Escrow Account for Crowdfunding Platforms Explained

No time to read? Let AI give you a quick summary of this article.

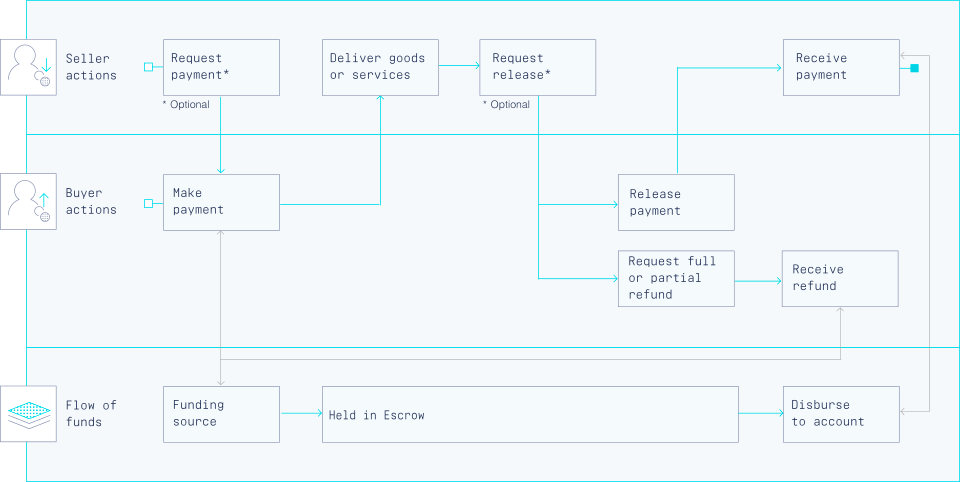

In crowdfunding, an escrow account is used to store investors’ money up until the crowdfunding campaign is completed, so that the funds can be transferred to the fundraiser.

When investors choose to invest in an offering on your crowdfunding platform, the amount of money that an investor pledges or “agrees to invest” has to be kept somewhere. It doesn’t directly go to the fundraiser’s account. Why? Well, if the crowdfunding campaign fails to collect the target amount, it’s going to be difficult to organize refunds.

For crowdfunding platforms, an escrow account allows large sums of money to be managed effectively and relatively securely while protecting investors’ and fundraisers’ interests.

What you will learn in this post:

An escrow account is a gateway for funding portals to manage investor’s money

On the regulatory side of the question, a crowdfunding escrow account solves a very big problem for funding portals1 in the USA or bulletin boards2 in the UK – it enables them to hold and manage investor’s money.

In contrast to broker-dealers that are authorised to make investment decisions and manage investor’s money freely, funding portals may only rely on an authorised third-party payment processor like MangoPay3 or Assembly Payments (now, Zai4) that provide an escrow account and required money processing operations.

There are, of course, certain procedures you have to follow and ensure that your payment provider knows the rules of the game too. For example, both business and payment processor must be aware of specific regulatory requirements5:

“Under no circumstances should any fees or charges be deducted from escrow prior to a deal closing, as those are investors funds and NOT (yet) the issuer’s funds.”

SEC also emphasises:

“…investors should be able to see, online, a ledger that shows their money received into escrow for offerings they have invested in, and for any funds returned to them from escrow on cancelled offerings or participations.”

How safe is an escrow payment for crowdfunding platforms?

On one hand, a third-party payment processor with an escrow service is arguably the only option to enter the crowdfunding business with a match-making business model, on the other hand, the regulators also highlight certain risks:

“If you make an investment using your credit card through a third-party wallet service or payment processor, you may have limited recovery options because these entities may be unregulated or operating unlawfully.”

If we ignore the “credit card investment” fact – which any regulator warns about – a third-party payment gateway is a third-party payment gateway. When times are good, you won’t even feel it, but when things shake – that’s when you may feel certain pressure.

Have you heard of the Payoneer and Wirecard scandal6 that mostly affected Eastern Europe? In the blink of an eye, funds became inaccessible for withdrawal or other operations. Many customers were scared. Even though it all ended relatively well and FCA resumed the regulated activity of Wirecard, scared customers = hesitant customers. And hesitant customers don’t invest which makes your business lose opportunities and deals.

Nevertheless, a third-party payment processor with an escrow account is a comfortably safe way to process investor’s money and run a profitable crowdfunding platform. It can certainly be a safe harbour for several years – that is the time required for your business to either take off or adjust.

A few words in the protection of crowdfunding payment processors

Crowdfunding platforms use third-party payment gateways not only because they provide an escrow account or open doors for their business, but also because of the KYC/AML services.

Not all customers are saints, they steal credit cards, abuse funds, and do plenty of other fraudulent stuff. For that reason, every person that uses your crowdfunding platform should be verified and protected.

Also read: "A list of proven payment gateways for crowdfunding"Payment gateways provide top-notch support with due diligence and dispute resolution and may help with financial reporting. They, just as much as you, are interested to provide their best services to make everybody happy. They are also regulated by the same financial authority, so a carefully selected payment gateway will become a professional partner for your crowdfunding business.

Article sources:

- SEC.gov | Registration of Funding Portals

- PDF (https://eurocrowd.org/wp-content/blogs.dir/sites/85/2019/10/20191002_ECN_Tril...)

- Welcome to Mangopay docs - Mangopay docs

- Zai | Complex Online Payments Made Simple

- PDF (https://www.sec.gov/comments/jobs-title-iii/jobstitleiii-204.pdf)

- Payoneer blocks funds to thousands of Eastern European freelancers amid Wirecard fraud. How and when they can access the funds - AIN