Secondary Market in Crowdfunding: A Myth or Reality?

The secondary market in crowdfunding is an emerging trend that has opened more opportunities to platforms and investors alike. Crowdfunding allows investors to support a promising project by purchasing its equity before the project’s IPO (Initial Public Offering). However, such investments were illiquid earlier. Investors had very limited options to exit their investment and get a profit: when a business goes public or when it is bought by another business. This takes time, and this detail often frightens many investors who would otherwise invest in a project.

Selling shares on secondary markets in crowdfunding is still impossible or limited in many jurisdictions because of legal limitations.

What you will learn in this post:

US secondary market for crowdfunding platforms

In the USA, according to the Jobs Act Title III, investors are restricted from reselling their shares for the first year, unless they transfer the shares to:

- the issuer

- an accredited investor

- a family member

- in connection with the investor’s death or divorce or other similar circumstance

- to a trust controlled by the investor or the investor’s family member

- as a part of an offering registered with the SEC.

European secondary market for crowdfunding platforms

In the EU, investors can advertise on the bulletin board on the investment platform their interest in buying or selling loans, transferable securities, or admitted instruments that were originally offered on the same platform.

The bulletin board is not an internal matching system that executes client orders on a multilateral basis, so the platform has to be either registered as an investment firm or as a regulated market.

Crowdfunding platforms also cannot accept orders on buying or selling from investors, all the activities shall be solely organized by investors and performed at their discretion only. Otherwise, the platform shall be authorized to act as a trading venue.

In other words, the provision of services that go beyond the advertisement of trading interest is not permitted and requires additional authorizations.

UK secondary market for crowdfunding platforms

In the UK, crowdfunding platforms do not require authorization as a trading venue. However, to benefit from this exemption, a platform shall be able to organize its activities so that trading interests interact within the system. This is why crowdfunding platforms rely on so-called bulletin boards rather than full-scale secondary markets.

Shortly put, when it comes to secondary markets in crowdfunding, we can speak rather about bulletin boards than fully functional secondary markets. A bulletin board is an electronic quotation system where investors can express their interest in buying shares, and buyers – their interest in purchasing shares.

All communication occurs directly between investors, without a middleman in the form of a platform, and no automated trading is available. However, the availability of bulletin boards is still a significant advancement in equity crowdfunding and offers considerable benefits.

Benefits of secondary markets in equity crowdfunding

Investors are more willing to invest in projects if they know that further, the project’s shares can be resold on a secondary market. Why so?

An opportunity to sell the project’s equity turns an illiquid investment into a liquid one. Instead of being forced to hold the equity for years, an investor can sell it whenever deems necessary. Even though the secondary market in crowdfunding is often characterized by low liquidity levels, a belief that the investment can be sold boosts the wish to invest.

Another reason is the possibility of early realization of gains. Normally, investors provide funding to promising projects that have significant growth potential. At later stages of the project development, when it becomes more popular, more people are willing to acquire its equity, and the project’s shares start growing in value. Thus, after a while, early investors can resell the shares at a higher price.

Along with the mentioned benefits such ones are worth attention as:

- Higher possibilities of portfolio diversification, when an investor can sell a part of his shares to invest in other promising projects.

- Improved risk management due to a higher possibility of portfolio diversification.

Limitations and drawbacks of secondary markets in equity crowdfunding

If the benefits of listing on a secondary market are so high, then it is logical to assume that the majority of projects announce their intent to allow trading their shares in the secondary market. However, it doesn’t happen. Many projects still opt to avoid this opportunity. In some cases, announcing that the project’s share will be available for trading on the secondary market may impact the capacity of the project to raise money in additional funding rounds.

Some investors and shareholders may interpret the willingness to sell shares on the secondary market as a bad quality of the startup or the unwillingness of the founders to develop it further.

When a buyer purchases a share on the secondary market, he knows that he won’t be able to benefit from a potential IPO soon. This is why secondary trades often come at a discount and do not deliver the desired benefits to both buyers and sellers.

Secondary markets for crowdfunding are not widely available, and even if they are, they can be used only for specific classes of assets.

Additionally, secondary markets in crowdfunding still have very limited liquidity which is a serious obstacle to trading activities. The legislation is also either not clear enough or puts certain limitations that do not favor the development of secondary markets for crowdfunding.

Top platforms that offer secondary markets to their users

Crowdinvesting platforms are trying to expand the available opportunities for investors and project founders. This is why the top platforms offer secondary markets, even though they are limited because of legislative requirements.

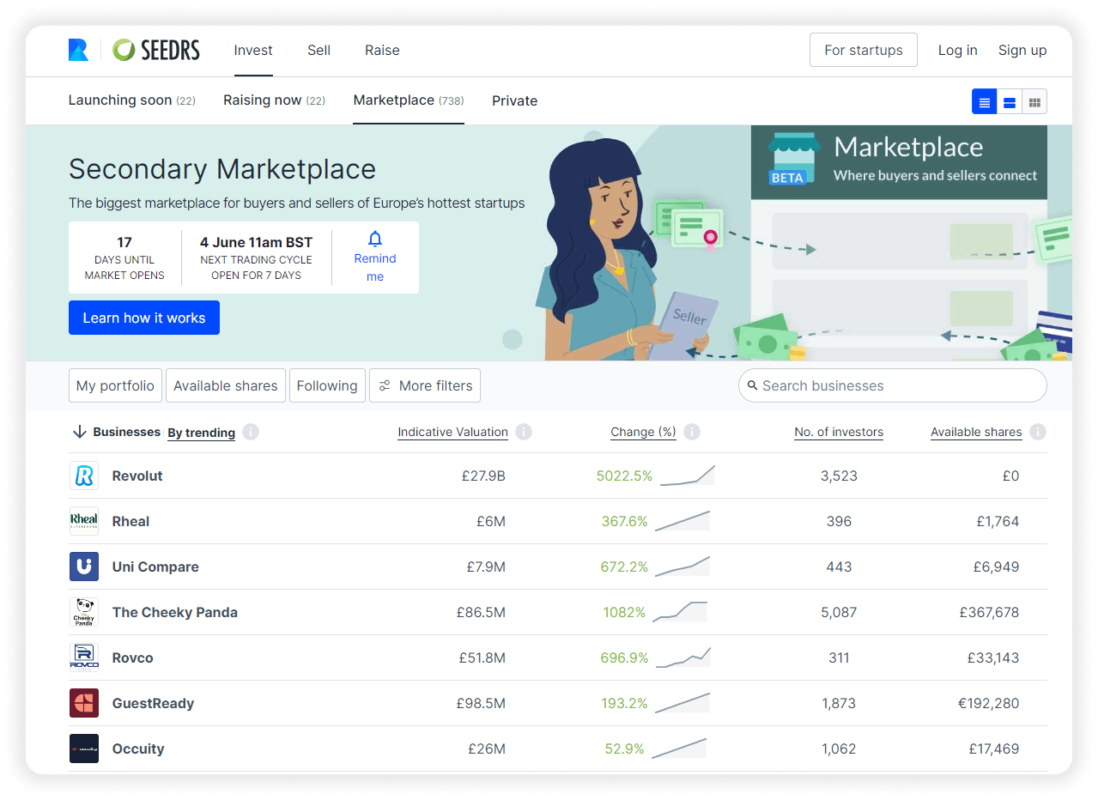

Seedrs

Seedrs is one of the most popular crowdinvesting platforms in the UK. It offers its users a marketplace where investors can sell and buy shares of projects that were raising funds on the platform.

By using the Seedrs Secondary Marketplace, users can check such details as the indicative valuation, price change since the share was first recorded on the platform, number of those who have invested in the project, and shares available for purchasing. By clicking on the project, one can move to the project’s page on Seedrs with all the information about the fundraising campaign and project details.

Crowdcube

Crowdcube is another platform that offers secondary markets for shareholders. The platform handles everything: it offers software, legal expertise, and investor coverage – all that a project needs to access liquidity.

StartEngine

StartEngine’s secondary market is the first market of such a type in the USA where non-accredited investors could publicly trade investments in startups that have raised capital via Regulation Crowdfunding and Regulation A+.

StartEngine Secondary is a trading system regulated by the SEC and operated by StartEngine Primary, LLC., a broker dealer registered with the SEC and FINRA.

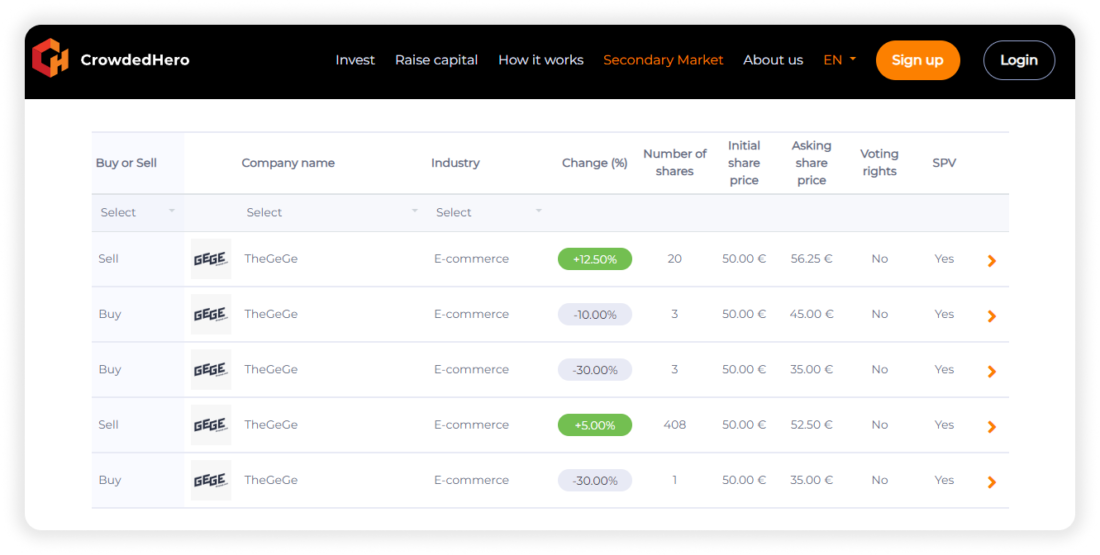

CrowdedHero

The secondary market offered by CrowdedHero is a dashboard-looking marketplace where investors can sell previously purchased shares of projects that have successfully closed their funding rounds on the platform.

Crowdpear

Crowdpear is an ESCP-licensed platform located in Vilnius, Lithuania. Crowdpear offers its users a secondary market which is a functionality where investors can sell their current investments. To be able to do so, an investor verifies his identity and fills in a questionnaire, and those willing to buy investments have to have sufficient funds to do so.

How to launch a crowdinvesting platform with LenderKit

If you are thinking about launching a crowdinvesting platform with or without the secondary market, consider white-label crowdfunding software from LenderKit to speed up the launch and minimize costs.

LenderKit offers both ready-made investment software and limitless customizations that our crowdfunding platform development team can offer. To see how the product works, you can schedule a live demo or just contact us right now to see how we can help you.