Will European Crowdfunding Platforms Adopt Tokenization?

The introduction of MiCA regulation in 2020 and the comments from the EUROCROWD in 2021 regarding the potential applicability of security token offerings for crowdfunding, leads us to think that European platforms may adopt security tokenization in the near future.

When you compare token offerings with crowdfunding campaigns, you will see that they share a lot of common features such as:

- The involvement of retail and accredited investors

- Raising funds from a crowd

- A possibility of small contributions

Even though token offerings are not common in crowdfunding, some platforms have already adopted the concept of asset tokenization, and with the updated regulations, more platforms might join the game.

What you will learn in this post:

Classification of security tokens and their value to crowdfunding

In crowdfunding, investors purchase traditional financial instruments such as shares or bonds. In a security token offering, investors purchase rights to an asset offered in the form of digitized securities. The only difference from traditional financial securities is that digitized securities are stored and transferred in a blockchain.

However, legally, token offerings in crowdfunding might be not as straightforward as the majority of crowdfunding campaigns.

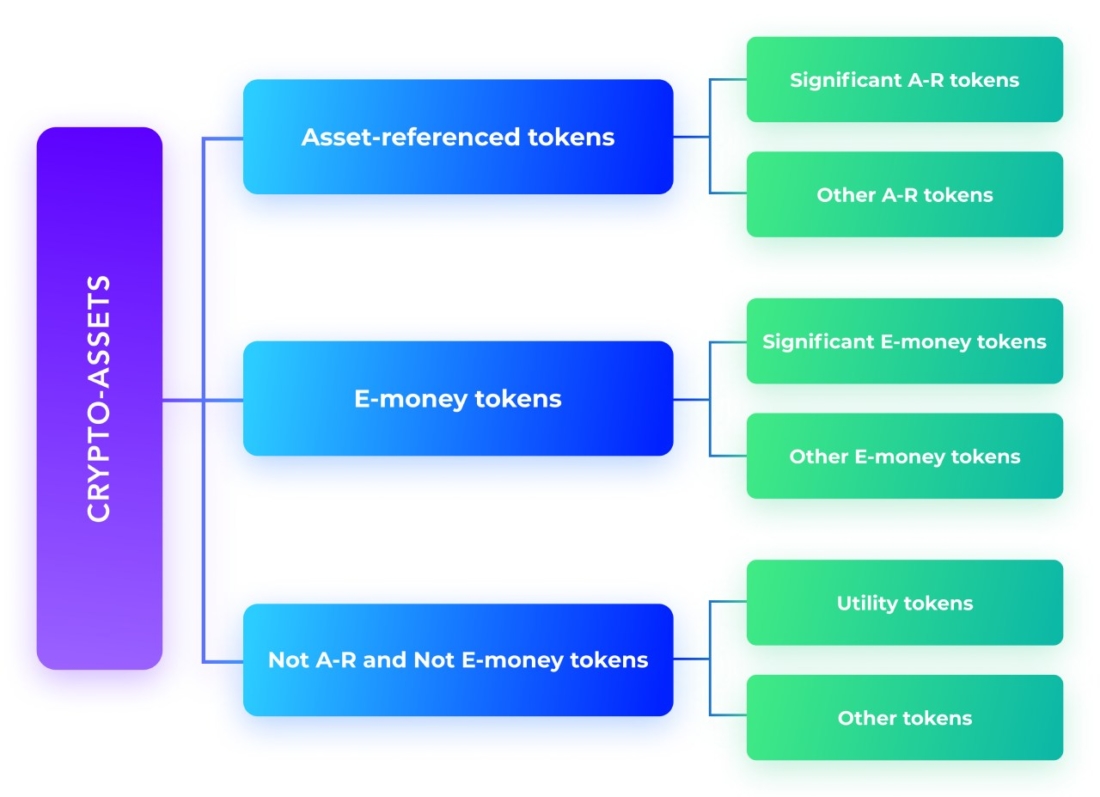

According to the European MiCa regulation, tokens are divided into the following categories:

- Asset-referenced tokens, or ART – their value is stable because the token is pegged to a physical commodity, a fiat currency which is a legal tender, a crypto-asset, or even a combination of such assets.

- Electronic money tokens, or EMT – their value is stable, it is pegged to the value of a fiat currency that is a legal tender. Such tokens are used as a means of exchange.

- Crypto-assets, other than ART or ETM – under this category, all tokens are classified that are not ART or ETM. This category is most heterogeneous, utility tokens are also included here.

According to the EUROCROWD response to the MiCa regulation, from these three categories, utility tokens can offer something suitable for crowdfunding platforms.

Utility tokens are crypto assets that provide access to a service or a good, they are available on the Distributed Ledger Technology (DLT), and can be accepted only by the token issuer.

Obstacles to adoption of tokenization in crowdfunding

EUROCROWD found certain inconsistencies in definitions and several possible scenarios of how they can be interpreted.

The problem with utility tokens for crowdfunding

According to the last part of the definition “can be accepted only by the token issuer”, EUROCROWD assumes that MiCa meant that utility tokens can’t be traded on crypto exchanges. However, in reality, any crypto assets including utility tokens often “change hands.”

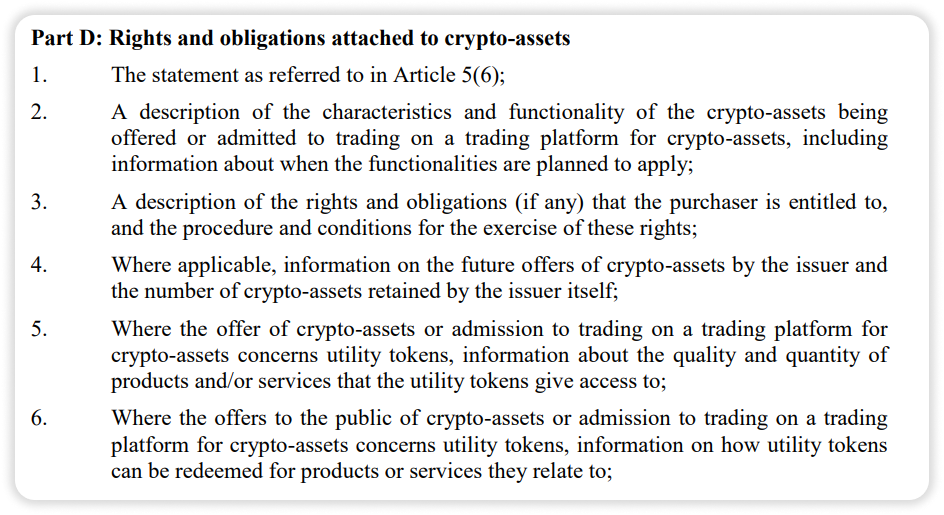

European Crowdfunding Network then clarifies that according to the Annex I Part D, Point 5 and 6, the utility tokens are actually meant to be traded.

Utility tokens look like pre-order assets

At this stage, the utility tokens look like a pre-order “voucher” which creates certain challenges. Basically, there’s a possibility of pre-ordering a product or a service that doesn’t exist yet.

Moreover, utility tokens currently don’t have a fundraising threshold which means that issuers could raise 25 million EUR or even more.

Increased risks to retail investors

Crypto-assets in crowdfunding are likely to attract a wider audience of investors, including the crypto-investors and NFT traders. This helps to back up the concept of “crowd” in crowdfunding, however, it also creates new challenges related to fraud in crowdfunding.

To ensure investor protection, MiCa requires issuers to publish a general white-paper with disclosures and risk warnings for offerings larger than 1 Million EUR. There are also requirements for circulation and administration of the assets.

As with standard online crowdfunding, crypto-crowdfunding platforms that work with security token offerings have to take some measures to ensure safety and KYC/AML compliance. So, the platform shall conduct the assessment of whether crowdfunding token offering is appropriate for retail investors. Also, the platform shall inform retail investors about the risks. In this regard, the adoption of tokenization by crowdfunding platforms could provide an additional security layer to those retail investors who are willing to participate in an STO.

A possibility of trading in secondary markets

Tokens are widely traded on secondary markets. But for financial instruments offered via crowdfunding, it is not common to be traded on secondary markets. It is a serious obstacle to the adoption of token offerings by crowdfunding platforms.

Crowdfunding operators were eager to get the ESMA permission to trade financial instruments in secondary markets more freely but ESMA has always been hesitant. The regulator explicitly states and regulates to which extent secondary trading can be facilitated through so-called bulletin boards.

However, through bulletin-boards it’s hard to organize fully-functional secondary market trading, and therefore, a crowdfunding platform cannot be considered a regulated multi-traded facility. While regulated multi-traded facilities are regulated by MiFID, this is not the case with crowdfunding platforms.

On the contrary, token offerings are directly connected with trading in secondary markets, moreover, MiCA which regulates the market of crypto-assets doesn’t prohibit it but regulates it, including fully-automated trading in secondary markets. Therefore, there are no reasons to prohibit trading in secondary markets of tokens offered via crowdfunding platforms.

Financial securities are regulated differently in all EU states

Local markets have differences in the regulation of crypto-assets and STOs for crowdfunding.

For example, in Germany, the Electronic Securities Act (eWpG) regulates securities such as bonds and debt instruments issued in an electronic form.The same act implements some restrictions to inhibit the storage, issuance, and transfer of those securities on the blockchain.

On the other hand, another German regulator BaFin permits STOs and qualifies them as “sui generis” securities. With it, the regulator enables blockchain-based debt instruments rather than equity instruments.

In Luxembourg and France, regulators took a different approach to blockchain-based securities. All the settlements of blockchain-based securities shall occur outside of traditional securities settlements. With it, regulators move the blockchain-based securities out of the securities regulation.

STO crowdfunding platforms

Even though there are differences in local legislative acts, some platforms have been offering STOs and crypto assets for ages.

Invesdor

Invesdor (formerly Kapilendo) is one of the major players in the German crowdfunding market that has embraced blockchain-based tokens as securities. It is the pioneering debt-based crowdfunding platform that enabled the issue of token-based bonds on Stellar blockchain for L’Osteria.

Exporo

Exporo is one of the leading real estate crowdfunding platforms that brought the STOs to their base of investors.

STOKR

STOKR, a major crowdfunding platform in Luxembourg, had to deal with this inconsistency when trying to offer securities on a cross-border basis. Eventually, the platform had to apply some measures, such as geo-fencing, to restrict their STOs to those locations only where regulators were explicitly friendly to STOs.

Can asset tokenization become a new business opportunity for crowdfunding?

In short, yes, it can, even though some preparations shall be made. First of all, regulatory acts shall be harmonized to prevent contradictions that are a hurdle on the way to tokenization adoption on crowdfunding.

The regulation favors the development of the cryptocurrency sector, so it’s only a matter of time when crypto-assets and security token offerings will merge with crowdfunding.

For crowdfunding platforms, it may be a sign to start looking for partners who can implement the tokenized securities technology either within the existing ecosystem or for a completely new product.

If you’re looking to build a blockchain crowdfunding platform with security token offerings and asset tokenization, consider LenderKit.

LenderKit is investment crowdfunding software which offers many features out-of-box and allows for full customization of the design and any core functionality. We also work with security token providers such as Polymath to help businesses launch crypto-crowdfunding platforms in Europe and worldwide.