Debt vs Equity Crowdfunding

There are two types of investment crowdfunding models – p2p lending and crowd investing. The main distinction lies in the models’ core. P2P loans are debt-based while the heart of investment crowdfunding is equity.

But this is not the only difference. If you dig deeper, you’ll see that p2p loans and crowd equity cover different layers of the capital stack for startups, vary in share types and interest rates, have different risks and rewards.

What you will learn in this post:

The Anatomy of Crowd Investing and P2P Lending

According to the latest report by Cambridge Centre for Alternative Finance, debt-based crowdfunding dominates the global market. China is the leader with 215.37b market value, the US (57.67b) takes the second place and the UK (9.31b) – the third.

Experts believe that it’s easier for institutional environments to adapt their infrastructure to alternative lending rather than to equity investments.

Also, they state that non-American investors tend to be more conservative and opt for less risky debt deals.

As for emerging markets like Africa debt crowdfunding is also preferred as it requires fewer efforts and smaller attention from policymakers.

Crowd investing (investment crowdfunding/crowd equity) takes place when everyday or accredited backers invest in shares or securities issued by a startup or business and not listed on stock exchanges.

Backers invest in stocks with expected IRR which may change as a result of additional share emission.

Unlike crowd equity, a p2p loan (crowdlending, debt-based crowdfunding) is credit investors lend to startups or businesses via online platforms in exchange for a fixed amount of interest. When participating in debt crowdfunding, backers invest in bonds.

See how to build your p2p lending website.

In both cases, investors gain a financial benefit and support the business idea they fancy.

In the US, both equity and debt models refer to securities crowdfunding – the use of exemptions from the registration requirements of the JOBS Act to fund businesses through investors acquiring the debt or equity securities of a company.

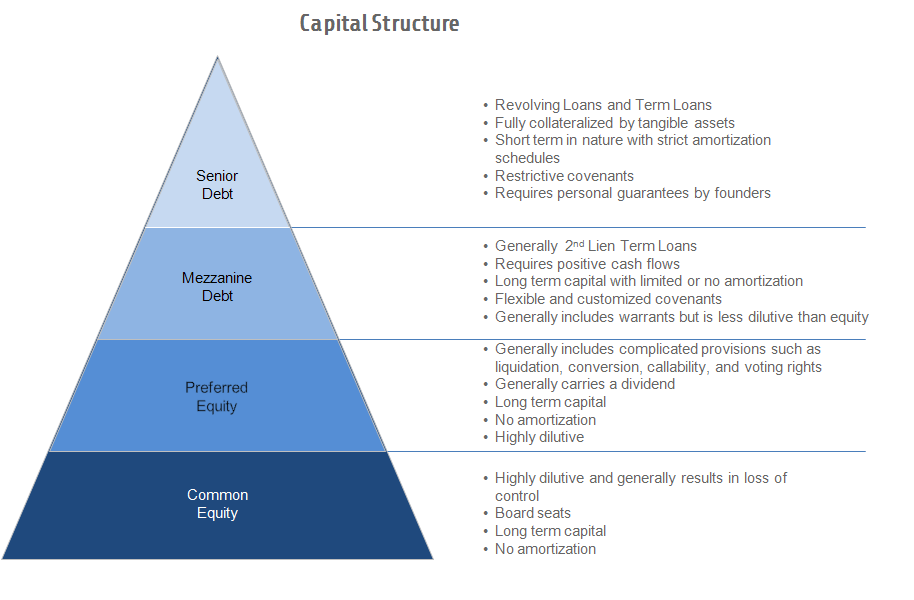

A typical capital structure for a startup consists of 4 layers.

- Senior debt. The top of the capital structure. Since it’s collateralized, senior debt is the least risky category. Senior debt can make up to 75% of the entire financing. Holders have the smallest interest compared to other investors, but in case the borrower fails, lenders can sell assets or property that serve as a mortgage.

- Mezzanine debt. It’s a mixed part of the financing, part equity and part debt. It may be any subordinated debt or preferred equity instrument that implies prioritized payments for backers ahead of common equity. Mezzanine financing is unsecured, thus it bears higher interest than secured debt. What’s important, lenders can convert to an equity interest in the company in case of default, generally after other senior investors are paid

- Preferred equity. The next layer in the pyramid made up by preferred equity owners who have higher repayment priority compared to common equity holders. Preferred shares are split into soft and hard. Hard equity holders have a right to influence business decisions, soft stocks come with limited rights.

- Common equity. This piece of the capital pie is the riskiest, yet the most profitable. Founders or sponsors pour their own money into the project and an ownership stake. In case of a project failure or business liquidation, common equity backers are repaid last. If a project is successful, they receive an exceptional rate of return.

Typically, crowdfunding providers work with preferred equity and mezzanine debt, however, there are some players involved in senior debt (InstaLend) and common equity deals (StartEngine).

Also read: "How to Start Your Debt Crowdfunding Platform"Debt and equity crowdfunding shapes

Debt- and equity-based fundraising have different forms. Let’s go over the list.

P2P marketplace consumer lending – a crowdfunding model where a borrower is an individual. This type of loans is unsecured.

P2P business lending – business entities raise seed capital via online portals.

P2P property lending – crowdfunding of real estate projects.

Balance sheet consumer/business lending – the closest type to traditional banking. Platforms originate the loan, keep it on the balance sheet and takes the credit risk.

Invoice trading – businesses are allowed to sell individual invoices in order to free up cash to an investor pool.

Mini-bonds – an investor makes an investment in a company in exchange for a “bond” – which is a form of a loan.

Debt-based securities – shares or bonds representing a debt from the investor to a company issuing these securities.

| Debt-based crowdfunding model | Market share, % |

| P2P consumer lending | 66% |

| P2P business lending | 17% |

| P2P property lending | 2% |

| Balance sheet consumer lending | 3% |

| Balance sheet business lending | 7% |

| Balance sheet property lending | 4% |

| Invoice trading | 1% |

| Mini bonds | 0% |

| Debt-based securities | 0% |

As for investment crowdfunding, it consists of real estate fundraising, revenue sharing, and community shares.

Property deals get over other models in terms of market share. And thanks to the rapid development of property crowdfunding, equity deals are gaining momentum.

Learn how to build a crowdfunding platform for real estate from scratch.

Revenue sharing is quite a new kind of raising money through specific contracts. Individuals can invest in companies in return for a fixed percentage of a company’s quarterly revenue. Once a startup gets funding, it pays back investors a percent of gross revenue monthly. It’s worth mentioning that in Canada and Africa this model is very popular with 51% and 46% market shares respectively.

Community shares is a group method to raise funds for projects. Startups offer shares in their organizations to the community.

| Equity-based crowdfunding model | Market share, % |

| Equity crowdfunding | 31% |

| Real estate crowdfunding | 60% |

| Revenue sharing | 8% |

| Community shares | 1% |

Check out the software for an equity-based crowdfunding portal.

Except for the above models, there are hybrid crowdfunding instruments like convertible notes.

They’re debt products that, as the name suggests, can be converted into equity at prescribed prices under certain conditions.

Risks & rewards

If we range the capital stack layers according to their risk and cost level, we’ll get an inverted pyramid.

Senior debt has the lowest risk while common shares are the most speculative fundraising method. This is what makes debt-based crowdfunding more appealing for borrowers and backers than equity.

Benefits of p2p loans

For businesses. It’s a fast and secure way to raise capital bypassing incumbents and an ability to save control over the enterprise. Once the payback period is over, your relations with investors will finish and you won’t have any obligations.

For investors. There’s a chance to get higher returns than yields offered by banks at a minimum risk. Even in case of borrower default, you as an investor we’ll be the first to get your money back. Besides, regular repayments generate a more stable cash flow for a longer period – 3-5 years.

Challenges

For investors. As it happens with all other investments, backers can lose all their money if a startup goes unsuccessful. Also, angels undergo Inflation risk. Your investment value is likely to decrease due to the rise in prices. Finally, the loan interest rate may be lower than the average market – nobody likes missing opportunities.

For businesses. Every rose has its thorns. No matter how well a business performs, borrowers must keep making loan repayments. Current debts can limit your borrowing potential and influence future credit history.

Now let’s dissect crowd equity.

How does equity benefit players?

Businesses. Compared to venture capital, equity crowdfunding provides a simpler opportunity for startups to get millions of funding. Besides, attracting investors, you obtain new business contacts and can get valuable insight to foster your undertaking in the future.

Investors can get super high returns. If an idea rocks the market, the compensation may be crazy and reach up to 150-200%. Today almost everyone with free cash can become a shareholder in the next Uber or Airbnb; the number of platforms for non-accredited investors is growing. By purchasing a share in a startup they fancy, angels contribute to idea implementation and startup success.

Limitations

Always remember about the limitations of investment crowdfunding if you’re the one who raises or donates money.

If you’re a backer, be ready to wait for a return. It may take a startup some time to gain public awareness and, therefore, generate profit. What’s important, equity investments have low liquidity; it’s often impossible to get rid of unprofitable shares. Another concern is fraudulent startups, so, always deal only with solid platforms running due diligence. The last but not the least is share dilution which we mentioned earlier.

The greatest downside for startups is sharing your business with others, which may influence its development and strategy. Also, borrowers may find it difficult to create a persuasive crowdfunding campaign and meet the regulatory requirements for security filings.

Debt vs equity crowdfunding: the bottom line

Actually, there’s no winner in the battle debt vs equity crowdfunding. Both models are polar-type regarding nature, conditions, terms, risks and rewards. And there’s no rule of thumb for whom and when equity or debt can be a perfect match.

That’s why before joining the game as a fundraiser or angel, it’s important to weigh the pros and cons of each model carefully. Let’s wrap this up by citing David Einhorn, a famous investor, – “The loss wasn’t bad luck. It was bad analysis”.