The Ultimate Guide to Real Estate Crowdfunding

Real estate crowdfunding is a financing model that allows multiple investors to pool their money online to invest in real estate projects like apartment complexes, commercial buildings or housing developments.

This model typically involves 3 key players:

- Investors — retail or accredited

- Project owners — real estate developers or sponsors

- Crowdfunding platform — deal facilitator and manager

If a platform doesn’t list specific projects from real estate developers or sponsors, it’s going to work more like a REIT (real estate investment trust), for example — Fundrise. In this case, investors don’t pool money in individual projects, but invest in a diversified portfolio managed by the platform itself.

In contrast, platforms like CrowdStreet or Brickstarter list individual projects, allowing investors to choose specific opportunities — following a more traditional crowdfunding model.

What you will learn in this post:

Types of real estate crowdfunding

Real estate crowdfunding platforms typically offer three main investment models:

- Debt crowdfunding or P2P lending

- Equity crowdfunding

- Portfolio investing

Debt crowdfunding

In debt-based deals, investors lend money to real estate developers and receive fixed returns based on a predetermined interest rate. These investments are secured by the property itself, which serves as collateral — similar to a traditional mortgage or loan.

Common types of debt instruments in real estate crowdfunding include:

- Senior debt – First in line for repayment, it has lower risk and lower return

- Bridge or mezzanine debt – Intermediate-term financing with higher risk and returns

- Convertible debt – Loans that may convert into equity under certain conditions

Let’s take a closer look at each of these financial instruments.

| Investment Type | Risk | Return | Control | Typical Investor |

| Senior Debt | Low | 3-8% | Low | Conservative, passive |

| Mezzanine Debt | Medium | 9-15% | Medium | Moderate risk takers |

| Preferred Equity | Medium | Fixed | Low-Med | Income-focused |

| Common Equity | High | 15-20%+ | Medium-High | Aggressive, long-term |

| Portfolio Investing | Low-Med | 5-12% | Very Low | Passive, diversified |

Senior debt is the very first source of money that real estate developers are trying to secure. It is also the biggest component of the project funding. If a project gets into trouble, senior debt owners are the first ones to get their money back.

It is the safest option to invest but in return, it offers the lowest income which is 3-8%.

The holding period is 3-9 years. Normally, banks are the main senior debt owners but sometimes, such projects can be found on crowdfunding platforms, too.

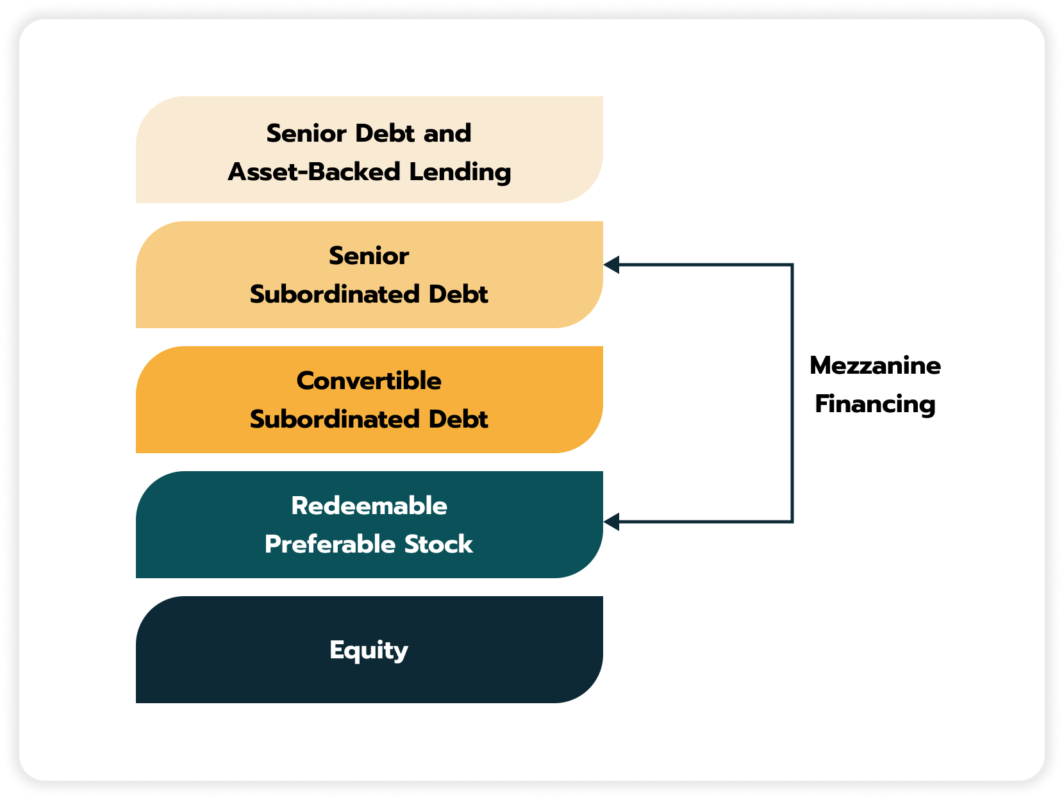

Bridge debt, which is also called mezzanine debt, is a “bridge” between the senior debt and the equity investment. If a project has issues, mezzanine debt owners are paid their money back after senior debt owners and before equity investors.

Risks taken by mezzanine debt owners are higher than those taken by senior debt owners. That’s why potential returns are higher, too, and vary between 9-15%.

The holding period and payment schedules are similar to the senior debt.

For mezzanine debt holders, it is crucial to check carefully who are the senior debt holders. If a respected financial institution is a senior debt holder, it gives other investors confidence that the project was subjected to proper due diligence and has perspectives to succeed.

Any type of investor can be a mezzanine debt holder that’s why this investment option is frequently presented on real estate crowdfunding platforms.

A convertible debt deal can be a good alternative for those investors who cannot decide between debt and equity investment. A company gets funds from investors and repays them later in the form of a property share. If investors are not willing to convert a debt, they receive returns anyway according to the agreed interest rate.

Equity crowdfunding

When it comes to investing in equity-focused real estate deals, investors become stakeholders and have a share proportional to their investment. Their returns are generated from any cash flows (rental) or value appreciation of the project when the property is sold.

The access to the income from the property appreciation gives equity investors an opportunity to benefit from higher potential returns.

But the risks taken by equity investors are also much higher than those taken by debt investors. Returns are derived from rental income and property appreciation, and it may take time to receive the income.

Equity investors also shall take special care with such terms as “target holding period”. This term means that the holding period is not fixed, and therefore, it is not clear when you can get your returns back and how much.

Anyway, there are two types of equity available for real estate investment:

- Preferred equity

- Common equity

Preferred equity investors have priority over the project’s cash flows compared to common equity investors. It means that in case the project faces issues, they will receive their invested funds before common equity investors.

The main difference between this investment type and common equity is that returns are capped for preferred shareholders. The returns are paid out at a fixed rate and depend on the income the project generates.

This investment type is frequently confused with the mezzanine debt investment. Indeed, they are similar in many regards, especially in the expected potential risks and expected returns, but the main difference is the legal aspect.

Equity investors are given a share in the project and thus, are entitled to the project appreciation gains while for debt investors, this opportunity is normally not available.

Common equity investments are the riskiest in real estate crowdfunding. If the project doesn’t develop as expected, common equity investors have the lowest priority in the capital stack:

- First, senior debt investors are paid.

- After them, mezzanine debt and preferred equity investors receive their share.

- And in the end, common equity investors receive their funds from whatever is left (if anything).

But high risks are compensated with high yields. If a project succeeds, common equity investors get about 20% or even more depending on the project’s success.

Portfolio investing

Portfolio investing on real estate crowdfunding platforms allows investors to put their money into a diversified bundle of real estate projects such as residential, commercial or mixed-use properties without selecting individual deals.

These portfolios are typically pre-built or algorithmically generated based on the investor’s risk profile, offering a passive, time-saving approach.

Compared to selecting individual equity or debt deals, portfolio investing provides built-in diversification, reduced volatility and often includes automated reinvestment features.

While it offers less control and potentially limited transparency over specific assets, and may involve platform fees, it suits those seeking a hands-off strategy with returns typically ranging from 5-12% annually depending on the platform and asset mix.

Popular real estate crowdfunding platforms

There are many investment platforms worldwide, but Crowdspace — a crowdfunding website directory is featuring at least 1,000 platforms globally. It’s a great tool to find crowdfunding platforms not just in real estate, but in any other niche.

Let’s group some of the popular real estate crowdfunding platforms into categories, as we discussed above, and explore use cases.

Debt-based real estate crowdfunding platforms

These platforms allow investors to lend money to property developers or owners in exchange for regular interest payments:

- Twino – offers short-term real estate-backed loans across Europe.

- CapitalRise – specializes in prime central London properties, offering high-net-worth investors secured debt investments.

- Raizers – a French platform providing access to real estate loans with detailed project breakdowns and strong borrower due diligence.

Equity-based property crowdfunding platforms

Here are a few equity-focused platforms where investors buy shares in a property or development project and receive returns from rental income and/or appreciation:

- Brickstarter – focuses on short-term rental properties in Spain with automated property selection.

- CrowdStreet – U.S.-based platform offering access to institutional-quality commercial real estate deals.

- EquityMultiple – targets accredited investors seeking diversified real estate portfolios with equity and preferred equity options.

Real estate portfolio investing platforms

These platforms provide diversified portfolios of real estate investments, often using a REIT-like structure:

- Fundrise – a U.S. pioneer in real estate investing for non-accredited investors, offering eREITs and eFunds.

- Mintos – primarily a loan investment platform, but it also includes real estate-backed loans in its offerings.

- Bricksave – provides access to pre-vetted real estate opportunities in global markets with a low entry threshold.

Tokenized real estate crowdfunding platforms

Tokenized real estate platforms use blockchain technology to divide property ownership into digital tokens, making it easier to buy, sell, and trade fractional shares in real estate. These platforms typically offer low minimum investments, high liquidity and global accessibility.

- Lofty.ai – offers tokenized rental properties in the U.S., with instant rental income payouts and the ability to buy and sell tokens anytime.

- RealT – one of the first movers in tokenized real estate, allowing investors to own fractions of U.S. rental properties through Ethereum-based tokens.

Minimum investment requirements in real estate

If you want to roll into the real estate market as an investor, you need to know the minimum investment requirements, money lock-in periods and risks.

The rules of the game are different in the US, Canada, Europe, UK, Saudi Arabia or UAE, but to get the idea of what to look for, let’s focus on the US requirements.

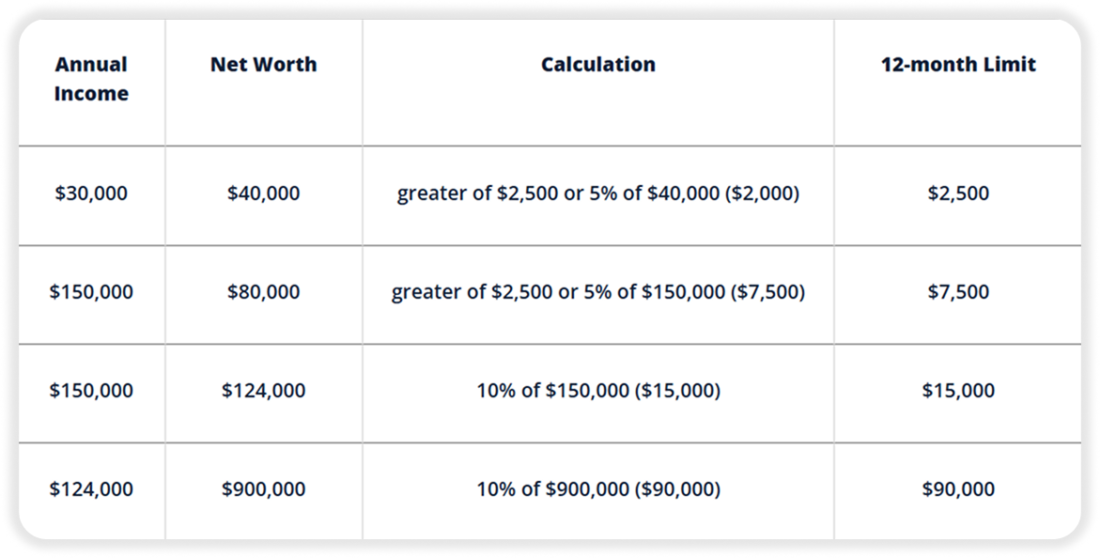

Since the passing of the JOBS Act, and then regulation crowdfunding (Reg CF), both accredited and non-accredited investors can participate in real estate crowdfunding offerings. While accredited investors face no federal investment caps, non-accredited investors are subject to limits based on income and net worth to help manage risk exposure.

In 2024, the SEC updated these investment limits to account for inflation, as required by law every five years. The current rules for how much a non-accredited investor can invest over a 12-month period are as follows:

- If either your annual income or net worth is less than $124,000, you can invest the greater of $2,500, or 5% of the greater of your annual income or net worth.

- If both your annual income and net worth are $124,000 or more, you may invest up to 10% of your annual income or net worth (whichever is greater), but not more than $124,000 in total.

For most offerings on CrowdStreet, the minimum investment level is $25,000. It means that offerings are available for accredited investors only.

EquityMultiple permits investments from $5,000, but for the majority of offerings, the investment minimum ranges from $10,000 to $30,000. EquityMultiple is open to accredited investors only.

There are platforms that indeed open doors to real estate investing to non-accredited investors, too. Lofty.ai enables investments in real estate projects with $50 only, and Fundrise enables investors to start with as little as $10 as an initial investment.

Speaking about the hold period or money lock-in, it varies from 3 to 9 years and in some cases it can be 10+ years, depending on the platform. So, when you invest in real estate, you’re expected to let your money sit there for some time before you can reinvest or withdraw, making property crowdfunding illiquid and risky investments.

How much real estate companies raise via crowdfunding

The amount real estate companies can raise through crowdfunding varies depending on local regulations. In the United States, for example, the SEC’s Regulation Crowdfunding limits annual fundraising to $5 million. In the European Union, the European Crowdfunding Service Providers Regulation (ECSPR) sets a similar cap of €5 million per year.

These limits typically apply to public offerings aimed at retail investors. For larger amounts, companies often turn to private placements or target accredited investors under different regulatory frameworks.

Trends in real estate crowdinvesting

The COVID-19 pandemic and climate-related disruptions prompted investors to pay more attention to sustainability-related risks and challenges. Now, Environmental, Social and Governance (ESG) practices play a more significant role in how companies operate. That’s why investors consider ESG for every stage of the real estate crowdinvesting cycle, from due diligence to acquisitions.

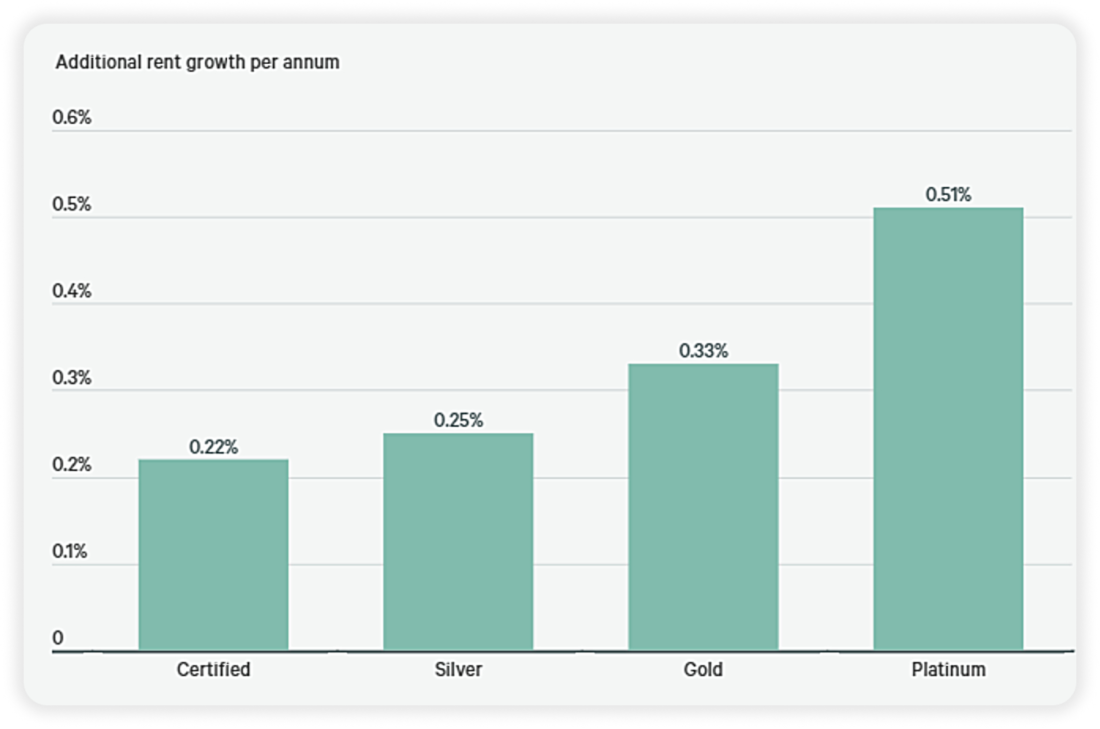

Even though such certifications as LEED, BREAM, and NABERS remain important measurements for the environmental performance of buildings, the focus is shifting to investment in the World Green Building Council’s (WGBC) Net Zero Carbon Buildings Commitment. It calls for all buildings to reduce carbon emissions by 2030 and the complete decarbonization of the sector by 2050. Many real estate development companies already include carbon neutrality objectives in their investment strategies, so, crowdfunding platforms are following their steps by including such projects in their listings.

Why investing in ESG projects may be interesting for investors? Just as an example, office rent for LEED-certified buildings in the USA is 11% higher than the rent for those that don’t have the certification. The LEED-certified assets had a 21.4% higher average market sales price per square foot than those assets that didn’t have the certification.

For investors, the implication is clear: in the long term, return on investment in a LEED-certified office building will generate more income than investing in a building that doesn’t have the certification.

Over time, the capital value will be growing, and monthly operating and maintenance costs will be dropping.

On average, the rental premium for LEED Platinum-certified offices delivers 0.51% more annual growth than non-certified buildings.

While now, investing in ESG projects is a matter of a higher ROI, in the future, it is going to be subject to regulatory requirements applied to property owners and property developers. That’s why ESG is probably one of the hot trends in real estate crowdfunding.

Benefits of real estate crowdfunding

Real estate crowdfunding offers a modern, flexible approach to property investment and fundraising. For both developers and investors, it presents several key advantages:

- Access to capital without relying on traditional banks or institutions

- Fractional ownership allows more investors to participate

- Diversification across property types and locations

- Efficient fundraising through online platforms with lower barriers

Risks of real estate crowdfunding

While the model has clear advantages, it also comes with certain risks that both issuers and investors should be aware of:

- Market volatility can affect property values and returns

- Illiquidity, as investments are typically long-term and not easily sold

- Platform risk if the crowdfunding platform fails or mismanages funds

- Limited control for investors compared to direct property ownership

How much it costs to start a real estate crowdfunding platform

Real estate crowdfunding platform development costs depend on the type of solutions you go with. For example, a business may opt for real estate crowdfunding software that will definitely be cheaper than starting a crowdfunding business from scratch.

Alternatively, if a custom platform is required, working with a crowdfunding platform development agency will help you be more flexible and have more control of the operations, but the development costs will depend on project complexity. Agencies typically charge on a time & material basis, but some may even offer a fixed-price project.

Depending on the location of the hired crowdfunding platform developers, the costs will vary greatly. Crowdfunding platform developers’ rates may be as little as $20/h or as high as $120/h. For the whole project, you’d probably pay over $200,000 to build a decent platform.

The costs of your platform will also depend the features such as:

- Core features — investor onboarding, accounts, investing, project listing

- Additional features — secondary market, auto-investing, tokenization

- Integrations — payment processing, KYC/AML, accounting, reporting

- UI/UX design — web or mobile app

With crowdfunding software, monthly costs may start from $1,000 — but it depends on the provider and available packages. Some crowdfunding software providers have flexible payment plans such as monthly, quarterly or yearly and may provide customization services to make your platform unique.

Build a real estate crowdfunding platform with LenderKit

When it comes to developing a real estate crowdfunding platform, you have several options:

- Build in house

- Outsource to professionals

- Find a ready-made one-size-fits-all solution

- Work with LenderKit — to combine the power of a ready-made tech with on-demand customizations

LenderKit offers real estate white-label crowdfunding software which gives you a confident start with a branded solution. Trusted by over 50 clients globally, we’ve launched platforms at different stages — from startups to established companies looking for expansion opportunities.

Our solution is fully scalable and can be customized on demand as your business grows. We can rebuild, redesign, add new features — everything you need to run and scale your real estate crowdfunding business.

Excited to learn more about our offer? Don’t hesitate to reach out and discuss the details.