Crowdfunding for Covid Projects: Is That a Thing?

No time to read? Let AI give you a quick summary of this article.

There are numerous reports and investigations on the impact COVID-19 had on the Fintech industry.

In general, the crowdfunding industry experienced a global downturn: the number of new campaigns decreased, investors lost interest and desire to splurge. Despite this, there are some obvious positive changes.

Many platforms like GoFundMe1, Crowdcube and StartEngine created new industry profiles to support individuals and businesses suffering from the pandemic.

Besides, some organisations like WHO2 turned to philanthropic crowdfunding in their fight with the crisis consequences.

By and large, COVID crowdfunding is here to stay, whatever form it may take in the future. The question is whether it’s worth taking up? We mean, should you bother with going this path and building a COVID crowdfunding platform?

What you will learn in this post:

From Vaccine crowdfunding to COVID-struck community financing

In March 2020, at the moment when COVID-19 began its fatal march around the globe, GoFundMe saw a substantial increase in overall online crowdfunding campaigns.

A study3 published by Social Science & Medicine found that more than 175,000 COVID-19-related GoFundMe campaigns in the U.S. raised more than $416 million, from January through July 2020.

Campaigns varied from individual needs to raise money for food or rent and to matching funds for businesses.

Some interesting facts4 about GoFundMe crowdfunding campaigns:

- the median campaign goal was $5,000

- Only 1% of campaigns received nearly 25% of all the money raised

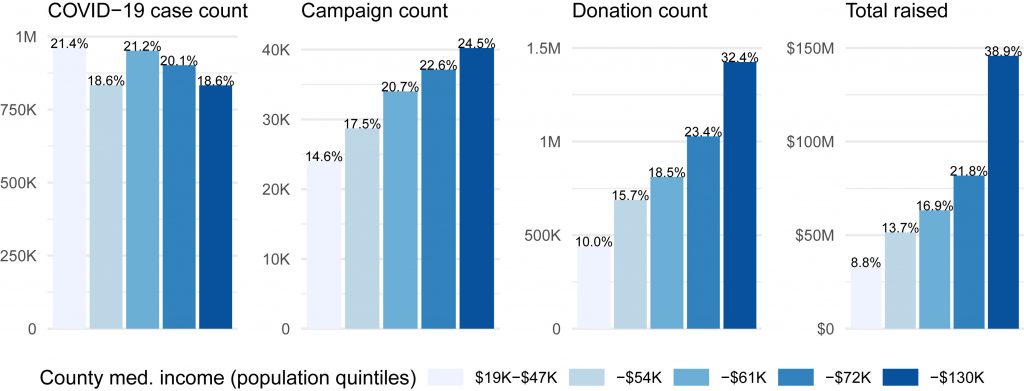

- The more COVID spreads around the globe, the more campaigns are created in the developed countries with higher education and income levels

- Business fundraising appeared to be more successful than individual projects

However, as the COVID-19 pandemic progressed, the number of GoFundMe campaigns dropped.

Partially it happened because COVID-19 isn’t so unique anymore, the society is got used to its presence in our lives. But it’s more about donation-based individual campaigns.

For business crowdfunding, COVID-19 has opened new opportunities.

We’ve found a few interesting cases on the Covid crowdfunding market for businesses.

#WirVsVirus (Germany)

#WirVsVirus Hackathon5 organised by the Federal Government brought together the private and public sectors to tackle social problems stemming from the COVID-19 outbreak.

A Matching Fund was one of the initiatives under the umbrella of the hackathon. Private companies, foundations and other players provided financial help to businesses solving COVID-related issues.

The fund is triggered when a fundraiser reaches the financial goal on the Startnext6 platform, and an extra 25% are taken from the fund monies.

Given that the model is rewards-based, it can take the form of investment crowdfunding.

Community Business Crowdmatch

An alliance between Crowdfunder and Power to Change called Community Business Crowdmatch7 is to help community businesses in England boost the funds raised.

Every community-supporting project that collects public money via Crowdfunder will be able to get extra financial aid from Power to Change who will match every pound raised with one pound up to £10,000.

The programme supports businesses who:

- Launch innovative ideas for local communities

- Experience high demand

- Seek monies to bridge a funding gap

- Strive to save a community space

The COVID-19 Solidarity Response Fund for WHO

The UN Foundation and the Swiss Philanthropy Foundation together have launched The COVID-19 Solidarity Response Fund for WHO to engage the public and the private sectors in financing the WHO’s response to the coronavirus pandemic.

The donations are to help WHO in addressing a number of COVID-related issues:

- suppress the disease transmission and reduce exposure

- reduce the disease exposure

- counter misinformation in the online and offline realm

- protect the most vulnerable sectors of the population

- provide the society with the access to all COVID-19 tools

The fund is supported by donors from all over the world: European countries, the UK, China, Japan, the USA, etc. Among investors are Facebook, FIFA, Google, Accenture, TikTok.

UNICEF’s VaccinAid appeal

On its Fundraiser campaign page8, UNICEF is gathering cash from everyone who isn’t indifferent for the vaccine delivery project.

Having vast experience in buying and delivering vaccines for children, UNICEF is planning to spread 2 billion COVID-19 vaccines around the world and provide 165 million treatments and 900 million test kits to help beat this pandemic.

The min amount of donations is £10, all the donations go to UNICEF’s fund. If the fundraiser hits the goal and manages to collect more money than needed, the rest of the funds will go to the Children’s Emergency Fund.

UK equity crowdfunding platforms and the Future Fund

In spring 2020, the UK government announced the launch of a dedicated Future Fund to assist startups experiencing difficulties during the coronavirus outbreak.

The Future Fund was delivered in a partnership with the British Business Bank and was open from May to September 2020. Partners managed to attract investments from some equity crowdfunding platforms, as Cambridge experts report in their survey9.

The convertible loans the Fund offers can help those businesses who are unable to access other government support programmes.

Who can turn to the Fund for financial aid?

- Businesses unlisted and registered in the UK

- Those companies who have previously raised at least £250,000 in equity investment from third-party investors within 5 years

- Those fundraisers who can attract the same amount of funding from third parties

Kickstarter, GoFundMe, Indiegogo and other platforms do crowdfunding for coronavirus projects of any kind and scale including new COVID-19 tests10, full-face modular masks11, rescue packages12, etc.

How to build a crowdfunding platform for COVID-related projects

If you’d like to promote and finance more COVID-related initiatives, you can start your own crowdfunding platform either with an out-of-box solution or build a custom one. We’ve got a solution for you – LenderKit – a flexible white-label software for any kind of crowdfunding business.

LenderKit is suitable for investment-based and non-investment-based crowdfunding businesses and supports various models including p2p loans, equity crowdfunding, donations and rewards.

When using LenderKit, you get:

- A feature-rich admin panel for platform management

- Personal dashboards for clients (borrowers and backers)

- One of four ready-made design themes

- Automated investment flows

- Fees management and e-wallets

- Secondary market

- User royals and permission settings

- GDPR module

You can also request to build a mobile crowdfunding app for investors. Backers can use the app to interact with your offerings and services, in particular monitor the product portfolio performance, view transactions, discover new investment opportunities.

Final thoughts on COVID investment projects

There’s hardly anyone or anything in the world untouched by COVID-19. People, businesses, industries – all should adapt to the new conditions and play by the new rules, which sometimes bring new opportunities though.

For the crowdfunding industry, COVID-19 has become a catalyst. New projects, new partnerships and even new regulatory rules (the SEC has recently facilitated13 capital formation for small businesses impacted by coronavirus) are what COVID-19 has brought to the industry table.

So, is crowdfunding for coronavirus projects a thing? Probably, yes, even though society is able to cope with the incidence rate, the consequences will remain heavy for upcoming years.

Given that crowdfunding can bridge the financial gap for many businesses and public companies, we may see new shapes and forms of COVID-19 fundraising projects.

Article sources:

- How to Help Those Affected by COVID-19 - GoFundMe (UK)

- WHO launches crowdfund for COVID-19 response

- Crowdfunding as a response to COVID-19: Increasing inequities at a time of crisis

- Pandemic-era crowdfunding more common, successful in affluent communities | UW News

- Hackathon on Corona: #WirvsVirus brings solutions

- Startnext - Mutige gestalten die Zukunft

- Community Business Crowdmatch | Crowdfunder.co.uk

- Help UNICEF deliver vital COVID-19 vaccines

- PDF (https://www.jbs.cam.ac.uk/wp-content/uploads/2021/03/2020-ccaf-global-covid-f...)

- C3 Test for Coronavirus & COVID-19

- Blanc: Face the world with the only full-face modular mask

- Lawnbrook Estate V2020 COVID-19 Rescue Package

- PDF (https://www.sec.gov/rules/interim/2020/33-10829.pdf)