CNMV and Crowdfunding in Spain

Spain isn’t only the country of siesta, paella and sangria. It’s, also, a crowdfunding market with one of the highest rates of development in Europe.

According to the Digital Market Outlook, the crowdfunding segment in Spain is expected to grow to 530.8M U.S. dollars in 2024 with average funding per loan 77,739.6 U.S. dollars. To compare, in France the average amount accounts for 60,626 US dollars and in Italy – 300,605 US dollars.

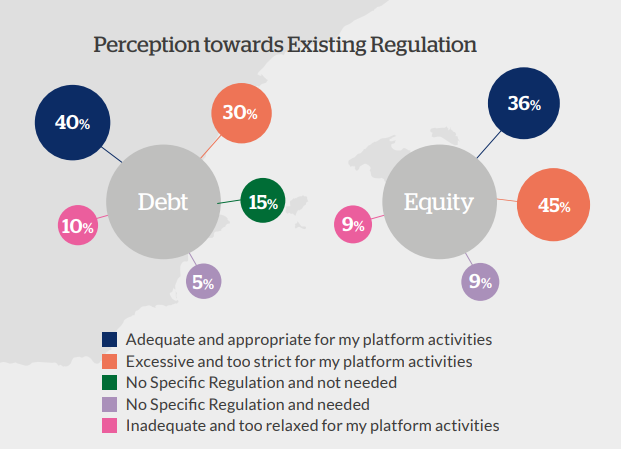

CNMV’s (Comisión Nacional del Mercado de Valores) policy is a booster for Spanish alternative financing industry growth. In its survey, JBS reports that almost half of crowdfunding platforms in Spain consider government regulations as adequate and the environment – as user-friendly.

Herein, we’re explaining the role of CNMV for crowdfunding platforms in Spain, market opportunities and challenges.

Key takeaways:

- Spanish crowdfunding market now and then;

- CNMV’s regulations and rules for fundraisers;

- top fundraising companies in Spain.

What you will learn in this post:

The brief story of Spanish crowdfunding

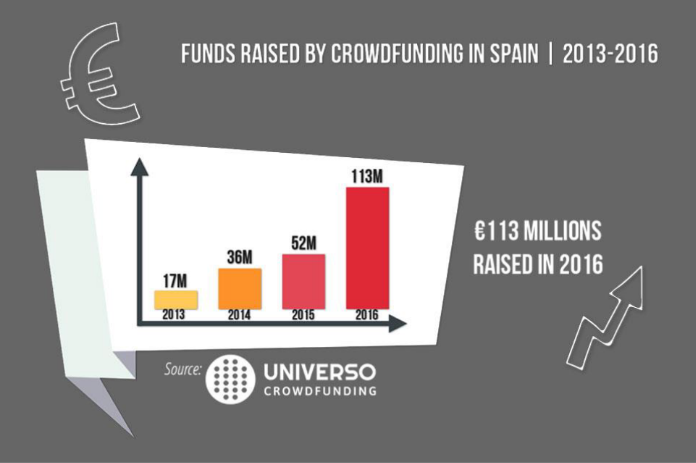

First crowdfunding platforms in Spain such as Verkami and Lanzanos appeared in 2010. Up to 2015, the industry was developing at a moderate path just like other European countries, but 2016 demonstrated an unprecedented 167% increase in crowdfunding volumes.

Experts from UNIVERSO crowdfunding name several reasons for such an expansion:

- platform consolidation;

- increased business interest in alternative financing;

- the arrival of traditional investors;

- global expansion and popularity of crowdfunding.

Besides, in 2015, CNMV presented a specific legal framework for financial crowdfunding, which added clarity to provider-investor relationship and attracted more players to this niche.

The era of alternative financing in Spain just began.

Here’s what CNMV did:

- in tandem with the Bank of Spain, it created administrative and financial requirements for new entrants;

- divided investors into accredited and non-accredited and set limits for both;

- introduced a unique legal framework for different types of crowdfunding (equity-based and loan-based);

- developed the CNMV FinTech Portal to support crowdfunding enthusiasts.

CNMV FinTech Portal was designed to provide consultation and help for promoters and financial corporations regarding different aspects of securities and market rules and create an informal community to exchange information.

Spanish crowdfunding market now

The Spanish crowdfunding market is a great option if you seek funding for your RE project or want to try luck at debt-based investing.

According to CrowdfundingHub, in 2018, Spain remains the 7th largest alternative finance market in Europe.

The highest growth occurred in the section of lending platforms (43.32%), followed by real estate (20.79%) and equity-based crowdfunding (16.06%).

On the CNMV official website, there are 27 platforms officially registered as fundraising providers including the first Spanish government-run crowdfunding portal – Crowdfunding Bizkaia.

The idea behind the Crowdfunding Bizkaia project is to boost investor confidence and eliminate financial uncertainty related to alternative financing.

There are also some benefits for borrowers:

- startups can request to increase the investment limit;

- lower commissions comparing to other platforms (1% instead of 3-4%);

- each project receives a free year of business mentoring and support;

- the provider offers alternative financing options once the year is over.

Investment crowdfunding platforms in Spain

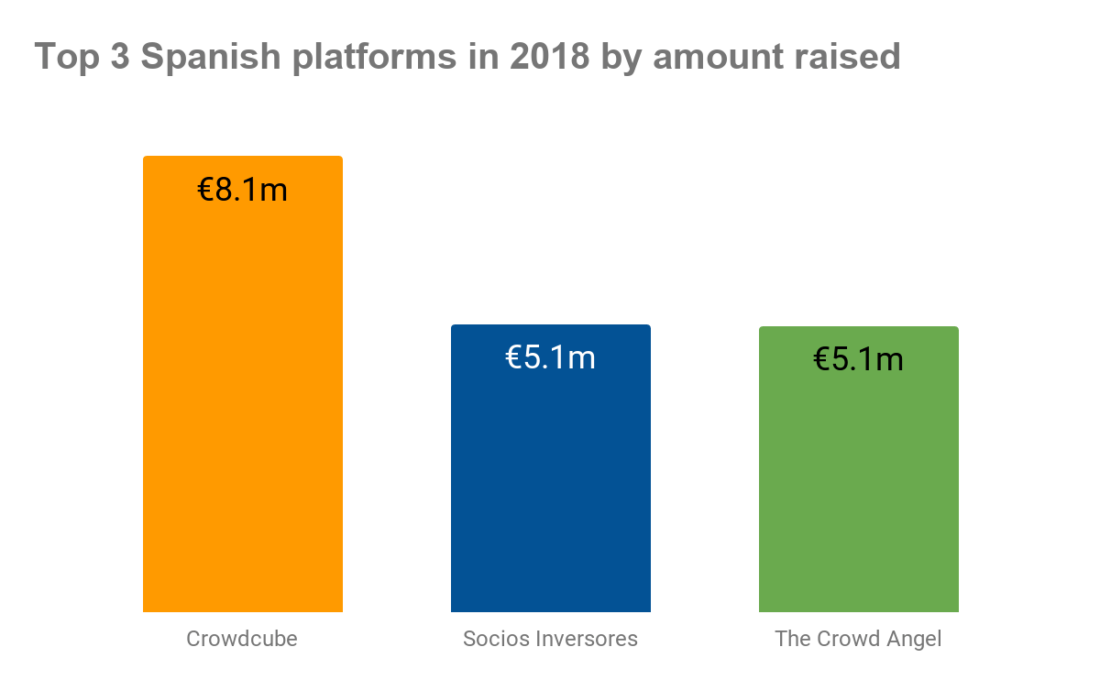

It’s the second most active investor in Spain presenting 7% of the Spanish market. Since 2014, the company has raised over €20m for local businesses and completed 72 projects. Some great campaigns funded by Crowdcube: Nanusens, Wave App, Woom.

Being the leading company in equity crowdfunding in Spain, Socios&Inversores has collected €35m funds for +145 campaigns. The provider selects projects very thoroughly and admits that less than 1% of the ventures pass their analysis. Among Socios&Inversores success stories are AlgaEnergy, Roams, Chargy, and Hangry.

The Crowd Angel is a premium equity crowdfunding platform enabling users to invest from €3K in the best Spanish startups.

The Crowd Angel in numbers:

- 20M investment volume;

- 18K investors;

- 56 operations funded.

The Crowd Angel is a co-investor working with Inveready Technology Investment Group, Keyword, Caixa Capital Risc, etc.

Real estate crowdfunding in Spain

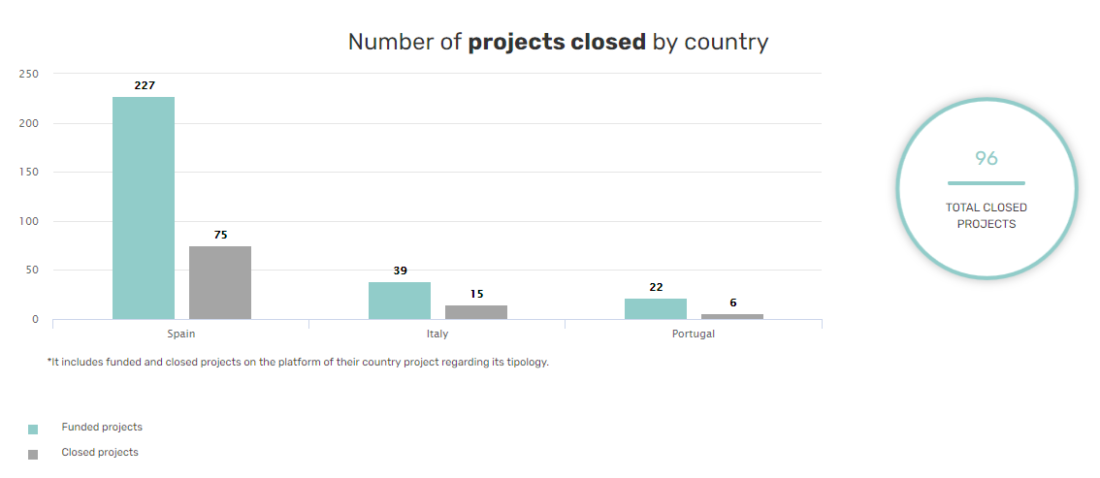

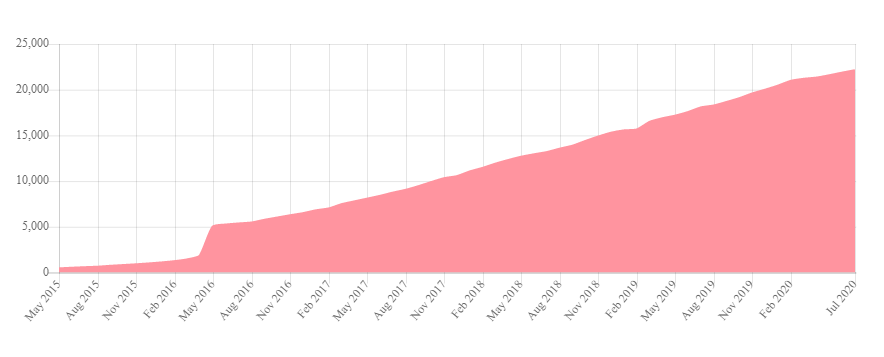

This provider is the key player on the Spanish, Italian, and Portuguese real estate investment markets. Housers suggests diving deep in property investing with only €50. For now, they have 122,912 users and an accumulated investment of €117,233,936. Housers’ products include participative loan, Buy-to-Let and Buy-to-Sell opportunities.

If you have a real estate crowdfunding project on paper, turn it to reality with LenderKit, white-label real estate crowdfunding software.

Spanish crowdlending

MyTripleA is a Spanish investment platform launched in 2015. There are two ways to invest via MyTripleA: fixed and guaranteed returns, non-guaranteed loans. The company has two licenses to operate as a payment entity and crowdfunding platform. For professional investors, MytripleA offers up to 7% of profitability, for borrowers – seed financing available at 2%.

October

Formerly Lendix, the French firm October entered the Spanish market in 2016. In the beginning of 2020, the company hit the new milestone – €400m funds collected for 800 projects founded by SMEs. October deals both with individual and institutional investors and supports the responsible lending approach.

Grow.ly is a Spanish peer-to-peer lending platform for small and medium-sized enterprises. The company helps startups and small businesses attract funding from individuals and is an alternative solution to traditional banks. The total amount of money collected since the launch of Grow.ly is 24,5m, medium interest rate – 7,15 %.

Reward- and donation-based projects are also very popular in the Kingdom of Spain. Key players are Kickstarter, Verkami, and Indiegogo (rewards). Donations are presented by Teaming, Gofundme and MigranodeArena.

Taking up crowdfunding in Spain: opportunities and challenges

Alternative financing, in particular crowdfunding, appeared as a response to tough banks’ requirements towards SMEs-borrowers.

SMEs are key elements of the Spanish economy. According to DIRCE, Spain’s central business directory, of the 3.11m companies in Spain, 99.6% are SMEs.

Given that, borrowers can’t help but take advantage of simplified fundraising and the regulator – promote it.

Opportunities of the Spanish crowdfunding market:

- the increasing demand for inexpensive financing demonstrated by SMEs;

- vacant niches such as real estate and educational crowdfunding;

- the fundraising ecosystem in Spain focused on innovation, which means lots of options for products and business models;

- ongoing implementation of national regulations offered by the EU to adjust the regulatory framework to the reality;

- non-sophisticated and institutional investors joining the market.

Since the Spanish market is early-staged, the main challenges of the industry are the lack of crowdfunding education and immature legislative framework. People don’t realize the opportunities of p2p crowdfunding and businesses have concerns regarding investment risks.

The bottom line

Unfortunately, there’s not enough data and statistics to estimate the real scale of crowdfunding development in Spain. Although the majority of providers appeared a few years ago, the funds channelled through their platforms are growing rapidly.

The Spanish market is fresh, yet it already demonstrates new approaches and models to FinTech and alternative financing. And the credit for that goes to CNMV – the national crowdfunding regulator.

The future of Spanish crowdfunding is up-and-coming, which is to positively influence the national economy and business climate.

Thinking about crowdfunding business expansion to the Spanish market? Reach out to us. We’ve got a ready-made solution, LenderKit, to help you automate your investment business operations.