Crowdfunding in Europe: Can You Rely on Crowd Only?

The European Cohesion Policy 2021-2027 considers crowdfunding as a powerful finance source that can help the EU achieve ambitious goals of harmonious and strong economic and social development.

Given this, ESIF Managing Authorities (MAs) are planning to use crowdfunding platforms to streamline financial flows to underserved niches and domains.

And there are already visible “initial signals” of this trend.

The positive statistics in the pre-covid period shows the growing number of active platforms and finance volumes, as well as an increasing pool of investors.

However, it’s still questionable – whether startups and businesses can totally rely on public crowdfunding only? And who is the crowd in crowdfunding in Europe?

If you’re seeking answers to these questions, this article has got you covered.

What you will learn in this post:

Who is the crowdfunding target audience in Europe?

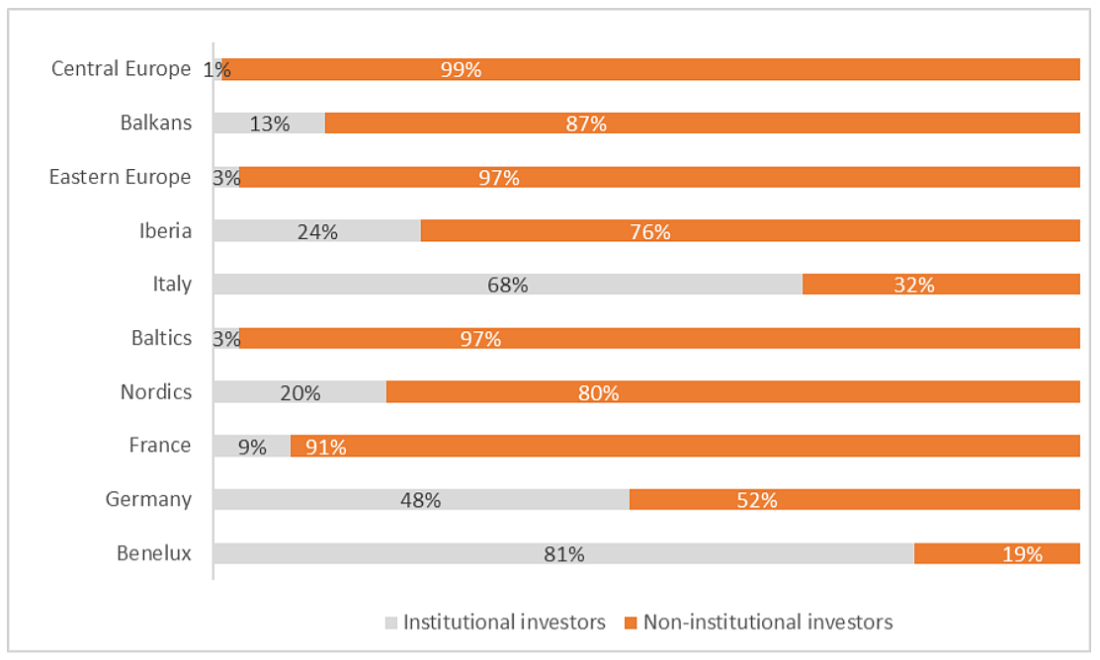

By default, crowdfunding intends to empower individual backers to support worthy projects. And, indeed, the numbers say that individuals make up the largest part of the European investment pools.

However, the percentage of institutions involved in crowdfunding has increased in recent years, as providers from Italy, Benelux and Germany report. Eastern Europe and the Baltic States still have low levels of institutional funding – about 3%.

One of the initiatives of the European Commission in this direction is long-term pools of capital and private funds.

As the Association for Financial Markets in Europe (AFME) states in its report, European long-term investment funds (ELTIFs) are the target investment audience for crowdfunding.

The existing regulatory framework has certain restrictions of ELTIFs’ operational, marketing, and distribution activities and should be adapted to the crowdfunding needs.

Updates to the framework will hopefully extend the array of assets required for the funds’ scalability and open ELTIFs for retail backers.

Obviously, the European authorities and regulators focus on both investment groups: institutions and everyday investors, to make crowdfunding beneficial for both.

Notably, the European Commission is currently working on the EU strategy for retail investors.

The consultation paper calls on individuals, households, and different organisations representing consumer/retail investor interests to discuss the strategy of turning citizens into active retail investors.

This strategy is expected to:

- match non-professional backers with worthy offerings;

- create appropriate conditions for affluent citizens who need financial advice;

- enhance financial literacy among all groups of backers;

- Provide relevant financial disclosures of projects and ESG factors.

Also read – how to launch your ESG crowdfunding platform.

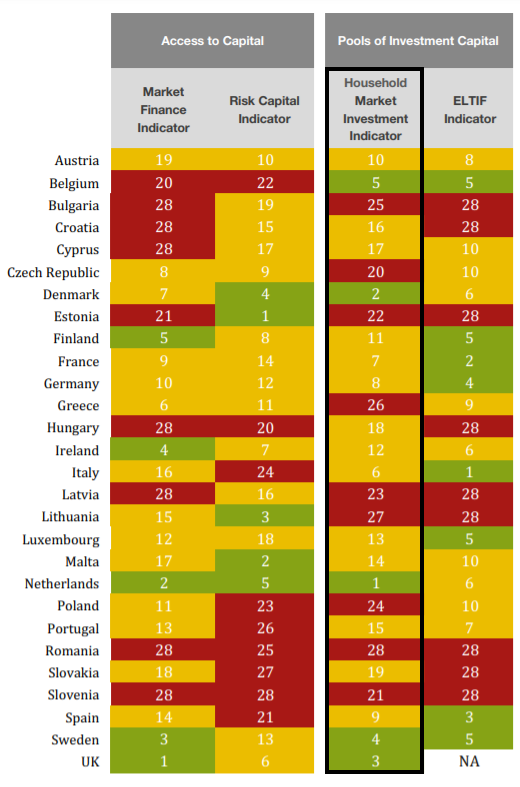

The household market investment indicator is the key measure for analysis of the activity of retail backers in the European crowdfunding market.

It measures the amount of savings retail investors pour into financial instruments (bonds, equity shares, investment funds, and pension funds) as of %GDP.

According to Eurocrowd report, this indicator has grown by 13% in 6 years (in 2015 it was 2% and in H1 2021 it was 113.3%).

Interestingly, the Netherlands and Denmark have the largest household market investment indicator among all European countries, which means the pools of retail capitals in these countries play a significant role in the economic development of these countries.

Can a business raise funds from crowdfunding retail investors only?

It’s a hard question. Let’s say that not every business or project can rely on public or private crowdfunding. There are cases when external financial help, e.g. governmental grants, is needed.

But first, let’s look at successful campaigns that managed to raise funds via European platforms.

Oceanvolt, a Finnish designer and manufacturer of electric motors for sailboats, managed to raise €2M during the first round on Invesdor.com in 2019. The financial goal of the second round was from €400,000 to €1,500,000.

HarBest Market, a B2B Marketplace that connects restaurants with farmers for the purchase of fruit and vegetables, exceeded the target goal of €564,000 with the help of crowdfunding user personas on Dozen.

Another example of a small business that was lucky to meet the minimum funding goal, even exceed it, was a GRAGGER & CHORHERR wood-fired oven baker. The crowdfunding platform 1000×1000.at connected 141 retail investors and raised €202,405 for the project.

There are thousands of similar success stories from European public and private crowdfunding portals like Crowdcube, Seedrs, Ulule, and EstateGuru.

One of the limitations of crowdfunding platforms is the fact that not all investors with sufficient funds can take part in deals.

Governmental grants bypassing crowdfunding campaigns

Europe is experiencing a mainstream of public authorities providing grants to project owners outside crowdfunding platforms.

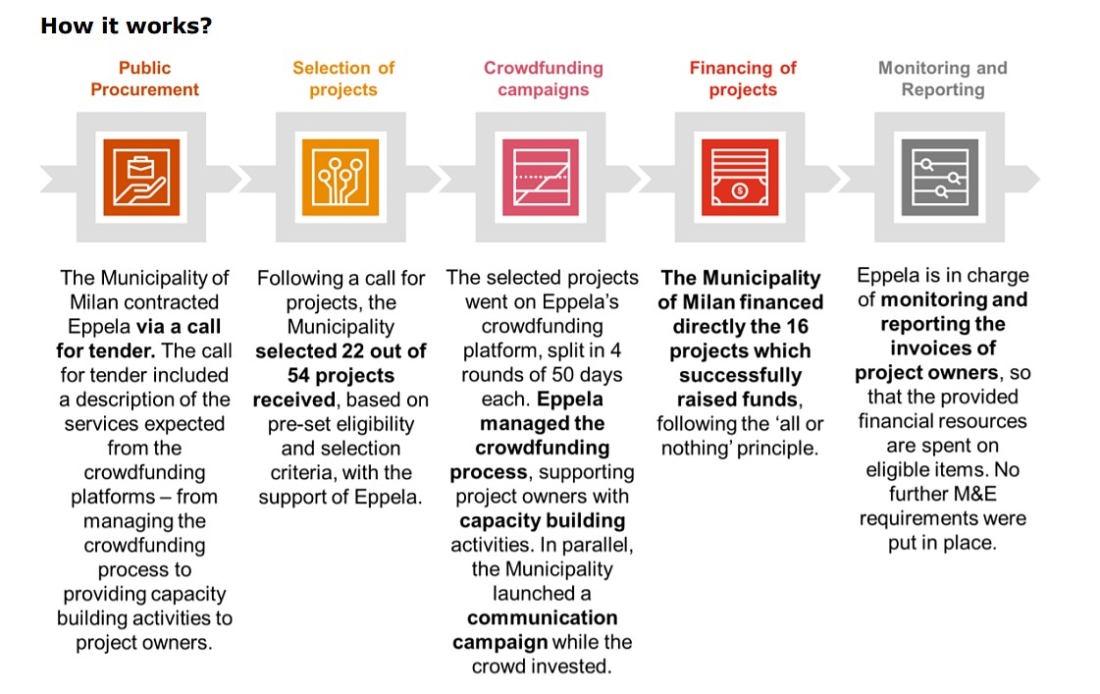

One of the case studies is the collaboration of the Municipality of Milano and the crowdfunding platform Eppela supporting local projects that have reached 50% of the total targeted financing.

As a result of this alliance, 16 projects were funded through crowdfunding, with a success rate of 88%.

Another case study is a partnership between the crowdfunding platform Goteo and the public authorities. The Municipality was focused on attracting private investments in culture and art projects.

Public authorities, organizations, and companies were invited to the round table matchmaking, where they discussed the crowdfunding process, responsibilities of stakeholders, project needs, etc.

This training met several goals: it helped project owners get funding, establish solid relations between fundraisers and the pool of backers.

German bodies also supported creative industry projects through pre-crowdfunding campaigns and grants.

The initiator was the cultural and creative industries’ competence team of the City of Munich. Its grants were independent, in other words, businesses were able to use any of the specialized platforms supporting the art industry.

The maximum size of the grant was EUR 3,000 Euro, and it didn’t depend on any previous financial records.

Grants were cross-sectoral and aimed at complex projects that could hardly be implemented without external help.

Summary

Herein, we’re discussing the crowdfunding user personas in Europe and figuring out whether it’s possible to raise funds only via a crowdfunding platform in Europe?

- Recently, European authorities have developed a few crowdfunding strategies aimed at involving both retail backers and institutions in the domain. The strategies are aligned with the Cohesion policy and are to accelerate the economic development of European countries.

- Earlier, the sector of retail crowdfunding investors was larger than the institutions’ shares, but new trends show the opposite results. More and more institutions, including governments, are participating in crowdfunding. European long-term investment funds (ELTIFs) are the target crowdfunding user personas.

- Since regulation restrains governmental participation in deals, they have found a workaround – pre-crowdfunding financing and grants.

- There are lots of successful crowdfunding cases, but frequently it’s impossible to gain the needed sum via the crowd only. In these cases, alternative schemes become a way out.

If you’re looking to build an online crowdfunding platform or investment marketplace for retail and institutional investors reach out to LenderKit. We offer white-label investment software and can also build a fully custom platform.