How Real Estate Crowdfunding Platforms Make Money

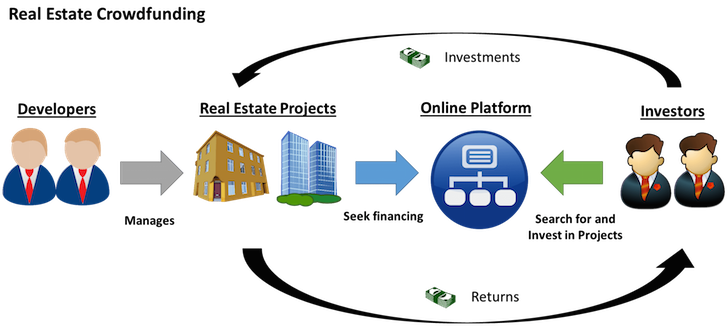

Real estate crowdfunding platforms allow investors to start with small amounts and take part in funding a large RE project or pool of projects.

By connecting property developers and investors, a crowdfunding platform earns money on management, advisory, and sales fees.

Depending on the regulations and the platform’s policies, a crowdfunding website may charge both investors and fundraisers. With that said, crowdfunding platforms may adjust their marketing strategy leaning towards investor’s or fundraiser’s interests to gain competitive advantage on the market.

In this article, we’ll look at how crowdfunding platforms make money. This information will be useful for your own real estate crowdfunding business and will help you:

- define if the real estate crowdfunding business is right for you;

- find out different ways to monetize your crowdfunding platform;

- analyze your potential competitors and adjust your strategy.

You may also check out: How to make money with a crowdfunding platform?

What you will learn in this post:

Fundrise

Fundrise is a crowdfunding platform that provides both debt and equity investment opportunities. The company is focused on sourcing, negotiating, and acquiring assets which they build into portfolios and present to accredited investors. To non-accredited investors, the company offers two types of REITs.

Both accredited and non-accredited investors can invest on the platform through specific account types such as:

- Starter – $500

- Core – $1,000

- Advanced – $10,000

- Premium – $100,000

Depending on the type of account, investors get access to various numbers of projects ranging from 5 to 80+.

How Fundrise real estate crowdfunding platform makes money:

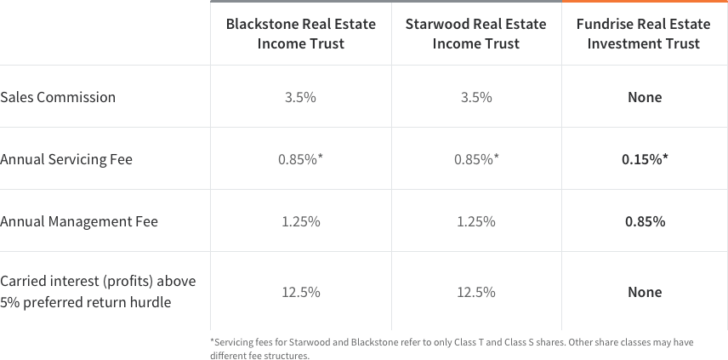

Fundrise charges investors 0.15% of annual advisory fee in addition to 0.85% of yearly management commission.

Operating more as a private equity fund, Fundrise closes debt and equity deals directly charging borrowers and property developers a commission.

Fundrise is heavily focused on providing the best services for investors, however, due to the illiquidity of assets, investors may wait up to 5 years before they are allowed to withdraw their revenue.

Other fees include investing through IRA. By partnering up with Millenium Trust Company, Fundrise allows investors to invest through their IRA, but a fee of $125 annually is required to support this option.

CapitalRise

CapitalRise is a private debt and equity crowdfunding platform. The company works with four major types of investors:

- Restricted Investor

- Sophisticated Investor

- High Net Worth Investor

- Corporate Investor

The platform operates in the UK and provides investors various opportunities charging zero fees.

How CapitalRise makes money:

CapitalRise charges property developers for raising funds through the platform while investors do not pay any fees.

This fee management structure allows CapitalRise to stand out from the crowd and become an interesting competitor on the market for other platforms.

If you’re launching in the UK, you may be interested to learn more about CapitalRise before starting your own crowdfunding platform.

Realty Mogul

Realty Mogul is a crowdfunding and property investing platform which provides private marketing offerings and REITs.

The company is focused on both accredited (1031 Exchanges and Private Placements) and non-accredited (Mogul REIT I and Mogul REIT II) investors offering them various opportunities to invest in.

At Realty Mogul, investors can start with a minimum of $5,000 and get monthly distributions.

How Realty Mogul makes money:

At Realty Mogul, fees vary based on the type of an investment, however, there are also set fees:

- management fee – 1% annually;

- REIT fees – range from 0.50% to 0.60% annually;

- one-time legal fees for certain projects;

- fees for borrowers and property developers.

Depending on the complex fee structure of Realty Mogul which they don’t publicly disclose, you have to reach out to them directly or do in-depth research.

CrowdStreet

CrowdStreet is a crowdfunding marketplace featuring both debt and equity investment opportunities in various projects such as multifamily, retail, office, industrial and land.

Individual investors can start with a minimum of $5,000. However, the platform is only open for accredited investors.

Investors can choose among the following real estate investment opportunities:

- direct investments;

- fund investments; requires a minimum investment of $25,000;

- managed investments; requires at least $250,000 to get started.

How CrowdStreet makes money:

CrowdStreet doesn’t charge joining or offering access fees. However, other fees apply:

- a 1-2% asset management fee;

- sponsor fees;

- property management fees ranging from 3% – 4%;

- development fees;

The list of fees may not be comprehensive, so you should look into the documentation of the CrowdStreet platform to learn more about fees.

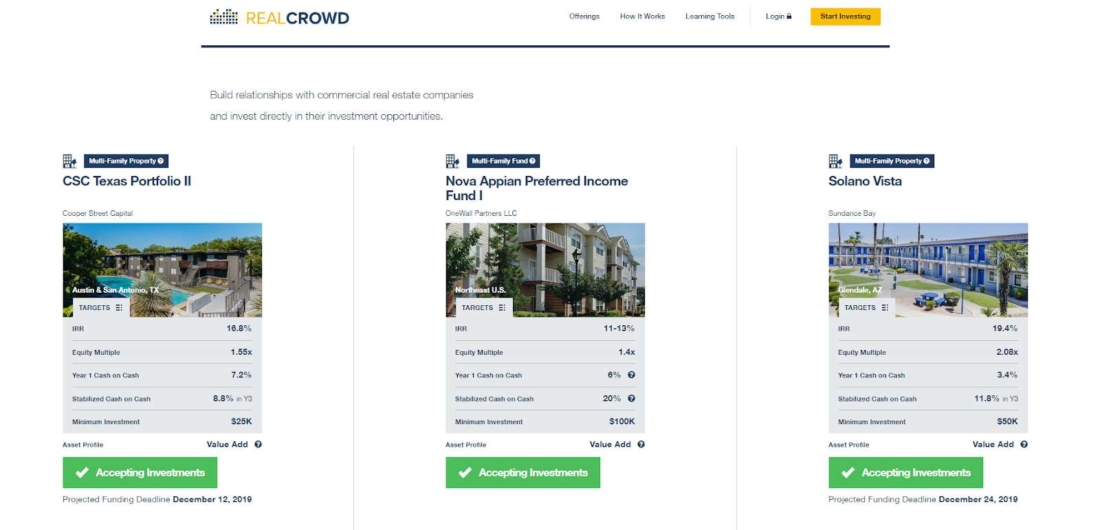

RealCrowd

RealCrowd is a crowdfunding marketplace which operates in a standard direct-to-sponsor model. With ranging minimum investments from $25,000 to $100,000, the platform provides investment opportunities for accredited investors only.

Sponsors get to decide whether to accept an investor’s accreditation documents as well as an investment.

The platform itself is not a broker-dealer and doesn’t take part in any deal curation. The platforms works as a bulletin board or funding portal.

RealCrowd is focused on commercial real estate equity deals and does not support family or house-flipping business.

How RealCrowd makes money:

RealCrowd doesn’t charge investors for using the platform, however, technology use fees apply to sponsors.

The technology use fee isn’t publicly disclosed.

What unites most of the crowdfunding platforms or how to monetize your crowdfunding portal

The majority of crowdfunding platforms have mixed types of investment flows combining both debt and equity. Some platforms are registered as broker-dealers while others provide only administrative services operating as funding portals, also known as bulletin boards.

The choice of the platform’s type may depend on the countries regulations, desire of the complexity of management, lifestyle, niche, etc.

While there are many factors that influence the crowdfunding platform monetization strategy, one thing remains solid – platform’s ability to adjust to the market requirements and needs.

To ensure this flexibility, platform owners may rely on:

- Constant research;

- Deal management and closure;

- Web design changes;

- Core functionality customisation opportunities;

Regardless of the type of the platform, there is one core feature that should be thought out from the very start of the crowdfunding platform development.

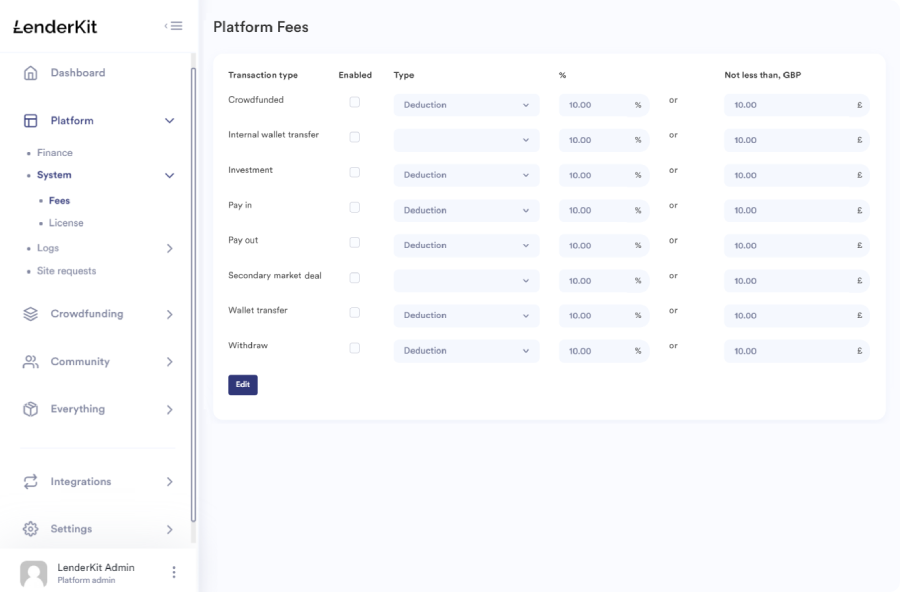

Fees management module in crowdfunding software

Flexible fees management module allows you to adjust to the market regulations and needs as well as to your crowdfunding platform growth strategy.

Many platform charge borrowers for posting offerings while others choose to deduct annual fees for asset management from investors.

However, there are a lot more ways to ensure that your crowdfunding platform generates the required passive income. From wallet withdrawals, transfers, payouts to pay-ins, membership fees, and secondary market fees, you can set up your own ways to monetize your crowdfunding platform.

Of course, fees are just a relatively small contribution to your platform’s revenue compared to active deal search, underwriting, management, and closure. However, that is something to keep in mind, if you want to automate your platform as much as possible.

How to implement fees configuration module on your platform

A fees management module is normally present in any crowdfunding software as it’s the core of the crowdfunding platform monetization strategy. So, if you are worried about how crowdfunding platform makes money, you can easily tweak the settings and make sure you provide the best rates for investors and fundraisers.

If you’re looking for crowdfunding software with a solid fees management system for equity or p2p lending flows, consider LenderKit.

LenderKit is white-label crowdfunding software for real estate and startup financing. Basically, it’s a framework for rapid crowdfunding software development. Using the key modules, investment flows, and pre-built features, our development team can easily adjust the platform to your country’s regulations and business needs.

If you’d like to book a demo and see LenderKit in action, contact out Fintech Strategist to figure out the most suitable time for a call.