How to Start a Debt Crowdfunding Platform

Starting a debt crowdfunding platform is a good way to automate your lending operations and scale your crowdlending business.

To build a crowdfunding platform from scratch as your first business venture or transition from offline operations and digitize your operations, you need to have a solid plan. In this guide, we’ve gathered best practices and milestones for starting your debt crowdfunding platform from scratch.

What you will learn in this post:

Choose a debt crowdfunding platform type

There are different types of debt crowdfunding platform you can start, including:

- Microlending

- Invoice trading

- Peer-to-peer lending

Microlending platform

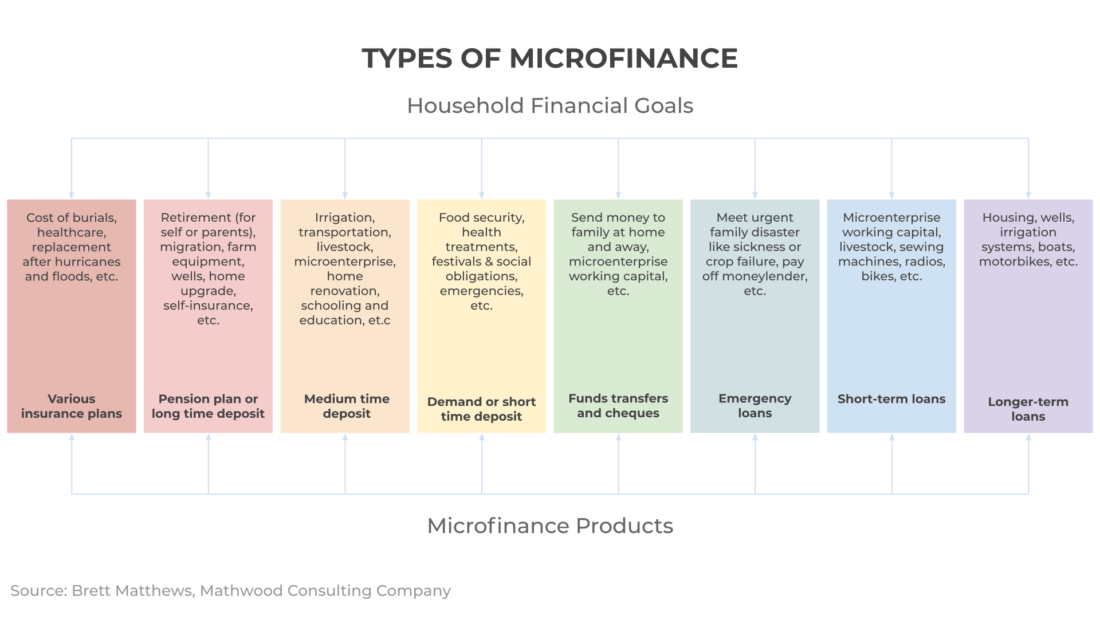

Microfinance platforms focus on individual entrepreneurs and small businesses which don’t have access to traditional ways of financing including bank loans. However, the whole microfinance concept is way larger than this. It varies by the industry type, corporate and personal needs, etc.

A microlending works best if there’s a high volume of projects in your area and market. Being dependent more strongly on automation technology due to higher volumes, a microfinance platform has to ensure strong KYC/AML procedures as well as secure online payment processing.

Invoice trading

Invoice crowdlending is a type of peer-to-peer lending where the invoice is used as collateral for a loan. Invoice trading platform managers often group invoices into portfolios and allow individual or institutional investors to invest in them.

According to the P2PMarketData, invoice trading is a more secure type of investment due to having collateral, but there’s also a risk that the invoice will never be paid. To start an invoice trading platform, a business has to focus on proper due diligence and ensure different product types from conservative to aggressive investment strategies.

Peer-to-peer lending

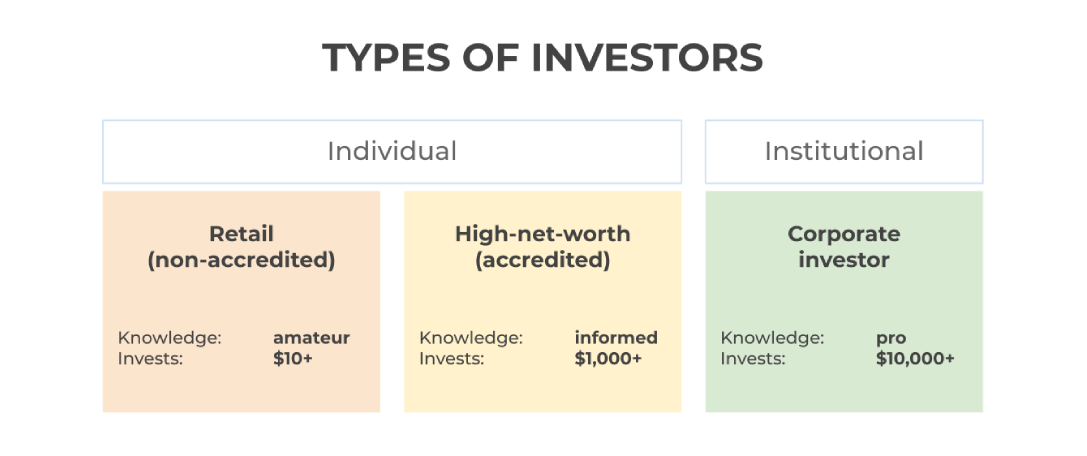

P2P lending or debt crowdfunding is a collective term for a general crowdlending platform that connects investors and borrowers. The investors can be both individual retail, high-net-worth or institutional investors. Borrowers can either be small companies that failed to qualify for a bank loan or seek debt financing as a strategic or additional source of capital.

Peer-to-peer crowdfunding platforms make money on charging the investors a servicing fee as well as borrowers a loan origination fee. There can be other administrative fees or services depending on the product lines.

Figure out your target audience

There are different types of investors which you can focus on including:

- Individual retail investors

- Individual high-net-worth investors

- Corporate investors

Your debt crowdfunding platform profitability depends on how you work with different investor types. There are certain restrictions on the marketing of mini-bonds to retail investors, so it can be a challenge if you’re looking to start a microlending business.

Having active investors on your debt crowdfunding platform is only one side of the coin because there also have to be active borrowers.

The challenge with a crowdfunding platform is that you have to masterfully find both customers, investors and fundraisers or borrowers.

Borrowers can vary from individuals to small and medium-sized businesses in different industries be it green energy, food & beverage, education or technology. The capital needs can also vary from $1,000 to $50,000+

Understand the market competition

Before launching your crowdlending platform, you need to consider the competition in your niche and location. There are several competitive platforms in the USA, UK, Europe and MENA region which you have to be aware of.

Debt crowdfunding platforms in the USA

According to the Money Under 30 article, there are several strong players in the US market:

- Prosper – personal and business loans

- LendingClub – personal and business loans, auto-refinancing, patient solutions

- Peerform – consolidation loans, personal loans

- Upstart – refinancing, personal and business loans

- StreetShares – small business loans

- Funding Circle – direct small and medium-sized business loans

Debt crowdfunding platforms in the UK

There are several competitive p2p lending platforms in the UK market:

- Zopa – consumer loans

- CapitalRise – property/real estate loans

- SoMo (former BridgeCrowd) – refinancing, property loans

- Assetz Capital – secured SME loans, property loans

- Funding Circle – direct small and medium-sized business loans

P2P lending platforms in Europe

According to P2P Empire and our research, the European market is dominated by the following debt crowdfunding platforms:

- EstateGuru – property-backed business loans in Estonia

- PeerBerry – short-term loans in Lithuania, Latvia

- Robocash – online loans in the Philippines

- Debitum – loans for small and medium business in Lithuania

- Iuvo Group – business loans in Estonia

- EvoEstate – real estate loans in Estonia

- Heavy Finance – agricultural loans in Lithuania

- Bergfürst – real estate loans in Germany

- MytripleA – loans for businesses and freelancers in Spain

- October – personal and business loans in France

P2P lending platforms in Saudi Arabia, UAE and MENA

The MENA crowdfunding market is rapidly growing. Currently, these debt crowdfunding platforms are active in the MENA region:

- Forus – SME loans in Saudi Arabia

- Beehive – SME loans in Dubai, the UAE and Saudi Arabia

- Raqamyah Platform – business loans in Saudi Arabia

- Saakhoo – insurance and personal loans in the UAE

Learn about the regulatory requirements for debt crowdfunding platforms

A very important aspect of any investment business including debt crowdfunding is regulations. Understanding the regulatory requirements in your area is key to running a successful crowdlending business.

The regulatory requirements may concern:

- Payment processing – holding clients money in an escrow, having cancellation policies, etc.

- Data protection of investors and fundraisers

- Marketing restrictions – such as restrictions to the marketing of mini-bonds to retail investors

- Conducting KYC/AML to ensure the safety of operations on the platform

- Risk notices – ensuring that investors and borrowers understand the risks

- Communication requirements – ensuring that there’s a transparent communication channel between investors and borrowers

- Financial reporting – both for the platform and the borrower, etc.

There are different regulatory authorities which you have to know how to communicate with, understand the rules and policies. The major regulatory bodies include:

- SEC, FINRA in the USA

- FCA in the UK

- European Commission in Europe

- SAMA, CMA in Saudi Arabia

- DIFC, DFSA in Dubai, the UAE

Explore strategic partnerships

It’s very popular to be “disrupting the traditional finance model” and compete with banks, however, it might not be the case for the debt crowdfunding platforms. According to the Deloitte research, marketplace lending platforms (MLPs) should explore the potential collaboration with banks:

Our fundamental view is that MPLs do not present an existential threat to banks and, therefore, that banks should view MPLs as complementary to the core banking model, not as mainstream competitors.

Since debt crowdfunding platforms work with borrowers that don’t qualify for the traditional methods of financing, including bank loans, platforms may use banks as institutional investors to provide loans to the “re-qualified” businesses.

In other words, if a business turns out to be profitable after obtaining and paying off the loan, it may now qualify for a bank loan or other forms of financing and can be an interesting customer to a bank.

Apart from banks, P2P lending platforms may also work with startup accelerators and provide further funding to firms that have already passed the incubator or accelerator program.

Use reliable debt crowdfunding software

Finally, to start a debt crowdfunding platform, you need reliable debt crowdfunding software to manage lenders and borrowers, partner with online payment providers, credit scoring agencies, etc.

LenderKit provides white-label debt crowdfunding software for early-stage and established businesses worldwide. The software is suitable for the prototyping stage as well as building a fully scalable custom crowdlending platform.

Our crowdlending software includes plenty of features out-of-box to save you time and money when starting your marketplace lending platform:

- Credit scoring functionality – you can assign a credit score to borrowers

- Auto-investing – allow investors to set up custom investment preferences

- Secondary market – enable secondary trading to provide more liquidity

- 3rd-party integrations – connect with payment gateways, credit scoring agencies, KYC/AML providers of your choice

- Analytics and monitoring – get insights into your platform performance via the admin dashboard

- User roles – set up custom user roles including administrators, advisors, etc.

There are a lot more features to talk about, so if you’d like to learn more about how LenderKit works, reach out to us to set up a live demo.