What is Investment Banking and How it Works

No time to read? Let AI give you a quick summary of this article.

Investment banking specializes in1 managing and executing sophisticated financial transactions, including:

- Initial Public Offerings (IPOs)

- Debt underwriting

- Mergers and acquisitions

- Corporate reorganizations

In addition, investment banks act as brokers, trading on behalf of institutions and private investors. Apart from helping with major complex financial transactions, investment banks assist with a company’s valuation and preparation of documents for the Securities and Exchange Commission2 for the company to go public. Investment banks or their subdivisions may also issue securities to raise capital for their clients.

What you will learn in this post:

Types of investment banks

Investment banks are classified3 into four main groups depending on their size, status, region of operation, and industry focus:

- Bulge bracket investment banks

- Middle market banks

- Elite boutique banks

- Industry-specific boutiques and regional boutique banks

Let’s take a closer look at each type of investment banks and see what they offer.

Also read: The Complete Guide to Private Investment ManagementBulge bracket investment banks (BBs)

Bulge bracket investment banks that operate globally and offer all products and services. They work mostly with larger financial deals, those that are over USD 1 bln. The examples of such banks are as follows:

- JP Morgan (JPM)

- Goldman Sachs (GS)

- Morgan Stanley (MS)

- Bank of America (BofA)

- Citigroup (Citi)

- Barclays (BarCap)

- UBS

Middle market banks (MMs)

These investment banks can also boast a global presence and provide all types of services. However, they work on smaller deals than BBs (less than USD 1 bln). Some examples of middle-market banks are:

- Jefferies Group

- Houlihan Lokey

- William Blair & Company

- Lincoln International LLC

Elite boutique banks (EBs)

Elite boutique banks are smaller banks that specialize in mergers and acquisitions and restructuring processes rather than in underwriting. Such banks can offer top exit opportunities and at times, they may work on very big deals. Here are some examples of elite boutique banks:

- Lazard

- Evercore

- Moelis

Industry-specific boutiques (ISBs) and regional boutique banks (RBs)

Such banks focus on a specific industry. Healthcare, technology, and real estate investment banking are some typical examples of the sectors in which ISBs and RBs operate. These banks normally operate on smaller deals that do not exceed USD 100 mln.

Some of the examples of industry-specific boutiques and regional boutique banks are the following:

- Rothschild & Co.

- Lazard

- Guggenheim Partners

- Evercore

- LionTree

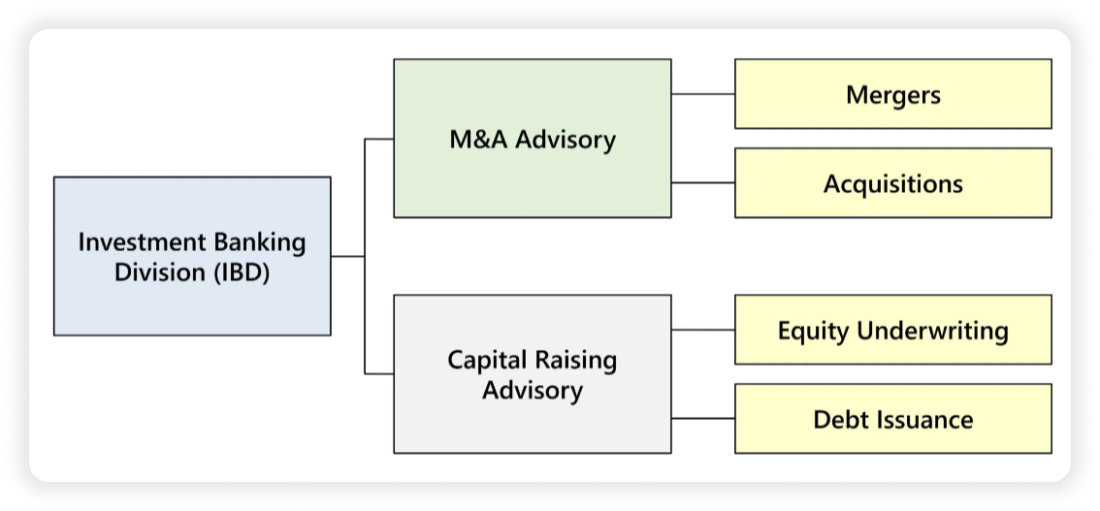

What investments banks do

Investment banks mostly engage in corporate finance4 by helping businesses raise money in stock and bond markets. Those are regulated markets, this is why investment banks must pay extra attention to financial regulation and compliance. Many investment banks also work in public finance which involves raising money for state and local governments. This involves arranging asset sales and leases and issuing municipal bonds.

In other words, investment banks help clients who have money to invest and generate profit from clients who need funding. This is a way to help companies expand.

Here are some examples of how investment banking operates.

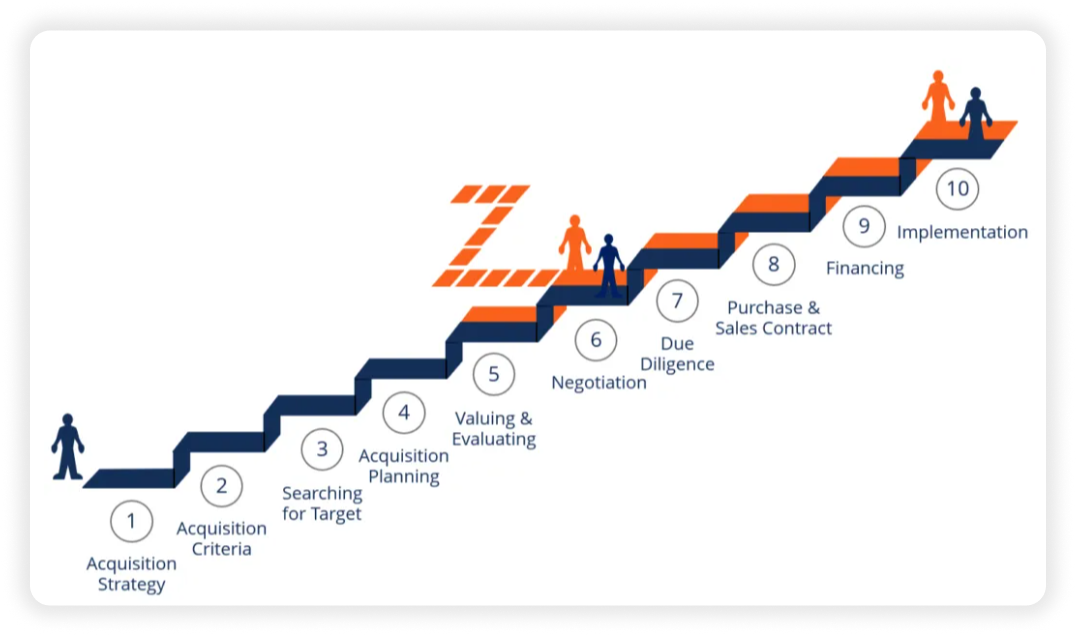

Mergers & acquisitions

While mergers and acquisitions5 are often used interchangeably, there is a distinction between them.

A merger is the process of consolidation of two companies of more or less the same size.

An acquisition is a purchase of a smaller company by a bigger company.

If an investment bank advises a potential acquirer company, it identifies the potential sellers, makes a list of them, and later, manages the entire M&A process6. If a bank represents a seller, it makes a list of potential acquirers and manages all the processes until the deal closure. Finally, after the deal is closed, the bank collects its deal fee.

Securities underwriting

In the case of securities underwriting7, the task of an investment bank is to raise enough capital with favorable terms. But in order to get funds, something shall be given in return. This something can be equity issued by a company (equity underwriting), or debt (debt underwriting).

In the case of equity underwriting, the company issues new shares to investors. Once a company goes public, it raises a good amount of capital, and its shares are listed on public exchanges. The bank collects its fee, and investors can start trading shares in the stock market.

In the case of debt, the client issues bonds and loans to investors in return for funding. In return, the company agrees to make scheduled interest payments and repay the principal at the loan maturity. Once the company raises the necessary amount, the bank collects its fee.

Also read: Decline in Access to Bank Loans for SMEs: Crowdfunding Comes to the RescueCorporate restructuring and divestiture

When a company is at risk of insolvency and considers such options as bankruptcy, defaulting on debt, or distressed sales, it may request an investment bank to provide restructuring guidance8.

Sometimes, a business may consider getting rid of a certain business segment. It can happen after a period of underperformance, if the segment doesn’t fit in the company’s development strategy, or if the segment may be operating as a standalone business. In such a case, a business may request an investment bank to provide the services of divestiture9.

Broker & dealer services

A broker is a company that matches buyers and sellers of securities, and a dealer sells securities from its own inventory. Investment banks provide retail and institutional investors with broker-dealer services and thus maintain revenue levels when corporate finance activities (M&A deals, IPOs) are down.

Clients of investment banks

Investment banks work with a wide range of clients that may be located all around the world.

Governments

Investment banks collaborate with governments to trade securities, raise money, and buy or sell crown corporations.

Companies

Investment banks help companies to go public, raise additional funds, make acquisitions, sell business subdivisions, and provide general corporate advising services.

Institutional investors

Investment banks work with institutional investors to provide research, trade securities and help to manage other people’s capital. For private equity firms, investment banks help to acquire portfolio companies and exit their positions by selling portfolio companies at a profit or via an IPO.

Corporate vs investment banking

Many people confuse investment banking and corporate banking, and indeed, both of them fall under the umbrella of financial services. However, these are two different things.

Corporate banking is about forming long-term relationships with a client which is a corporation. Investment banking is rather transaction-based, and a client may be a corporation or a government.

Corporate banking includes providing ongoing financial services10 to companies such as:

- Issuing loans and lines of credit to help companies finance a specific project or provide liquidity on an ongoing basis.

- Treasury management to help companies run smoothly. Here, a lot of services are included such as reporting, accounts payable, online banking, fraud prevention, and others.

- Foreign exchange services to enable companies to receive and send foreign currencies, manage payables and receivables in many currencies, and so on.

Many banks provide both investment and corporate banking services to the same clients. For example, a company may use the services provided by the bank’s corporate division. But if the company decides to go IPO, it may turn to the investment division of the same bank to get help through the process.

Bottom line

Even though individual investors are unlikely to interact with the investment banking sector, the latter has played a crucial role in the formation of the business sector as we know it now. Investment banking helps businesses to raise money and expand thus making markets function efficiently and grow.

Article sources:

- Investment Banking | Quick Primer

- SEC.gov | Home

- Classified

- Engage in corporate finance

- Mergers and Acquisitions (M&A) | Complete Guide

- Investment Banking Oveview

- Securities Underwriting | Definition + Process

- Corporate Restructuring Primer | Reorganization Strategy

- Divestiture | Definition + M&A Examples

- Ongoing financial services