3 Crowdfunding Software Solutions for Building a Crowdfunding Platform

Updated: 10.07.2023

As somebody who is researching crowdfunding software solutions, you’ve probably encountered white-label crowdfunding platforms, fundraising scripts, and custom crowdfunding platform development service providers. The biggest challenge may be finding what works for you,when and at what cost.

Crowdfunding software solutions come in all sorts of shapes and sizes, they include:

- Type-specific crowdfunding tools: donation, reward, debt, equity, P2P lending

- Industry-specific: real estate only, startup investing, etc.

- Fund management

- Private equity investing

- Single-raise and multi-raise portals

By technology type or business model, crowdfunding solutions may include:

- Proprietary software

- SaaS crowdfunding solutions

- Fundraising scripts

- Open source crowdfunding software

Finally, the custom development service speaks for itself because it’s the easiest model to understand where you hire crowdfunding platform developers and pay an agency or a freelancer to build your platform from scratch. However, the latter may not be the easiest in terms of time commitment and budget planning compared to ready-made crowdfunding platform solutions.

What you will learn in this post:

What is a crowdfunding platform?

A crowdfunding platform is an online platform or website that facilitates the collection of funds from a large number of individuals or organizations to finance a project or venture. It serves as an intermediary between project creators or entrepreneurs and potential backers or investors.

Crowdfunding platforms provide a space for project creators to present their ideas, set funding goals, and offer rewards or equity in return for financial contributions.

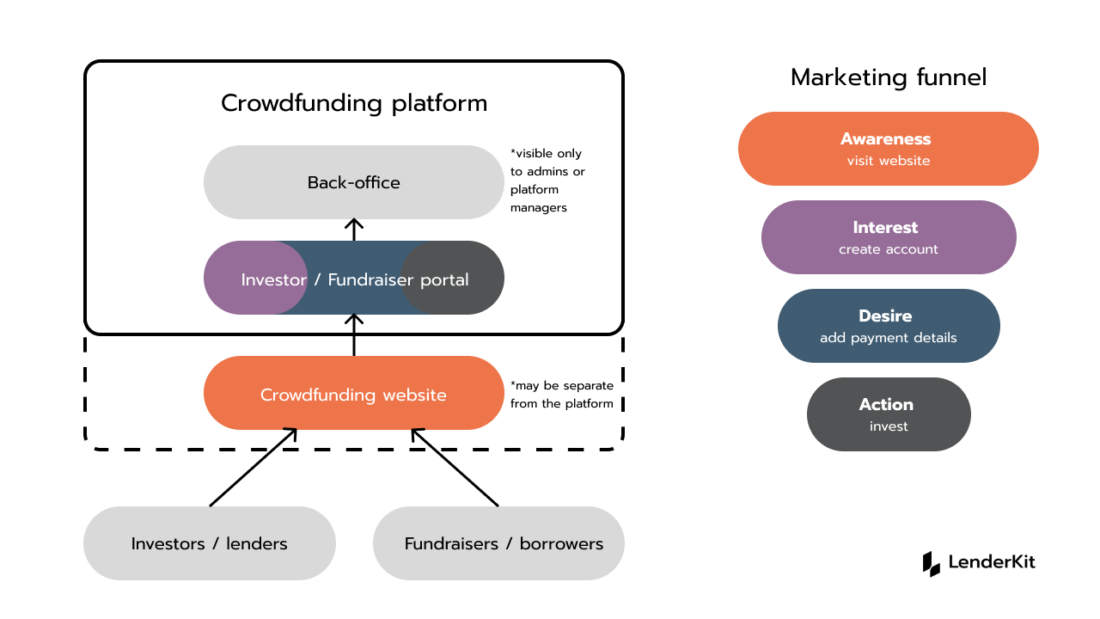

Technically, a crowdfunding platform may consists of 3 components:

- Website

- Investor portal

- Back-office or admin portal

The classical journey of a user looks something like this:

- A user visits a crowdfunding website where they learn about the available products on the platform including project types and average returns

- To actually see the projects and invest, a user needs to create an account which is created not on the website but on the investor portal, though the integration between the two is almost seamless

- Finally, the admin of the platform, campaign manager or investor relations manager can see all of the behind the scenes of the platform and run daily operations related to full-cycle crowdfunding and deal management

So, a crowdfunding platform is an essential tool if you want to run an online investment business because it allows you to lead and support your clients from the moment they visit your website to campaign creation, investment, dividend payout, reporting and post launch support — all through the platform. It’s your powerhouse of crowdfunding operations, analytics and data.

Crowdfunding solutions for your investment business

Crowdfunding solutions vary greatly, so the easiest approach to launching a crowdfunding business or expanding your existing operations is to understand what stage you are currently at and what you need the platform for.

For example, you may want to:

- Test the waters because you are totally new to crowdfunding

- Have a proven crowdfunding platform which complies with the regulations in your country of operations because you need to obtain a license from the local authorities

- Work with an existing audience, a pool of retail or accredited investors and project owners

- Launch a specific crowdfunding platform for your particular use case whatever it may be

All these things can be standalone challenges that you face as a business or you can view them as complex and interconnected things that you will eventually come across.

It all goes down to short-term or long-term vision and objectives.

At LenderKit, we take a comprehensive approach to working with crowdfunding businesses which means that our solutions can be used at the early stages of your journey to start quickly or if you are willing to go all in and invest in a unique crowdfunding platform and grow gradually.

Crowdfunding platform prototype

Prototyping a crowdfunding platform is an important step in the development process as it helps validate ideas, improve user experience, attract potential investors or partners, and refine the platform’s design before moving forward with full-scale development.

Businesses seek to start of with a prototype because it is:

- Cost-effective

- Quick to set up

At this stage, a business has clear short-term objectives which are easily understandable and can be addressed with the prototype of a crowdfunding platform:

- Test the market demand and get insights into the process

- Apply to the Regulatory Sandbox to get the operational license

- Pitch to investors to raise funds, etc.

LenderKit crowdfunding software would be a great fit for these needs.

LenderKit software for your crowdfunding platform prototype

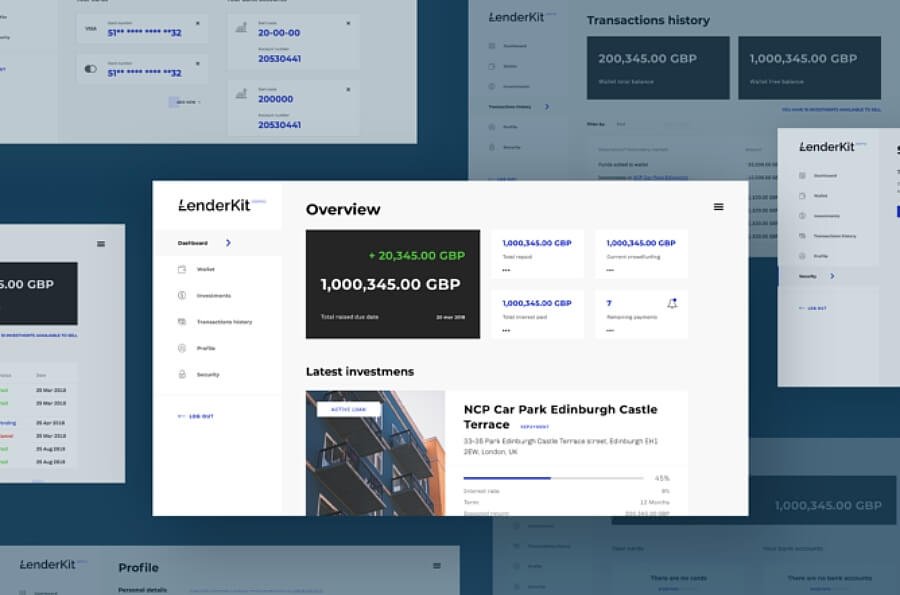

LenderKit is white-label investment management and crowdfunding software for real estate or startup fundraising and investing. It’s easily applicable to classical crowdfunding models, private equity investing and complex investment platforms with custom business logic and financial flows.

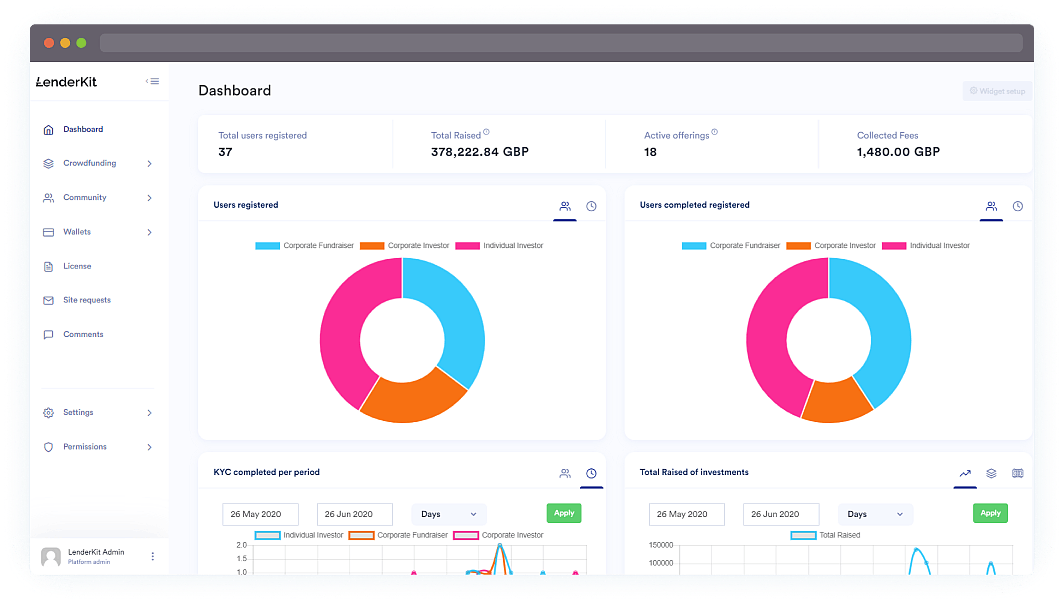

The software comes with many out-of-box features which will allow you to start your business off on the right foot:

- Dashboard with real-time updates

- Investor, borrower/fundraiser accounts management

- Wallet and transaction history management

- Manual or automated KYC/AML verification

- Manual or automated payment processing

- Fees configuration module

- Debt-based, equity, donation and rewards investment flows

- Automated repayment generation

- Secondary market

- SEO management

- Platform branding management

- Permissions and roles

- Cap table

- Documents management

- Multi-language support and more

Technically, the crowdfunding solution by LenderKit has everything you need from the marketing website and investor portal to admin back-office. It supports many integrations for compliant money processing, identity verification and even asset tokenization.

Overall, it should be a great fit for your prototyping needs.

As you raise the funds for further development or grow your business, you can proceed to building the MVP or the minimum viable product.

Crowdfunding platform MVP

Adhering to the software development philosophy – release early, release often or RERO – by Eric Steven Raymond, you have to move away from prototyping to MVP release to make sure your product is worthwhile.

MVP development is more of a psychological step rather than functional since you have to force yourself to release your perfect product which never seems too perfect to release.

In crowdfunding platform development, MVP stage is defined by new challenges which arise before an entrepreneur. At this stage, you need to:

- Have a base of white-listed investors and fundraisers to perform at least one transaction through your platform

- Automate payment processing, KYC/AML verification, set up eSign, and expand on other features to make them user-friendly

- Prove to your investors that the platform is striving for growth and your idea is market-viable to raise even more funds

- Make your platform more attractive to new investors and fundraisers who will become your active clients

At an MVP stage, entrepreneurs and agencies face the following pressure points:

- Limited or lacking technical expertise and resources

- Restricted budget which doesn’t allow for the trial and error approach and can only be allocated at the most important features

- Responsibility for the investors and borrowers who are awaiting interest rate payouts and/or are looking to diversify their portfolio as well as closing deals

With the help of flexible LenderKit crowdfunding software, these challenges can be seamlessly overcome. We’ve launched many platforms and know the pain points firsthand, so our team will help you avoid the major pitfalls and grow your online investment business.

Custom crowdfunding platform development and growth

Custom development is what most companies come to when they become mature businesses and want to avoid vendor lock-ins, have more data control, autonomy, and flexibility.

Some platforms grow beyond the capabilities of the crowdfunding software that they initially purchased or rented, so they need something more robust and they already have everything to continue building a platform further.

As your business grows, LenderKit offers you the source code buyout option which will allow you for unlimited customizations and better control over the product. Risk management and sustainability becomes the primary goal, so LenderKit covers these aspects with code escrow, risk monitoring and risk management procedures that will make sure your operations are secure and seamless.

If you are interested to learn more about the available product options and consider LenderKit as your tech partner and crowdfunding software provider, fill in the contact form and our fintech strategist will get in touch with you to answer any questions you may have.