Becoming an Appointed Representative for Crowdfunding Platforms – FCA Rules

No time to read? Let AI give you a quick summary of this article.

If you are a CEO, marketing manager, or business analyst checking on regulatory compliance, you might want to register a newly-built crowdfunding platform or create one first. One of the options to license a platform in the UK is to become an appointed representative.

Today we will focus on the UK’s appointed representative regulations for crowdfunding platforms. Beyond that, we will guide you through the risks of using an umbrella compliance provider.

Before we go any further discussing FCA approved umbrella companies and tell you what they can do for you, let us first mention all the options you have to license a crowdfunding website:

- Buy a white-label crowdfunding software that is already licensed

- Partner with one of umbrella compliance service providers

- Apply for the license on your own

The latter is quite a tedious, labour-intensive, and stressful task. If you have plenty of time on your hands and are not in a rush, you can go for it. But you can always take an easier, less time-consuming route and consider the other two scenarios.

We take a close-up look at the option #2 further. What does it take to be a crowdfunding appointed representative and how to partner with an crowdfunding umbrella compliance service provider?

What you will learn in this post:

The FCA, Appointed Representatives & Principals

The FCA defines an appointed representative 1(AR) as a company or an individual who conducts regulated operations and acts as an agent for a company that is directly licensed by the authority (a.k.a. ‘principal’).

Further, the UK’s financial markets authority stipulates that an AR and a principal need to sign an agreement after which a principal becomes fully in charge of AR’s compliance with the rules and regulations defined by FCA.

On the one hand, an AR has to give its principal full access to its associates, office premises as well as internal data so that the former can perform all the checks required.

On the other hand, a principal must check that its appointed representatives are financially literate and stable.

What else falls within a principal’s direct responsibility? The FCA adds that when a principal appoints ARs, it has to take responsibility for any advice ARs offer to clients and the products ARs sell or arrange.

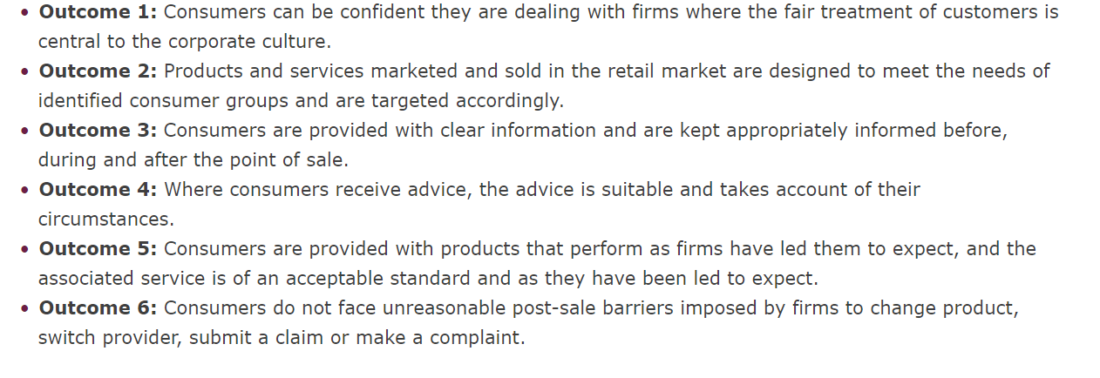

Beyond that, FCA approved umbrella companies have to ensure that the appointed representatives they work with deliver the ‘treating customers fairly’ outcomes that apply to a directly authorised firm. There 6 of the outcomes and they are:

Becoming an Appointed Representative Crowdfunding Platform

The regulator has a 5-step process 3an applicant must follow to become an appointed representative:

- decide which regulated operations a company wants to conduct; choose a principal who is in that kind of business

- decide whether you want to be an AR or an introdu4c4er appointed representative (IAR)4

- based on the kind of business and types of clients, choose how many principals a company wants

- research what agreements you need to have taken care of

- ask the chosen principal(s) inform the FCA of the appointment to appear on the official register

Partnership with an Umbrella Compliance Firm: Pros and Cons

A crowdfunding umbrella license firm can either concentrate on the licensing process only or offer crowdfunding software, too. You can start your crowdfunding business under the license of such a compliance provider.

Generally, an umbrella compliance company can create and launch crowdfunding platforms, explain you ins and outs of the regulatory matters, and guide you through complex process webs.

As an appointed representative FCA (AR) you get pre-launch support and post-launch consultancy, learn how to set up and operate a licensed crowdfunding platform hassle-free with the help of a ‘principal firm’.

According to FCA5, such companies are in charge of their ARs and regulatory responsible for their operations. Between the two parties, the ARs in the niche offer different types of services to all kinds of types, retail ones including.

What are other perks of such an arrangement? When you sign a deal with a principal, you can expect to:

- Start quickly with a pre-built SaaS platform usually with minor design customisations

- Partner with an expert compliance team

- Ease up paper work and reporting (the compliance partner will do it on your behalf)

Sounds smooth? Well, it does. But remember: when you hand over the entire compliance part to an intermediary, you should keep an eye on any legal changes and not just blindly trust your partner.

At the same time, you need to consider the downsides of such an arrangement, too. They are the following:

- High service costs

- Limited software flexibility as well as range of services you can provide to your investors and fundraisers

- Not many opportunities to scale

But that’s not all. Why are we saying this? For example, the FCA decided to solidify the ban of the mass-marketing of speculative illiquid securities6 (speculative mini-bonds including) to non-accredited investors.

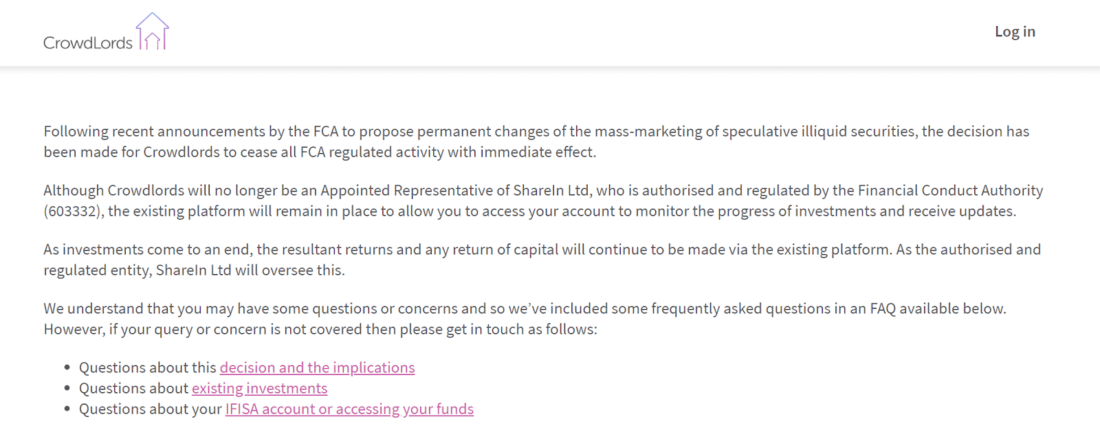

This step was an attempt to limit the access of retail investors to high-risk deals and “to prevent harm to consumers7”. The result? This led CrowdLords8, a local real estate crowdfunding platform, going out of business for some period of time.

CrowdLords, that is luckily taking steps to recover10, was not the only company affected by the FCA regulatory updates. This list also joined DP Crowd and other firms.

CrowdLords used to be an appointed representative of Sharein, a crowdfunding platform provider in the UK that offers regulatory compliance and ISA management. With the new rules by FCA, Sharein had to take a different course of action and change its business model to direct investing. This has led to 15 companies cutting ties with Sharein, as an FCA umbrella compliance provider between Jul 13 – Jul 20, according to the FCA register11.

This means most of the crowdfunding firms partnering with FCA umbrella service providers solely rely on the intermediary’s legal compliance expertise. The only problem?

Appointed representative licensing carries risk. While registering a crowdfunding platform by becoming an appointed representative might seem a good way to get started, it might have potential roadblocks that can harm your business growth or early launch.

Final Thoughts

Taking into account the recent story, crowdfunding businesses working hand-in-hand with compliance providers have to keep their eyes peeled. If you have a platform or willing to launch one, you still need to be up-to-date with the changes regulators introduce.

Otherwise, all your efforts might go down the drain and you will have to take a U-turn quickly rearranging your initial strategy and adjusting to the new reality. On top of that, you will have to look for another umbrella compliance partner in a hurry or apply for the license directly.

Article sources:

- Responsibilities and how to oversee your appointed representatives | FCA

- Fair treatment of customers

- Become an appointed representative | FCA

- FCA Handbook

- Review of principal firms in the investment management sector | FCA

- FCA to make mini-bond marketing ban permanent | FCA

- PS20/15: High-risk investments: Marketing speculative illiquid securities (including speculative mini-bonds) to retail investors | FCA

- CrowdLords ceases regulated activity following mini-bond clampdown - Alternative Credit Investor

- Crowdfunding UK, Property Investment London, Crowdfunding Property | CrowdLords

- CrowdLords working on way to reopen for sophisticated investors - Alternative Credit Investor

- NewRegister