Crowdfunding in the UK: The Ultimate Guide

No time to read? Let AI give you a quick summary of this article.

Crowdfunding in the UK is often referred to as a benchmark which, apart from the developed investment ecosystem, has its own unique features like appointed representatives to cut corners with regulatory hurdles, favorable taxation schemes like EIS1 and SEIS2, and transparent tools to check platform’s regulatory compliance3 or even find them on a warning list4.

With all that, let’s take a closer look at the UK crowdfunding market in 2024, and explore what types of crowdfunding platforms need licensing, what the requirements are, check out the major UK crowdfunding platforms and consider other details needed to launch your own crowdinvesting platform in the UK.

What you will learn in this post:

What makes UK crowdfunding special?

Crowdfunding took off in the UK in early 20115 with the launch of Crowdcube — one of the biggest equity crowdfunding platforms which wanted to merge with Seedrs — another large crowdinvestment platform.

Well, that deal didn’t happen in 2021 because the Competition and Markets Authority (CMA) blocked it6 after thorough investigation. As a result, Crowdcube expanded to Europe7 and Seedrs was purchased by Republic8.

As any market of that size, the UK is full of its intrigues, plots, mysteries and scandals like banning the marketing of mini-bonds9.

So, if you decide to enter the UK crowdfunding market in 2024 and beyond, this will definitely be a fun ride with fierce competition, strict rules and potentially fruitful results.

Whether you want to embrace the challenge or simply learn more about what it takes to run a loan-based or investment-based platform in the UK, we’ve compiled a useful checklist of the major things you need to consider.

Crowdfunding regulations in the UK

The Financial Conduct Authority10 is the legal body responsible for regulating P2P lending and equity crowdfunding platforms, or to be more precise, they are called:

- Loan-based crowdfunding platforms offer clients online tools to lend money directly to individuals or businesses and make money in form of interest and capital repayment.

- Investment-based crowdfunding platforms allow investors to invest directly in businesses by purchasing shares, debentures or debt securities.

Requirements for P2P lending platforms

If you want to run a P2P lending platform in the UK similar to CapitalRise11, CrowdProperty12 or Folk2Folk13, you can probably start with the requirements14 the FCA sets for loan-based investment platforms, including risk management, transparency, capital and taxation.

Risk management

So, a P2P lending platform needs have a risk management framework which requires taking the following measures:

- collecting information about the borrower that allows to access the credit risk

- categorizing borrowers based on their credit risk

- setting the interest rates and prices that reflect the risk profile of the borrower

Along with this, platforms should have clear rules for how they manage defaulted loans, procedures of their transferring and provide a clear plan of how the loans and repayments will be managed if the platform stops working.

Speaking about investors opting for lending funds through a P2P lending platform, they should understand that they won’t have access to the Financial Services Compensation Scheme15.

Transparency

When crafting an offering, the platform needs to offer maximum transparency about the promised return rates. So, the platform may advertise a specific return rate of a P2P offering only if it can demonstrate with reasonable certainty that such a return rate may indeed be reached.

Each platform shall publish an outcome statement14 with all the data for the previous year. This statement includes useful information for investors about offerings, their success rate, and returns that investors have made.

Regulatory capital

A UK loan-based platform is obliged to hold regulatory capital16 either equal to a percentage of loans funds or £50,000 — whatever is higher.

Investor types

P2P lending platforms are permitted to communicate offerings directly only to the following investor types:

- Certified, sophisticated, or high-net-worth investors

- Investors who received expert advice or investment management services from an authorized person regarding the advertised offering

- Individual investors who agree to invest not more than 10% of their net investible assets.

Taxation

Both the platform and investors pay taxes17. The platform pays a corporation tax, and an investor pays the basic rate tax which is calculated based on the income.

Requirements for investment-based platforms

The Financial Conduct Authority considers equity investment riskier than P2P lending18. Statistical data says that 50-70% of businesses fail18, so investing in such businesses would end in the loss of funds.

In contrast, most P2P loans are repaid within approximately three years, and P2P lending platforms have lower default rates than equity-based crowdinvesting platforms. Additionally, illiquid debt-securities offered by companies to invest in carry many more risks than short-term P2P lending agreements.

But anyway, platforms can pursue equity offerings if they have the right procedures, business model and tools in place.

Investor types

Equity-based crowdfunding platforms can offer their services to investors who are:

- Retail clients classified as corporate finance contacts or venture capital contacts

- Sophisticated or high-net-worth investors

- Individuals who receive financial advice from an authorized person or service

- Individuals who confirm that they will not invest more than 10% of their net investible assets (the primary residence, pension, and life cover are not included here)

Risk notification and management

When promoting a service or an offering, the platform shall be clear about the risks involved in each investment. Also, the platform shall include a notification about whether a secondary market is available or not, if there are any compensation schemes, and whether due diligence was performed on the investee and the outcome of the due diligence process.

Taxation

One of the main motivational factors for investors to invest in equity deals is a tax relief from 30% to 72%17. However, to ensure that investors can benefit from tax relief, the company shall be registered for EIS1. This is a complex area, and companies should double-check they comply with all requirements1 or consult a specialist.

Applying for a license or using appointed representative services

Crowdinvesting businesses that want to apply for a license19, but are confused about the process can opt for appointed representative services. There are companies that specialize in providing legal consulting and can offer umbrella compliance. Below are just a few examples of firms that can facilitate regulatory compliance with the FCA requirements.

LHI Consult

LHI Consult20 is a compliance and regulatory service provider that helps companies receive all the permissions to launch a business in the UK. It also assists EU-regulated companies to start working in the UK financial markets.

By choosing the LHI consulting regulatory team, a business gets access to the following services:

- Startup compliance assistance

- Advice and guidance

- Compliance training for employees

- Regulation assistance for fintech businesses

- Receiving authorizations and permissions.

Sturgeon Ventures

Sturgeon Ventures21 is an established regulatory incubator that helps companies to launch their operations in the UK or move from overseas to the UK market.

Sturgeon can help with a direct FCA application and for companies that require continuous regulatory monitoring. Sturgeon collaborates with many known reputable compliance advisory firms which facilitates the provision of its services.

Thornbridge

Thornbridge22 can assist with setting up a company in the UK, regulatory advisement, fund hosting, and many more services that a crowdinvesting startup may need. Thornbridge allows a company to use its permissions to carry out investment activities by keeping its branding, ownership, and control.

Crowdfunding platforms in the UK

A clear regulatory framework and benefits in the form of tax relief make the UK market attractive for multiple platforms. Here are some examples of crowdfunding platforms in the UK.

Republic Europe (formerly Seedrs)

Republic Europe23 (formerly Seedrs) is one of the leading equity crowdinvesting platforms not only in the UK but also in Europe.

The platform enables investing in promising opportunities in startups, gaming, real estate, and cryptocurrency. It collaborates with top venture capital firms, family offices, and high-net-worth individuals to facilitate the investment process.

A business may choose whether to raise funds from private investors or a crowd. Retail investors can start investing with as little as $10, and the maximum investment is $124. For accredited and high-net-worth investors, there are no upper limitations.

Ethex

Ethex24 lists investment opportunities for small and medium businesses operating for the benefit of the community and the environment.

Ethex is a non-profit organization and as such, is not required to be authorized by the Financial Conduct Authority.

The minimum investment is 250 GBP, and the advertised return is 6%. Some investors can benefit from tax relief.

Crowdfunder

Crowdfunder25 is a donation- and reward-based crowdfunding platform that has helped to raise over GBP 300 million to support community projects, businesses, charities, and personal causes.

The platform enables one to start investing with GBP 1. The fees charged by the platform depend on the project that is raising funds. So, all projects pay a transaction fee (1.9 – 2.4% + 20p). VAT of 0 – 5% is paid only by charities and fundraisers, non-profit community projects, social enterprises, sports clubs, for-profit campaigns, for-profit businesses, legal/regulatory proceedings projects, and community share offers. A platform fee of 5% is paid by for-profit sports clubs, for-profit businesses, and legal/regulatory proceedings projects, and a platform fee of 3% is paid by community share offers. Investors can also add tipping if they want to.

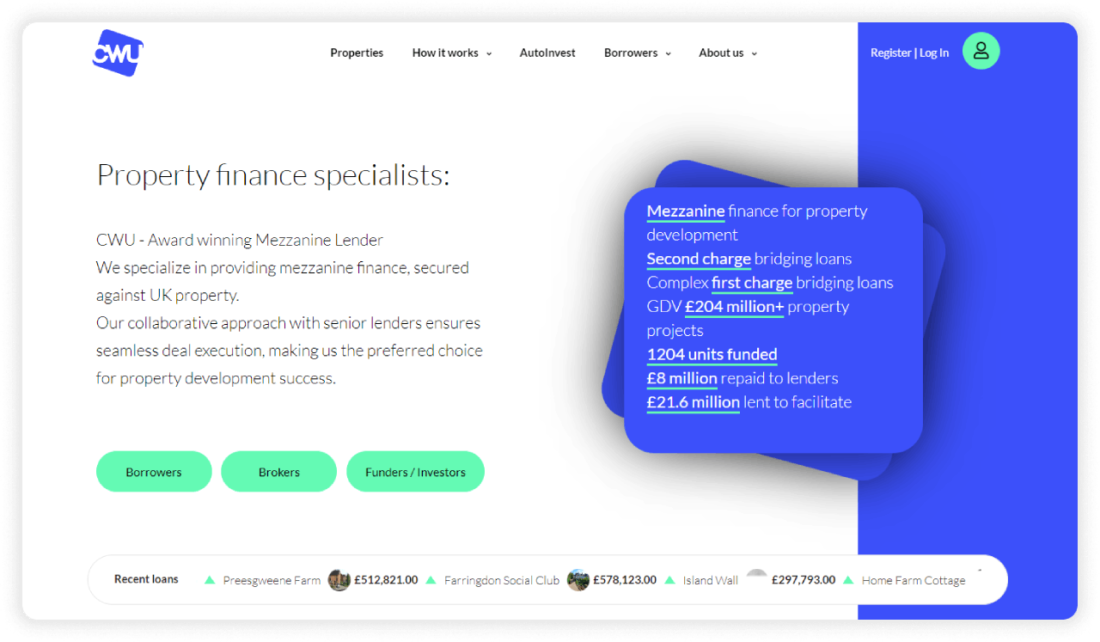

Crowd With Us

Crowd With Us26 is a London-based platform that provides mezzanine finance secured against UK property. This is an award-winning mezzanine lender that can boast 1221 units funded, almost GBP 3 mln lent to facilitate profitable property projects, and GBP 8,4 mln repaid to lenders.

Investing is available only to those investors that meet specific net worth or investment sophistication criteria. Loans can be made as an individual, as a limited company, or through an SSAS.

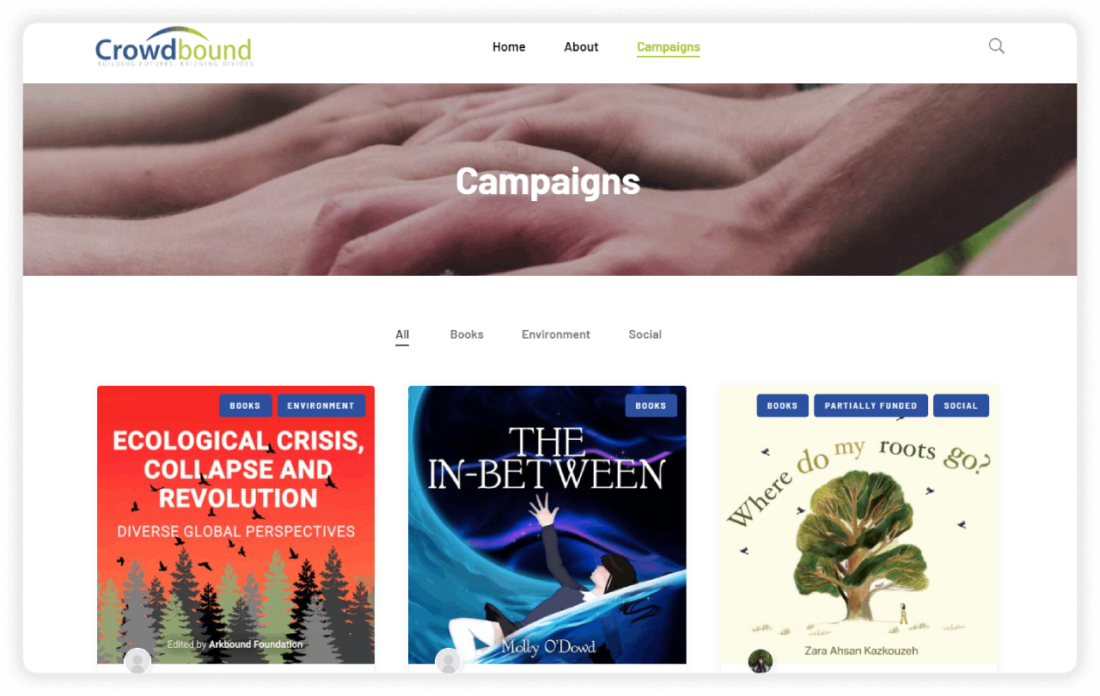

Crowdbound

Crowdbound27 is a donation-based crowdfunding and crowdpublishing platform that enables donations for books and projects covering social inclusion and environmental sustainability. The platform is managed by the Arkbound Foundation charity. The platform doesn’t charge fees from backers.

LenderKit your white-label crowdfunding software provider in the UK

If you are thinking about launching a crowdfunding platform in the UK, check out LenderKit white-label crowdfunding software.

You can start with a simple UK investment platform prototype to test the waters or explore a more robust package to run a scalable crowdfunding platform.

LenderKit has developed connections with payment systems, identity verification providers, document management tools and umbrella compliance services to facilitate your smooth launch in the UK market.

Whether you want to use an out-of-box solution or build a fully custom investment platform, we have the best crowdfunding platform development team and the ready-made solution to help you get started quickly.

If you’d like to learn more about the product and share your investment platform vision and requirements, don’t hesitate to reach out to us.

Article sources:

- Apply to use the Enterprise Investment Scheme to raise money for your company - GOV.UK

- Apply to use the Seed Enterprise Investment Scheme to raise money for your company - GOV.UK

- How to check a firm or individual is authorised | FCA

- FCA Warning List of unauthorised firms | FCA

- PDF (https://www.british-business-bank.co.uk/sites/g/files/sovrnj166/files/2023-07...)

- Crowdcube / Seedrs merger inquiry - GOV.UK

- Just a moment...

- US platform buys Seedrs for $100m after CMA blocks Crowdcube merger on home turf

- FCA to make mini-bond marketing ban permanent | FCA

- Crowdfunding | FCA

- Property Investment in London and the Home Counties | CapitalRise | CapitalRise

- Reliable Property Development Finance | CrowdProperty

- Robot Challenge Screen

- PDF (https://www.fca.org.uk/publication/policy/ps19-14.pdf)

- Financial Services Compensation Scheme | FSCS

- Loan-based crowdfunding platforms: summary of our rules | FCA

- PDF (https://www.weblaw.co.uk/ebooks/crowdfunding-guide.pdf)

- PDF (https://www.fca.org.uk/publication/policy/ps14-04.pdf)

- How to apply for authorisation or registration | FCA

- LHI Consulting – Bespoke Regulatory Solutions

- Sturgeon Ventures: Regulatory Umbrella - Regulatory Hosting

- Appointed representative & regulatory hosting services

- Invest online in startups via equity crowdfunding | Republic Europe

- Ethex: on a mission to make money do good

- Start Crowdfunding on Crowdfunder UK

- Crowd With Us

- Crowdbound | Charity crowdfunding for books and projects