5 Biggest Crowdfunding Scams in History

Scammers pose one of the greatest risks of crowdfunding. Typically, fraudulent activity is associated with donation- and reward-based crowdfunding: take the famous multimillion dollar case of Jeff Batio’s Futurefön. But what about investment crowdfunding?

Unfortunately, equity and debt crowdfunding are no exception. The real estate sector in particular is a target of many fraudsters despite tight regulations by local and federal authorities. Here, we go over the different types of scams in crowdfunding, what governments do to prevent them, and how platforms can avoid being labelled a scam.

What you will learn in this post:

Types of Crowdfunding Scams

There are dozens of scams that are unique to donation and reward crowdfunding, but some also apply to investment-based platforms:

- Clone firms. By using an FCA registered company’s name, address and FRN, copycats set up websites that lead investors to believe that they are the real firm. This type of fraud observed a dramatic increase over the course of 2020, with FCA issuing a warning to over 1,100 companies – double the amount compared to 2019.

- Campaign fraud. This occurs when a business misleads the investors, either purposefully or accidentally, about the nature of the project, its progress and outcome.

- Misuse of funds. This scam involves the fundraiser taking the invested money for personal use rather than spending it on the project. Often in this case the project is never completed and investors’ requests for a return are ignored.

- Fake platforms. Scam platforms that imitate “the real deal” target unsophisticated and inexperienced investors that don’t investigate the site before using it. Although not all new crowdfunding platforms are malicious, it’s important to recognise signs of fraud.

- Unauthorised companies. Platforms that avoid registering with the appropriate regulation authority are unsolicited and illegal. Such companies often conduct fraudulent activities, placing their users at risk. Honest business owners that don’t register their firm end up being prosecuted.

Examples of Crowdfunding Fraud

SEC frequently releases litigations about the lawsuits that it brings to the federal court of the United States, similarly to the notices released by the UK’s FCA. Typically, such lawsuits result in the defendant losing their license and paying a sizable fine. Let’s take a look at a couple of examples:

- Property Income Investors LLC and Larry B Brodman. Raising $9.06 million through 11 companies and unregistered fraudulent securities offerings, Brodman and his associates promised that they would spend the money to purchase properties in South Florida to rent and sell them, paying a portion of the profits to backers. In reality, more than $2.3 million was misappropriated into private accounts and to pay commission to unregistered sales agents. As a consequence, Brodman and his associates will be required to pay a civil penalty, as well as significant disgorgement and prejudgement interests that may amount to millions of dollars.

- William C Skelley and Innovation Funding LLC. Skelley’s case is a prime example of misappropriation of funds and campaign fraud. He embezzled more than $1 million by providing false information to investors about the use of their funds and the number of real estate projects that his platform had financed. Consequently, he was ordered by the court to pay more than $2,3 million in March of 2021.

- The Legacy Group $29 million scam. Operating between 2014 and 2019, the principals behind the Legacy Group and associated corporations raised more than $29 million by selling fraudulent unregistered securities offerings to more than 200 investors, many of whom were unsophisticated and unaccredited. The securities were being marketed as an opportunity to invest into high-end residential properties “to flip” with an annual interest of up to 16%. In reality, the money was largely misused and most of the real estate development projects failed, causing their investors to lose more than $10 million.

- In November 2020 Lanistar Ltd was issued a warning from the UK’s FCA for being an unregistered company offering securities and services. Investing with unregulated financial firms poses a great security risk to backers and shows a lack of trust. Luckily, in May 2021 Lanistar finally obtained regulatory approval.

Regulations to Mitigate Crowdfunding Fraud in the US and UK

It’s difficult knowing how to mitigate crowdfunding fraud when it spreads so rapidly. In 2020 alone, FCA issued more than 1200 specific warnings to firms that were suspected in scamming. Let’s consider what the authorities in the US and UK are doing to avert the crisis.

United Kingdom

In the UK, FCA makes continuous efforts to provide security and protection to consumers that make high-risk investments and make appropriate investment products accessible. This has generated several documents, including the most recent discussion paper on “Strengthening our financial promotion rules for high-risk investments and firms approving financial promotions”.

The authority stresses: “Long‑term social and economic changes, many of which have been accelerated by the COVID‑19 pandemic, have resulted in more consumers using high‑risk investments. This has been exacerbated by technological advances that mean these products are now more accessible and easier to invest in.

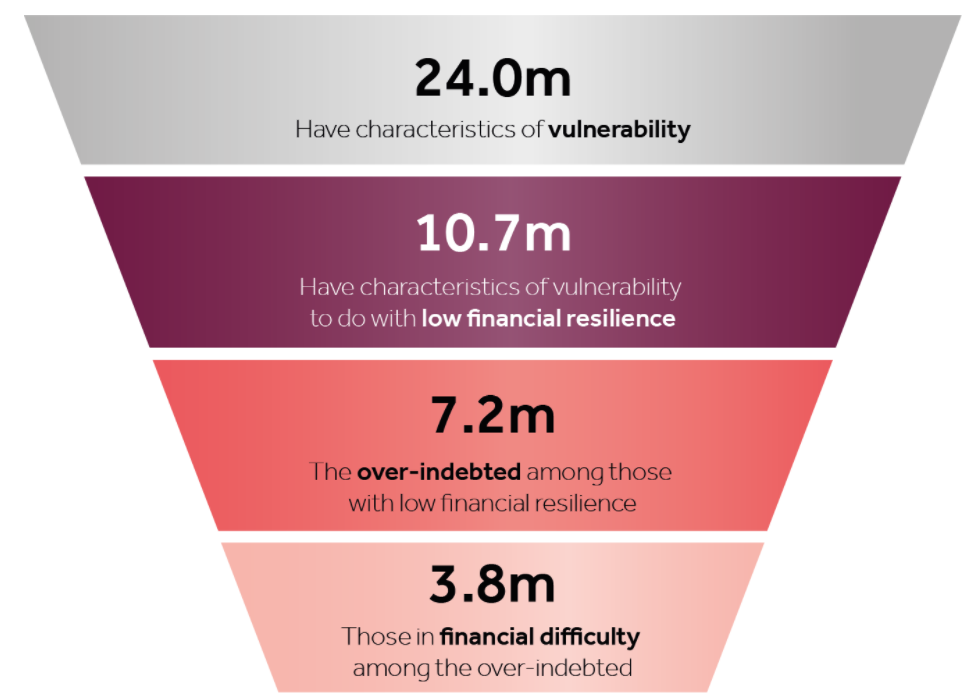

As a result we are seeing more consumers who are new to investing buying high‑risk investments, despite a majority being unable to cope with large investment losses and self‑assessing as having a lower investment risk appetite”. As a result, more backers are making high-risk investments despite a global increase in vulnerability due to the pandemic, as Figure 1 suggests.

Seeing that Google makes frustratingly little effort to prevent scam adverts from circulating all over the Internet, the FCA takes the matter in its own hands by imposing marketing restrictions, as shown in Figure 2. Notably, the authority has recently invested more than £300,000 to fight online fraud.

Furthermore, FCA encourages both new and experienced investors to be vigilant and make sure that the company they are working with is not included in the official FCA warning list.

United States

Like FCA, SEC have been reasonably active in ensuring the investors are well-protected. In particular, a lot of responsibility falls onto intermediaries as well as the officers and shareholders involved in securities exchange.

In 2015, the Final Rule of Crowdfunding was adopted by the SEC under the Securities Act of 1933 and the Securities Exchange Act of 1934:

Securities Act Section 4A(a)(5) requires an intermediary to “take such measures to reduce the risk of fraud with respect to [transactions made in reliance on Section 4(a)(6)], as established by the Commission, by rule, including obtaining a background and securities enforcement regulatory history check on each officer, director, and person holding more than 20 percent of the outstanding equity of every issuer whose securities are offered by such person.

The rule requires that an intermediary “have a reasonable basis for believing that an issuer seeking to offer and sell securities in reliance on Section 4(a)(6) through the intermediary’s platform complies with the requirements in Securities Act Section 4A(b) and the related requirements in Regulation Crowdfunding”.

The requirements in question are outlined here and include the following:

- Be registered with the Commission as a broker or as a funding portal

- Be a member of a national securities association

- Any director, officer or partner of an intermediary, or any person occupying a similar status or performing a similar function, may not have a financial interest in an issuer that is offering or selling securities through the intermediary’s platform, or receive a financial interest in an issuer as compensation for the services provided to or for the benefit of the issuer in connection with the offer or sale of such securities.

Moreover, the intermediary has a right to deny access to the issuer if they have not passed the background checks or present the potential for fraud or any other concerns for investor protection.

Also read: Reg A vs Reg D vs Reg CF – What's the Difference?5 Rules to Follow to Avoid Scams for Crowdfunding Platforms

Although a lot of fraudulent companies fail, not all failing businesses can be accused of fraud. The most common reasons for a crowdfunding platform to be labelled a scam without malicious intentions include misleading statements about the offerings and during progress reports, as well as failure to comply with regulations and adhere to the terms of securities.

That is not surprising given the sheer volume and complexity of the paperwork and regulations that need to be fulfilled. When starting your own crowdfunding platform it is often helpful to seek out support from professionals that are well-acquainted in the business.

Our white-label software, LenderKit, is highly customisable to suit any platform’s needs and is made to be compliant with all of the rules and regulations, both for SEC and FCA. Furthermore, after initial setup our team is there for ongoing support.

In order to avoid being labelled a scam, your platform must have the following features:

- A transparent communication channel

- Escrow account to store money securely

- 48 hour refund window

- Clear and concise information about offerings

- Conduct thorough due diligence with KYC/KYB/AML checks

At LenderKit, we build regulations-compliant crowdfunding platforms for SME or Real estate financing, drop us a line to learn more about the software options and services we can provide.

Conclusion

Although scams are more common in donation and reward crowdfunding, investment-based activities are not exempt from them. Scams have been on the rise since the beginning of 2020, but the regulation authorities in the US and UK are not standing still to take care of it, including substantial attempts to raise investor awareness.

It’s crucial for crowdfunding platforms to comply with regulations and provide means of transparent communication with investors and issuers alike.

If you would like to build a secure online crowdfunding portal with a focus on either P2P lending or equity crowdfunding, reach out to our Fintech Strategist.