How Viable is Crowdfunding for the Oil and Gas Industry?

For the majority of individuals, a direct investment in oil and gas has always been theoretically possible but not practically feasible.

This risky domain used to be a prerogative of professional institutional investors who can make informed decisions.

It was so until recently. The emergence and rapid development of alternative financing have made the O&G industry more accessible to the crowd. And helped small providers reach the capital market.

Now anyone willing to benefit from O&G assets can turn to EnergyFunders, PetroFunders or similar platforms and make an investment.

Oil and gas crowdfunding is a prospective domain that requires a special investigation. So, let’s discover it together.

What you will learn in this post:

O&G industry: pre-Covid, crisis and perspectives

To understand how alternative financing can facilitate O&G projects, let’s see what’s happening inside the industry now.

We’ve dug through several market reports published by best-known agencies KPMG, PwC, and Deloitte.

And here’s a brief summary of interesting facts.

Fact #1. 2020 was a challenging year for the O&G industry. Although the domain is used to economic cyclicity, this crisis was unprecedented. Global oil demand has fallen by 8%. In 2021, it’s expected to recover but remain lower than at pre-COVID times.

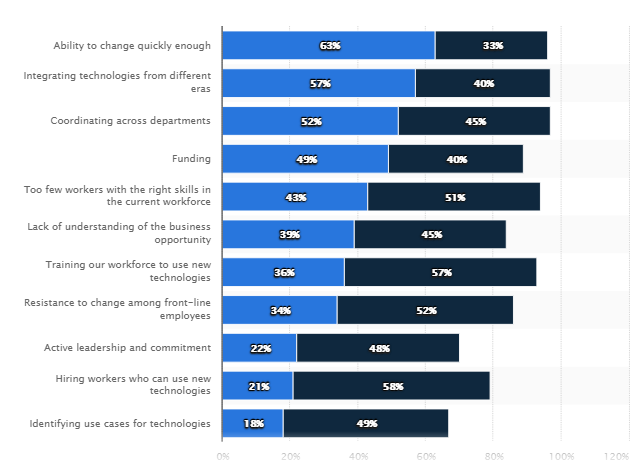

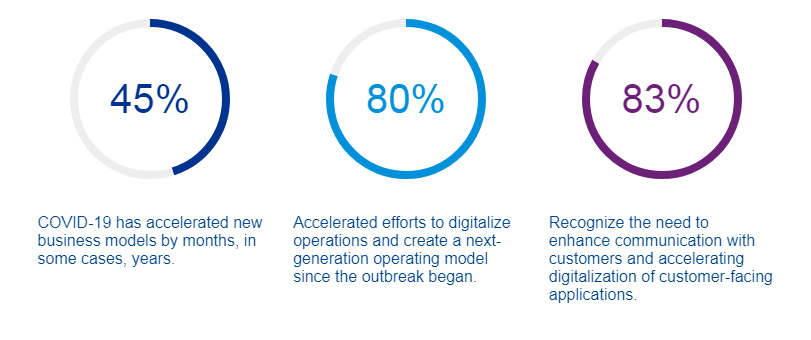

Fact #2. The pandemic forced the industry to reach “digital maturity”, which is going to solve several important problems, in particular, remote operation, unified reporting, human-machine collaboration, employee engagement. According to Statista, integrating technologies from different areas has always been a challenge for O&G businesses.

Fact #3. Approximately half of the energy CEOs surveyed plan to invest capital in new technology, digitalization, workforce skills, and capabilities – KPMG experts say. It means there are likely to be more projects and demand for investments.

Fact #4. The industry is pivoting to the new energy future intending to build a nationwide, integrated zero-carbon value chain and infrastructure. The new administration of clean energy that implies reconstruction of existing O&G facilities will require external financial support.

Fact #5. O&G investing is becoming more environmental, socially responsible, and impact-focused.

Fact #6. Currently, oil and gas companies need to sell discontinued assets to survive, which may boost the alternative finance market and force investors to use a simple yet powerful strategy – buy low, sell high.

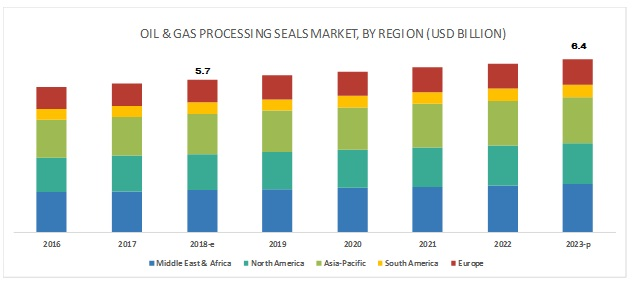

Fact #7. Oil and gas processing seals market is growing despite the overall industry downturn. The frontrunner by volume is The Middle East & Africa, however, Asia Pacific is expected to skyrocket in the nearest future and become a new lucrative sector.

Fact #8. An uncertain return on investment has always been considered as a barrier for O&G fundraisers. Experts believe that the acceleration of tech capabilities and total digitization will help businesses improve resilience and remain attractive to investors.

Fact #9. The production of independent oil providers especially in the US and Canada is growing and OPEC members are likely to limit their production to support the necessary level of prices.

Fact #10. There are going to be new players on the market of conventional gas – East Africa and Eastern Mediterranean while China is going to become the largest consumer and importer of gas.

So with all that being said, O&G players are predicted to seek alternative sources of capital to transform digitization strategies and enter new markets. Investors, in their turn, are projected to show bigger appetites for a new lucrative set of assets.

This is the moment when crowdfunding becomes a game-changer. It may help the industry satisfy an already facing capital demand from companies and ramp up investment activity.

A sneak peek into the US oil and gas crowdfunding industry

Oil and gas crowdfunding is a pretty difficult business compared to other sectors – real estate, tech, health, education, travel. Oil and gas investments are high-risk, structurally complex, and typically require additional capital, yet they may bring appealing returns.

There’s no holistic overview of the global oil and gas crowdfunding market, but we’ve found some stats of the US sector prepared by PetroFunders.

For the crowdfunding market, there were 74 more offerings in July than a year ago: 137% increase.

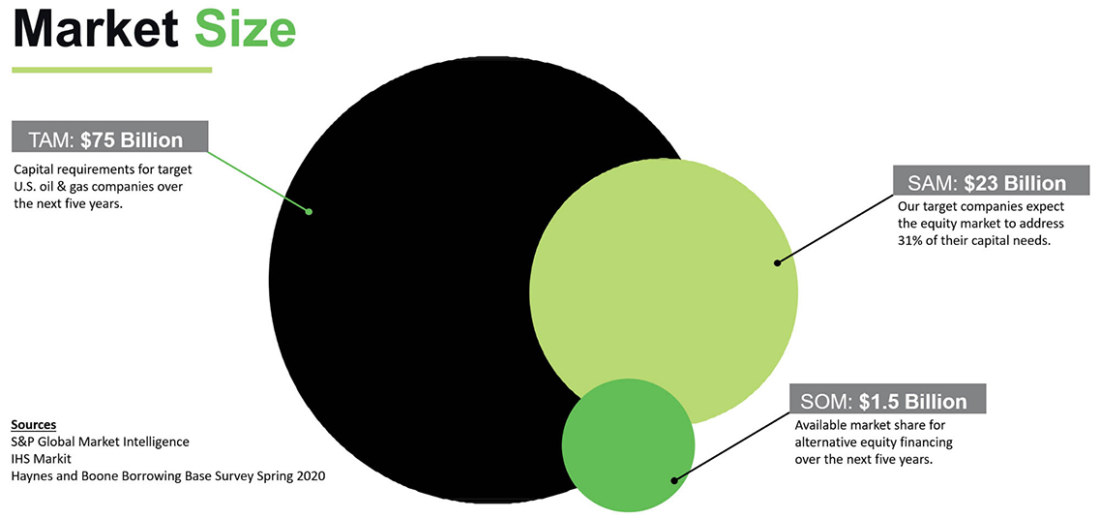

PetroFunders experts predict that the SAM (Serviceable Available Market) for alternative equity financing will reach $1,5 billion over the next five years.

Fundraisers believe that equity crowdfunding can solve 31% of all investment needs.

In 2014, 4 enthusiasts founded the first of its kind oil and gas crowdfunding portal- EnergyFunders.

The company operates according to the Reg D framework and works only with proven oil and gas operators and oil and gas finders.

Clients invest in a limited partnership that purchases oil and gas assets throughout the United States.

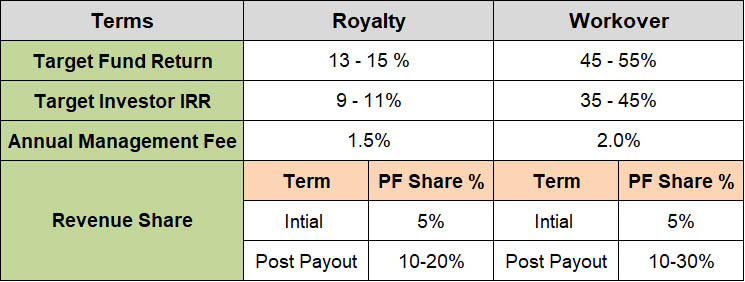

There are 3 options: you can opt for Income Fund, Yield Fund and Wildcat Fund. The frequency of payments, risk level, targeted returns and payback periods vary.

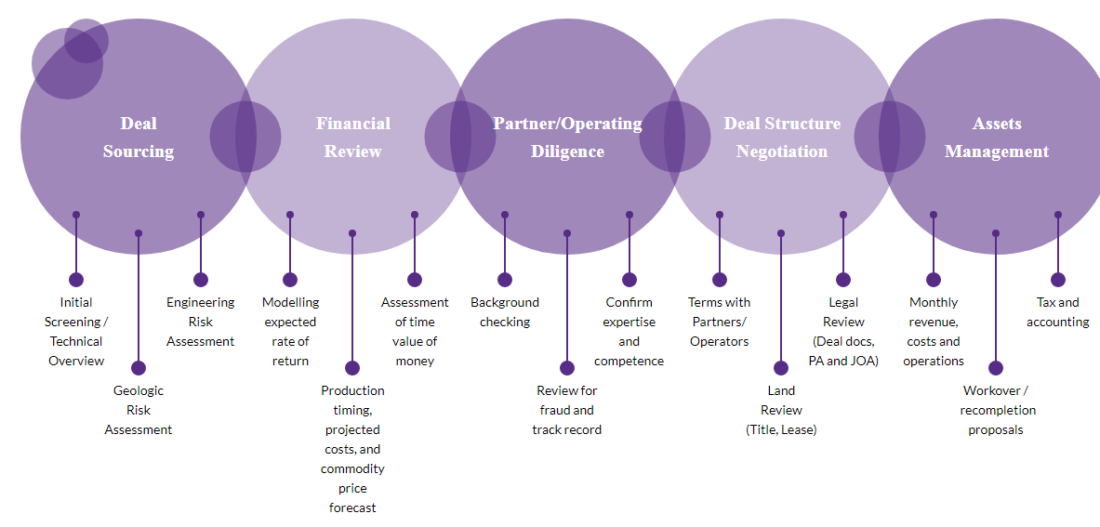

Each project is thoroughly vetted by the team of industry experts.

Among the benefits of investors are:

- high return potential;

- tax benefits for investors;

- long investment life;

- faster cash flow.

PetroFunders is another provider of oil & gas investment opportunities from the US.

The company explains its mission as “utilization of a disruptive business model to bring the oil and gas investment industry out of its archaic dealings, and into the 21st century”.

PetroFunders provides access to accredited investors who want to invest in exclusive oil and gas deals.

The portal operates under the Reg CF synchronizing financial technology, equity crowdfunding, engineering and investment expertise, and world-class management.

Perks to investors include robust projects, cash flows from wells passed on to investors, multiple tax incentives.

How crowdfunding affects oil and gas ventures

Traditional financial options for O&G companies include:

- equity sources (IPOs, cash calls, shareholder loans and share subscriptions);

- third-party financing options (corporate loans, acquisition financing, reserve based lending (RBL), equity bridge loans (EBLs), project finance, capital markets, hybrid financings and hedging);

- other sources (operational current or future cash flows and the raising of funds through asset disposals).

Unlike the above methods, oil crowdfunding platforms provide smaller operators with a turnkey platform that puts the fundraising process on the autopilot and requires smaller operators to use very few internal resources.

Fundraisers can focus on the development strategy to drive the business growth.

Also, crowdfunding creates a room for more participants in the investment pool and facilitates some investment procedures.

As a result, all investment dollars poured earlier into administrative tasks, now work for project development and scaling up.

What the future holds for oil and gas crowdfunding business

Historically, O&G projects were closed off to individual investors due to the uncertainty accompanying them.

IPOs, bank loans, hybrid financing and capital markets were among traditional financial resources for O&G companies. However, smaller vendors had limited access to this kind of funding.

EnergyFunders and similar crowdfunding providers gave the green light to both small-scale businesses and individual investors willing to unleash the potential of the new investment opportunity.

Despite the temporary downturn, the demand for oil and gas is projected to rise. And crowdfunding is to ensure there will be enough supply to cover a rising demand.

If you’re looking to build an oil and gas crowdfunding platform LenderKit can be a good software choice. Our customisable white-label solution for equity crowdfunding, investment management and private placements can help you automate your business operations and scale into the oil and gas crowdfunding market.