AI-Assisted Fraud in Crowdfunding: A Possible Threat?

No time to read? Let AI give you a quick summary of this article.

In the rapidly evolving landscape of digital finance, crowdfunding has emerged as a powerful tool that enables entrepreneurs and creators to secure funding directly from the public.

Crowdfunding is not without its risks, but a new wave of innovation may have also opened new avenues for fraudsters, particularly with the advent of artificial intelligence (AI).

AI-assisted fraud in crowdfunding may theoretically exploit digital identity loopholes and pose significant challenges to both platforms and users.

What you will learn in this post:

AI-assisted fraud in fintech

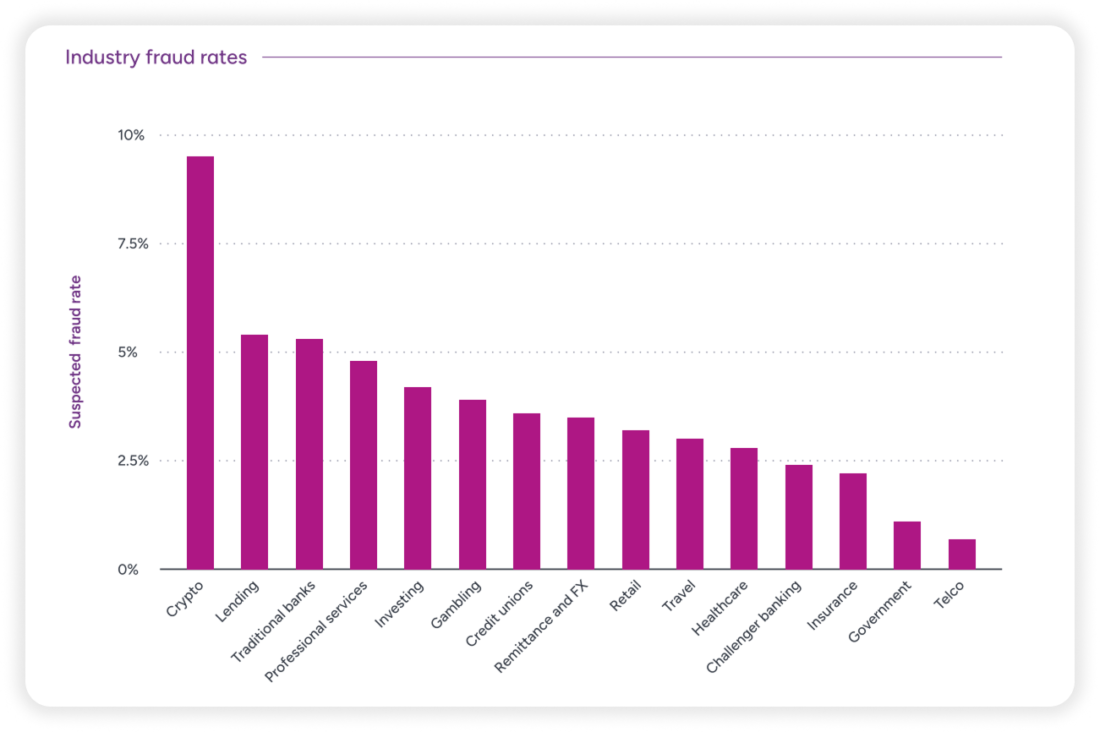

The 2025 Identity Fraud Report by Entrust1 highlights a surge in AI-driven fraudulent activities, including synthetic identity fraud, deepfakes and fraud-as-a-service platforms. The top five most targeted industries are related to financial services, such as:

- Crypto

- Lending

- Traditional banks

- Investing

- Challenger banking

While crowdfunding is not specifically listed, platforms should watch out for potential AI misues.

Many platforms like Kickstater2 and GoFundMe3 have rolled out AI policies or outlined the rules in their terms and conditions which regulate the use of AI in campaigns creation or even raising capital for AI-focused projects.

Crowdfunding platforms seem to be generally secure when it comes to AI fraud cases explored by the Entrust report. At least, there’s no clear or systematic evidence of AI abuse that could be referenced as proper use cases. However, platforms should be mindful of the potential upcoming challenges.

Potential use of AI-based fraud in crowdfunding

Understanding the various forms of fraud is important to develop effective countermeasures. Here are the main fraud types that might be possible in crowdfunding.

1. Synthetic identity fraud

Synthetic identity fraud is one of the fastest-growing frauds out there. The Deloitte Center for Financial Services projects that synthetic identity fraud will lead to at least $23 billion in losses in the United States by 20304.

Fraudsters create fictitious identities by combining real and fake information. They may use these identities to launch crowdfunding campaigns, collect funds, and disappear without delivering promised products or services.

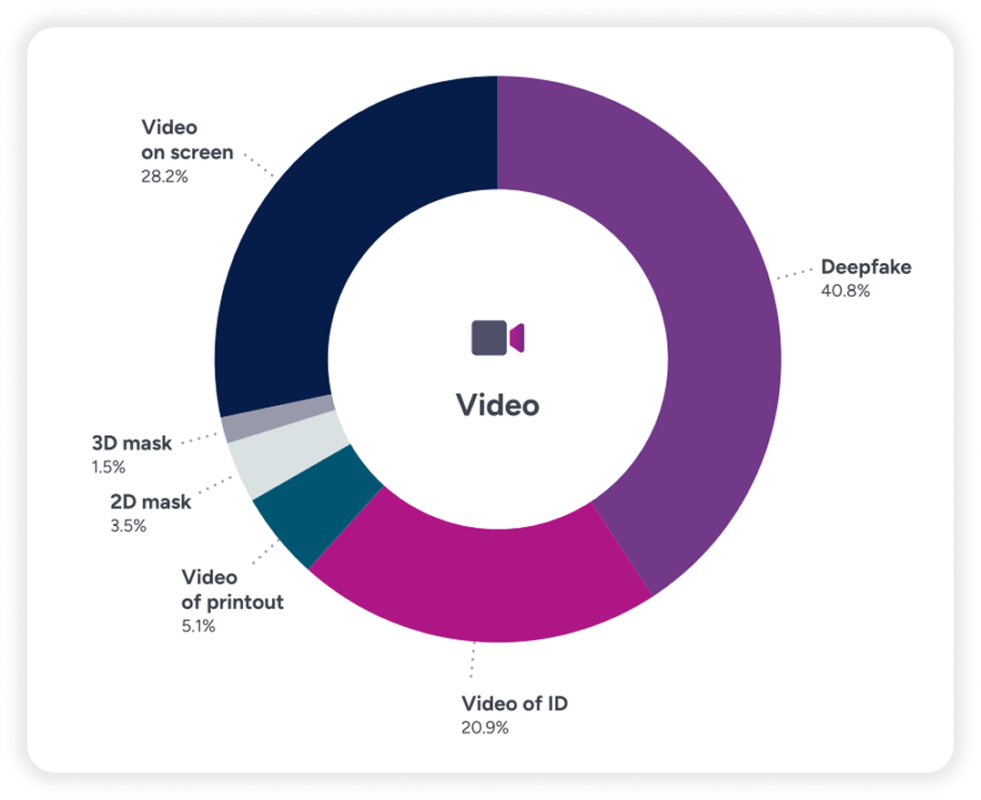

2. Deepfake technology

AI-generated deepfakes can produce realistic images and videos of individuals who endorse or promote campaigns. These fabricated endorsements can mislead backers into supporting fraudulent projects.

For instance, in 2024, scammers used deepfake videos of celebrities like Elon Musk5 to promote fake investment schemes, defrauding victims of millions.

3. Fraud-as-a-Service platforms

Information and services that support fraud are widely available on the dark web. These include hacking tutorials, step-by-step guides, and even full cybercrime courses. Criminals can also buy stolen personal data like login details, Social Security numbers, and credit card information. For example, a 2023 study found that a credit card with a $5,000 balance could be bought for just $1106.

Because most of this activity happens in hidden corners of the internet, it’s difficult to measure how widespread and damaging it truly is.

4. Misappropriation of funds

In some cases, campaign creators misuse the funds raised for personal expenses rather than the stated project goals. This breach of trust undermines the credibility of crowdfunding as a whole.

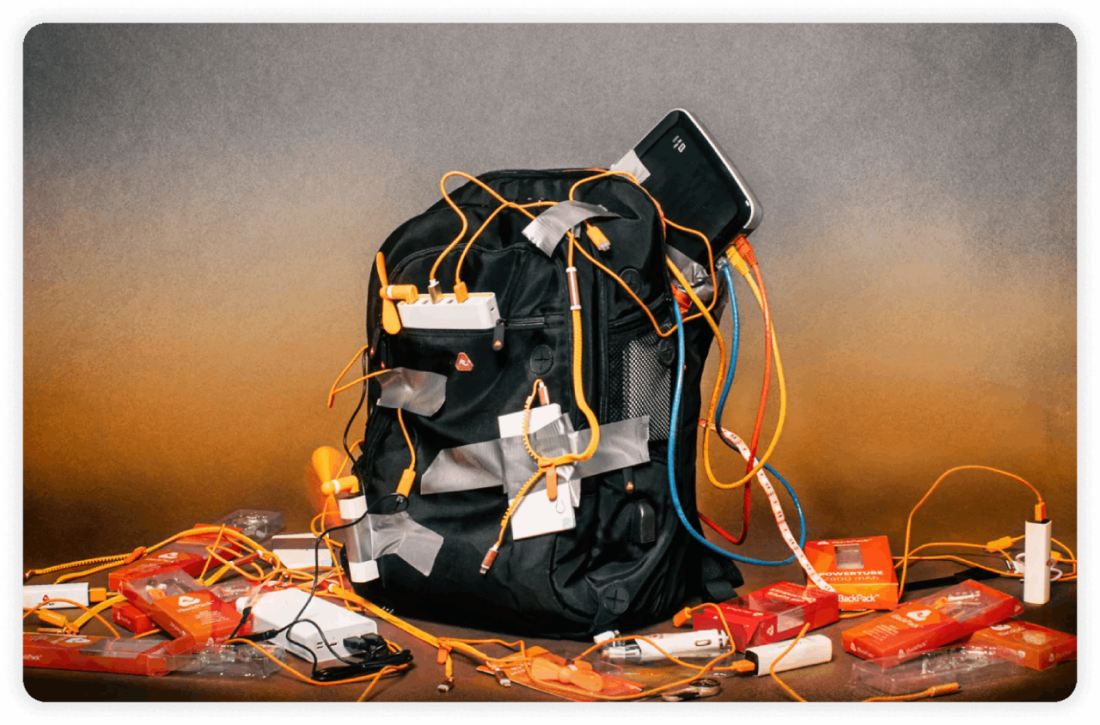

A notable case is the iBackPack scam7, where the creator raised over $800,000 on Kickstarter and Indiegogo, promising a technologically advanced backpack. However, the funds were reportedly used for personal expenses, leading to legal action by the FTC8.

5. Fake crowdfunding platforms (phishing)

A classic form of scam is phishing. In the AI era, it’s possible to create tons of content from scratch or copy the branding based on a legitimate crowdfunding website. While these website are most likely to get banned quickly, users need to watch out for links and visit official platforms only.

Fraudsters may clone entire campaigns from real platforms and present them as active fundraising efforts on their fake sites. The goal is simple: to lure unsuspecting contributors into donating money to what appears to be a credible project.

Mitigation strategies

A multifaceted approach is needed to address AI-assisted fraud. As the tools used by scammers become increasingly sophisticated, so too must the mechanisms for detection and prevention. Here are some mechanisms that will help to protect users from scams.

Multi-factor authentication and biometric verification

To ensure that only legitimate individuals are permitted to launch campaigns, platforms must implement robust identity verification processes. Multi-factor authentication, such as combining something the user knows (like a password), something the user has (like a phone), and something the user is (like a fingerprint or facial recognition), creates a more secure verification mechanism. Biometric verification, in particular, can reduce the risk of synthetic identity fraud by requiring real-time, verifiable physical presence during account creation and campaign approval.

AI-powered fraud detection

Artificial intelligence should not only be viewed as a tool for fraud but also as a way to protect users against it. Advanced machine learning models can analyze behavioral patterns, transaction histories, and metadata to detect anomalies that suggest fraudulent activity. By flagging inconsistencies in real time, such as unusual funding velocity, geographic mismatches, or AI-generated content, platforms can proactively stop scams before they escalate.

User education and due diligence

It is easier to prevent scams if users are informed. Platforms should invest in clear, accessible educational resources that help users identify red flags in crowdfunding campaigns. This includes guidance on how to verify campaign creators, analyze project credibility, and avoid emotionally manipulative content. Encouraging contributors to perform due diligence before making a financial commitment can significantly reduce the success rate of fraudulent campaigns.

Stronger regulatory oversight and platform accountability

Governments and regulatory authorities must establish and enforce guidelines that hold platforms responsible for fraud prevention. This includes mandating transparency in campaign operations, requiring disclosure of identity verification methods, and enabling swift legal action against bad actors. Regulatory bodies should also work in partnership with crowdfunding platforms to create industry standards that ensure consistent, reliable fraud prevention measures across the board.

Wrapping up

While the issue of AI fraud in crowdfunding remains largely theoretical, users need to be aware of the growing challenges in the fintech industry. Most platforms mitigate the risks by parthering with third-party identity verification providers that help to prevent fraud.

At LenderKit, we make sure to integrate KYC/AML tools as well, so if you’re considering launching your own crowdfunding platform, you can be sure that you have all the required safeguards.

If you’re interested to learn more about LenderKit and explore white-label crowdfunding software, don’t hesitate to reach out to us.

Article sources:

- PDF (https://www.entrust.com/sites/default/files/documentation/reports/2025-identi...)

- Introducing Our AI Policy

- GoFundMe Terms of Service

- Biometrics in banking | Deloitte Insights

- - YouTube

- Dark web price of illegal digital products 2023| Statista

- The iBackpack has it all: Kevlar, batteries, and a federal investigation | The Verge

- Federal Trade Commission | Protecting America's Consumers