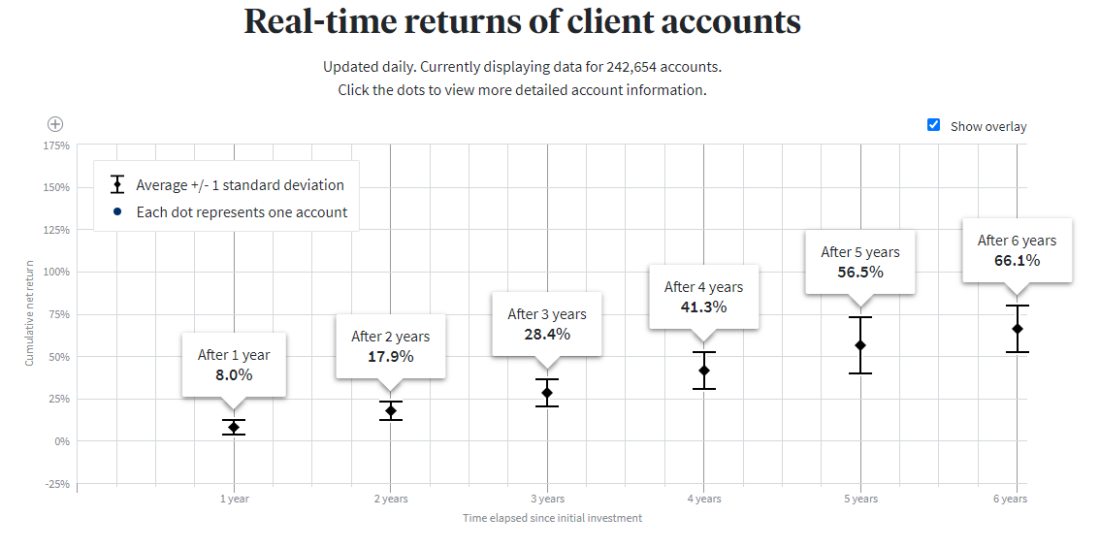

What type of crowdfunding fits my style, preferences and portfolio?

Typically, investors understand crowdfunding risks, but there are very vague areas related to the freedom of choice.

Crowdfunding has many shapes: funding startups and businesses at different stages, property deals, impact investing, even legitimate crowdfunding. Should I await stable returns or gamble and take a risk?

Real estate offerings are believed to bring lower, but more stable returns (somewhere in the 4-8% zone) to compare with startups funding.

Let’s look at the rates that different crowdfunding players offer today:

- CrowdStreet: 17.3% IRR

- Fundrise: 8-24% (for 1-3 year offerings)

- Modiv: 2-3% per year

Note, platforms may calculate returns by different metrics: IRR vs equity multiple. For comparison, use a unified approach.

You’ll hardly find an average return on platforms raising funds for startups as the IRR greatly varies. On the one side, the platform isn’t obliged to reveal the performance statistics, on the other side – it may scare potential backers away.

What you can find on websites for startups is the number of deals closed, investors joined, and funds raised.

Note, platforms may calculate returns by different metrics: IRR vs equity multiple. For comparison, use a unified approach.

You’ll hardly find an average return on platforms raising funds for startups as the IRR greatly varies. On the one side, the platform isn’t obliged to reveal the performance statistics, on the other side – it may scare potential backers away.

What you can find on websites for startups is the number of deals closed, investors joined, and funds raised.

Summing up the investor crowdfunding concerns

This list isn’t complete. If you wander around investor forums like this one, you’ll get even more concerns – from the lack of information about the fundraiser to shady platforms with painful fees and overvalued consumer business crowdfunding.

The most common questions refer to secondary markets, lock-up periods, risk-profit ratio, taxes, etc.

Opinions differ: some backers advise to abandon your cash and treat it as donations, others suggest doing a deep research, weighing risks and benefits before splurging.

Once you make your choice on the crowdfunding platform, look around and make sure you understand how the investment process works. As a rule of thumb, reliable platforms assist backers and try to protect their interests.

If you’re looking to build a crowdfunding platform which your investors will enjoy using, then reach out to us at LenderKit for a online demo of the crowdfunding software.