Building a Private Crowdfunding Platform for Real Estate Investing

Over the years of working in real estate, you may have established strong connections between property developers and investors.

Decades of experience and a large network lay a perfect foundation for advancing the career. Often, the next step is either consulting, investing, or private crowdfunding platform development.

Debt or equity real estate crowdfunding business is a good option for leading a less risky, more conservative, and stable lifestyle by managing a digital platform.

To build your own real estate crowdfunding platform, you need a basic knowledge of:

- crowdfunding and financial regulations in your country;

- property market analysis;

- property investing;

- technology, in terms of understanding how a similar platform works and how to scale it;

- product marketing.

Understanding these workflows and concepts will help you research your business idea and its regulation-compliance, hire crowdfunding platform developers, and launch your platform.

What you will learn in this post:

How to research crowdfunding regulations in your country

Doing the due diligence beforehand may save you hours of lawyers and help you validate your idea even before you start developing the platform.

Many entrepreneurs feel the urge to launch fast by sacrificing the research explaining that “they’ll figure it out as they go.” This approach may or may not work out.

If you want to minimise the risks and enter the investment market safer, you have to research the regulations.

You should start your research by visiting the official website of a financial regulatory authority. Here is an excerpt from the full list of financial regulatory authorities by country:

- U.S. Securities and Exchange Commission (SEC) – the USA

- Financial Conduct Authority (FCA) – the UK

- National Crowdfunding & Fintech Association (NCFA) – Canada

- Saudi Arabian Monetary Agency (SAMA) – Saudi Arabia

There you can find extensive information about the regulations, processes, and documents application workflows.

However, some may not comprehend the legal voice of those documents due to the specifics of the terminology and constructions. In this case, you can also find answers on Quora. In relation to that, we’ve covered a few topics on regulations at JustCoded blog, so check it out.

Legal and consulting may cost you around $10,000 – 50,000, so make sure to get to know your topic. It’s better if you come up with exact questions, rather than paying for the whole lecture. To be clear, legal consulting is inevitable because you still need to draft and file the documents to the financial regulator. And no one can do it better for you, but a professional legal firm with focus on the financial technology and crowdfunding.

How regulations impact the technical side of a real estate crowdfunding platform development

It’s no secret that a crowdfunding platform has to be regulations-compliant and registered with a regulator in your country. But what does it technically mean to fundraisers, investors, and you as an admin?

Fundraisers

Companies that are seeking funds have to disclose their business plan, funding goals, business operations, file financial and development information annually, quarterly, or monthly.

Technically, it means that there has to be the corresponding website design and functionality which would allow fundraisers to upload documents and provide other information:

- identity verification documents (passport, ID card, etc.);

- phone, email, local address of the organisation, etc.

- financial and performance reports;

Investors

One of the most important details on a crowdfunding website is a disclaimer that all investments are at risk to help investors understand that they can lose all of their money.

Apart from that, as an admin, you need to ensure that all of the investors pass:

- KYC checks;

- income source proof or AML verification;

- accreditation check (if applicable);

If you think that we’ve missed something, leave your comment below.

Administrator

There are certain risks related to managing a crowdfunding platform. Depending on the type of the platform – a broker-dealer or funding portal – the level of responsibility varies. By that, we mean more reports, strict user role management, more regulations concerning payment processing, etc.

Generally speaking, you need to take care of:

- KYC verification of your staff responsible for the administering of the platform;

- payment processing – especially if you plan to escrow, hold, and transfer money;

- investor and fundraiser fraud protection and risk mitigation;

When it comes to payment processing, you may want to choose a reliable third-party tool like MangoPay or LemonWay for donation-based and reward-based crowdfunding only.

In contrast, if you’re looking for debt and equity investing payment processing, you may want to connect Goji investments or alike since it’s an eligible ISA provider.

Finally, having conducted multiple transactions on your platform, you may apply for getting an ISA license in the UK or European countries. In the USA, you have to pass the FINRA checks.

However, since you’re looking to build a private crowdfunding platform, you may be fine with manual payment processing such as wire transfers.

Once you’ve successfully conducted your regulation-compliance research and got an approval of the legal eligibility of your idea, you may focus on formalising all of the technical requirements.

How to formalise software development requirements and why you need to do that

One reason you want to create a software requirements specification file (SRS) is to save funds for the development. There are many crowdfunding platform development companies that do not charge you for the discovery phase, but some do.

While the discovery phase is something you can never escape if your development partner is responsible, you may save up a couple of thousands by documenting the features, workflows, needs and wants yourself:

- create a new document in Google Docs or Google Spreadsheets;

- write down every single detail of your perfect crowdfunding platform;

- review the requirements;

- define the core features and prioritise them;

- look through the features as an investor, fundraiser, and admin;

- document the problems that your platform should solve in a separate sheet;

These simple but quite time-consuming steps have just saved you a few grand. Now, you should look for crowdfunding solutions.

At this stage, the best thing is to aim low and launch fast with the minimum viable requirements.

A crowdfunding MVP at around $75,000 is more than enough to get started. While this is not a low price by any means, it’s something that will get you a platform that actually works according to your expectations.

What features of a real estate crowdfunding platform you need

If you want an admin to manage the offerings from publication to deal closure, then you only need an admin back-office and front-end panel for investors where they can look up for property listings.

However, if you want property developers to publish their fundraising campaigns, then you need a front-end dashboard for fundraisers in addition to admin back office and investor’s dashboard.

Generally speaking, the list of features for an admin user would probably include offering, transaction, secondary market, and wallet management.

Offering management

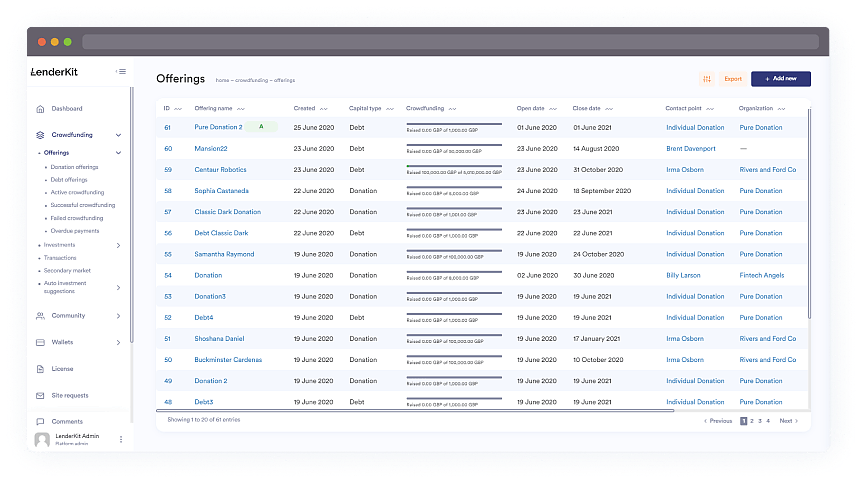

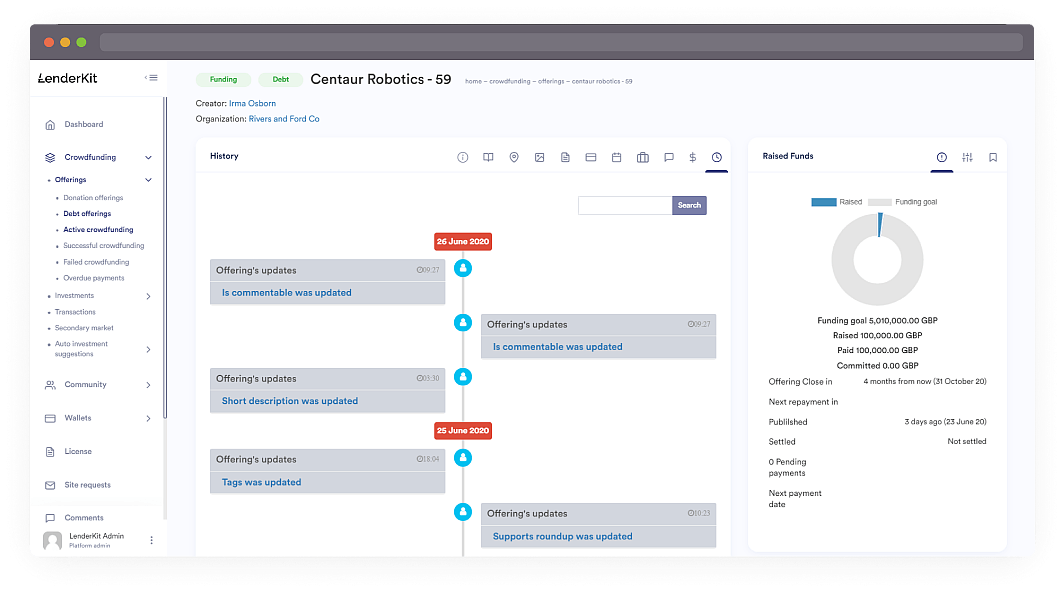

In the admin panel, you will have full access to offerings, where you can manage their statuses, history of funding, payouts, view fundraisers’ names, etc.

You can manually change statuses of the offering, add taglines to organize the offerings by categories, or review history of actions on a particular funding campaign.

The history of actions allows to trackback each and every step and get a fuller picture of a particular campaign performance.

Transaction management

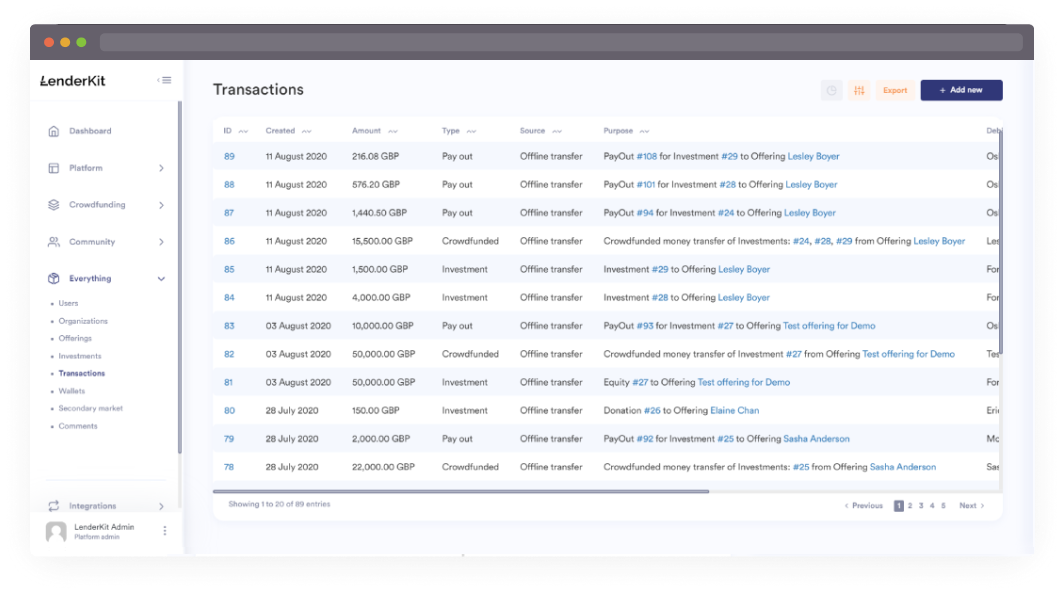

For accounting and financial reporting purposes, you may also require a transparent transaction management panel where you can see the amount, source, type, and destination of the transaction.

Having a transaction recording panel is not only required by law but also useful in terms of getting marketing insights on the campaign performance.

You may want to see an average, minimum, and maximum invested amount to understand your audience and obtain information for your marketing decisions.

Secondary market

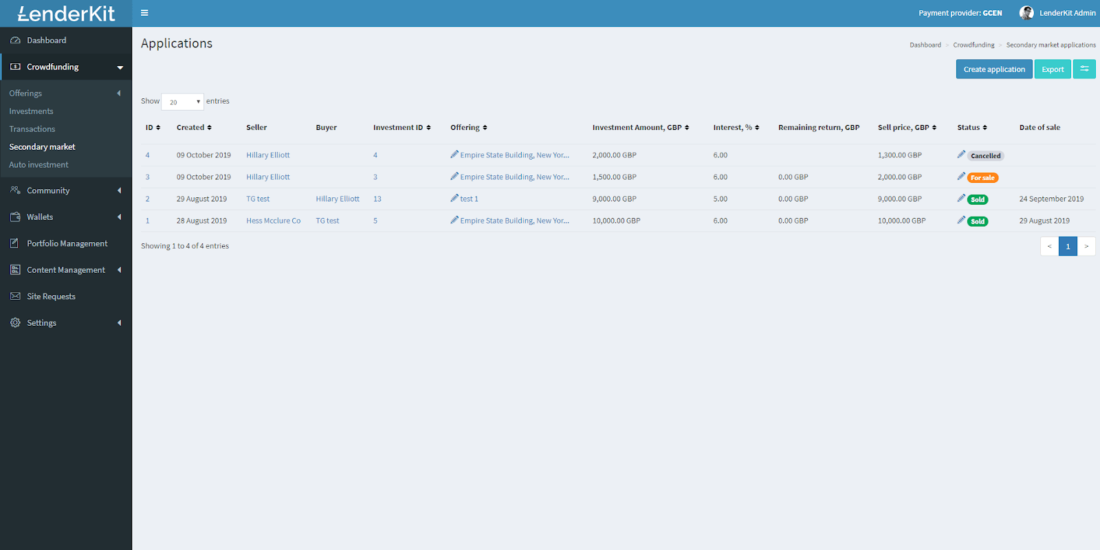

You may want to provide an opportunity for investors to liquidise their assets faster by implementing a secondary market.

In the admin panel, you can change the offering status by approving for sale, cancelling, or displaying the entity as sold.

You can see the name of the buyer and seller, their contact information, investment amount, and interest rate.

Wallet management

Arguably, one of the most important features is wallet management. As an admin, you’ll be responsible for all of the pay-ins and payouts.

In your private platform, you may manually top up the balance of investors if you don’t want to deal with any credit cards.

Here, you can view existing transactions, export, or create new ones.

In any of the above-mentioned features, you can easily switch between individual or corporate investors, and view their contact details, attached documents, transaction history, and statuses.

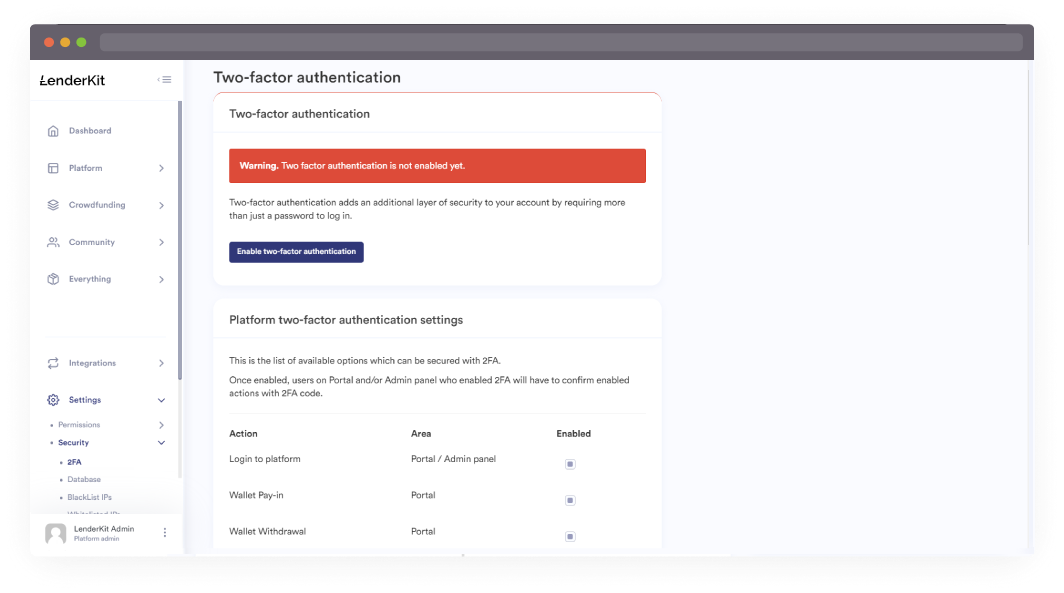

Two-factor authentication

To ensure maximum privacy, you can enable 2FA access to your account or lock up separate pages in the dashboard.

This feature allows you to set up role-based access to a particular page or even action establishing a high level of security to prevent unauthorised log-in and data manipulations.

Having prioritised the admin features of a crowdfunding platform for real estate, you can now think of the required functionality for investor and fundraiser accounts.

For these types of accounts, you don’t need such a complex-looking dashboard. Investors and fundraisers would probably be interested in a more fancy-looking front-end panel where they can see the most important metrics like interest rate, funding goals, funding progress, fees, forecasted ROI, etc.

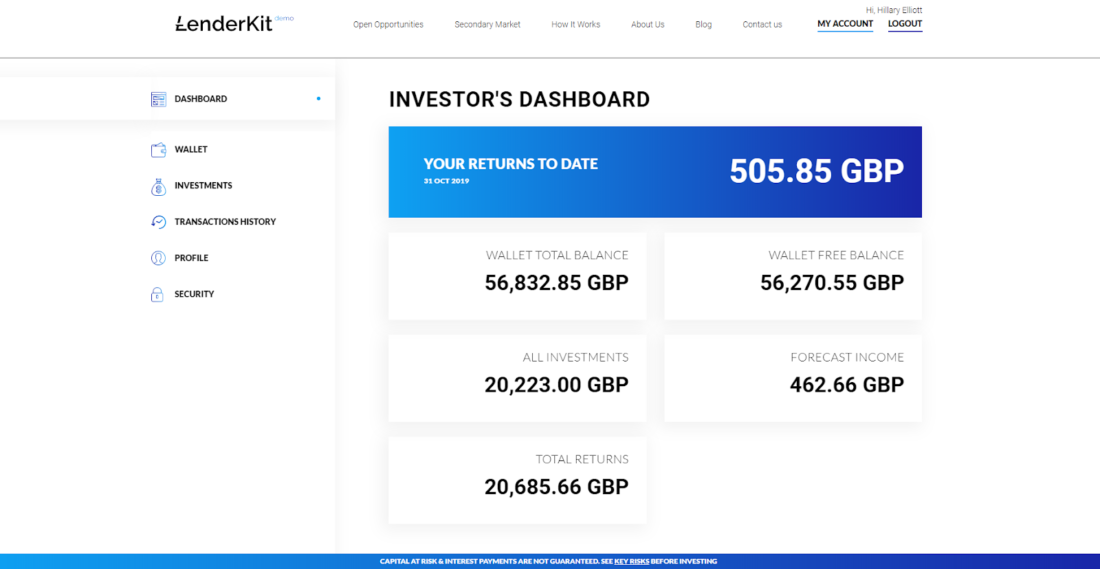

Investor’s dashboard

An investor’s dashboard must display current balance, revenue, forecasted income, net worth, and provide opportunities to top-up or withdraw money. Technically, topping up the balance and setting up repayments can be done manually by an admin. If required, it’s possible to automate these workflows.

Investors should be able to see their transactions, customise profile, browse offerings and make investments in the most favourable investment opportunities.

For a more sophisticated platform, you may want to provide investors with portfolio management functionality and allow to invest in both debt and equity assets. Apart from that, you can also provide choices as to reinvest, hold, or cancel investments if necessary.

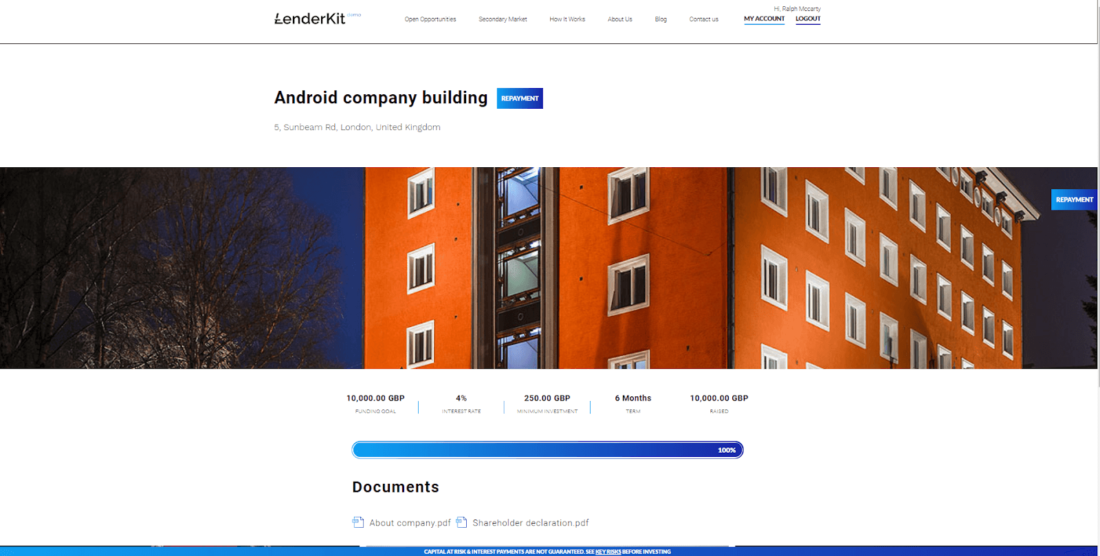

Fundraiser’s dashboard

A fundraiser’s dashboard shows total amount raised, funding goal completion on each of the offerings, average and maximum investment amounts to understand if investors are interested in the campaign.

Fundraisers are able to schedule repayments to investors, review and export the transaction history, and manage properties.

At the offering’s page, both fundraisers and investors are able to see the funding goal, interest rate, minimum investment, and offering terms.

To promote their campaigns, fundraisers may request an admin to set up interest rates, upload entity promotional documents, and add as much content as needed for a successful campaign.

What product development model to choose before building a private crowdfunding portal

It doesn’t make much sense to go with a fixed-price contract which would lock all of the requirements for a contract-limited period of time.

Working on a crowdfunding portal, you’d probably be more interested in flexibility, adjustability, and step-by-step development.

Time and material may be the right solution for you as all of the work is divided into development sprints. With the time and material approach, you have enough flexibility to raise funds in the process for further steps, put a project on hold, etc.

How to register a crowdfunding portal

Remember the first step where you researched all of the financial and crowdfunding regulations in your country and state?

The importance of that step is valuable now, when your platform is ready, working smoothly, and brings you profit.

It’s time to register your platform.

There are many legal and consulting agencies that will draft and file all of the required documents for you.

You may expect to spend around $5,000+ for drafting the documents and $25,000+ for registering your company with SEC and FINRA or alternatives in your country. Note that the amount is the lowest we’ve heard and may be different for your particular case.

We’ve already talked to several crowdfunding legal and consulting firms in the USA:

- Bevilacqua PPLC;

- Syndication Attorneys PLLC;

- LawCloud – have inexpensive drafting tool which can save you money;

- CrowdCheck.

Private crowdfunding platform development summary

It was a long read, so let’s just recap the steps that you should follow when building your own crowdfunding platform for real estate:

- Research crowdfunding regulations;

- Document all of the crowdfunding platform features;

- Find a crowdfunding platform development partner;

- Register your crowdfunding platform.

At LenderKit, we take crowdfunding solution development to the next level by offering you a 55% ready platform which you can start using right away as a Prototype or MVP. As for the rest of the solution, our team will evaluate your business requirements and needs, provide the project estimation and build a custom layer on top of the existing functionality according to your needs.

We partner with LemonWay, MangoPay, GC partners, and Goji investments – a licensed ISA manager – to help you set up seamless KYC/AML verification and payment processing.

For further information about developing a private crowdfunding platform for real estate investing, please reach out to us at lenderkit@justcoded.com.