Revolut’s Crowdfunding Triumph: Lessons from a $45 Billion Valuation

No time to read? Let AI give you a quick summary of this article.

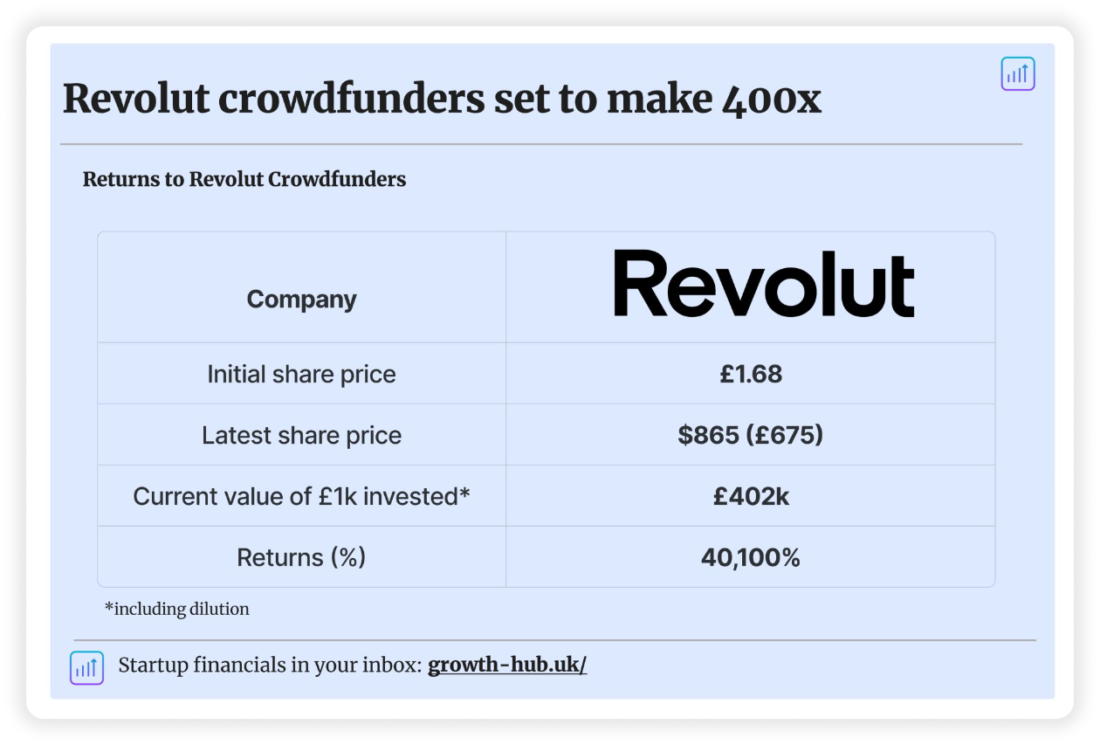

On August 16, 2024, Revolut confirmed a new $45 billion valuation1 which is a significant advancement compared to its $33 billion valuation in 2021. It means that the value of Revolut’s stakes increased by 40,000%2, and some investors saw the paper value of their investments — holdings in private companies that can be sold only at the moment of exit event — boost to $1 million.

How did Revolut make it so big and what steps did it take to become a fintech unicorn? Let’s dive into Revolut’s success story, fundraising rounds and development timeline.

What you will learn in this post:

Revolut crowdfunding rounds and history

Revolut launched in July 2015 with a mission to offer a digital-first approach to financial services. In July 2016, the company partnered with Crowdcube to offer retail investors up to 2.4% of the company’s shares at a $40 million valuation4. With 433 investors, Revolut raised over $1 million, with an average investment of £2,152. Now, those shares were worth approximately £860,000 considering the last Revolut’s valuation of $45 billion.

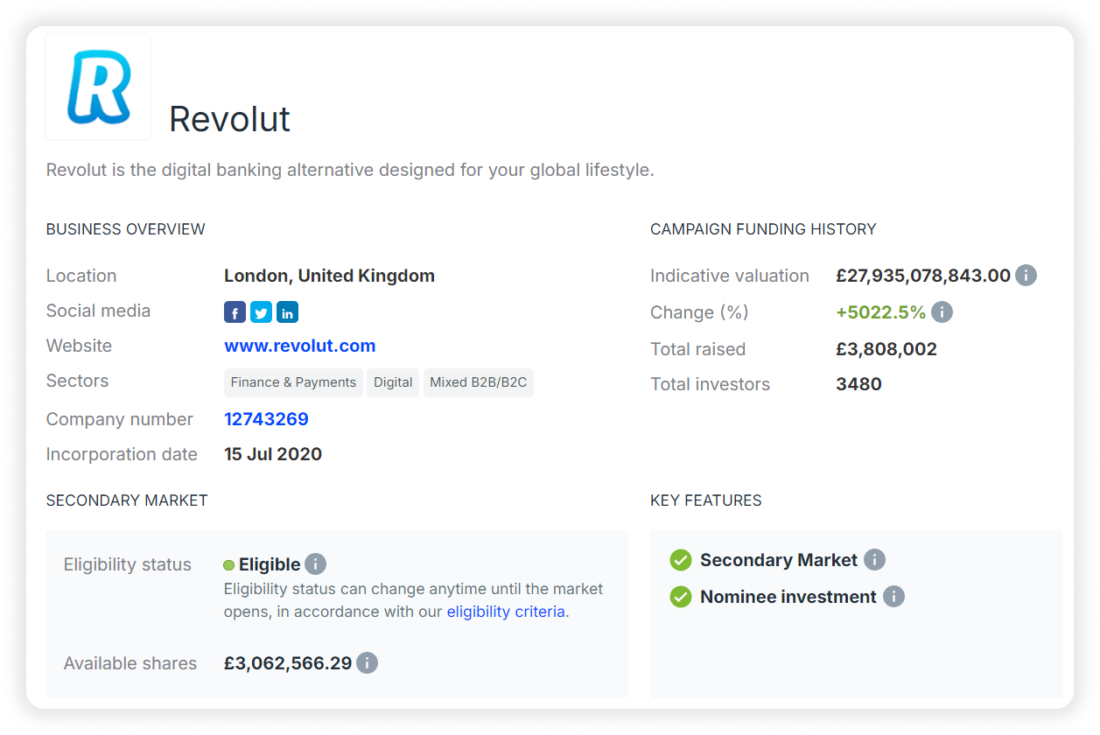

In 2017, Revolut raised 3.8 million on Republic Europe5 — former Seedrs — from 3486 investors.

Some of those backers could sell their shares on the secondary market provided by the platform. For now, the investment of those who kept their shares has generated an x100 income.

These two crowdfunding campaigns on Seedrs and Crowdcube were not the only fundraising efforts of Revolut.

In 2017, the company raised $66 million in a Series B round at a $350 million valuation6 with Index Ventures leading the round, and Balderton Capital and Ribbit Capital joining too.

In 2018, Revolut raised $250 million in a Series C round at a $1.7 billion valuation7 — an x5 increase in one year — which makes Revolut one of the fastest tech companies in Europe to reach unicorn status. This round was led by Hong Kong-based DST Global, along with other investors including Index Ventures and Ribbit Capital. At that time, Revolut was processing $1.8 billion on a daily basis and had from 6,000 to 8,000 new customers signing up with the service every day.

In 2020, the fintech startup raised $500 million in a Series D round at a $5.5 billion valuation8 which turned Revolut into one of the highest-valued fintech companies in the world. The investment round was led by the US-based investor TCV, and a number of existing investors also participated.

In 2021, Revolut topped $800 million in a Series E round at a $33 billion valuation9. That new funding round brought on board two new investors: SoftBank Vision Fund and Tiger Global Management, with the previous investors also participating in funding the further Revolut expansion and development.

Finally, in August 2024, the company upped its valuation from $33 billion to $45 billion10 after an employee share sale. The transaction involved the sale of $500 million worth of shares of Revolut employees. Nik Storonsky, Revolut’s founder and CEO, sold between $200 million and $300 million11 of his shares during the sale, accounting for about half of the $500 million in shares sold by employees. The shares were purchased on a secondary market by such investors as Coatue, D1 Capital Partners, Tiger Global, and some other investors such as Abu Dhabi’s sovereign wealth fund Mubadala.

The last sale followed another important milestone for Revolut. On July 25, the fintech unicorn received its UK banking license with restrictions from the Prudential Regulation Authority (PRA), the regulator that is responsible for overseeing the UK banking sector.

How Revolut became successful

Revolut has disrupted the finance industry by offering a digital-first approach to financial services. The service positions itself as a digital alternative to traditional banking and offers lower-cost currency exchange services with cheaper financial transactions. At the early stage of its development, Revolut offered a prepaid card and an application that allowed users to use various currencies without additional costs. By allowing people to convert currencies within the app, the service was able to attract thousands of users on a daily basis without the need to spend money on advertisements.

Since then, the range of services has expanded. Now, among the new Revolut’s services, one can find the following:

- Multicurrency accounts

- Cryptocurrency exchange

- Peer-to-peer payments

- Travel insurance services

- International transfers

- Interests on the account balance

Revolut is not aiming at creating a monolithic banking service, instead, it focuses on international expansion. Being located in the UK, Revolut also obtained a banking license in Lithuania12 from the European Central Bank in December 2018. This license permitted the company to accept deposits and offer consumer loans, but not to provide investment services.

In September 2019, the company entered the Japanese market, and one month later, it started operations in the Singaporean market.

In January 2022, Revolut started operating as a bank (instead of an electronic money institution) in Belgium, Finland, Denmark, Germany, Liechtenstein, the Netherlands, Spain, Sweden, and Iceland.

On July 25, 2024, the company also secured a UK banking license, with restrictions from the Prudential Regulation Authority (PRA). Revolut now enters the so-called “mobilization stage” which is given for the new banks to build their operations.

Even though Revolut has been operating in the USA since 2020 and applied for a banking license in 2021, it has not received it yet.

The company is present in over 250 countries as an electronic money institution, with over 25 million customers.

Embracing financial inclusion

Along with disrupting the financial landscape, Revolut was the first company of such a scale that allowed retail investors and early users to invest in the business in a crowdfunding campaign on Crowdcube in 2016.

Earlier, retail investors and users could not invest in the equity of other valuable companies with European origins, such as Spotify. Another chance was given to retail investors when the company announced the second crowdfunding campaign on RepublicEurope (former Seedrs). These crowdfunding campaigns democratized high-growth startup investing by allowing everybody to participate in an opportunity that was normally reserved for high-tier investors only.

In its efforts to make the investment space more accessible to retail investors, Revolut went further. It expanded its services by including bond trading for European customers and is planning to do the same for US customers.

How Revolut impacts the crowdfunding ecosystem

The success of Revolut has had a significant impact on the entire startup crowdfunding ecosystem. Many startups now consider crowdfunding as a viable idea to get funding for their operations, and equity crowdfunding platforms like Crowdcube have enjoyed elevated interest from both investors and project owners.

While Revolut is still not announcing its plans to go public, doing so would become an important moment for retail investors who have proven that they can fund a startup no worse than venture capitalists.

Final thoughts

Revolut’s rise to a $45 billion valuation showcases the power of crowdfunding and digital-first financial innovation. By allowing retail investors to participate through platforms like Crowdcube, Revolut democratized investment opportunities traditionally reserved for venture capitalists. This move has since influenced the broader startup crowdfunding ecosystem.

Revolut’s success stems from its low-cost, user-friendly financial services, including multi-currency accounts and cryptocurrency exchanges, coupled with strategic international expansion. As one of the fastest-growing fintechs, its impact on financial inclusion and the startup investment landscape is profound, setting a strong example for future fintechs.

While Revolut is not a crowdfunding platform, it leveraged many crowdfunding platform services on its way to success. If you are looking to build your own crowdfunding platform and host “the next Revolut” under your roof, exploring white-label crowdfunding software by LenderKit can be your best bet to get started off on the right foot.

If you are interested to explore how LenderKit works and what it can offer, don’t hesitate to reach out to us for an online demo or a quick call to discuss your project requirements.

Article sources:

- Early Revolut crowdfunders see 40,000% increase in investment value | Sifted

- From Pennies To Millions: The Remarkable Crowdfunding Success Of Revolut

- Revolut crowdfunders set to make MILLIONS £1M RETURNS FROM A 2K INVESTMENT A year after being founded Revolut offered Crowdcube investors the opportunity to buy up to 2.4% of the business at a… | Seb Johnson 📊🇪🇺 | 124 comments

- Just a moment...

- Revolut

- Revolut raises $66 million for its global banking alternative | TechCrunch

- $250 million in a Series C round at a $1.7 billion valuation

- Revolut raises $500 million in Series D funding as it sets sight on profitability and daily adoption in 2020

- Revolut raises $800m series E funding from Softbank Vision Fund 2 and Tiger Global

- Revolut cements $45bn valuation in employee share sale | Sifted

- Mubadala Invests In Revolut, Valuing Fintech At $45bn | Crowdfund Insider

- Revolut receives banking license from Lithuania’s central bank - LRT