Investment Crowdfunding Business Models

There are two types of investment crowdfunding – P2P lending and equity crowdfunding. The ultimate goal of investment crowdfunding is to facilitate either startup or property development and bring profits to investors. To make things work, three players are needed:

- Crowdfunding platform

- Investors (individual or institutional)

- Fundraisers or borrowers (individual or institutional)

A crowdfunding platform facilitates communication between investors and fundraisers, conducts due diligence, provides the required information to help investors make weighted decisions, and ensures that transactions are successful. A platform charges transaction fees or other commissions and negotiates special terms before the fundraiser’s offering goes live on the platform.

Regardless of the investment crowdfunding business model, the platform’s interest is to minimize risks, make profits, and ensure that all parties are happy. The platform, however, is not responsible for the actual success of the crowdfunding campaign and future business performance of the fundraiser side.

What you will learn in this post:

P2P lending or debt crowdfunding as an investment crowdfunding model

P2P lending is primarily used to finance property development projects as they tend to be more secure thanks to the measurable collateral which can be sold in case of the project’s failure.

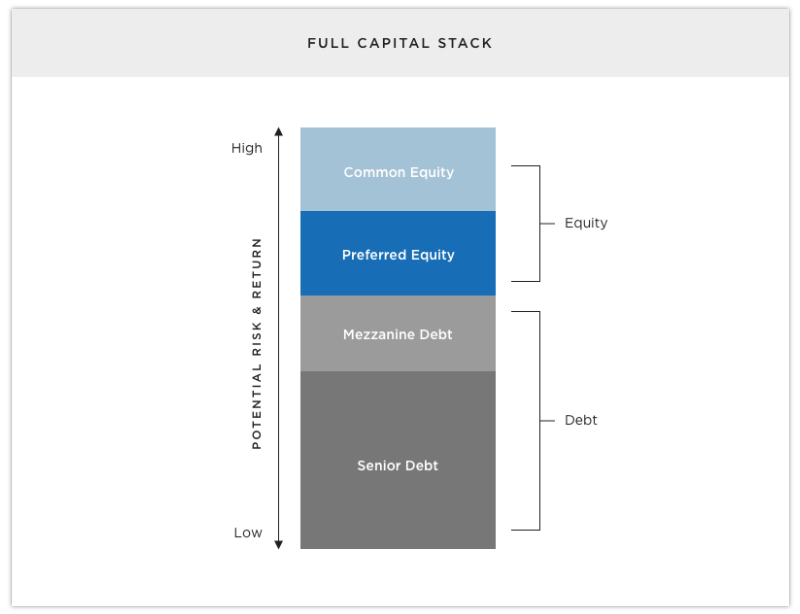

In property investment crowdfunding, P2P lending platforms can play a significant role in the cap stack. Debt-based crowdfunding platforms usually focus on senior debt financing or mezzanine debt financing depending on the platform’s existing investor base. If the platform has institutional investors or banks as investors, it can consolidate a decent amount of senior debt. Also, if the platform targets retail investors, then it has good chances to raise mezzanine debt.

In practice, debt-based investment crowdfunding platforms help borrowers achieve many financial goals mainly related to the expansion of the existing business operations. That’s because platforms need to ensure that the money borrowed will be paid back within a specified period of time at an agreed rate.

For fundraisers or borrowers, the benefits may include the speed of capital raising, less bureaucracy, higher customer service value and more.

For investors, either institutional or individual, P2P lending platforms open up a new asset diversification channel which helps them save up for retirement or make profits.

P2P lending in startup development

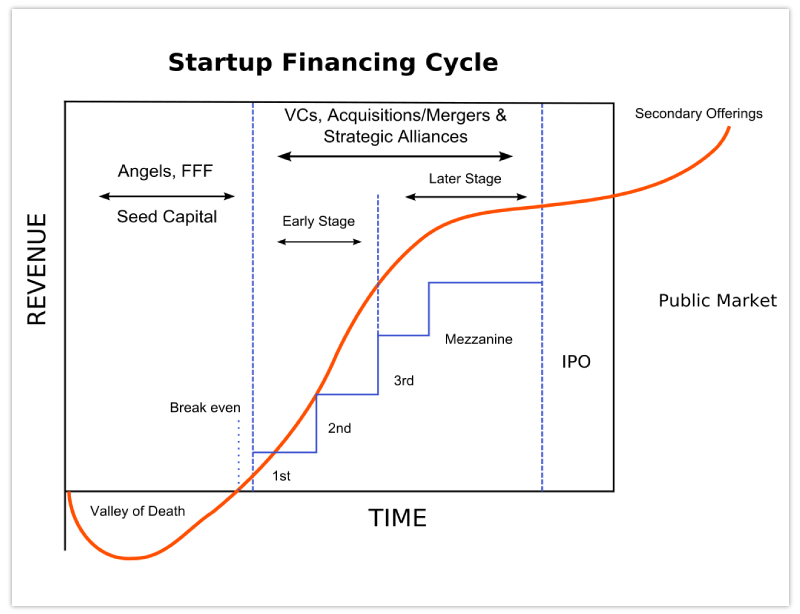

When it comes to startup investing, P2P lending makes sense at early and later stages of the business financing cycle. When the business already has established proven market feedback, revenue streams, and is no looking for a capital boost to launch new product or service lines, then debt crowdfunding can come in handy.

For a crowdfunding platform, it’s vital to conduct thorough research and due diligence of the startup to make sure that it’s performing well and there is a solid foundation for future performance as well.

What do P2P lending platforms work with?

According to P2PMarketData, debt-based crowdfunding platforms focus on:

- invoice trading,

- balance sheet investing,

- mini-bonds,

- and convertible debt securities.

Equity investment crowdfunding model

Crowdfunding platforms usually don’t offer to invest in the “Common stock” which provides the voting rights for investors. Instead, crowdfunding focuses on facilitating the “Preferred stock” investing for individual investors, usually, sophisticated or retail.

With higher rates ranging from 12 to 20 percent IRR, preferred equity crowdfunding is an attractive option for investors worldwide.

Equity crowdfunding for property development works best when it comes to the buy-to-sell model (renovation or house flipping) and ground-off construction where the risk is at its peak and so is the return on investment.

In equity crowdfunding for startups, the equity part is usually at the seed round or other stages where things are not very clear but can hype in the future. For example, when a fundraising company wants to incorporate disruptive technology, product or service but there is little proof or historical evidence that it can work or when the market doesn’t know it needs innovation. In this case, equity crowdfunding can be a viable option to raise capital and meet the required business objectives.

When equity crowdfunding meets debt crowdfunding

The two investment crowdfunding models cross when it comes to convertible debt or mezzanine debt.

Convertible debt is when a company issues a debt-based security which can be converted into an equity share in the future. As Fred Wilson, an American businessman, venture capitalist and AVC blog author writes:

“If the company believes its equity will be worth more at a later date, then it will dilute less by issuing debt and converting it later. It is also true that the transaction costs, mostly legal fees, are usually less when issuing debt vs equity.”

The thing with convertible debt is that it’s more likely to be used by more or less established companies compared to early-stage startups.

Mezzanine debt financing is the middle layer between senior debt and preferred equity. According to the Divestopedia:

“A company owner should consider mezzanine debt instead of equity when the business is producing stable free cash flow, since this allows him/her to obtain financing without issuing equity and diluting the ownership of the business.”

For more established companies, mezzanine debt is often a way of financing expansion projects, recapitalization, and M&A deals.

What investment models should crowdfunding platforms focus on

Crowdfunding platforms can focus on particular segments of the capital stack and business development stages or they can incorporate a one-stop-shop strategy and facilitate businesses comprehensively.

Often, our clients are combining different financing methods. The most popular combinations include:

- Debt + equity (mezzanine debt, convertibles, preferred equity, debt)

- Debt + donation

- Debt only (balance sheet investing, invoice trading)

- Equity only (preferred equity)

To be able to manage crowdfunding campaigns, the platform should provide the required technological capabilities to help a crowdfunding platform manager run daily operations. The choice of the investment crowdfunding software can be a difficult task as there are plenty of solutions available. For example, you can have a look at LenderKit.

LenderKit is constantly working on improving the investment crowdfunding software to help new and established businesses enter the crowdfunding market smoothly.

If you’re looking to build your own crowdfunding platform, schedule a live demo to see LenderKit in action.