How Crowdfunding Platforms Protect Investors and Fundraisers

No time to read? Let AI give you a quick summary of this article.

Crowdfunding has revolutionized the way businesses build seed capital. However, the alternative investment method remains a challenging path for every party involved in the process.

The challenge lies in different types of crowdfunding risks. If you’re a serious investor, fundraiser or a crowdfunding business owner, it’s hard to resist from asking this question “How well do crowdfunding platforms protect their clients?”.

Let’s talk about crowdfunding protection policies and platform security methods.

What you will learn in this post:

Types of crowdfunding risks

Investment crowdfunding bears low and high-risk depending on the project, capital structure, and risk mitigation policies.

For example, investors face multiple risks1 including:

- Business failure risk. The probability of failure for early-stage startups is always higher than for lager-stage businesses. investors need disclosure documents from fundraisers explaining the potential risks, guarantees, liquidity limitations and other potential pitfalls.

- Lack of investor proficiency. A growing number of crowdfunding companies and campaigns target everyday investors who may not have the required knowledge and experience to make informed investment decisions.

- Fraud. When it comes to crowdfunding, fraudulent activity may occur on a many-to-many basis. Ingenuine fundraisers tend to create fake campaigns or portals to get into the funds of angels.

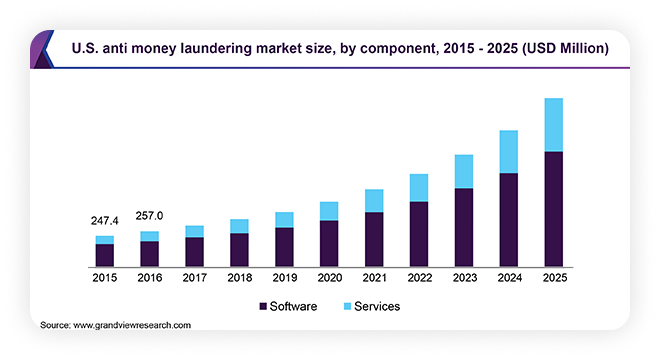

- Money laundering. Similarly to traditional financial schemes, money laundering sometimes occurs in crowdfunding. Platforms who fail meeting AML laws and compliance requirements may be exposed to fishing schemes.

- Sector risk. Some projects may be complex and hard to understand especially for those investors who have little experience or knowledge in the specifics of products or services that are offered.

- Business relations risks. The lack of communication between investors and fundraisers may lead to misunderstandings and influence the fortune of the project badly.

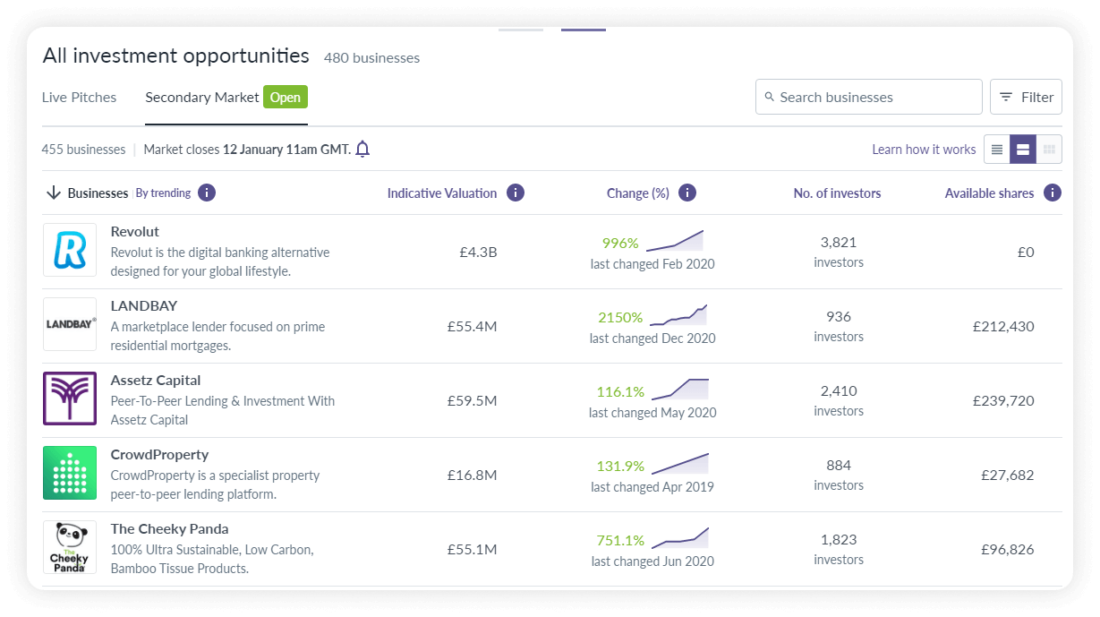

- Liquidity risks. There is no public market for private shares and very few crowdfunding platforms have built-in secondary markets; as a result, these investments present limited liquidity. Even in secondary markets, there may be a low demand, especially, if the crowdfunding platform is small.

The main challenges for startups are:

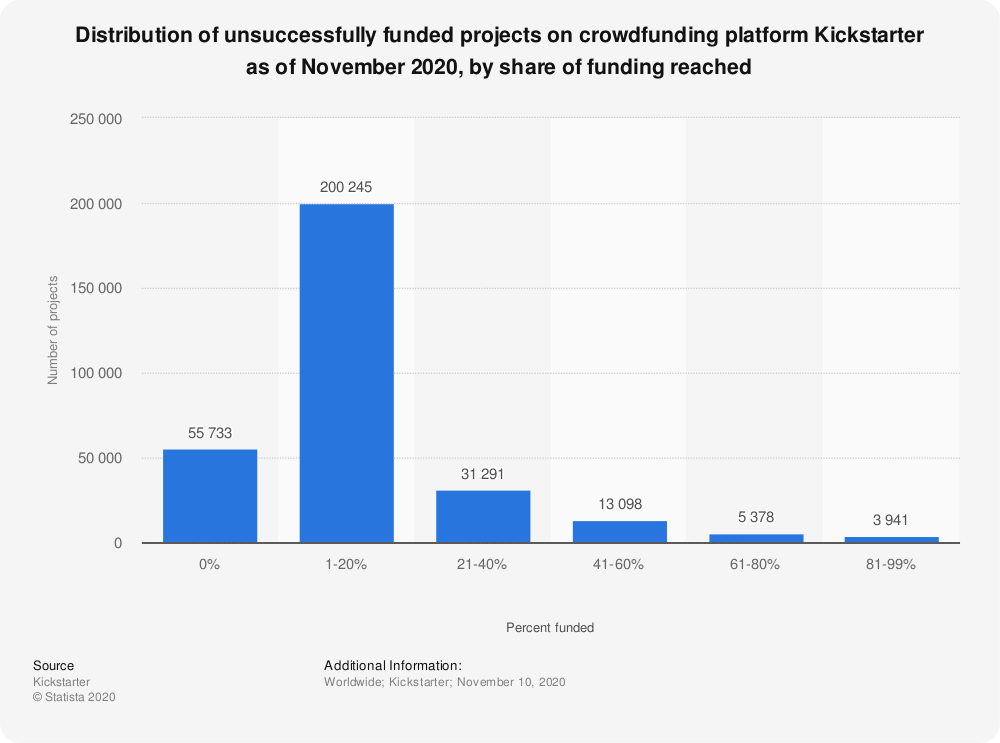

- the risk of not collecting the required amounts of investments

- a project failure and investment loss (underfunding)

- intellectual property infringement

- overfunding

Also, there are general platform-related risks which may impact both parties.

Lack of operational transparency. The transparency gap may occur due to updates and certification. Some platforms don’t have the proper licence or provide updates on the progress of crowdfunding campaigns.

Illegal trading activity. To operate as an equity-based crowdfunding platform, in many cases, a company should apply for authorization similar to that required for other financial services. Entitled crowdfunding providers aren’t allowed to conduct trading activities. Strict country regulations are one of the entry barriers for crowdfunding companies.

Poor reporting. If there’s no reporting or analytics on a platform, investors and investors can track the offering progress and alter the investment strategy.

Lacking risk notifications. IThe provider needs to explain all the investment risks angels may undergo. Typically, it comes in the form of a general or deal-related warning. According to the law, platforms should explicitly point to potential risks if they have any. Otherwise, investors risk losing funds.

No info requirements. The cornerstone of a successful deal is informed decisions based on the project info and prospectus obligations. Issuers of securities have to prepare key information for an accurate assessment of financial security. Platforms are obliged to publish detailed project descriptions and fees breakdown.

Sensitive data leakage. From time to time, the media reports about another data breach on a crowdfunding platform. In 2014, criminals compromised Kickstarter user data4 by gaining unauthorized access to customers’ records.

Startup and Investor Protection

Elimination of the above risks is an urgent primary task of any crowdfunding platform aimed at improving its safety. And, of course, the safety of its clients.

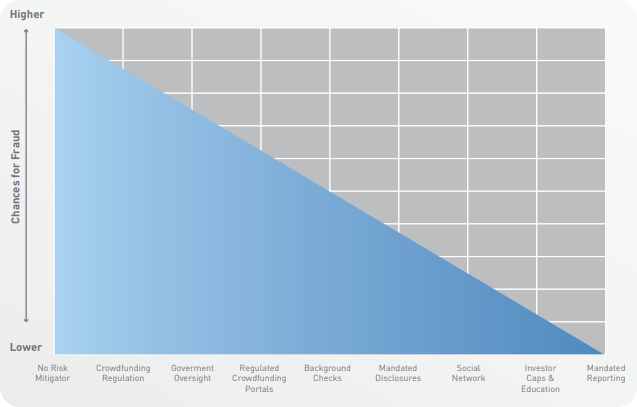

There are lots of studies and recommendations helping crowdfunding providers to overcome challenges over there. Several years ago InfoDev studied the state of crowdfunding security1 and offered protective mechanisms.

Preventing fraud

There are several ways to prevent fraud cases: conduct background checks, use all-or-nothing financing, educate investors. The bodies, in their turn, have to make sure that all crowdfunding takes place on regulated platforms.

For the same purpose, authors of this article 5offer to use a rating system based on operational, investment, financial risks and risks of innovation. It can help in reducing the access to fraudulent pyramid schemes to a platform.

Avoiding investor losses

To handle this issue, InfoDev advises to:

- use investment limits for retail investors

- let the public do crowd vetting and crowd diligence and share the results

- promote secondary markets

- educate investors about portfolio diversification

- update and review current regulation to strengthen investor protection

For instance, experts from the EU have developed proposals to the current regulation to protect unsavvy investors from potential losses.

By running entry knowledge tests on prospective investors, a provider can check their experience, objectives, financial situation and a basic understanding of risks and investment types. Also, a platform should ask an investor to simulate an ability to bear loss taking regular income proceedings into account.

Since more and more everyday investors are trying crowdfunding, local governments are strengthening protection measures.

It’s the SEC who is responsible for investor protection in the US. By releasing Investor Bulletins6, the regulator educates investors and explains the ins and outs of alternative financing.

In the UK, FCA keeps building a solid basis for protecting retail investors7. Canadian OSC8 is making and enforcing rules for the securities industry and investors safety.

A niche example is the Small Investor Protection Act9 that was adopted by The German Bundestag to safeguard small-sized investors engaging in the new asset class.

Under the Act, investors should send self-disclosure statements if the investment size exceeds EUR 1,000 and can’t donate more than EUR 10,000 per investment.

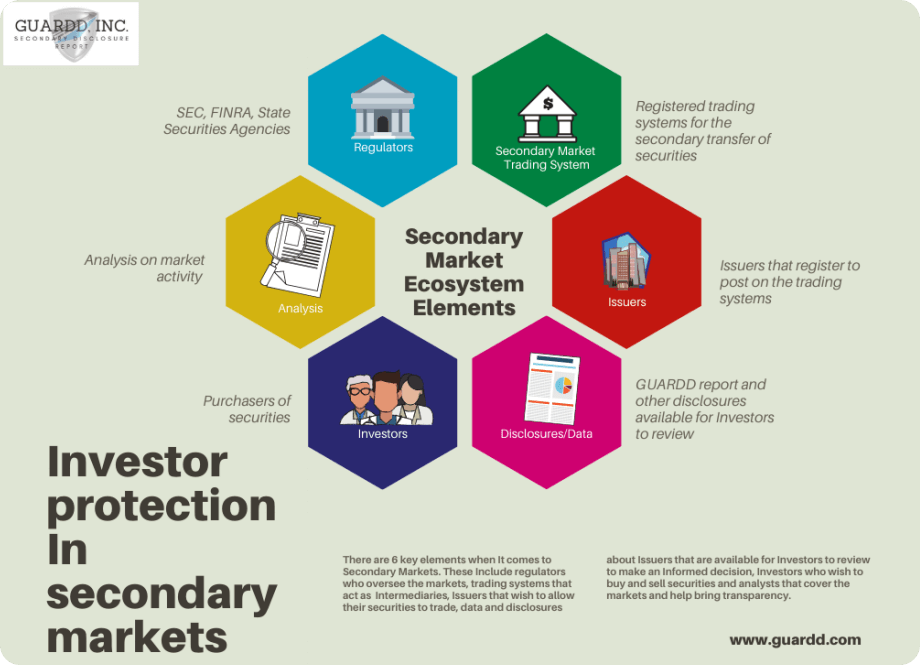

Bridging the disclosure gap

According to experts, the best tactics here is to implement mandatory auditing, financial disclosures and business reviews. At the same time, providers should restrict or monitor social media communication about offerings.

Also, the disclosure gap may be addressed with the help of GUARDD-like tools.

GUARDD10 is a cloud-based financial data platform that hosts private company disclosures. Potential investors may review a consolidated document/report of a company’s operations and financial history.

It does help those investors who may need regular, updated information about the financial condition and corporate news of companies they support.

Protecting startups from failure

The InfoDev report includes useful tips on startup protection, which can help in mitigating market rejection (investor community doesn’t show interest in a project), sector risks, and funding failure.

| Risks | Tactics |

| Sector risk | – enable businesses to raise small amounts of capital to show market interest – let the crowdfund only a small part of the overall capital raise – build on small successes in certain areas (science and energy) |

| Market rejection | – offer combo products (crowdfunding+traditional investments) – share successful business stories through media and investor testimonials |

| Funding failure | – create educational programs for startups on how to raise funds – partner with broker/dealers, attorneys or accountants to help startups stick to a business plan once funded |

Strengthening platform security

Under the current COVID-related conditions, cyber threats are dramatically increasing. FinTech is one of the most vulnerable sectors, therefore platforms should take extra safety measures to protect clients.

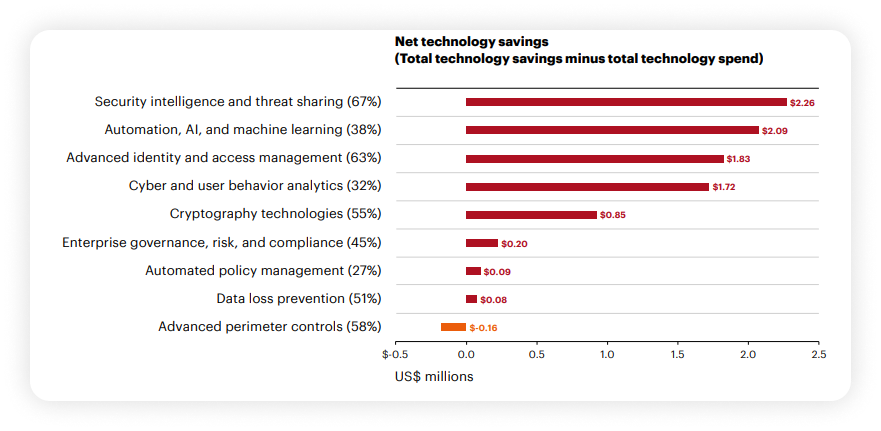

Accenture has studied cyber risk policies of financial institutions and concluded that only one-third of players are using AI/ML technologies to cut back threats.

This cyber risk panorama is discouraging, that’s why Accenture suggests13 that FinTech companies:

- implement feasible security technologies (AI/ML, cryptography, etc);

- mitigate people-based attacks;

- be compliant with privacy regulations such as GDPR and CCPA;

- invest in security issues discovery (automated policy management, advanced identity, access management);

- partner with vetted third-party providers, etc.

Final thoughts

“Trust is paramount in crowdfunding, and we all know that once it’s lost, it is very difficult to get it back.” Simone Marinesi.

Pitfalls are a trademark of financial activities and their mitigation should be a priority for any crowdfunding provider.

Investors, fundraisers and the provider itself are exposed to significant financial risks. For investors, it’s a risk of losing capital. Project failure of IP theft may be disastrous for startups.

Crowdfunding platforms risk user data and their reputation if not being compliant to industry protection standards.

Security optimization may be a complex task, but for platforms it’s the only way to deliver the highest possible value to clients.

Article sources:

- PDF (https://www.infodev.org/infodev-files/wb_crowdfundingreport-v12.pdf)

- Google Image Result

- Page Not Found | Republic Europe

- Kickstarter calls for password changes after data breach | CSO Online

- This article

- Investor Alerts and Bulletins | Investor.gov

- FCA says more work needs to be done to protect retail investors - Alternative Credit Investor

- How regulators protect investors | GetSmarterAboutMoney.ca

- Client Challenge

- Products – guardd.com

- PDF (https://www.sec.gov/comments/s7-14-19/s71419-6658131-203832.pdf)

- Kickstarter: unsuccessfully funded projects 2025| Statista

- PDF (https://www.accenture.com/_acnmedia/PDF-96/Accenture-2019-Cost-of-Cybercrime-...)