5 Challenges Private Equity Firms Face

Inflation, rising interest rates, and a slowdown in M&A activity create more pressure and urge private equity firms to adjust and respond to the market needs. To stay competitive and with the market share, private equity firms need to address some challenges they face on their way forward.

What are those private equity challenges and what options do they have to handle them? Let’s dive into the details and find out.

What you will learn in this post:

Increasing competition

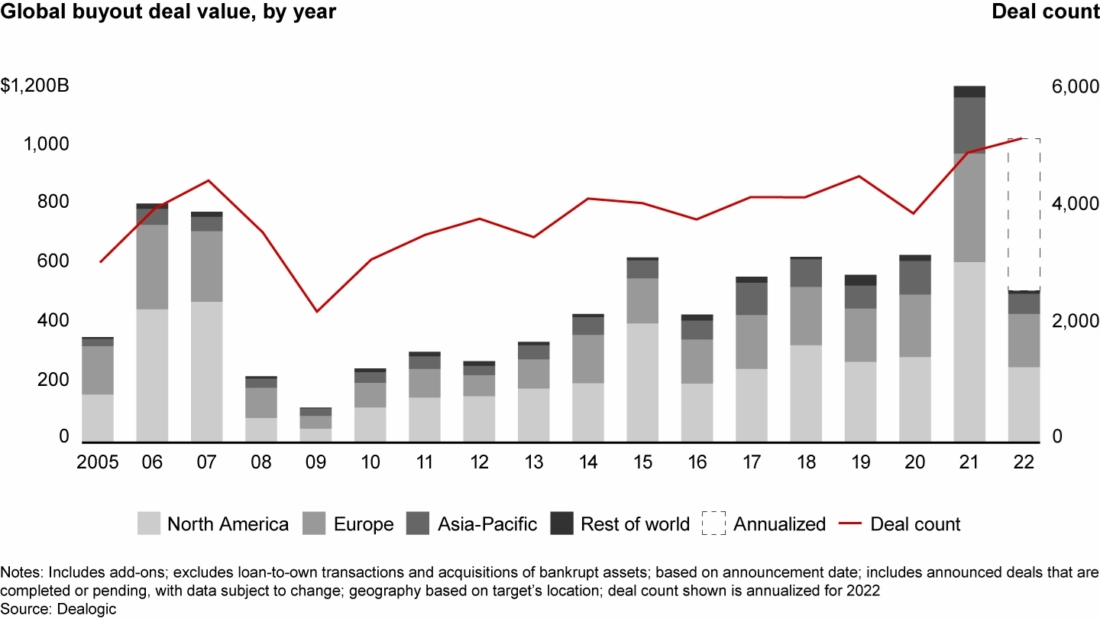

Competition is one of the main challenges private equity firms have to deal with. There are over 13,000 private equity firms in the US with billions of funds available for investing. In 2021, private equity deals surged and surpassed $1 trillion in total buyout deal value.

The problem is that the number of companies willing to raise funds for equity in a business is approximately the same as the number of PE companies. However, according to some statistics, the number of startups in the US is over 72,000, but apparently not all of them are looking for private equity investments.

The small number of startups that do qualify for PE funds have a huge selection of firms to consider. From the large players such as Petershill, Blackstone, and Dyal to many mid-sized firms that enter the market every year.

Even though 2022 isn’t going to be so productive, and private equity firms are more careful with investments, the number of PE firms is growing. To win the best deals, private equity firms follow different ways:

- Switch from being a mono-lined buyout firm to a multiline which enables them to offer the right capital solution to the right client at the right time

- Focus on technology- and software-enabled deals that scale very rapidly and can start generating profits faster

- Diversify in the specific sectors and source for niche-oriented clients

- Take a diligence-lite approach to stay competitive

Large amount of deals to process quickly

Private equity firms can check over 1,000 deals a year, out-of-which, only 100 are considered seriously and around 10 qualify for investments.

The selection process requires a lot of time and manpower. The fastest firms leverage private equity software to automate customer onboarding, screening and qualification before pouring the fund’s money.

There are several ways private equity firms source and attract the best deals:

- Build a strong SEO-presence and optimize for keywords

- Create an outbound marketing team to find deals in a specific niche

- Leverage partnerships and referrals

All of these deals have to be consolidated and processed with an equal level of services. The best way to do that is through dedicated investment software which allows for full-cycle deal management from onboarding to fund disbursement.

You can find firms using eFront, AppFolio, DynamoSoftware, Katipult or LenderKit.

Diversification

Private equity firms aim to produce a recurrent predictable revenue stream. Some funds focus on one sector only, but it may not be as efficient if you have built a multi-sector fund which scales much faster and brings more money.

The majority of private equity firms expand their deals in different asset classes. Now, tech, software, and data-enabled businesses are on the rise, and therefore, they are the center of attention of PE funds willing to diversify their portfolios.

Along with investing in different asset classes, private equity firms also leverage these diversification strategies:

- Long-term investment: investing in a long-term (approx. 15 years) allows a private equity firm to build its investment strategy in the long-term. It also opens access to a larger pool of deals.

- Growth equity: a private equity firm targets minority equity in a promising company that is growing. This field is less crowded and enables buyout-like returns.

- Focusing on a specific sector: a private equity fund focuses on one sector only – the one in which the PE has notable strength. For example, if a PE fund focuses on healthcare, it can invest in a business working on a new device to facilitate the care of disabled patients. This device will improve the entire healthcare chain value and will be beneficial for the PE fund.

Due diligence

When a private entity firm is looking for a deal, conducting due diligence enables it to make the decisions. A bigger quantity of deals cannot replace their quality, so private equity firms focus on investing money in the right companies to create a constant flow of income.

Due diligence is the process of assessing investment opportunities and determining which of them are worth pursuing. There is a lot of information to evaluate and requires an expert approach to every deal by the diligence department.

The private equity team needs to assess the target company’s financial, management, and legal situation to minimize risks and identify opportunities within the big pool of fundraisers. It also helps to uncover red flags and keep the PE firm away from a company that doesn’t seem appropriate for the investment.

Even though due diligence is important to make the right investment decisions, the competition among private equity firms is so high that many of them switch to a diligence-lite approach.

Strategic partnerships and profits

Private equity companies used to buy companies, implement the changes needed for a business to start performing and sell the businesses after yielding profit. It was common to buy businesses to sell them later for a profit. Many PE firms still hold onto that approach. However, it is not as efficient as it was.

Multiple public companies appeared that pursue the buy-to-sell strategy. These companies became effective competitors of private equity funds. Private equity funds are illiquid and not so attractive to investors because once an investor gives their money to manage, the PE firm takes over the control. Public companies that pursue a buy-to-sell strategy are answerable to stakeholders and thus, are more attractive to investors.

That’s why private equity firms are shifting to a new strategy called flexible ownership. By taking such an approach, a PE firm holds onto a business until it can fuel its growth. But even when the business achieved the peak of its performance, the PE fund is free to sell it or to hold it further.

There are not many public companies that pursue the strategy of flexible ownership, that’s why this sweet spot is free for PE funds.

How LenderKit helps to overcome some private equity challenges

Some of the private equity challenges can be easily solved with efficient investment software offered by LenderKit. Using our private equity solution, you can:

- Automate due diligence and investor onboarding

- Reach more clients in different domains

- Attract more high-net-worth investors

- Run an online platform that supports full-cycle deal management

- Access deal analytics and investor insights

- Monitor performance and increase efficiency

- Comply with the regulations

The private equity platform software by LenderKit is fully-customizable because there’s a development team behind the software who can help you create a top-notch solution that fits your particular business model and needs.