The Complete Guide to Private Investment Management

Private investment management is a type of wealth management service that is focused on protecting and growing an individual or institutional financial wealth.

Private investment management firms often provide a comprehensive set of financial services to individual clients, families, businesses, pension funds, universities, foundations, and endowments. The services may include:

- Portfolio management

- Asset allocation

- Customized investment strategies

- Trading

- Research

- Advisory services

- Tax planning

- Estate planning

- Risk management

- Reporting and more

High-net-worth individuals typically use private investment management platforms to access more sophisticated and tailored investment strategies than those available through public retail brokers or investment products.

What you will learn in this post:

How does private investment management work?

Private investment management services are normally provided by banks, independent financial advisers, large brokerage companies, portfolio managers, funds, or family offices. Many private investment management companies belong to larger corporations and are created to provide clients with more personalized services.

Such companies offer services in all types of financial advising:

- Investment with cash

- Investment in equities with fixed income

- Investment in alternative assets and similar.

Family offices offer comprehensive financial solutions to high-net-worth individuals. There are single-family offices that work for the benefit of a single affluent family or individual, and multifamily offices that manage the wealth of several families.

How much do private investment advising services cost?

The fees charged by private investment managers can vary based on several factors, including the complexity and size of the portfolio being managed, the type of services being provided, the level of customization, and the experience of the investment manager.

Common private investment management fees include:

- Management fees: 1-3%

- Performance fees: 10 – 20%

- Transaction fees: depend on the transaction type

Additionally, some companies charge an annual fee and hourly fees depending on the services they provide.

Types of private investment management

A private investment company normally collaborates with less than 100 investors, and most of them have large investments somewhere else.

The most common private investment firms are venture capital funds, private equity funds, and hedge funds.

Venture capital funds

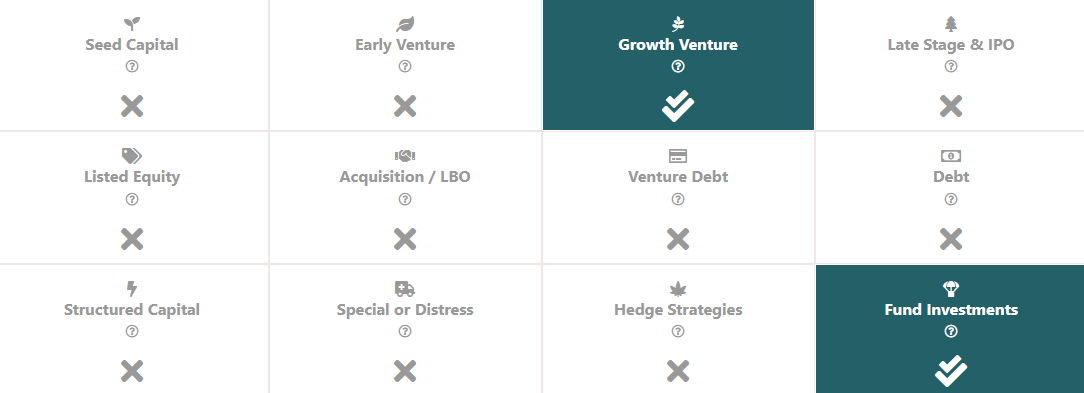

Venture capital funds invest in illiquid private assets such as early-stage private companies. They manage the money of investors who seek to get a share (equity) in promising startups, small-, and medium-sized businesses with a strong potential to grow and deliver a profit.

Top VC funds

Bain Capital is a venture capital firm that is also a pioneer in a consulting-based approach to private equity investing. The fund has offices in the Americas, Asia Pacific, and Europe and focuses on all types of investments.

- Launch year: 1984

- Assets under management: $165 billion

- Minimum investment: $50 million

Bill and Melinda Gates Investments (BMGI) is a private family investment office. It manages the funds of Cascade Investments and makes private investments for the Gates family, and focuses on a wide range of assets such as equity, fund investments, etc.

- Launch year: 1985

- Funds under management: $170 billion

- Minimum investment: $25 million

General Atlantic invests in established companies with strong revenue growth and fast-growing companies with established business models. The VC fund’s focus is financial services, technology, and healthcare.

- Launch year: 1980

- Assets under management: $78 billion

- Minimum investment: $20 million

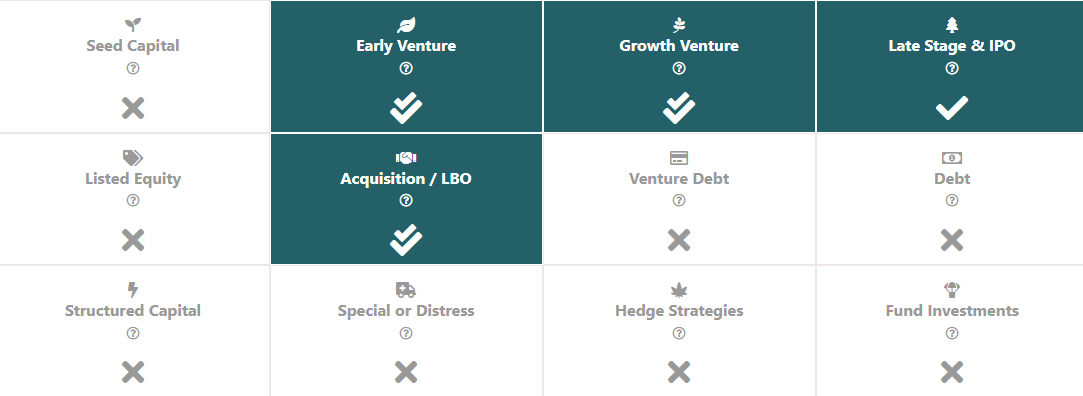

Private equity funds

Private equity funds invest in illiquid private assets. This investment type also includes growing and later-stage private companies. Investors are required to commit significant capital for a long time; this is why this investment type is limited to institutional investors and high-net-worth individuals.

Top PE funds

Goldman Sachs is one of the largest asset management companies in the world. It makes investments in all types of assets, including senior and mezzanine debt, late-stage venture capital, and private equity, among others. The main focus areas are technology, biotech, consumer products and services, healthcare, finance, media and entertainment, property, resource extraction, agriculture, and infrastructure.

- Launch year: 1986

- Assets under management: $2 trillion

- Minimum investment: $25 million

The Blackstone Group Inc. is one of the largest and most successful alternative investment companies in the world. It has five divisions: private equity, real estate, hedge funds, credit, and tactical opportunities. The main focus areas of the fund are technology, consumer products and services, healthcare, media and entertainment, property, and infrastructure.

- Launch year: 1985

- Assets under management: $991 billion

- Minimum investment: $2,500 (not available for all investment types)

KKR is a global investment firm that manages private equity, real estate, and other types of alternative investments. The main focus areas are technology, biotech, consumer products and services, healthcare, infrastructure, and agriculture.

- Launch year: 1976

- Assets under management: $504 billion

- Minimum investment: $50 million

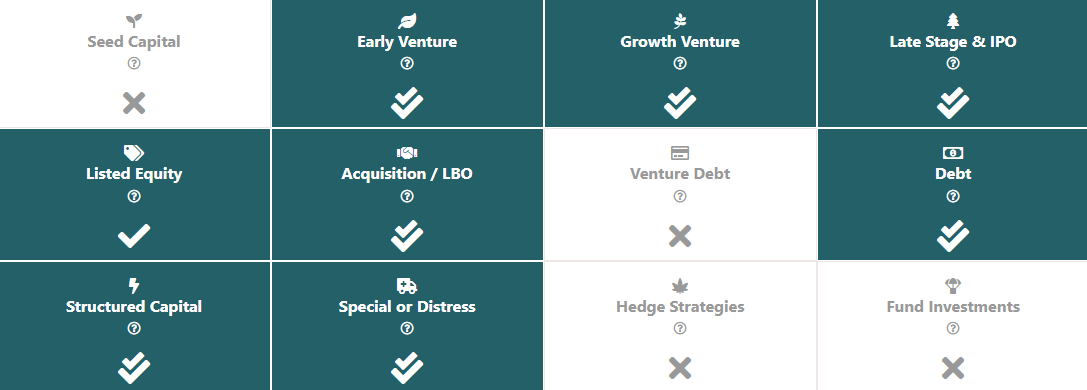

Hedge funds

A hedge fund pulls money from private investors. The funds are managed by expert fund managers who use all possible strategies to make a profit.

Hedge funds are considered a risky investment alternative because they use leveraging, trading non-traditional assets, or investing in derivatives such as options and futures to generate an above-average profit.

Investments by hedge funds are considered illiquid because investors cannot cash them out rapidly, and thus, this option is available for institutional and high-net-worth investors only.

Top hedge funds

Citadel Advisors applies all available investment strategies to grow assets under their management. The company’s advisors may take short and long positions across a range of investment securities with a focus on equity, commodity, currency, fixed-income, and currency investments on a global scale.

- Launch year: 1990

- Assets under management: $339 billion

- Minimum investment: $10 million

Bridgewater Associates provides financial services to pension funds, banks, charitable foundations, and other institutional and accredited investors.

- Launch year: 1975

- Assets under management: $132 billion

- Minimum investment: $10 million

AQR Capital Management is a global investment management firm that offers services in the management of traditional and alternative investments, proprietary investment analysis, portfolio recommendations, and similar. It is open for pooled investment vehicles, institutional investors, and high-net-worth investors with assets over $5 million.

- Launch year: 1998

- Assets under management: $123 billion

- Minimum investment: $5 million

Private investment regulations

Private investment companies aren’t required to be registered with the Securities Exchange Commission in the USA. However, to start operating as a private investment company, the business shall meet specific requirements and exemptions.

One of the most common requirements is to consider the limited number of investors who can own shares in a private investment fund. So, a company under section 3C1 can have no more than 100 investors, and a company under 3C7 is allowed to have up to 2,000 investors.

Private investment companies do not make public offerings, nor do they solicit funds from retail investors. Their focus is on high-net-worth private investors and institutional investors.

Private investment companies may assign financial advisors. Such advisors also have to comply with some regulatory requirements.

- They are subject to periodic SEC audits.

- They are allowed to charge performance fees only to qualified clients only (e.g., those with a $1.5 million net worth)

- They have to follow other procedures, including those related to the custody of their clients’ funds, insider trading, and proxy voting, among others.

- Even if a fund manager may be exempt from the SEC registration, a financial advisor may have to be registered with the SEC in some states.

Private investment companies shall also consider anti-money laundering requirements. They have to present a written AML program to prevent the company from being used for money laundering activities or financing terrorism. This applies to all private investment companies that:

- Have $1 million or more in assets

- Are organized under the law of the USA and operated or sponsored by a US person.

- Allow their stakeholders to redeem interests within 2 years from the investment date.

How to start your own private investment management platform

If you are thinking about launching your own private investment management platform, you need to consider plenty of details, including regulatory ones. First of all, think about the legal formation of your company. Some funds are registered as limited partnerships, others can be liability companies and corporations. Whatever structure you pick, make sure you create all the required documentation that will govern the relationship among all the parties.

For example, if you pick a limited partnership for your model, indicate in the documents such details as how the limited partners will call for capital commitments, how profits are split, whether there are any management fees, and their size, and similar

If you are going to appoint a financial adviser, check whether he is exempt from the SEC registration or he has to register with the regulator and indicate his responsibilities.

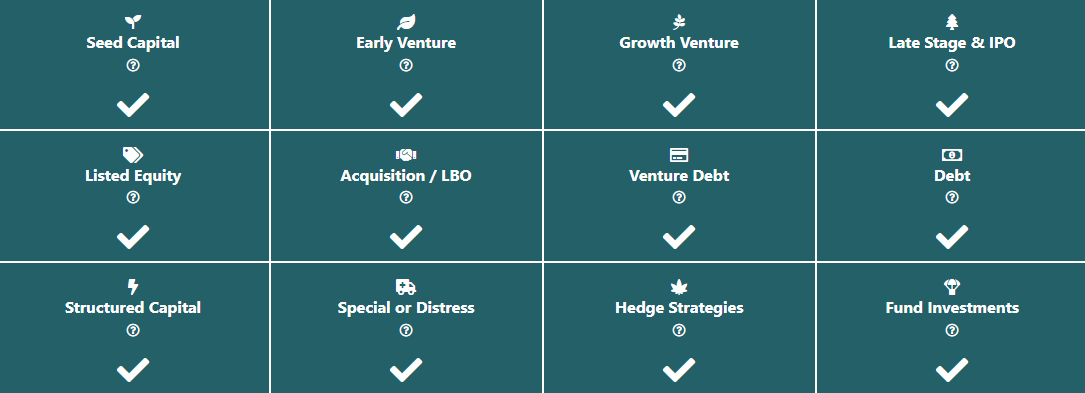

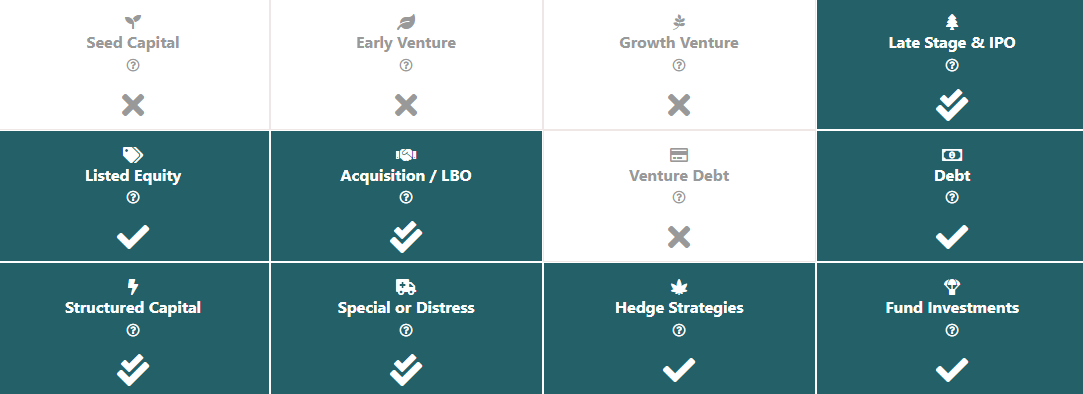

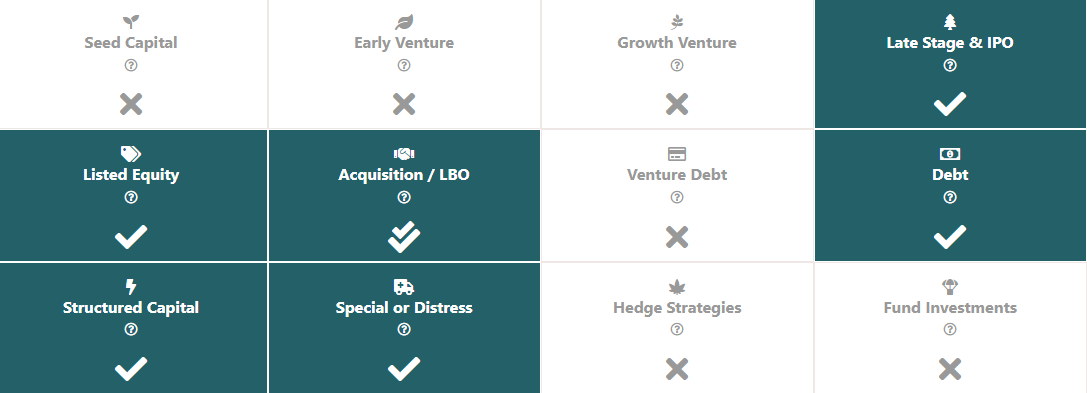

Finally, consider how you are going to develop a platform where you will be managing all the investment activities. The best way is to use a white-label private investment software from a knowledgeable provider such as LenderKit. The company provides fully-functional investment software for VC and private equity with an extensive set of functions.

The software has robust out-of-the-box and custom functionality that allows automating business investment operations and managing deals more efficiently, and tailoring your platform to any regulation, audience type, and business needs.