FiDA Regulation and Crowdfunding: How It May Work

No time to read? Let AI give you a quick summary of this article.

During the last EUROCRO1W1D conference1 we attended, entrepreneurs, enthusiasts, and researchers discussed many topics, mainly focusing on how to grow the crowdfunding market, its challenges, and solutions.

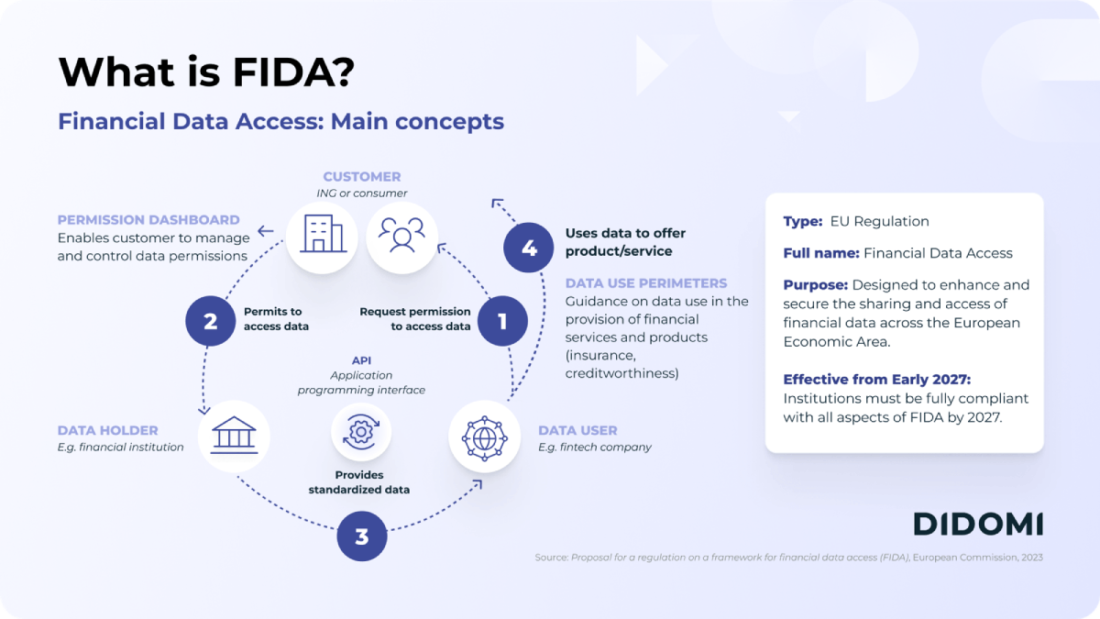

The coming framework for Financial Data Access Regulation (FiDA)2 that is likely to see the world in 2027 is expected to bring new challenges, but it will also allow crowdfunding platforms to expand their businesses across the EU.

In this article, we will dive into the main highlights of FiDA and what it means for crowdfunding service providers.

What you will learn in this post:

What Is the FiDA Regulation?

The Financial Data Access4 (FiDA) Regulation is a European framework designed to give customers greater control over their financial data. It mandates financial institutions to provide access to specific categories of data when requested by customers and allows the secure sharing of this data with third parties based on customer consent. Financial institutions, acting as either data holders or data users, include entities that offer financial products, services, or relevant information to customers.

FiDA also introduces safeguards to ensure that data sharing doesn’t lead to unfair practices, especially for vulnerable segments like low-income consumers. For instance, when financial institutions use data for credit scoring or pricing insurance, the regulation requires specific protections to avoid risks of financial exclusion or unfair pricing.

To empower customers, FiDA requires financial institutions to offer permission dashboards. These dashboards allow customers to easily manage and control how their personal and non-personal financial data is accessed and used, without being pressured to grant or withdraw permissions. This system may integrate trusted identification services, such as the European Digital Identity Wallet, ensuring secure and informed data management.

How FiDA affects crowdfunding platforms

The Financial Data Access (FiDA) Regulation will significantly impact crowdfunding platforms by enabling more streamlined, secure, and transparent data sharing. Here are a few changes that platforms can expect:

- Enhanced Data Control: Customers will have greater control over their financial data through user-friendly permission dashboards, allowing them to manage access without pressure.

- Secure Data Sharing: Crowdfunding platforms can share customer data securely with third-party services based on explicit consent, improving service offerings.

- Increased Transparency: The regulation mandates clear communication about data usage, fostering trust between users and platforms.

- Focus on Consumer Protection: Specific safeguards will prevent unfair practices, particularly for vulnerable consumers, ensuring equitable access to crowdfunding opportunities.

- Innovation in Services: By accessing richer data, crowdfunding platforms can develop tailored financial products, enhancing user experience and engagement.

- Regulatory Compliance: Platforms must align with FiDA’s standards, promoting ethical data use and adherence to security protocols, thereby improving overall industry reputation.

Data holders, customers, and investors

Each customer will be able to determine what data they are willing to share and to what extent through a special dashboard. The dashboard shall provide a customer with the following options:

- the name of the data user to which the data will be provided

- the customer account, financial service, or product to which the access will be provided

- the purpose for which the permission is given

- what data will be shared

- the validity time of the permission to share the data.

The customer shall be able to withdraw, change, or reestablish the withdrawn permission at any time. Also, there shall be a record of all permissions so that a customer can view which ones were given, which are still active, and which were withdrawn. This will boost the confidence and trust of the data users and holders.

The data holder shall make it easy to find the permission dashboard in the user interface and clearly write the rules for using it.

Data users can use customer information only for the purpose specified in a request for information. Such information is protected legally and technically and mustn’t be used for advertising purposes except for direct marketing. This will ensure that those obtaining customers’ information won’t be reselling it or misusing it in any other way.

When customer information is no longer needed, it shall be deleted.

A data holder shall ensure that the customer’s information is available to a data user in real-time and of good quality (at least not in the worse quality than it is available for the data holder itself). When permissions are withdrawn or modified, the data holder shall inform the data user about changes. For investors, it means access to more accurate information about campaigns and businesses and, thus, an ability to make more informed decisions.

This will allow crowdfunding platforms’ customers to control their financial information and to benefit from personalized attention.

Data access for investors

FiDA allows investors to receive financial data based on their preferences, which will help them benefit from more personalized financial services. The ability to receive data from various platforms will enable them to make cross-platform comparisons and make better-informed decisions.

The availability of objective financial data for investors will increase customer expectation levels and boost competition among crowdfunding platforms, thus pushing them to offer better services.

Challenges for crowdfunding platforms

Along with benefits, crowdfunding platforms may face multiple challenges when FiDA comes into force. One of the main challenges is the technical and financial burden of complying with FiDA’s5 data-sharing and reporting requirements.

To become a financial information service provider, a crowdfunding platform shall develop a special system complemented with a dashboard to provide the platform’s customers with the required functionality to share and access financial data. Technical standards are still to be developed, and it is unclear yet how such solutions will function.

Additionally, crowdfunding platforms will have to apply for permission to collect, store, and share financial data, which involves additional costs.

If a crowdfunding platform does not opt to become a financial information service provider, financial data will have to be collected from third-party services, which will not be free.

Platforms based outside the EU but working with EU customers will face additional challenges. According to FiDA, they will have to appoint a legal representative within the EU, which will add a layer of complexity for international players.

Opportunities for crowdfunding platforms

If crowdfunding platforms approach the coming framework wisely, they will be able to take advantage of the opportunities offered by FiDA.

Additionally, the availability of richer and more updated data sets would lead to improved credit scoring, more relevant investment opportunities, and the development of enhanced financial tools for both investors and SMEs.

By integrating customer data into more intuitive dashboards, crowdfunding platforms will be able to provide more user-friendly services and make it easier for investors to track their portfolios and compare offerings.

Bottom line

While FiDA will deliver a lot of benefits that would transform the crowdfunding industry by driving transparency, innovation, and investor trust, it also comes with a lot of challenges. For existing and new crowdfunding platforms, it will be crucial to comply with all the requirements to stay competitive and meet evolving customer expectations in the EU financial data economy.