Infographic: Crowdfunding Market Analysis 2019

We were looking for fresh business crowdfunding statistics, particularly, for the number of live crowdfunding platforms worldwide.

To our surprise, all the crowdfunding data was of 2012-2016 or there was no such data available. As our contribution to the crowdfunding community, we’ve compiled this simple crowdfunding infographic which may be useful to you.

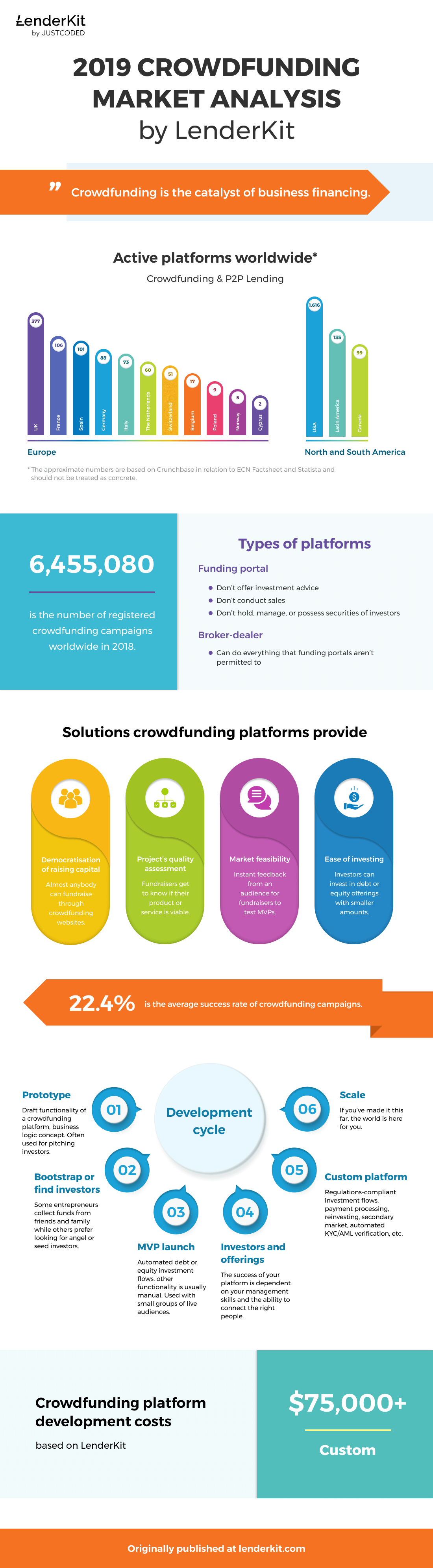

Active crowdfunding platforms worldwide

We decided to look at the European and US crowdfunding market relying on the data provided by Statista, Crunchbase, and ECN Factsheet.

Here is what we’ve found*:

- 889+ crowdfunding platforms are registered in Europe where 377 platforms are in the UK, 106 in France, 101 in Spain, 88 in Germany, and 73 in Italy.

- around 1,616 platforms are registered in the USA, 99 in Canada, and 135 in Latin America.

The data is a rough estimation of the market which is for informational purposes only and should not be used to make decisions. Do your own research or seek authorised research centres for in-depth market analysis.

What problems crowdfunding solves

All investors, fundraisers, and platform operators find their own value in a new fintech solution – crowdfunding.

Crowdfunding is an alternative source of financing SMEs and personal projects as opposed to traditional bank loans or other types of financing.

There are several problems that crowdfunding solves:

- Democratisation of raising capital. Almost anybody can fundraise through crowdfunding websites for both low-cost and high-cost projects.

- Project’s quality assessment. Fundraisers get to know if their product or service is viable. If a campaign performs well, then the product might actually be useful.

- Market feasibility. Instant feedback from an audience for fundraisers to test MVPs. With just a few design layouts or even an MVP, entrepreneurs can gather valuable feedback and improve their product accordingly.

- Ease of investing. Investors can invest in offerings starting with as little as 5$. If we are talking about donation-based or reward-based crowdfunding, investors should not be accredited or registered. When investing in equity or debt, particular investor requirements should be met.

Enter the market – risk-free. Learn “How to manage crowdfunding risks”

Types of crowdfunding platforms

In this crowdfunding infographic, we mention two types of crowdfunding platforms which concern debt and equity platforms only:

- Funding portal

- Broker-dealer

The difference between the two is in the registration and due diligence procedures.

Both funding portals and broker-dealer platforms should be registered with FCA, SEC or other country’s regulatory authorities. In contrast, donation and reward-based platforms are not regulated by these authorities.

Did you know that 22.4% is the average success rate of crowdfunding campaigns, according to Fundera?

Funding portals are limited in the services they are able to provide:

- Don’t offer investment advice

- Don’t conduct sales

- Don’t hold, manage, or possess securities of investors

On the other hand, broker-dealer platforms can do all of the above-mentioned things and more.

Crowdfunding platform development process

In debt or equity crowdfunding, many entrepreneurs come with a legal, real estate investing, fintech, startup development or banking background having prior experience in the field.

The majority of entrepreneurs don’t have the required funds to pay off the development of a crowdfunding platform at a fixed-price rate, so usually, the development process is slightly different from, say, a website development one.

A standard crowdfunding platform development process has the following stages:

- Step 1: Prototyping. A development team provides draft functionality of a crowdfunding platform. The features including investment flows and business logic are just enough to pitch the idea to investors and raise funds for further development.

- Step 2: Bootstrapping or finding investors. Not always do entrepreneurs want to share the stake at the company, so they decided to go on their own and do self-funding while collecting money from family and friends. Usually, this happens simultaneously while negotiating a prototype.

- Step 3: MVP launch. A minimum viable product is a well-functioning crowdfunding solution which can handle limited user flows either manually or automatically such account creation, KYC/AML verification, offering publication, investing, repaying, withdrawal, wallet management, etc.

- Step 4: Finding investors and offerings. Usually, entrepreneurs will have already established a large network of investors and fundraisers (e.g., property developers) and launch a private crowdfunding portal.

- Step 5: Custom platform development. This stage is characterized by sufficient funds, proven market, clear growth, and a solid business plan. The platform is usually regulations-compliant and registered with the required financial authority.

- Step 6: Scale. Scaling usually includes the company’s portfolio diversification, more opportunities to invest in, own licensing, etc.

Crowdfunding platform development costs

The costs vary from $10-50 for a white-label crowdfunding solution to $100,000+ for a tailor-made crowdfunding platform.

See “How LenderKit works”

The way it’s different from a white-label solution is that our team is ready to customise and develop the platform for your needs. We call this stage an MVP which usually ranges from $25,000 to $75,000+ depending on the scale of the project.

Finally, there is a fully custom platform which again depends on the scope of work and complexity and may start at around $75,000 – $100,000+.

Final thoughts

In this 2019 crowdfunding market analysis, we wanted to cast some light on what’s going on in the crowdfunding platform development sector, how many crowdfunding platforms are in Europe and the USA, and what it costs to build one.

Also, we’ve peeked inside the types of the platform, some regulations regarding such platforms, what problems crowdfunding platforms solve and other facts which you might have found useful.

If you’re looking to build a crowdfunding platform or need advice, email us at lenderkit@justcoded.com.