How to Start a Crowdfunding Business in Mongolia

Mongolia is a low-to-medium income country on track to rising to a medium-high. In recent years we have observed its early-stage economy blossom and expand, creating room for business opportunities and inviting foreign investments. The investment-based crowdfunding sector is raw but up-and-coming. There are a few things you need to know to start your own crowdfunding platform:

- Market standards

- Competition

- Regulations

- Registration process

- Challenges

What you will learn in this post:

The current state of the Mongolian crowdfunding market

Mongolia is typically overlooked as a country to do business in, and that is too bad – the state of the capital market across the country has never been better. The financial market is currently taking up 16% of the overall GDP, and the capital market is at 9.1% with the value of 2,693MNT, or $1 billion. This capitalisation holds a dramatic increase compared to 2015, when it was valued at 1400MNT.

There are currently more than 2400 businesses operating under the regulation of the country’s main regulatory body, including:

- Brokers

- Investment funds

- Joint stock companies

- Insurance companies and intermediaries

- Non-bank financial institutions

- Securities firms

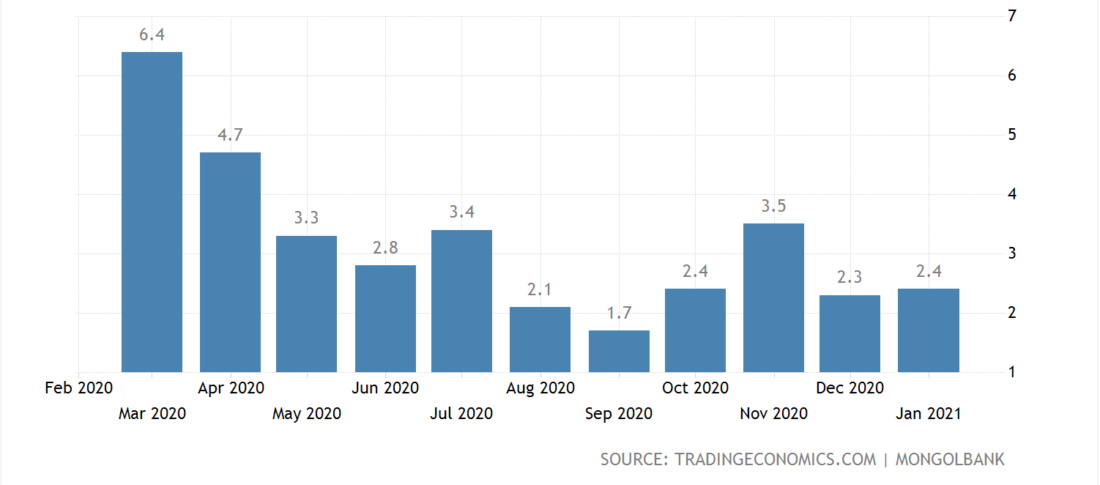

When it comes to long-term development goals, the Mongolian sustainable development plan for 2030 aims to end poverty and reduce unemployment – an endeavor they have so far been extremely successful in. Since the beginning of 2019, the unemployment rate has fallen from 11.8% to 7.3%. Additionally, over the past year the inflation rate has dropped by 4%, showcasing the country’s economic stability.

Moreover, since the resolutions were made in 2016 the annual economic growth rate has only increased – the most recent GDP growth rate statistic is as high as 6.6%, and the GDP itself is as high as it’s ever been at $13.85 billion.

Both debt and equity crowdfunding in Mongolia happens to be an emerging entity, meaning there are few strong competitors for startups and small businesses. The most recent major partnership is Fintech Hub AIFC with Titanium Technologies. Titanium Technology is a leader in innovations with branches all over Europe, and with their new VentureRocket Eurasia project in conjunction is a promising tool to attract capital in Asian countries.

Moreover, AIFC Fintech Hub has their own startup support program, Fintechstars, based in Kazakhstan. The program offers memberships for fintech startups, providing expert knowledge and training, a platform for networking and forming valuable partnerships, as well as cooperating with investment funds and private individuals.

Real estate crowdfunding in Mongolia is another promising branch of financial activity. For instance, MongolianProperties is by far the most flourishing investment platform currently on the market.

How to get started with a crowdfunding business in Mongolia

To start your online crowdfunding business in Mongolia, you need to study the market, explore the regulatory framework, understand the competition and find out what software to use.

Where to register your business

If you want to register your own crowdfunding platform, you must obtain a license from the FRC. There are currently 20 investment management license holders in Mongolia, and you can apply for a license on the FRC website here.

Once you’ve obtained the permit, you have the ability to establish more than one investment fund as long as you follow the Company Law and the Law on Investment Funds. In 2019 alone, 8 licenses for investment management activities were issued, with the number ever increasing.

Regarding the optimal location to register your crowdfunding platform, the capital is the obvious choice. UlaanBaatar houses the most licensed non-banking financial institutions – 86.2% of the national total. At the moment the industry is at its financial prime – the number of customers has doubled since 2018 and total assets have increased by more than a billion MNT over the past five years. However, you should bear in mind that in Mongolia, 94.8% of NBFIs are domestically invested.

What risks to keep in mind

There are several risks to keep in mind if you want to start a crowdfunding business in Mongolia. Perhaps the most crucial element to keep in mind is the actual size of the Mongolian financial market. Being a relatively small country with a population as low as 3.2 million, it also includes:

- very modest financial and banking sectors

- the majority of the nation is not as financially literate and involved in the market as one might wish

- the challenge of developing an environment secure and liquid enough for businesses to thrive in

Given the amount of government stocks and bonds in trade, one may conclude that corporate bond financing is very weak and the capital market is underdeveloped relative to more economically advanced Central Asian countries. There is an acute need to establish a secondary market and thus significantly upgrade current policies and regulations.

Luckily, the Mongolian regulatory authorities have taken great steps towards modernising and strengthening the infrastructure. Recent enhancements toward the Securities Market Law have already made significant changes in the Mongolian Stock Exchange and provided a platform for building up the capital market.

Crowdfunding regulations in Mongolia

Up until a couple of years ago, there was a complete lack of appropriate regulations in the financial sector, which made raising funds from the public a challenging enterprise. Even though recently crowdfunding in Mongolia has been getting more attention, the local regulatory bodies are still in the stage of exploration of such opportunities and in the process of establishing concrete laws.

There are two main financial market authorities in the country – the Financial Regulatory Commission and the Bank of Mongolia. While the latter is solely responsible for the banking sector, the FRC deals with several areas:

- Insurance market

- Securities market

- Microfinance market

- Non-bank financial institutions

- Savings and credit cooperatives

There are several regulatory frameworks for domestic capital markets, including laws on investment, investment funds and securities market. All of these are being actively improved – very recently as many as 185 provisions have been implemented in 10 different policy documents for the financial market, and 89% of them have been successfully performed.

Wrapping up

Although the financial market, including crowdfunding, is not yet full-fledged in Mongolia, the progress that has been made over the past several years is astounding and holds a lot of promise to both domestic and international economies.

If you are looking to start a business in a rapidly growing economy with a potential to expand across the entire Central Asia, now may be the perfect time to do so. Here at LenderKit we are happy to help, whether you want a customised crowdfunding platform or investment management software.