What is Title III Crowdfunding or Reg CF and How it Works

Title III Crowdfunding or Regulation Crowdfunding (Reg CF) is a regulation peculiar to the US market. It allows a fundraising company to aggregate a total of $1.07 million in a 12-month period.

[Update]: Companies can now raise up to $5 million in a 12-month period, according to the new Reg CF rules.

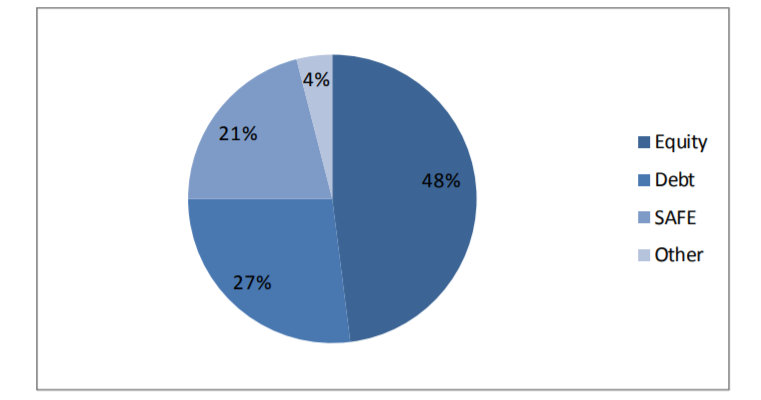

According to the SEC official documents on regulation crowdfunding, companies that are raising funds do so through different instruments: preferred equity (48%), convertible debt (27%), simple agreements for future equity – SAFE – (21%) or other financial instruments (4%).

What you will learn in this post:

Regulation crowdfunding investment limits

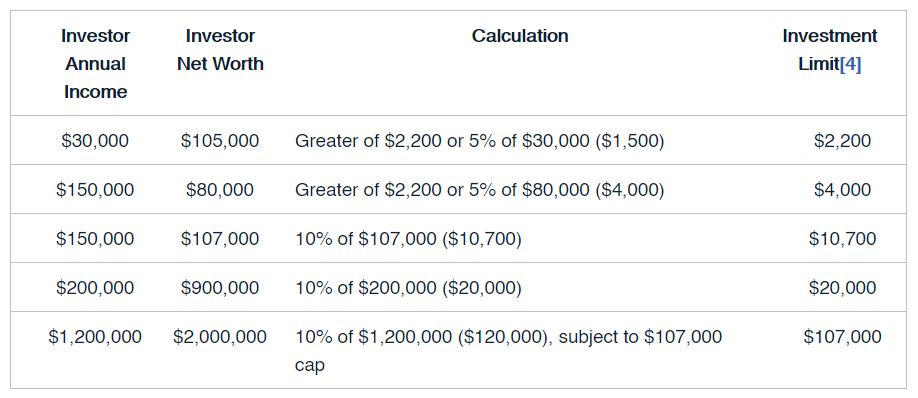

On a crowdfunding platform, both accredited and non-accredited investors can finance the Reg CF offerings. While accredited investors can invest with no specific limitations, non-accredited investors do have some restrictions that define how much they can invest in all regulation crowdfunding offerings in a 12-month period:

For fundraising companies, these limits define how many investors can take part in the fundraising campaign and when registration with the Commission will be required:

Registration is required if an issuer has, on the last day of its fiscal year, total assets greater than $25 million and the class of equity securities is held by more than 2,000 persons, or 500 persons who are not accredited investors. – according to the Exemption from Section 12(g).

Title III crowdfunding forms that fundraisers need to fill in

To be eligible to fundraise under the Reg CF, a company has to file the Form C. The company that applies, will have to disclose quite a lot of information including:

- Who is fundraising (company’s and appointed personnel info)

- Funding goal (purpose and how much is needed)

- Securities offered

- How investors will get securities and eventually get paid, etc.

The form also has information about the annual reporting instructions which will be useful when the crowdfunding begins.

“An issuer must provide an update on its progress toward meeting the target offering amount within 5 business days after reaching 50% and 100% of its target offering amount.”

And when the securities are sold under the regulation crowdfunding offering, the company will have to file the annual report on Form C-AR no later than 120 days after the end of its fiscal year.

How Reg CF information can be useful to crowdfunding platform managers

To be able to manage or “matchmake” online fundraisers and investors under the regulation crowdfunding, the platform has to be technically viable. It may mean that a crowdfunding platform should:

- Have capabilities to set fundraising limits

- Provide an opportunity to combine several financial instruments such as debt and equity

- Send fundraisers a notification of their raising progress, mainly, at 50% and 100% of the campaign’s success, so that the fundraising company can report on time via the Form C-U

- Monitor how many investors take part in the funding process

- Allow investors to sign and receive documents online

- Establish a clear communication channel between investors and fundraising companies via an open comments section, etc.

Other technical features for crowdfunding platforms may include:

- Escrow account to allow investors to pledge money. In this case, an escrow will serve a bridge that will allow for refunds or cancellations until 48 hours prior to the close of an offering.

- Authorised payment processing provider that can hold client’s money unless the crowdfunding platform is an authorised asset manager – that is a broker-dealer. If the platform is a fundraising portal (bulletin board), then a payment gateway is the only option to manage online operations.

Companies that fundraise under the regulation crowdfunding

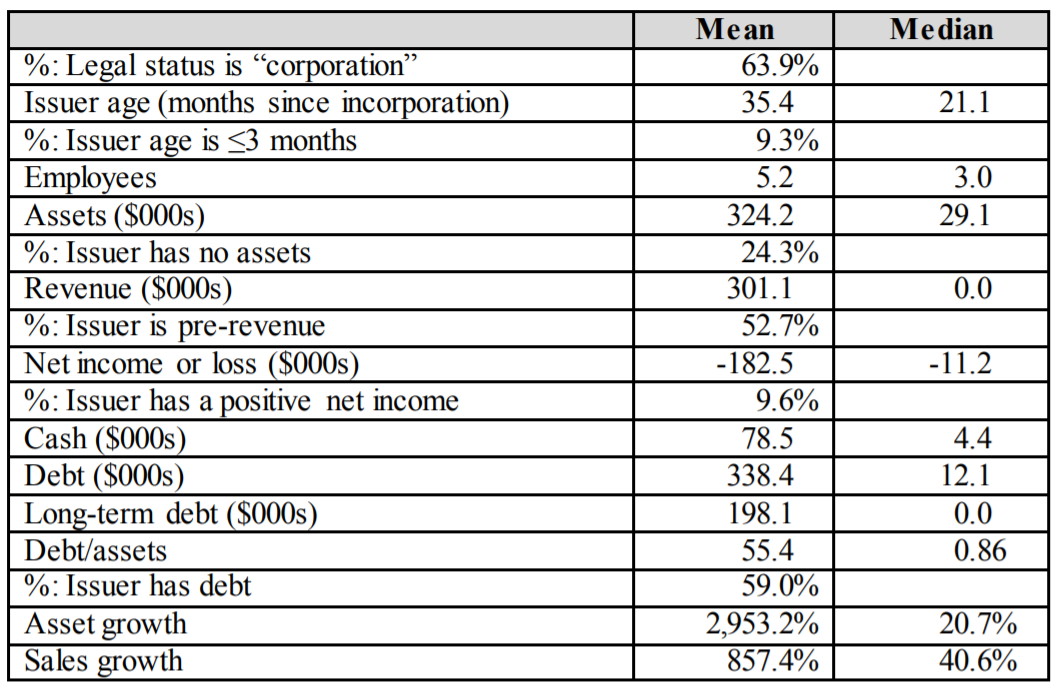

For crowdfunding platform managers, it’s important to understand the target audience and who is actually fundraising under Reg CF. According to the analysis of 1,246 issuers done by SEC, business owners can study the characteristics of fundraising companies.

Only 9.6% of fundraising companies have a positive net income while asset growth is 20.7% median and 2,953.2% average and sales growth is 40.6% median and 857.4% average.

An interesting fact is that 52.7% of companies are pre-revenue. It’s difficult to value a pre-revenue startup due to very little historical data and trends.

For platforms, this can mean higher KYC/AML requirements to eliminate fraud and increase the likelihood of more legitimate businesses to enter the platform. A KYC-tailored registration form can sort out plenty of startups and unethical players.

Usually, platforms partner with a third-party KYC/AML provider that will be qualified to conduct thorough due diligence and present the data to the decision-maker on the platform to have the final word whether to accept or reject a startup or an investor.

How to register your funding portal under the reg CF rules

In the USA, crowdfunding platforms have to file the Form Funding Portal under the proposed Rule 400(a) and (b) – (d). According to the rules, a crowdfunding platform can have several websites and one registered portal which allows a company to diversify its marketing efforts and create tailored messaging for the target audience.

Once the platform registers with the Commission, it’s time to think about the data gathering and record keeping. All the KYC data that’s been collected has to be carefully protected, while “certain” information about the funding portal’s activity has to be accessible for the SEC staff for audits. As a crowdfunding business owner, you can contact the Commission to learn exactly what information you’ll be required to keep, for how long, and in what preferred accessibility.

Final thoughts

SEC regulation crowdfunding is helping startups and real estate development companies to raise capital from accredited and non-accredited investors. The diversity of industries allows crowdfunding platforms to find the right niche where the Reg CF offerings become a functional fundraising instrument that brings profits.

If you’re looking to create a crowdfunding platform under the Title III regulation crowdfunding, LenderKit can become your crowdfunding software provider. To see LenderKit in action, schedule a demo.