Custodians and Crowdfunding Platforms Unite to Provide IRA-investing Opportunities

No time to read? Let AI give you a quick summary of this article.

It’s been more than 30 years now since Global Investor launched its first report on custodian services.

Back then, custody was about looking after the physical evidence of a client’s ownership in shares – the certificate.

Today certificates have been replaced with electronic records about different types of clients’ financial assets – stocks, bonds, real estate, alternative assets, etc.

The Business Research Company reports1 that alternative assets are expected to be the fastest-growing segment in the custody services market by 2030.

The skyrocketing growth of this market section is partially a result of collaborations between crowdfunding platforms and custodians.

And self-directed IRA accounts are what makes these partnerships possible.

What you will learn in this post:

The fundamentals of alternative asset custodians

Custodians or IRA/trust brokers2 are safeguards and processors of clients’ financial assets. They hold cash, stock certificates, bonds, and other financial instruments in their physical facilities or on electronic devices.

Custodians work with different clients and are also responsible for the settlement of the associated transactions. They deal with investment/insurance funds, pension schemes/funds, banks, global custodians, corporate clients, asset issuers.

They conduct activities only according to the instructions of their clients.

Trust brokers are often confused with depositaries3 since the services of both are very similar. However, depositaries deal mainly with investment funds and focus on asset monitoring.

Depositaries act independently and have greater control and reliability.

What do custodians do?

Custodians’ service package may include trade reception & execution, asset servicing, reconciliation, reporting/account management.

The core custody services don’t greatly vary among players, which results in high price competition.

To stand out, players tend to extend the service portfolio and improve the tech aspect of all processes through Robotic Process Automation (RPA) and Distributed Ledger Technologies.

Custody services market state

As of Q3 2020, the custody market size in the US was valued $32 billion. Due to global lockdown and social distancing, the market has declined by 12.2% this year.

Experts4 predict that the industry is going to recover and reach $34.6 billion in 2023.

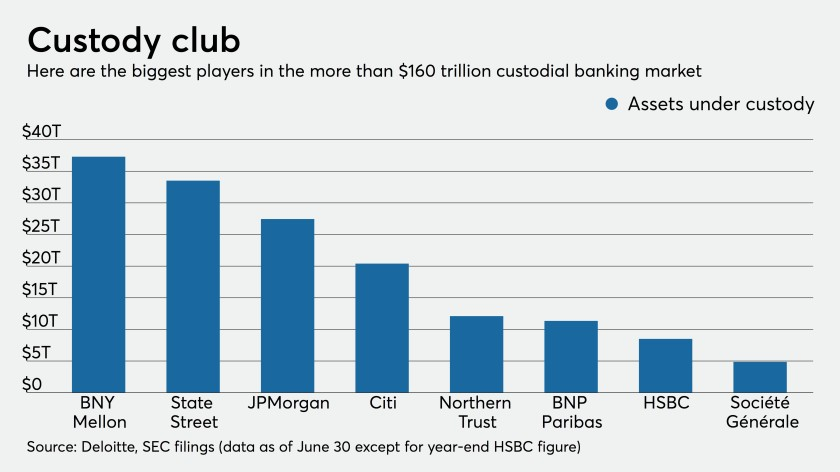

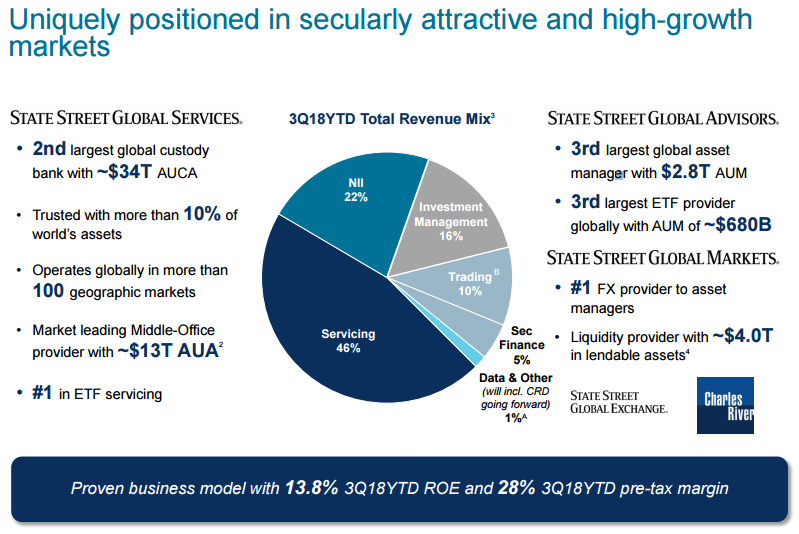

The custody industry has always been very concentrated with four largest players controlling the market – The Bank of New York Mellon Corporation (BNY Mellon), State Street Corporation, Citi, and JPMorgan Chase (Deloitte5, IBISWorld4).

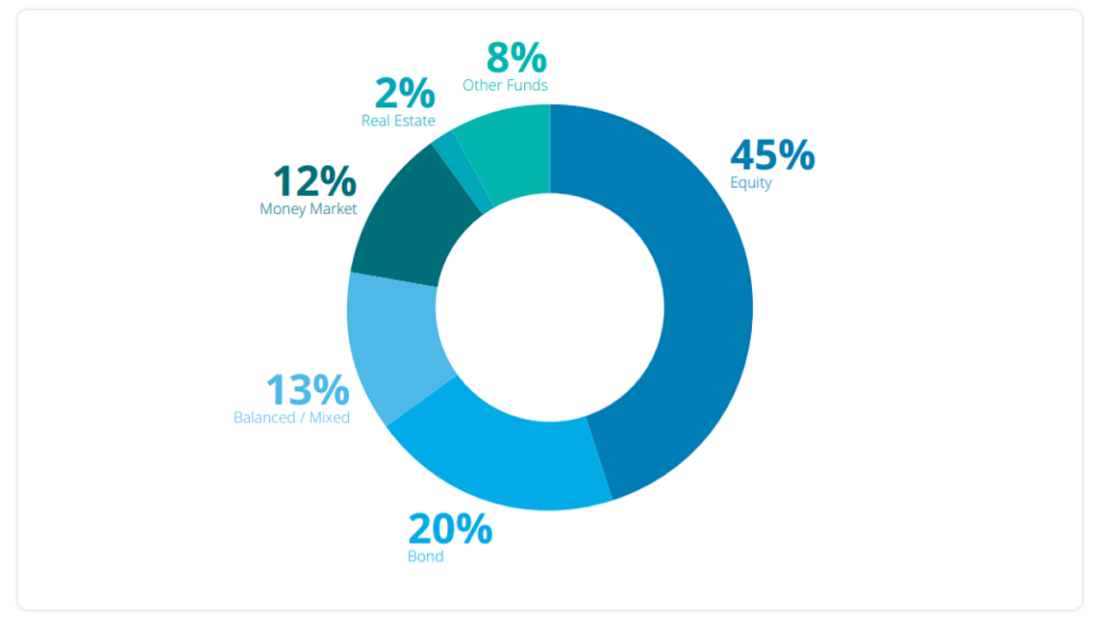

Dating back to 2018, the share of alternative assets supported by custodians was 10% and increased from US$1.8tn to US$4.3tn worldwide during 10 years (from 2008 to 2018).

According to the IBISWorld4 survey, alternative assets and other segments are going to get ahead of traditional equity and fixed income, and grow at a CAGR of 8.7% the next year (PRNewswire1).

State Street Global Services say that in 2018 servicing was the largest share (46%) in the revenue mix of custody organisations.

Revenue for the Custody, Asset and Securities Services is projected to decline by 4.1% in 2020 as a result of declines in corporate profit and disposable income impacted by COVID-19 pandemic (IBISWorld4).

In this case, alternative assets may become an additional revenue stream for the custodians partnering with crowdfunding platforms.

Self-directed IRA account – the key element in the custodian-crowdfunding platform chain

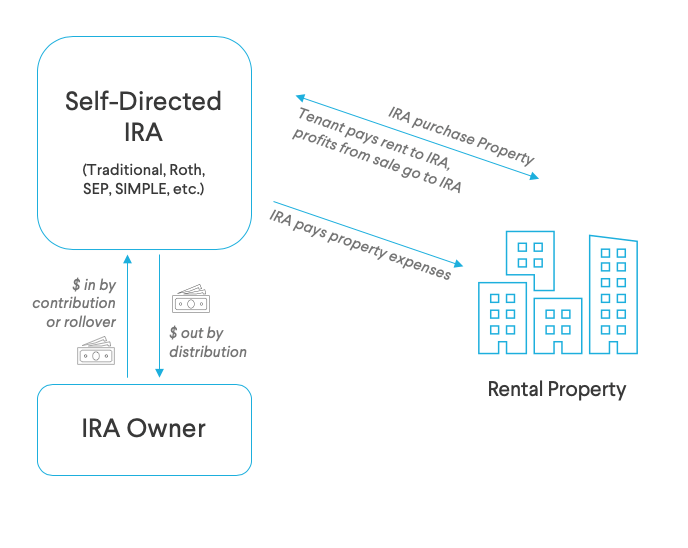

A self-directed IRA2 (SDIRA) is a type of traditional or Roth IRA held by a custodian that allows investment in a broader set of assets than is permitted by most IRA custodians.

Investors can save for retirements on a tax-advantaged basis and still have the same IRA contribution limits.

Compared to traditional IRAs that cover only basic instruments, SDIRAs provide numerous investment opportunities: real estate, promissory notes, tax lien certificates, and private placement securities.

Investment restrictions are collectable items, life insurance, S-corporation stock, and prohibited party transactions.

All these assets present high investment risks due to the lack of disclosure and liquidity. Besides, SDIRAs allow making investments in certain types of “digital assets” like crypto-currencies, coins, and tokens.

Importantly, backers should consider all the risks related to deals themselves; custodians don’t provide either investment advice or consulting services (Section 408 of the Internal Revenue Code8) or take any action without the express direction of the SDIRA owner.

SDIRAs offer many perks to investors:

- potentially higher profits thanks to the ability to invest in early-stage startups through private placements and real estate

- better management of retirement accounts to protect or grow investors’ wealth

- a chance to avoid volatility in the stock market through putting eggs in multiple baskets

- ability to get the full control of investment activity and complete responsibility of arising risks

- a chance to enjoy new investment paths which were previously available only for professional investors

Understanding the potential of SDIRAs for both Millennials and older generations, custodians and crowdfunding companies bet on them.

Let’s look at a couple of case studies.

Custodians and crowdfunding companies – how they partner

Many crowdfunding platforms found a strategic opportunity to partner with custodians. For platforms, custodians enable the SDIRA investments which becomes an additional benefit when attracting new investors to the platform and keeping them engaged.

For custodians, crowdfunding platforms become a new sales channel which allows them to work directly with the existing investor group on a crowdfunding platform.

EquityMultiple

The company keeps making professional real estate investments accessible to retail backers.

Last year EquityMultiple announced that it started working with several IRA custodians to allow clients to support property projects at low minimums.

There’s another goal of the company’s partnership with SDIRA brokers – to make the investment process through this type of accounts smoother and less complex.

The entire procedure is simple: clients set up accounts with custodians, transfer funds to SDIRA accounts, select a real estate asset and instruct custodians to complete an investment. All the proceedings from the asset are directed to SDIRA not directly to the account owner.

RealtyMogul

RealtyMogul has established an online income-oriented non-traded REIT called MogulREIT I10.

Since 2017, the fund has been accepting retirement funds from SDIRAs. For the past 6 months, the total asset value of the trust has achieved $216 million with more than 5000 investors.

The investment characteristics include average annual distribution rate – 6.00%, min investment amount – $5,000, distribution frequency -monthly.

The fund offers various investment options including multi-family, retail, office.

What’s cool about MogulREIT I is that it lets investors automatically reinvest their dividends and gain compounded returns11.

RealtyMogul works with a variety of custodians, including their preferred custodian, IRA Services Trust Company12.

CrowdStreet

Another crowdfunding provider enabling accredited and non-accredited investors to diversify their portfolio with strategic commercial real estate investments is CrowdStreet.

The company doesn’t restrict investor’s preferences of custodians.. The only requirement for clientele is to make sure that crowdfunding IRA custodian supports and allows investments available on the CrowdStreet marketplace.

To set up SDIRA accounts on CrowdStreet, backers should create an investing equity13, in which they may be a member. Next, investors execute closing documents themselves or delegate this opportunity to custodians.

For now, CrowdStreet collaborates with multiple crowdfunding IRA brokers such as Millennium Trust, Entrust, and Equity Trust.

Wefunder

Finally, we’d like to mention a fruitful collaboration between Alto IRA14 and Wefunder.

Last year, WeFunder announced the integration with Alto which enables individuals to invest in a diverse portfolio of alternative assets like startups, real estate, and marketplace loans.

With this new feature, backers get a chance to use their pre-tax dollars to make long-term Wefunder investments and diversify their portfolio.

SDIRA investments are only available for startups raising capital through convertible notes, SAFE, or stock contracts.

Both AltoIRA and Wefunder’s clients can initiate an investment from their platform account.

Such partnerships are lucrative to both parties of the deal.

Platforms consider SDIRAs as an additional selling point and a way to grab the attention of Gen-Xers and Boomers. As a bonus, they get almost vetted backers as custodians do their due diligence. And Self-directed IRAs can become an additional source of financing and complement the “traditional” or “general” account

For custodians, there’s a possibility to expand the client base and build a new source of revenue.

How to set self-directed IRA investing on a crowdfunding platform

As a crowdfunding platform owner, you should build out the logistics and balance responsibility zones.

Investors should be able to request the account opening and be able to transfer funds there. This can all be done on via a crowdfunding platform dashboard or through a custodian’s dashboard.

Also, investors should be notified of their status updates and get the latest information about the SDIRA funds movement while a custodian handles the administrative work.

It’s required to figure out the process of checking IRA-eligibility of the offerings that are published by fundraisers.

Another task here is to be monitoring any UBIT (Unrelated Business Income Tax) in order to make sure that investors meet the UBIT rules applied to IRAs15.

Ultimately, it’s about setting up the correct processes and logistics. You may look into at the above mentioned crowdfunding platforms closely and go through their existing solutions which can help your crowdfunding platform integrate with a custodian.

Currently, we’re working out the solution for integrating our white-label software, LenderKit, with a custodian.

If you’re interested in launching a crowdfunding portal and embedding SDIRA investment functionality, contact us to discuss the details.

Article sources:

- Worldwide Custody Services Industry to 2030 - Benchmark Performance Against key Competitors

- Investor Alert: Self-Directed IRAs and the Risk of Fraud

- What is a Depository? Definition, Types, and Examples

- IBISWorld Snack Food Production in the US Industry Report

- PDF (https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-service...)

- Will Citi snafu bring fresh scrutiny to custodial banks? | American Banker

- Access to this page has been denied

- Sec. 408. Individual Retirement Accounts

- Multiple Perspectives Podcast | Tara Fung, CRO of Alto IRA

- RealtyMogul Income REIT

- Compound Return: Definition, How It Works and Example Calculation

- Forge Trust : Client Portal

- Help Center Closed

- Alto IRA | Invest in Alternatives Like Crypto, Startups & Real Estate with Your IRA

- Publication 598 (03/2021), Tax on Unrelated Business Income of Exempt Organizations | Internal Revenue Service