What Problems Does Crowdfunding Solve?

No time to read? Let AI give you a quick summary of this article.

Crowdfunding as an alternative financing tool and a technology-driven solution solves various problems in different domains. Depending on the investor, fundraiser, or platform manager perspective, crowdfunding opens doors to tax-advantageous investing, company structuring flexibility, marketing and sales.

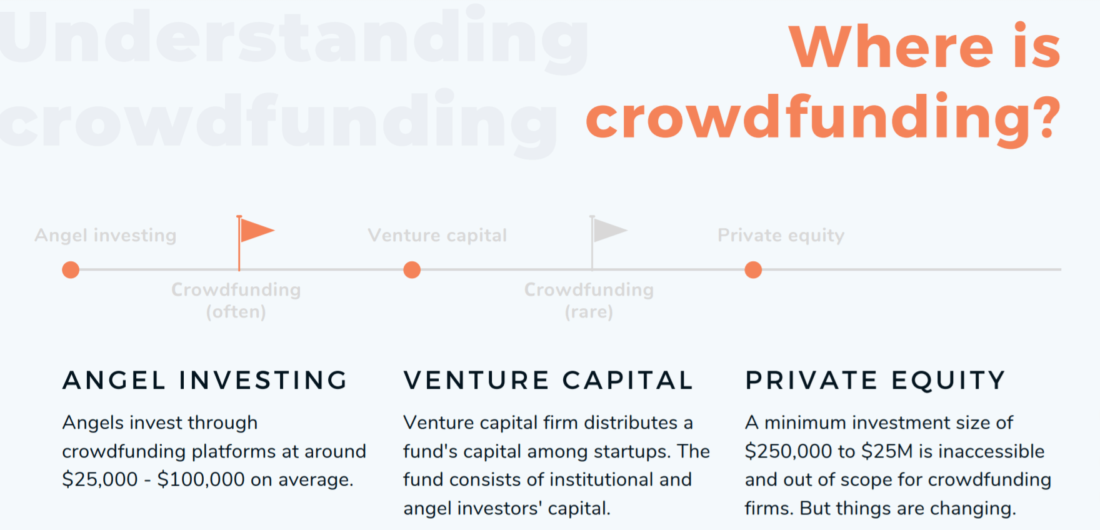

When it comes to understanding what problems crowdfunding solves, it’s important to determine where crowdfunding lies on the angel investing, venture capital and private equity spectrum.

Ultimately, crowdfunding is a tool for raising capital which is used by angel investors and venture capital firms. In some cases, there are also private equity firms with a fund of around an average venture capital firm.

But why crowdfunding? Is it some magical technology? What’s the disruption?

What you will learn in this post:

A blocker entity which saves money

In the provocative article “Don’t Let Venture Capitalists Force You To Convert To A C-Corporation1” at Inc.com, Ryan Feit, the CEO and Co-founder at SeedInvest said that there is a way to set up a “blocker entity.”

The entity allows venture capital firms to invest in the blocker, or a crowdfunding platform, which will capture the UBTI (unrelated business taxable income). This way, the crowdfunding platform will pay corporate taxes and they won’t reach the limited partners, usually, institutional investors who don’t want to pay UBTI.

This structure allows startups to remain an LLC and not convert into a C-corporation. The majority of lawyers will say that keeping your startup an LLC is advantageous2 as you have to pay fewer taxes in some cases. The only reason startups may convert into a C-corporation is because institutional investors will insist on it.

Diversification by asset classes, niches, gender and race

Among other problems crowdfunding solves, particularly in America, is gender and race.

“Women represent half the population of our country, but get less than 10% of venture capital. And people of colour fare even worse – a paltry 1% of venture-backed entrepreneurs are African American, for example.” – writes Revolution3.

The venture capital investing “hub” is mainly located in California, New York and Massachusetts where the 75% of venture capital has been allocated in 2014, while the remaining 25% have been spread among all other states.

Six years have passed since then, so it’d be great to see what’s changed. Nevertheless, one fact is undeniable – there have been more crowdfunding platforms including equity crowdfunding and P2P lending entering the market in different segments.

Being rather mobile, crowdfunding platforms usually target specific market segments like real estate, agriculture, education, green energy, technology, and more. There are marketplaces like Lending Club, CrowdCube, and AngelList as well as niche-focused platforms like HarvestReturns, Fundeen, and others. Not only in America, but all across the globe.

For fundraisers, niche-focused platforms offer expert knowledge and community which is ready to be leveraged in to push only highly-vetted businesses. For investors, there is diversification by asset class, hence, more protection.

Microeconomic development and other problems crowdfunding solves

Crowdfunding is a linking element between small firms that always needed capital to grow and investors that always wanted to find the next disruptive firm to invest in during its infancy.

For the country’s economy, it means that crowdfunding stimulates small business development which improves overall economic stability and creates means for higher life-standards, comfort and overall quality of life for individuals and firms.

While crowdfunding is happening at the micro-level, private equity firms and large venture capital companies are on the lookout for the perfect opportunities to join the game. This means that crowdfunding, as a concept, is tested by quantity until it can be qualitatively upgraded.

Also read: "How to Start a Private Equity Crowdfunding Business"For example, the appearance of the “advisor” role in crowdfunding platforms is not only the response to stricter regulations but also the market demand. A professional advisor has always been needed to regulate the investing activity of retail or “non-sophisticated” investors. The sheer appearance of the advisor role is a more “corporate” approach to crowdfunding which is heating up the interest among private equity and venture capital firms.

Final thoughts

Crowdfunding has passed the hard testing stage which speculatively happened in between 2012-2016. Intuitively, now is the time for the newer crowdfunding boom with more requirements and higher standards among firms and individuals.

If you’re looking to build a crowdfunding platform, reach out to us to discuss your project with our manager.