Crowdfunding in India: Market Overview

India is not new to the crowdfunding concept. Indians have been donating funds for the construction of worship places and other social-cultural causes for ages. Such donations were called “chanda” back then. Now, this word is replaced by the modern term “fundraising” or “crowdfunding,” but the principle hasn’t changed.

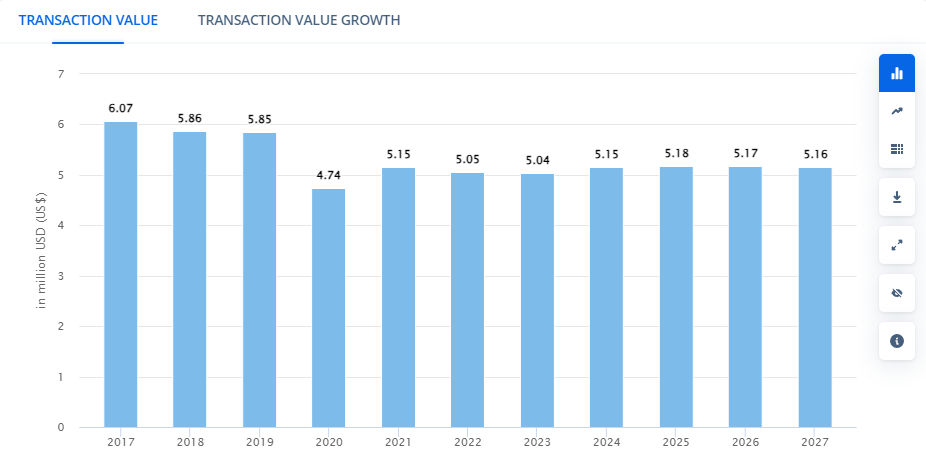

By the end of 2023, the transaction volume in the Indian crowdfunding market is expected to reach $5.04 million, and the transaction value is projected to grow at a CAGR of 0.59%.

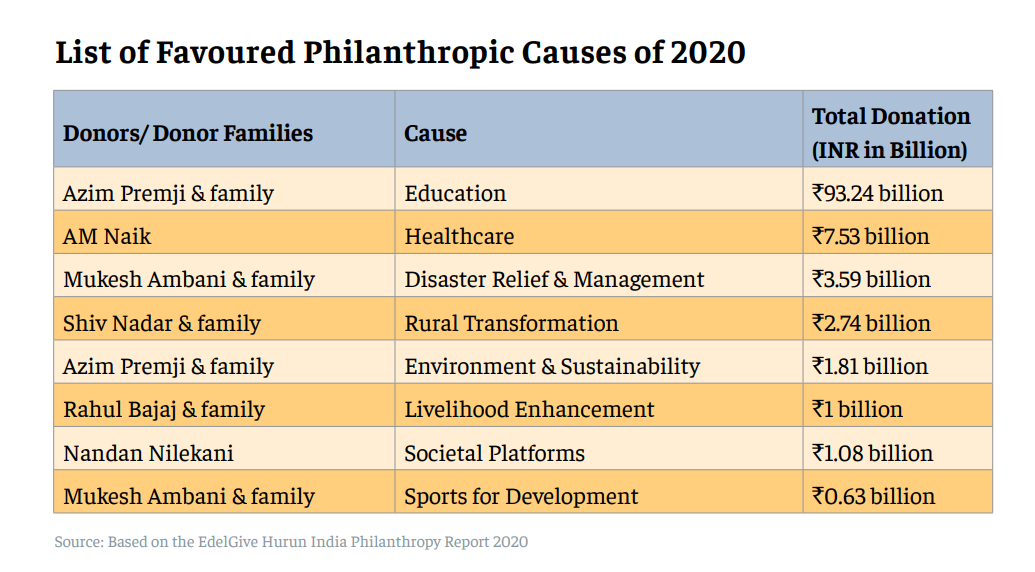

Until now, donation-based crowdfunding has prevailed in India. Many orphanages, health care centers and shelters rely on it to exist; people collect funds for their medical expenses or personal needs, and this way of raising funds is completely legal. So, in 2020, billions of Rupees were donated for different purposes.

However, there are other crowdfunding types, and the situation with them is not that clear.

What you will learn in this post:

The legal status of crowdfunding in India

The crowdfunding sector in India is regulated by the Securities and Exchange Board of India, or SEBI for short. The main regulator’s aim is to protect investors, and thus, it created different rules for different crowdfunding types.

Donation-based crowdfunding

According to this regulator, donation-based crowdfunding can happen within the regulatory framework issued by SEBI. This crowdfunding type doesn’t involve financial returns, and thus, anybody can participate in it.

Lending-based crowdfunding

Lending-based crowdfunding platforms connect lenders and borrowers on one platform. The loans managed by platforms are of unsecured nature, and thus, SEBI pays special attention to this crowdinvesting type. There is a separate regulatory framework for peer-to-peer lending in India. The main requirements were specified in a consultation paper issued by the Reserve Bank of India. Further, this paper served as a foundation for the Master Directions issued in 2017 by RBI.

So, an investment business that is going to run a P2P lending platform in India shall be registered as a company and obtain a Certificate of Registration from the Reserve Bank of India. Any company, including a P2P platform, that seeks registration with the Bank shall have a net-owned fund of at least 20 million Rupees (approx. 250,000 USD at the moment of writing this article). The company shall be incorporated in India and have all the required technical, entrepreneurial, and managerial resources to operate.

Equity-based crowdfunding

When it comes to equity-based crowdfunding, there are several restrictions that make it illegal. The thing is that most crowdfunding platforms raise funds through a private placement, and this way of fundraising is regulated by The Companies Act, 2013. The norms for private placements are specified in section 14, the Companies (Prospectus and Allotment of Securities) Rules, 2014.

According to the Indian crowdfunding regulations, an offer or an invitation to subscribe to securities under a private placement cannot be sent to more than 200 investors during one fiscal year. Also, such placements cannot be advertised, or announcements about them cannot be placed on social media. Moreover, an offer can be made only to those persons who have been identified as investors by the company in advance. These rules make the use of a crowdfunding platform impossible because:

Investors cannot be pre-identified when an offering is published on a crowdfunding platform.

Crowdfunding platforms advertise offerings, and in the case of a private placement, doing so is forbidden.

The limitation to 200 individuals only also contradicts the principles of crowdfunding.

So, even though equity crowdfunding is not explicitly forbidden or regulated in India, complying with all the requirements specified in the Company Act is impossible. Indian equity crowdfunding regulatory unclarity slows down the development of the alternative investment market in the country. However, even though SEBI accepts the fact that it is needed to create a clear regulatory framework to protect investors, the regulator hasn’t advanced much in solving the issue.

Examples of crowdfunding in India

The purposes why people or businesses raise funds are mostly determined by the existing regulation. Crowdfunding for personal use dominates in India because everybody can launch a campaign, and anybody can donate money.

Another popular application of crowdfunding is raising money for real estate. It can be done through a debt-based platform.

Personal loans, such as loans for study, home loans, loans for paying medical expenses, and similar, are becoming increasingly popular among the Indian population. Crowdfunding allows getting funds rapidly without all the lengthy procedures that one has to pass when applying for a loan with a bank.

SME crowdfunding is not that popular due to the limitations imposed by SEBI. In most cases, SME looking for funding approach venture capital funds or angel investors only to avoid exceeding the number of investors and collect the sums required for the project development.

Top crowdfunding platforms in India

Along with international donation-based platforms such as Kickstarter or Indiegogo, the country has platforms launched by Indians and operating exclusively in India. They are the following.

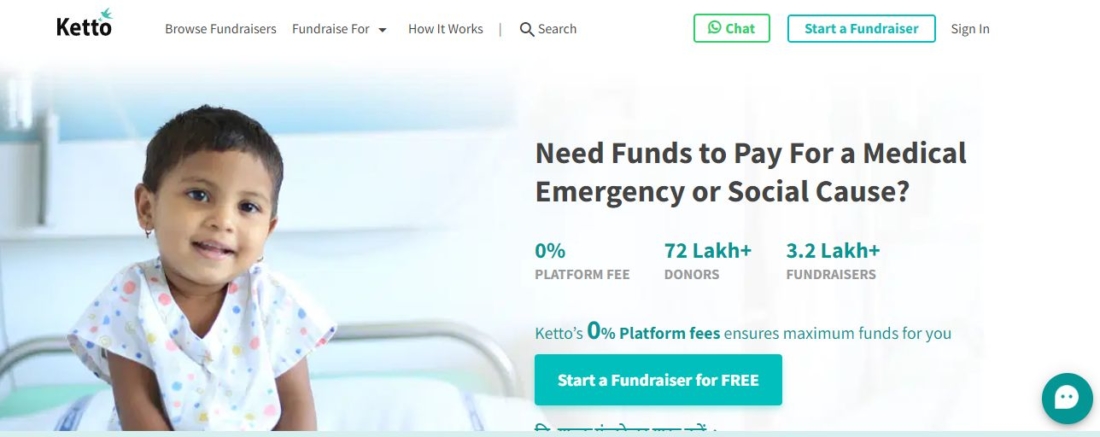

Ketto

Ketto is a donation-based crowdfunding platform in India that focuses on assisting in raising funds for a medical emergency or social cause.

The platform was launched in 2012 by Varun Sheth, Kunal Kapoor, and Zaheer Adenwala. Since then, it has assisted multiple people and organizations in raising funds for medical expenses.

The platform doesn’t have a minimum limit to invest, and it charges a 5% fee on the sum raised. Foreigners can donate funds through Ketto, too.

The platform is managed by Ketto Online Ventures Private Limited, a company incorporated under the Indian Companies Act.

Fueladream

Fueladream is an Indian donation- and reward-based crowdfunding platform founded in 2016 by Ranganath Thota.

With a minimum investment of just 100 Rupees, the platform allows funding both personal and social projects, such as raising funds for a medical bill, studies, or even launching your own business.

The platform charges 6% from the raised funds and 3% for payment processing, along with other fees that may reach 18% per campaign.

Crowdera

Crowdera is an Indian-based platform with Singapore origins. The platform was launched in 2009 by Chet Jainn, Chai Atreya, and Ritch Matsuura. The platform offers its services for free for both fundraisers and donors if they pick a Basic plan, and with the Premium plan, they have to pay 5% of the funds raised during a campaign.

How to launch a crowdfunding platform in India

If you are thinking of launching a crowdfunding platform in India, you need to consider many details to make it compliant with regulations and operate as expected. This is why developing a platform from scratch may be too time-demanding and costly.

White-label crowdfunding software from LenderKit can help you launch a crowdfunding platform in India. If you’re focused on the real estate investing in India or maybe crowdfunding for Indian startups, LenderKit may be the right fit for your business. LenderKit investment software provides many features out-of-the box to help you get started quickly or we can fully customize the platform to offer you a unique investment marketplace. Please feel free to get in touch with us to discuss your needs and find the best option.