SEC Reporting and EDGAR Filing Automation for Crowdfunding Platforms

No time to read? Let AI give you a quick summary of this article.

In the USA, every company that decides to sell securities and raise capital for their project must file an appropriate form to the Securities and Exchange Commission (SEC).

Depending on the type of securities offered, either debt, equity or convertible and the amount of funds needed, the issuing company or fundraiser needs to file one of these forms:

- Regulation Crowdfunding (Form C1)

- Regulation A, Tier 1 or Tier 2 (Form A2)

- Regulation D, 504, 506(c), 506(b) (Form D3)

Also read about the intrastate rules4 for issuers.

The filing application is processed before the offering goes live on a crowdfunding platform. So, to get things moving faster and professionally, a crowdfunding platform may see an opportunity for processing form filing requests.

The responsibility for filing the required form is totally on the issuing company, however, crowdfunding platforms may facilitate the process, provide the necessary guidance and even implement the SEC reporting and EDGAR filing automation in the platform.

What you will learn in this post:

What is the EDGAR system?

In the context of crowdfunding, EDGAR5 is the electronic platform which allows individuals and companies to submit documents and forms to the Securities and Exchange Commission.

The appointed manager on the SEC side will review the submitted documents and will send a notification to the individual or a company that filed the document with the corresponding status like approval, rejection, or if additional information is required.

The fundraising companies often require help with the filing process, so they turn to a filing agent in case the crowdfunding or investment management platform doesn’t offer support with the applications.

EDGAR provides guidance6 on the applicant types which shows that a funding portal or an investment management firm may file the application on behalf of the fundraising company.

Starting with EDGAR filing

To start using the EDGAR system, the filer has to apply for access through the Form ID7. Once the application is accepted, you’ll receive a unique Central Index Key (CIK) number which will help you search for your filings8 in the system. After that, you will have to generate EDGAR access codes to begin filing electronically.

You can follow the instructions provided by the official website9.

Note that the EDGAR system doesn’t work 24/7. According to the information on their website, there’s a certain schedule when you can use the system:

“EDGAR is available for filing from 6:00 a.m. to 10:00 p.m. ET, Monday through Friday, except federal holidays. Transmissions to EDGAR started but not completed by 10:00 p.m. ET may be canceled, and you may have to re-transmit the next business day.”

How can crowdfunding platforms automate SEC reporting and EDGAR filing

If a crowdfunding platform has an in-house compliance team or partners with a crowdfunding law firm like CrowdCheck10, a trusted filing agent or an SEC reporting automation software provider like SECfly11, there can be a business opportunity to facilitate the “pre-sale stage”, in other words, the preparation stage before the fundraising process.

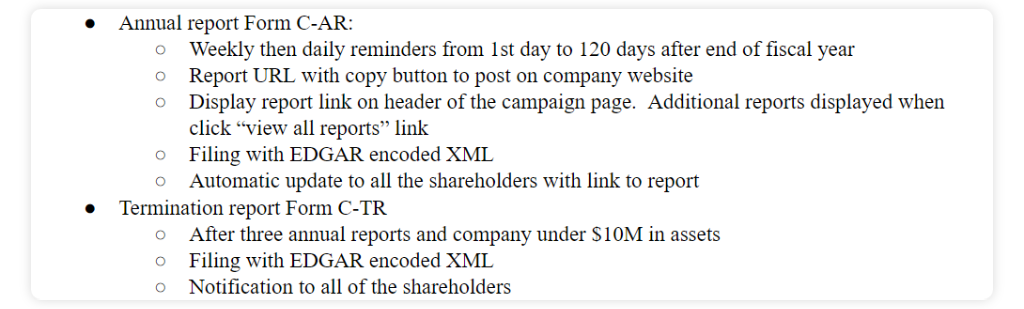

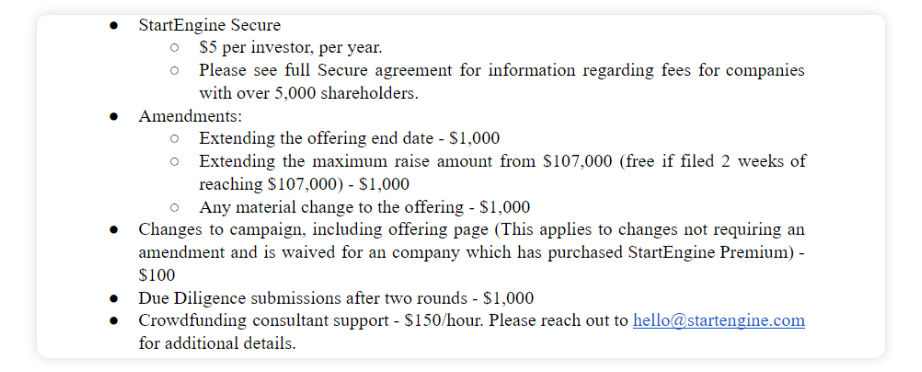

StartEngine, for example, an equity crowdfunding platform, includes the filing support within their “StartEngine Secure” package.

The fees for the StartEngine secure package as well as other services are listed in the their “Company Engagement and Posting Agreement12”

The technical framework for automating EDGAR filing

Technically, a crowdfunding platform needs to partner with the SEC reporting automation software provider which offers EDGAR filing alternatives. Due to the potential complexities of the EDGAR system design, functionality, and process, a crowdfunding platform that partners with a user-friendly EDGAR filing provider will be able to offer unique benefits to the compliance team and the fundraiser.

There are two ways for a crowdfunding platform to build an integration. A filing agent can provide the white-label solution – that is a portal branded to your company’s identity – which will allow the fundraiser to send the required information to the SEC and get notified about the updates.

In this case, the integration is rather conceptual than technical, however, it allows you to add compliance and administration fees and make additional profits here.

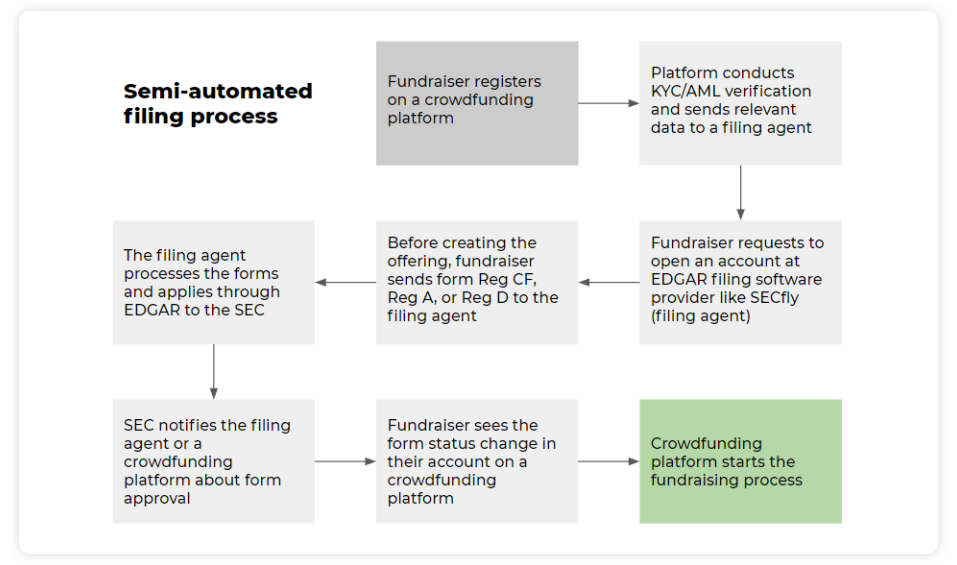

In the image above, the simplified integration process represents semi-manual EDGAR filing automation. In this case, a user registers on a crowdfunding platform and the data is sent via the API to the filing agent.

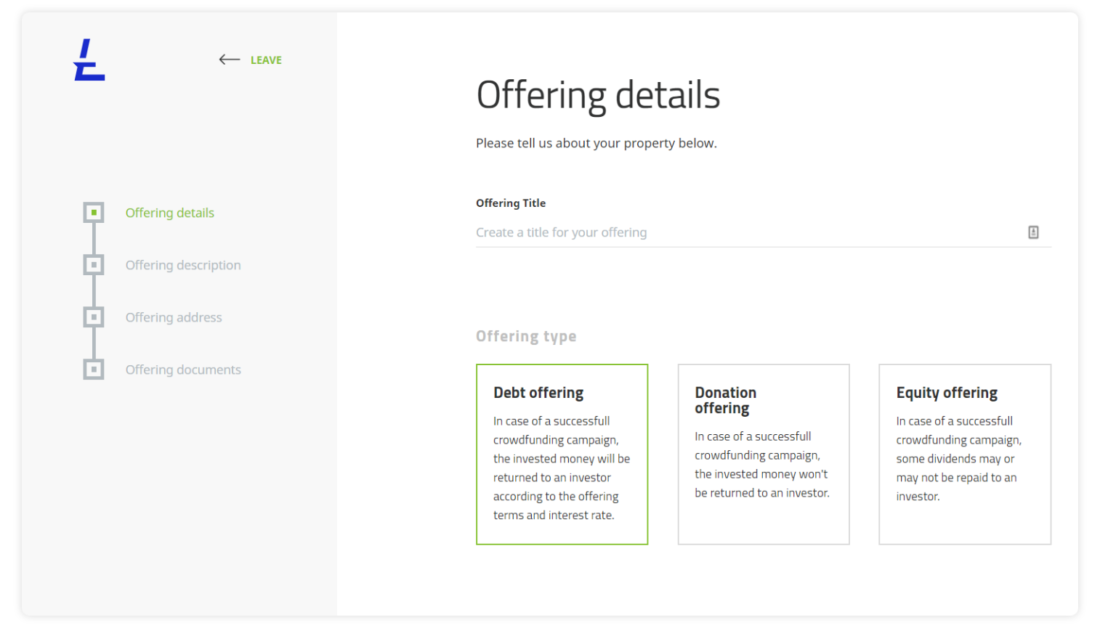

Before the live fundraising on a crowdfunding platform, the fundraiser will choose the offering type, fundraising amount and fill in other offering details like types of securities, interest rates or IRR, etc.

Depending on the form that will be filed to the SEC, it can be chosen and attached via the investor portal on the platform.

The compliance and reporting manager will process the request and will do the administrative work behind the scenes. After that, the fundraiser will see an update in their account with the corresponding status such as “sent to SEC, approved, rejected, additional details required”, etc.

The benefits of using SEC reporting and EDGAR filing automation portal

Crowdfunding platforms can gain competitive advantage, simplify administrative work and create additional revenue streams on providing the compliance facilitation and reporting services.

Financial reporting automation 13software like SECfly allows crowdfunding platforms to:

- Convert Word into HTML and back

- Manage multiple documents of various fundraisers

- Work with different document formats including PDFs, HTML, Word

- File financial statements via the XBRL and iXBRL

- Assign staff members to different sections of the document and more.

If you’re looking to launch a crowdfunding platform in the USA under the Reg CF, Reg A or Reg D and want to integrate the financial reporting software, reach out to LenderKit to discuss your integration.

Article sources:

- PDF (https://www.sec.gov/files/formc.pdf)

- PDF (https://www.sec.gov/files/form1-a.pdf)

- PDF (https://www.sec.gov/about/forms/formd.pdf)

- SEC.gov | Intrastate Offering Exemptions:

- SEC.gov | About EDGAR

- SEC.gov | Filer Support & Resources

- Filer Management

- SEC.gov | CIK Lookup

- Filer Management

- Homepage - CrowdCheck

- SECfly

- Google Docs: Sign-in

- Financial reporting automation