What is Private Lending and How it Works

No time to read? Let AI give you a quick summary of this article.

Traditionally, borrowers relied on banks to cover their financial needs. However, their stringent requirements may pose significant challenges, especially for borrowers with complex ownership structures, non-conventional income sources or those with unfavorable credit history. This is where private lending comes into play as an alternative to traditional funding sources.

What you will learn in this post:

What is private lending?

Private lending is a financial avenue where borrowers get loans from private lenders — individuals or businesses instead of borrowing funds from a bank or a credit union. Here are a few use cases of private lending and how it helps companies:

- Asset-rich cash-poor businesses may opt for private lending to receive funds quickly to cover their cash shortfalls or benefit from time-sensitive investment or business opportunities.

- Real estate investors choose private lending for real estate to buy commercial prosperity or underdeveloped land, or to close a project within a tight deadline, as an example. Rental property investors may need quick funding to make repairs or renovations.

- Business owners who want to create another company for a specific project or want to launch one more business and avoid the stringent pre-sale requirements of traditional lenders.

- Companies that need funding for immediate remedial work, improvements, or renovation.

- Investors who want to acquire new property but have no liquidity to do so.

- Non-traditional borrowers such as foreign citizens who have no verifiable income but have property that can serve as collateral.

Private credit vs direct lending vs other forms of lending

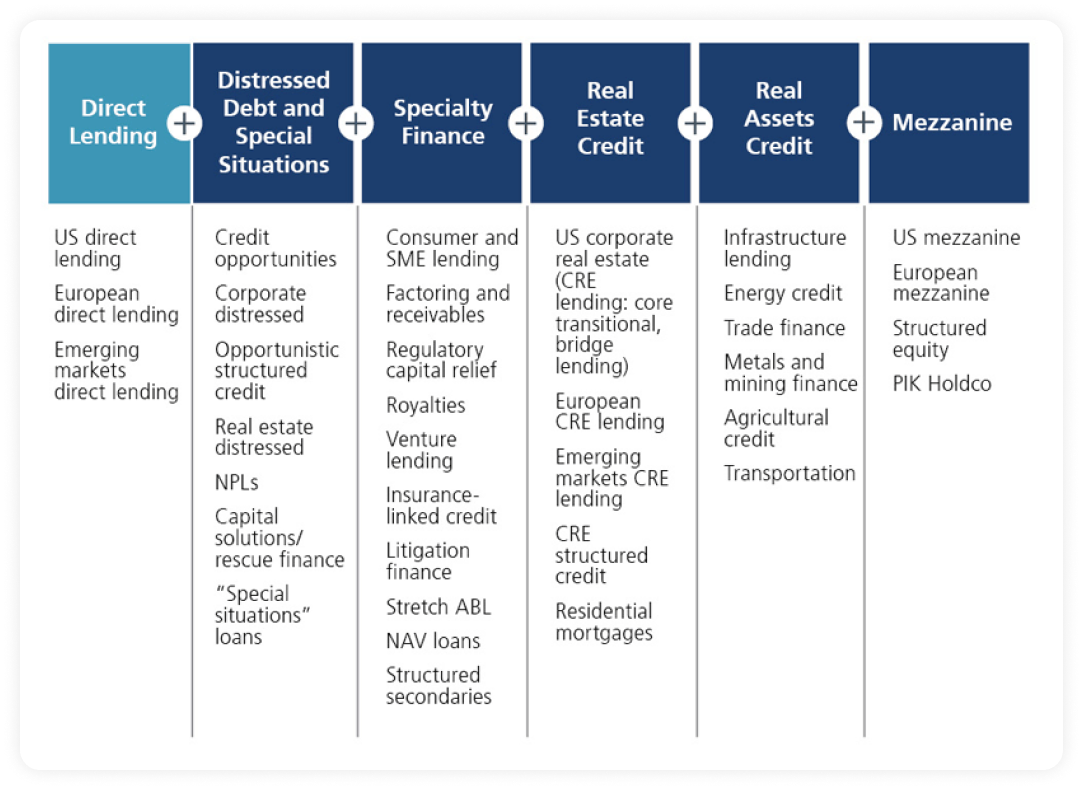

In the context of private lending, we often hear such terms as private credit1 and direct lending. Private credit, or private lending, is a form of lending outside of the traditional banking system, and direct lending is one of its forms. Generally, the following forms of private lending are distinguished:

Direct lending: lenders provide funding to small and medium-sized companies directly or by providing capital to third-party fund managers or platforms.

Junior capital (mezzanine, senior lien debt, preferred equity): this type of loan is not secured by assets in the event of default, and ranks below senior loans for repayment.

Distressed debt: when companies enter financial distress, they work with distressed debt investors to improve their operational turnarounds and restructure their balance sheets. This type of debt is very specialized and along with high risks, it is distinguished by potentially high returns.

Special situations: individuals or companies may need funds for a corporate event, merger and acquisition transactions or other events.

Along with these types, we can also outline the following private lending for real estate types:

Real estate credit (bridging finance): This type is used by those who need bridging finance when changing a house and are in need of a short-term loan to cover their current expenses.

Real assets credit (development finance, land bank finance): This lending type is used to get funds to cover the construction costs of a property development project or buy a large block of undeveloped land.

Finally, there are also private lending platforms that offer personal loans to finance education, travel, and similar.

Benefits of private lending

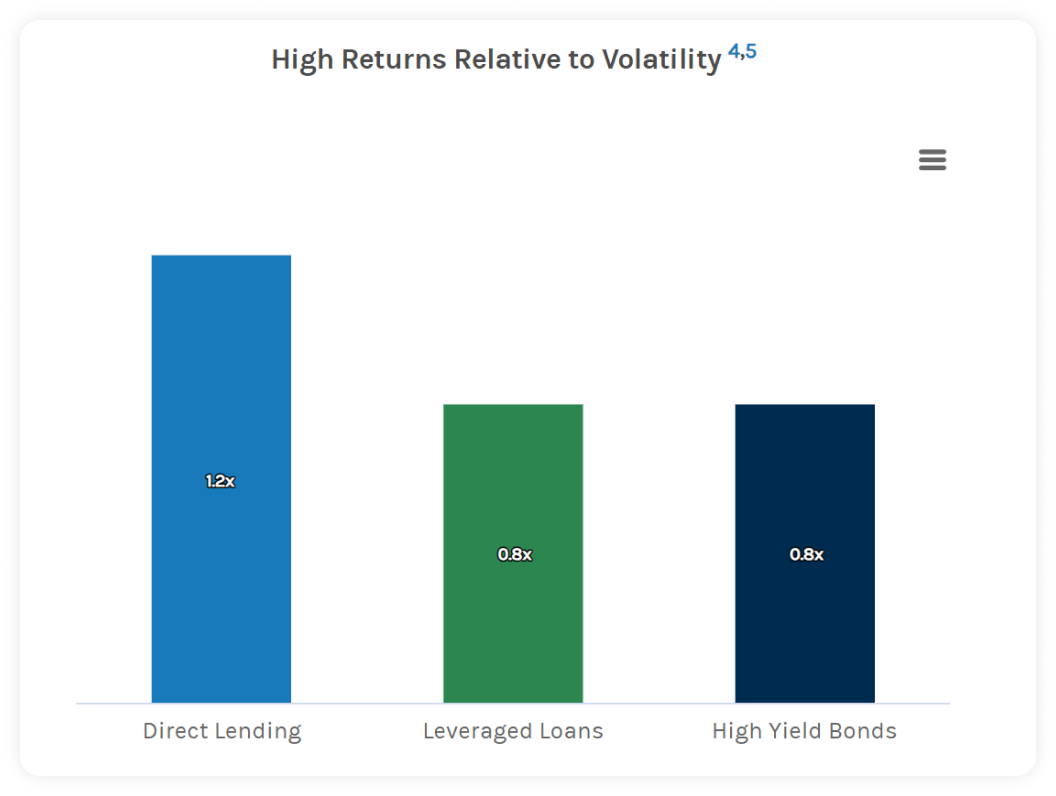

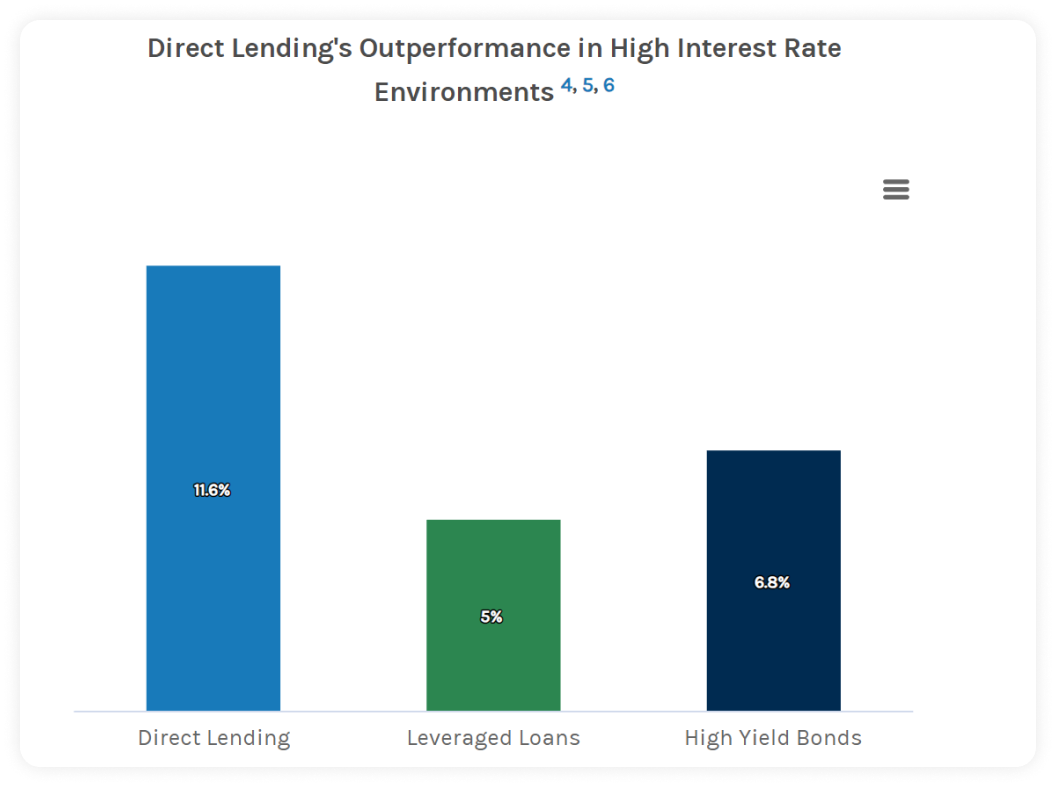

Private lending can deliver potentially high returns compared to other segments of the market. For example, direct lending alone showed a significantly higher performance2 compared to leveraged loans and high-yield bonds.

During 2008-2023, direct lending yielded average returns of 11.6%, compared to 5% of leveraged loans and 6.8 of high-yield bonds.

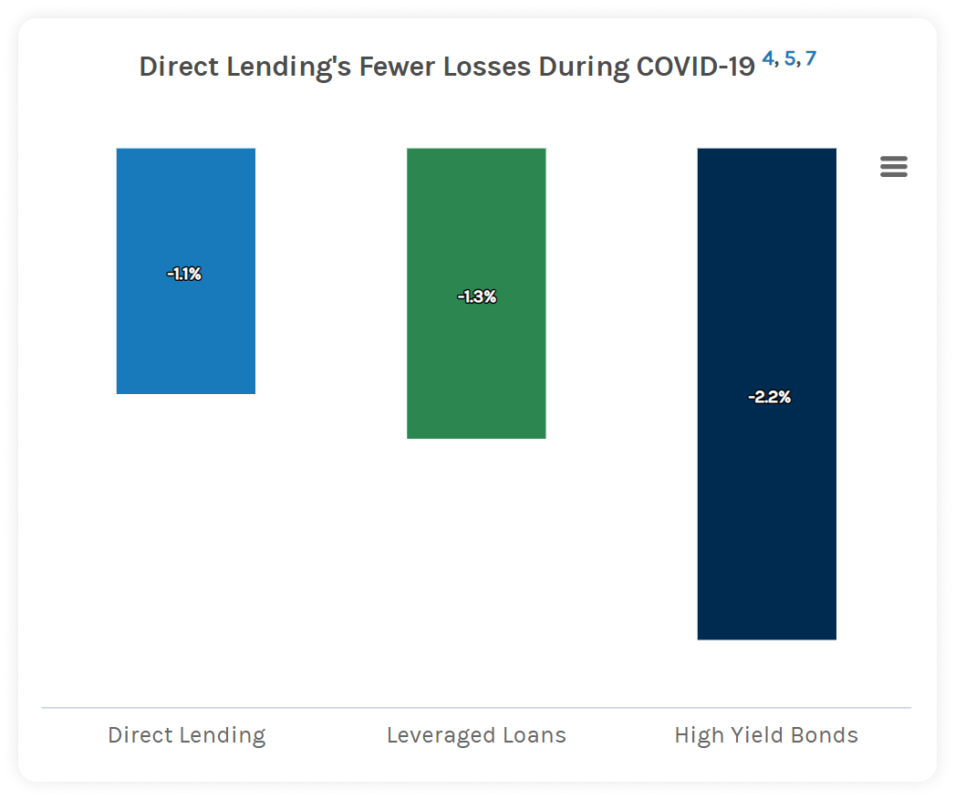

Private lending offers better mitigation against losses, as we can see from the data taken during the COVID-19 pandemic. Between the COVID outbreak and the third quarter of 2023, direct lending sustained losses of only 1.1%, compared to 1.3% for leveraged loans and 2.2% for high-yield bonds.

Additionally, investors have control over their investments because they can set requirements for a borrower such as credit history, income, and similar.

Additionally, investors have control over their investments because they can set requirements for a borrower such as credit history, income, and similar.

Portfolio diversification is another benefit of private lending for investors. They can not only invest in loans, along with other investment activities, but choose the industry focus, loan size, and geography, among other criteria.

Risks of private lending

The main risk for a lender is the borrower’s default. Even though most loans are secured with an asset, the procedure of selling that asset to recover the funds in the case of a borrower default may be lengthy and time-consuming. Moreover, over time, the asset may decrease in value and the lender won’t be able to recover his investment after the asset sale.

Top 5 private lending platforms

When selecting a private lender, have a look not only at reviews, credentials, and performance but also pay attention to the types of loans that they offer. Here are the top private lending platforms.

SoFi

SoFi3 offers all types of private loans from loans for a trip to mortgage funding. The platform can boast over $73 bln in funded loans and $34 in debt paid off.

The rates are fixed and vary from 8.99% to 29.49% with a 0.25% autopay interest rate and 0.25% direct deposit rate already included. Only the most creditworthy borrowers qualify for the lowest rates.

An origination fee varies from 0% to 7% and is deducted from any loan proceeds that a borrower receives.

The repayment period varies from 2 to 7 years.

LightStream

LightStream4 offers loans for practically anything: auto financing (purchase of a new or used car, motorcycle, lease buyout, etc.), home improvement, recreation, family (dental loans, adoption loans, medical financing, etc.), land purchase loans, refinancing loans, and any other loans.

The interest rates are fixed and vary from 6.99% to 25.49% depending on the credit history with a variety of account types (installment loans, car loans, mortgage, etc.), income proof, the availability of assets able to cover the loan obligations and payment history are considered to determine the interest rate.

The loan duration depends on the loan type and the sum to borrow.

Upgrade

Upgrade5 helps to get all types of personal loans up to $50,000. The loans can be paid at any time, without prepayment penalties.

The loan terms vary from 24 to 84 months, and the interest rates depend on many factors, including the loan size, period, income, and many more details.

Also, users can benefit from many other functionalities, including a no-monthly fee checking account that offers a 2% cashback on all purchases.

Upstart

Upstart6 offers personal loans with fixed rates, from $1,000 to $50,000 for the period between 3 and 5 years. The rates vary from 7.8% to 35.99% and depend on the loan size, purpose, income, credit history, and whether the loan is secured or not. Most loans are approved and funded within 24 hours of the application submission.

Discover

Discover7 is a private lending platform that offers all types of loans with interest rates from 7.99% to 24.99%. The loans are issued for a period of 3 to 7 years, and the maximum borrowed is $40,000.

How to launch a private lending platform with LenderKit

The private lending market sector has seen significant growth in recent years, and by 2028, it is forecasted to reach $2.8 bln2. This is why if you have been thinking about launching a private lending platform, it might be the right time to do it now.

With LenderKit’s white-label investment software, you get a market-ready private lending or private equity investing platform. The one-stop-shop investment solution by LenderKit offers you an easy way to enter the market, onboard more clients, streamline daily operations and grow your online investment business.

Whether you are looking for private lending software or private equity investment software, LenderKit has got you covered. If you’d like to learn more about how it works, fill in the contact form on the website and our team will get in touch with you.

Article sources:

- Private Credit: More than Just Direct Lending

- Private Credit Outlook: Estimated $5 Trillion Market by 2029 | Morgan Stanley

- Just a moment...

- LightStream - Access to this page has been blocked

- Upgrade - Personal Loans, Cards and Rewards Checking | Home

- Upstart

- Online Personal Loans from $2,500 to $40,000 | Discover