Crowdfunding in Asia: What Countries are Leading the Game?

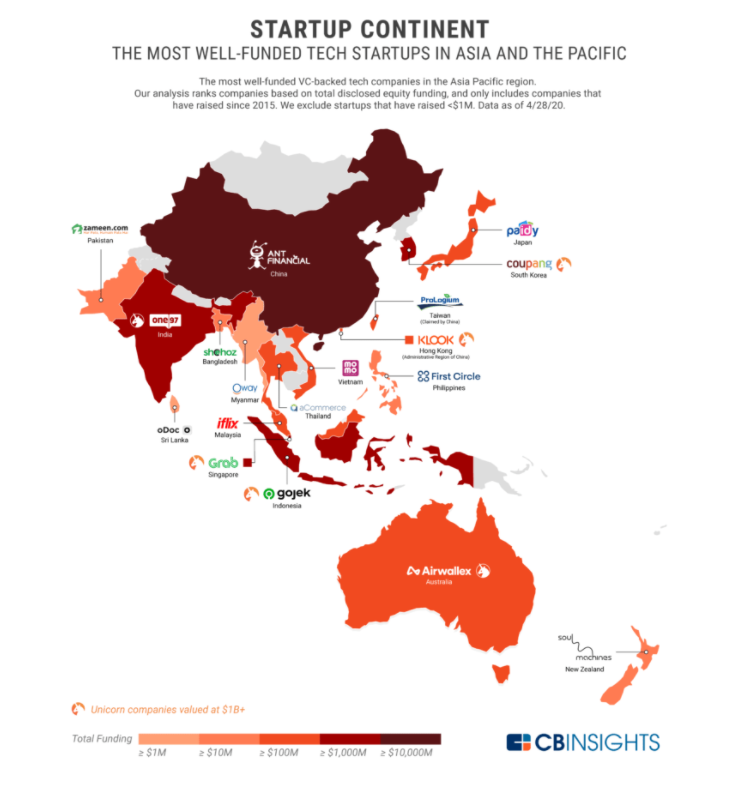

Asia is the globe’s most populous and diverse region and is home to 4.5 billion people, a melting pot of innovation and revolutionary businesses. It’s fairly called a ‘startup continent’.

Perhaps unsurprisingly, the Asian crowdfunding market is likely to climb to 2,634 million USD by the end of the year with a total number of crowdinvesting campaigns springing to 21.6 thousand showing 19% and 9% of annual growth respectively.

Notably, the average funding per campaign will reach 121,796 USD in 2021. China will lead the field with its market size gaining an annual 16% and soaring to 1,323.8 million USD, which is nearly half of the region’s transaction value.

In this post, you will find out about Asia-Pacific (APAC) top-tier players, learn about regulators of crowdfunding in South East Asia, and explore the crowdfunding niches making a difference.

What you will learn in this post:

Leading Asian crowdfunding countries & high-performing domains

In 2018, China’s alternative finance market share was 215.4 billion USD that showed a 40% year-on-year decrease from 2017 when the country accounted for 99% of the total APAC market volume.

Still, it is the region’s best performer that along with the US and the UK were labeled as respective continent’s leaders. Its footprint on the alternative financing sector is so vast, that analysts exclude it from the performance data as the ultimate high-flyer that is far away from the regional cohort, which we will focus on in this post.

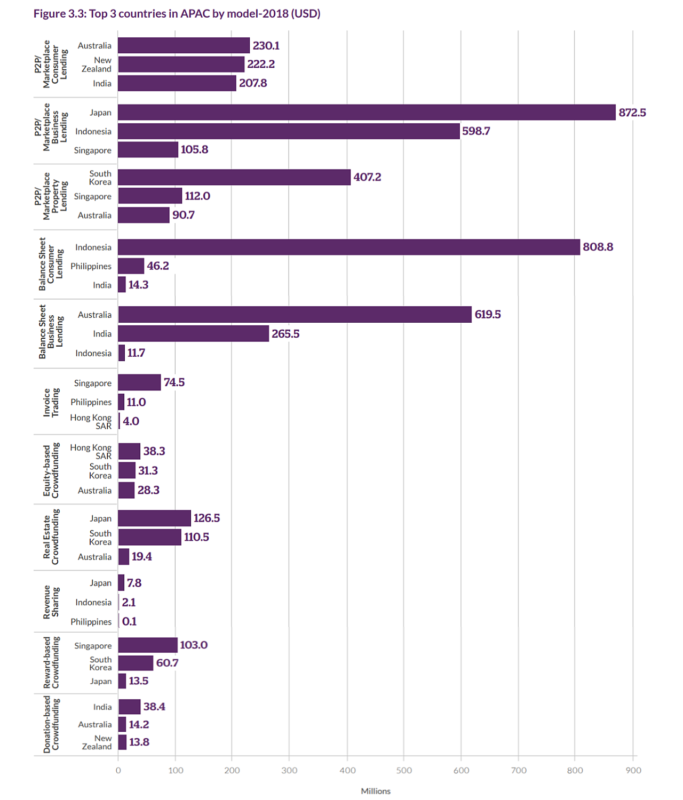

The value of each alternative finance model market in the top three countries in the Asia-Pacific region (excluding China).

Asia-Pacific crowdfunding platforms & regulatory authorities

Asia-Pacific region has different crowdfunding platforms and authoritative bodies which regulate the market. Let’s go through them by country.

Australia

Australian Securities and Investment Commission (ASIC) is in charge of local marketplace lending. According to the country’s laws, companies offering such products need an Australian financial services (AFS) license along with an Australian credit license for those players dealing in personal loans.

The country’s crowd-sourced funding transactions are monitored by another regulator, the Corporations and Markets Advisory Committee (CAMAC) whose report suggested Australia introduce regulations that allow retail investors to put up to $10,000 a year in start-ups via equity crowdfunding, backing each project with a maximum of $2,500. CAMAC proposed that CF platforms offer businesses to raise up to $2 million per year.

The country’s first p2p lender, SocietyOne made personal loans easy for Aussies. Through the lender, Australians can borrow money for various needs including debt consolidation, auto and study loans, vacation, home remodeling, and wedding financing.

With SocietyOne investors can make 6-7% and get paid either every 2 weeks or monthly. The platform charges annual 2.25%-receivables management and 0.25%-trust expenses fees for loans of $5,000 to $50,000 that have 2, 3, or 5-year payback periods.

VentureCrowd ‘funds the future’ and offers capital from thousands of local sophisticated investors usually eager to support campaigns lasting at least 6 weeks and having median funding of 35,000 AUD per investor.

The platform takes 6% of capital raised as its commission + $7.5K campaign fee, and has a diverse portfolio of projects backers can go for. From promising tech ventures to real estate, VentureCrowd has numerous projects on offer:

- Series A high-growth property fund with a minimum investment of 25,000 AUD and expected return of 30.47%; a 22-month project is likely to bring a handsome rental yield of 4.6%;

- A renewable energy tech venture, Wave Swell, that had a minimum contribution of 20,000 AUD raised 1,640,000 AUD (9% more than its initial target due to high demand from backers) offering shares on 25%-discount;

- Pre-IPO campaign of Curae Health that aims to digitize dentistry prosthesis and radiology offered its equity with 20% off IPO price and received 125% of its target capital.

New Zealand

Financial Market Authority (FMA) regulates P2P lenders in the country. The body encourages the market players to get a license, so that they can offer debt securities to borrowers with no need to submit a product disclosure statement (PDS).

FMA obliges authorized peer-to-peer lending platforms to complete and submit an annual regulatory return, a questionnaire related to the state of their business and license usage.

Another player from Oceania, Harmoney can boast of quick and simple loans for individuals willing to finance their special occasions, medical expenses, or start up a biz.

At the annual rates of 6.99%–24.69%, the lending platform can offer personal loans limited to $2K-$70K with a payback period of 3-5 years charging an establishment fee of $200 for loans under $5,000 and $450 for borrowers of $5,000-$70,000.

India

The Reserve Bank of India (RBI) is the authority responsible for p2p market regulation. But its power comes with a side note. The authority informs about the exemption on the platforms managed by individuals, proprietorship, partnership, or Limited Liability Partnerships that would not be under its jurisdiction.

Under RBI’s p2p lending norms, all the peer-2-peer lenders come as non-bank financial companies (NBFC). In December 2019, RBI raised the existing limits for lenders to 50 lakh INR (68,205 USD) with each borrower being allowed to raise 50,000 INR (close to 700 USD).

Certified by the national Reserved Bank, LendBox has a choice of personal products such as debt consolidation, credit card repayment, marriage, and instant loans, etc. It offers 6 to 24-month loans offering borrowers up to 5,00,000 INR (6,800 USD) of funds.

Annual rates vary from 12 to 36%; the platform charges a registration fee of ₹ 500 in addition to Goods and Services Tax (GST), processing fee 2-6%, and applicable service tax. Lendbox offers lenders monthly returns with at least 10,000 INR of min investment.

Japan

The country has the Financial Services Agency (FSA) that takes care of the local FinTech sector. Japan’s Money Lending Business Act obliges lenders to register with the regulator. However, the country saw alternative methods of transferring capital from lenders to borrowers including silent partnerships.

For instance, experts believe that Japanese P2P lending is successful because a potential investor needs to sign a Silent Partnership Agreement (TK agreement with Maneo) if they want to put their capital in a loan fund. One more benefit of TK is that under it, there is neither cap on the net worth of an investor nor on his capital.

Maneo, the country’s veteran lender, offers business lending and loans related to the real estate industry.

The company has an exhaustive list of loan repayment terms and offers borrowers from 50,000 yen of funds at no more than 15%.

Indonesia

The Financial Services Authority or OJK is the country’s regulating body and a policymaker for FinTech. In 2017, this authority announced new rules regarding loan-based lending services made through online platforms.

Investree is an Indonesian FinTech trailblazer that paved the easier way to loans for local SMEs through its innovative business solutions.

The platform offers borrowers quick and simple funding for eCommerce, wholesale buyers, invoice financing, and working capital term loans at affordable rates starting from monthly 0.9% and requires no fixed asset collateral. Lenders can earn up to 20% per year if they have IDR 1,000,000 – IDR 2,000,000,000 (70 USD to 143K USD) to invest.

Singapore

Being Singapore’s central bank, the Monetary Authority of Singapore (MAS) enhances the fair competition, diversity, and compliance of the country’s crowdfunding players. According to the Securities and Futures Act, P2P lending platforms have to obtain a Capital Markets Services (CMS) license from MAS.

Considered one of the leading platforms in the region, Funding Societies offers digital peer-to-peer lending solutions to a broad range of SMEs allowing both individuals and institutions to back up innovative ventures.

Micro (up to $100,000; 1 – 12 months), term (up to $2 Million; 1 – 12 months) or invoice (up to $1 million; up to 120 days) financing, the crowdfunding engine has a few options to grow big. As of 2019, investors made 9.82% on average through Funding Societies.

Hong Kong

The Securities and Futures Commission (SFC) controls the crowdfunding sector in HK. An equity crowdfunding platform has to get certified with the regulator under the Companies Winding Up and Miscellaneous Provisions Ordinance (CWUMPO) and, in addition, might be restricted to provide services only to sophisticated investors.

AngelHub, Hong Kong’s pioneer in equity crowdfunding, was the first to get the license from Securities and Futures Commission. The platform offers a unique chance to invest with institutions in USD $50+ million Series C offerings across multiple business domains.

South Korea

Under the current rule, SMEs that have been on the market less than 7 years can opt for crowdfunding, states the country’s Financial Services Commission. In 2015, the Amendments to the Financial Investment Services and Capital Markets Act (the Capital Markets Act) passed in the South Korean Parliament set the rules for the country’s investment crowdfunding under “Venture Firm License” that local SMEs can apply for.

Seoul-based Tera Funding, a leading real estate crowdfunding business in Korea has its property-secured bond projects that are thoroughly vetted by its inspectors.

Launching a crowdfunding platform in Asia-Pacific

Asian market is one of the global leaders in terms of alternative finance. The crowdinvesting market share promises to reach new heights before long and add 8.4% of annual growth during 2021-2025 landing at $3,631.1 million USD market value by 2025.

If you want to tap into the land of opportunities by launching your own equity or p2p lending platform, you can check out LenderKit’s crowdfunding software.