5 Barriers to Entry for Crowdfunding Business and How to Beat Them

FCA recently banned the promotion of speculative mini-bonds to retail investors. The changes will take place on January 1, 2020, and will last for a year. This is how it goes:

“We are using temporary product intervention powers without consultation because of our significant concerns with the widespread marketing of these products…” claimed FCA.

To add fuel to the fire, the media seems to have blown the conflict into a world-class disaster.

“You’re limited in power and soft”, says the media.

The concerns FCA is talking about include:

- Mass-marketing of speculative mini-bonds to retail investors;

- High risk of the investments;

- Promotion of high returns with little emphasis on the risks;

- False-claiming that FCA or HMRC offers protection of these products.

The problem with speculative mini-bonds is that they’ve been so overhyped that around 11,000 of investors pledged over £25,000 per investor in these bonds.

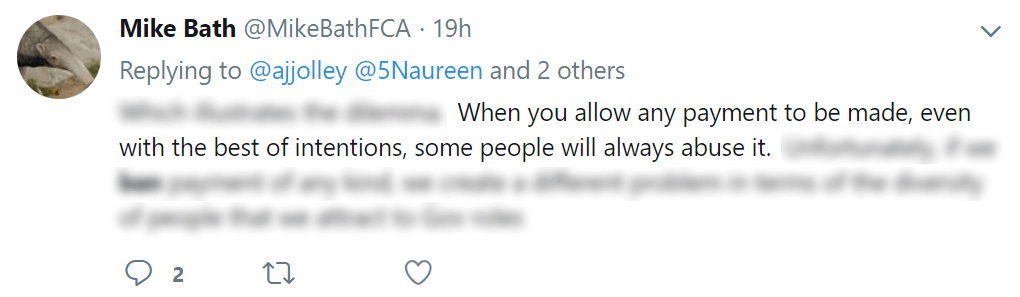

If an issuer of speculative illiquid securities fails to repay to investors, then investors are at risk of losing significant amounts of money while being poorly informed. The problem with mass-marketing of mini-bonds is that they attract unsophisticated everyday investors who are likely to suffer great losses in this game.

What you will learn in this post:

Strict country regulations

The biggest roadblock to entry for equity or debt crowdfunding business is country’s regulations.

It’s not even about the software and functionality that has to be compliant with the regulations in the form of risk notifications and accurate information on the crowdfunding platform. That’s too easy.

It’s about the operations and services you provide using the platform.

You have to study regulations carefully with your lawyer who is proficient with your particular type of the platform either funding portal or a broker-dealer.

When you hear “a regulation-compliant crowdfunding platform” it usually means:

- the marketing website provides clear information with the right emphasis on the risks;

- the services such as deal curation, portfolio management, or other online and offline services are clear and compliant with the regulations;

- the platform doesn’t self-impose more rights than it’s compliant with;

- issuance of the securities is compliant;

- online payment processing and data storage is compliant;

- you provide regular financial reports to the financial authorities, etc.

FCA, SEC, SAMA, and others are regulating human relationships in business and not the platform operations.

A crowdfunding platform is used as an investment management automation tool for efficient business financing.

The platform itself is not something that has to be compliant in most cases. It’s how you run the company, what services you provide and what is your target audience – this is what has to be compliant.

Low startup capital

We truly believe in and support the sweat equity. There are many great examples of people who made it through and build their businesses using enthusiasm and charisma at some points of their journey.

However, neither FCA nor the marketing and development agencies are able to share the pure energy which a mission-driven entrepreneur illuminates.

So, having enough capital just to push through another iteration is a must.

There are several ways to raise capital for your business:

- self-funding or bootstrapping;

- angel or seed investors;

- P2P lending;

- bank loan.

You may have noticed that we mentioned “iterative” approach to development. What does it mean?

Both development companies and clients may sometimes collaborate on a fixed-price basis. For example, you may want to build an equity crowdfunding platform for real estate. The development task is pretty straightforward, right?

In most cases, it’s not. However detailed your specs may be, there will always be something to work on. This is exactly where the agile development approach comes into play which allows to deliver large projects iteratively, step-by-step.

Limited access to the market

Due to strict regulations and promotion rules regarding debt and equity crowdfunding, access to the market is one of the most important things you need to work on.

Usually, the most successful platforms are private and target only sophisticated or accredited investors.

Making a platform public and accessible for everyday investors is a serious step and requires a ton of due diligence and compliance work because of certain risks.

Often entrepreneurs believe that they may start off with some basic crowdfunding platform and figure out the market later. Such an approach might be true in other types of businesses like starting a B2B matchmaking platform, but matchmaking investors with borrowers is not at all that simple.

It’s vital to define your market before you start your own crowdfunding platform. Also, you need to find a legal firm which specialises in crowdfunding and figure out the regulations for this market.

Longer trustworthiness development

At first, this paragraph was meant to be dedicated to a “selling proposition”, however, it’s usually not as important. Surviving the regulatory procedures is the selling proposition itself.

In crowdfunding business, trustworthiness is the key. Depending on how liquid your assets, the time of paying back to investors may vary. The faster investors can get to the ROI, the more your site’s credibility will be growing.

There are several key factors that investors and borrowers are looking for in crowdfunding platforms:

- management team, because it’s to managers investors trust their money;

- expertise and communication;

- KYC/AML verification procedures;

- transparency of fees and terms of service;

- returns and reinvesting policies;

- portfolio management opportunities, etc.

The more informed your investors and borrowers are, the more they trust you. If you’re operating on a local or international market, keep your audience updated and secure as much as possible.

Adoption of technology

Why is that even a thing? In 2019-2020, adoption of technology is not a big deal, some might argue.

But hey, many people are still using Excel spreadsheets. Learning to operate, borrow or invest through a crowdfunding platform might actually be challenging.

Unlike Excel spreadsheets, a crowdfunding platform requires both business management and technical expertise to operate smoothly. So, adoption of technology is something to consider. Ask yourself these questions:

- What is your target audience?

- Do they have experience using online banking or other digital solutions?

- Are they happy and confident using such tools?

Understanding your customers is the first step to building strong relationships with them.

Final thoughts

The 5 barriers to entry for crowdfunding businesses that we’ve listed are the most common ones which means there are ways to overcome them. Let’s recap:

- Find a legal consulting firm which can advise, draft and file the documents for registering a crowdfunding platform;

- Define your target audience of investors before providing them opportunities to invest in.

- Make sure you have enough capital to get started and proceed with further development. Check out this crowdfunding infographic to get a rough idea of how much it costs to build a crowdfunding platform.

- Build trust in your community or find influencers to help you do that.

- Make sure that your target audience is familiar with crowdfunding platforms or is willing to learn how to use them.

This might look scarier than it sounds, so don’t worry. The most important thing you need is to figure out the regulation-compliance side.

As a crowdfunding platform development service provider, we are happy to tackle your technical challenges. If you have any questions, you can contact us at lenderkit@justcoded.com.