Crowdfunding in Ireland: A Pro-Business Environment?

No time to read? Let AI give you a quick summary of this article.

The European Crowdfunding Service Providers Regulation requires all platforms to get authorization to access markets in all the EU countries seamlessly. According to different sources, over 60 – 90+ crowdfunding platforms have already received an ECSP license and are benefitting from the new European crowdfunding opportunities.

The country of registration varies because platforms have set up businesses in Spain, the Netherlands, the Baltic states, and other countries of the European Union.

But where should you register your crowdfunding platform to enter and service the European market? Crowdfunding in Ireland appears to be one of the possible locations for the big brands like Seedrs1 that have already received an ECSP license there, so maybe it’s worth taking a closer look at this market.

What you will learn in this post:

Overview of the Ireland crowdfunding market

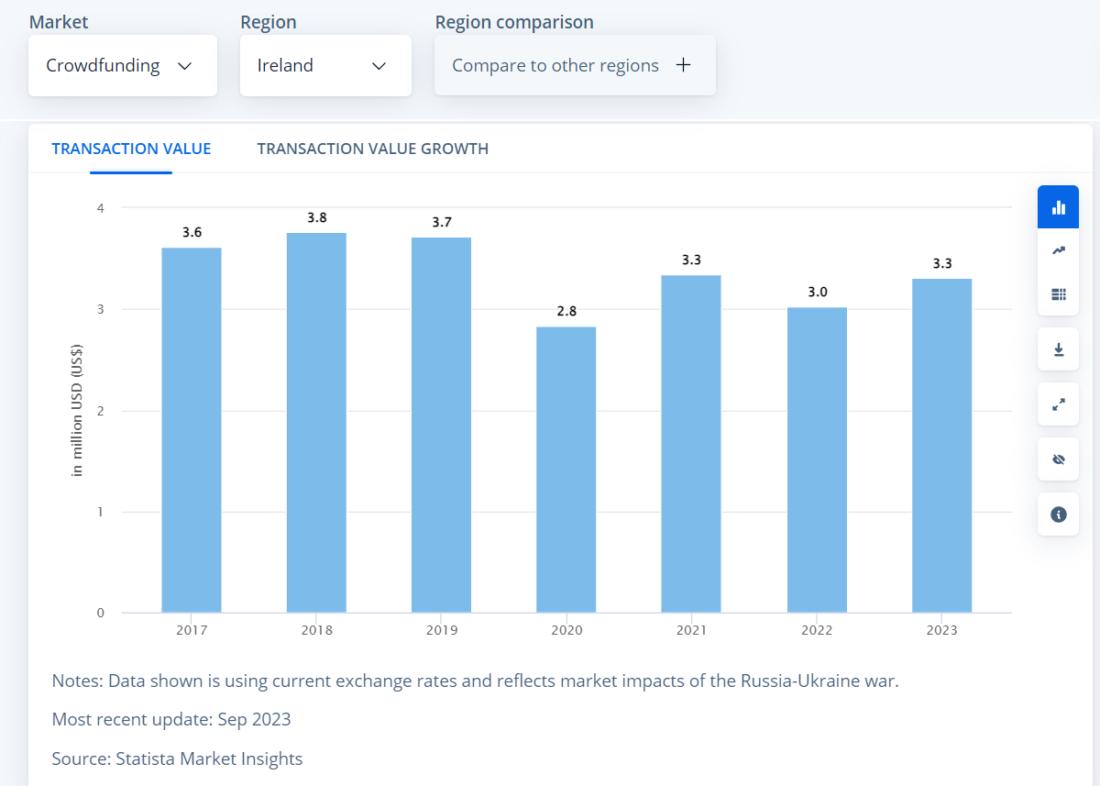

In recent years, the crowdinvesting market in Ireland has been relatively stable and even experienced some growth despite the unfavorable economic situation in the world and the impact of the Russian-Ukrainian war — one of the biggest conflicts in the heart of Europe.

The main reason for the growth of crowdfunding in Ireland is the country’s vibrant start-up ecosystem with a significant number of ambitious entrepreneurs and new ideas.

The crowdfunding demand in Ireland is driven by a number of financial factors:

- Getting a loan from a bank not only comes with heavy interests, but is a challenging task on its own, especially for early-stage businesses.

- Financing through other sources such as lending is limited and in most cases, doesn’t cover the needs of a startup, making crowdfunding one of the most viable alternatives to get the necessary funding.

Underlying macroeconomic factors also contributed to the development and growth of this sector. Ireland has experienced steady economic growth3 recently. Inflation is going to ease, and the employment rate is at a record high3. Even though further employment growth is anticipated to slow down, it won’t stop. This, in turn, contributes to the financial well-being of the public and the willingness of people to invest in promising startups.

Another factor that led to the growth of the crowdfunding sector in Ireland is the strong sense of community4 and support for local initiatives. These factors also fuel the growth of crowdfunding platforms and make Ireland attractive to the major players in the crowdinvesting sector.

Additionally, some crowdfunding platforms offer EIIS (Employment Investment Incentive Scheme) investment opportunities. EIIS is a scheme for start-ups in Ireland to receive investment that is tax-efficient for the investor. A tax relief on such investments is 40% which makes this scheme very attractive for investors. Spark Crowdfunding, Seedrs5, Crowdcube6, and Green Crowd7 are the platforms that allow investors to benefit from EIIS investment opportunities.

Crowdfunding regulation in Ireland

On 10 November 2021, the EU regulation 2020/15083 came into force, and on 13 December 20219, it was transported to the Irish legislation. With it, a new regulatory regime was introduced for entities that provide crowdfunding services, making crowdfunding recognized as an important type of financing for businesses that rely on smaller investments.

Now, the Central Bank of Ireland10 is designated as a competent authority in Ireland that will authorize the operation of peer-to-peer lending and investment-based crowdfunding platforms in the country. The authorization process by the Central Bank consists of the following stages:

- A preliminary meeting with the Central Bank representatives to discuss the application details.

- Submission of the application form and individual questionnaires.

- The Central Bank acknowledges the receipt of the application form within 10 working days.

- The Central Bank assesses the application for completeness within 25 working days.

- If the Central Bank decides that the application is complete, it assesses it and gives its decision within three months.

- The Central Bank issues an authorization letter where the authorization requirements are outlined and any applicable conditions are indicated.

Best crowdfunding platforms in Ireland

Crowdfunding campaigns have been very successful for several years in Ireland, with not so many platforms operating there. Here are just some examples of crowdfunding campaigns that managed to raise millions in crowdfunding.

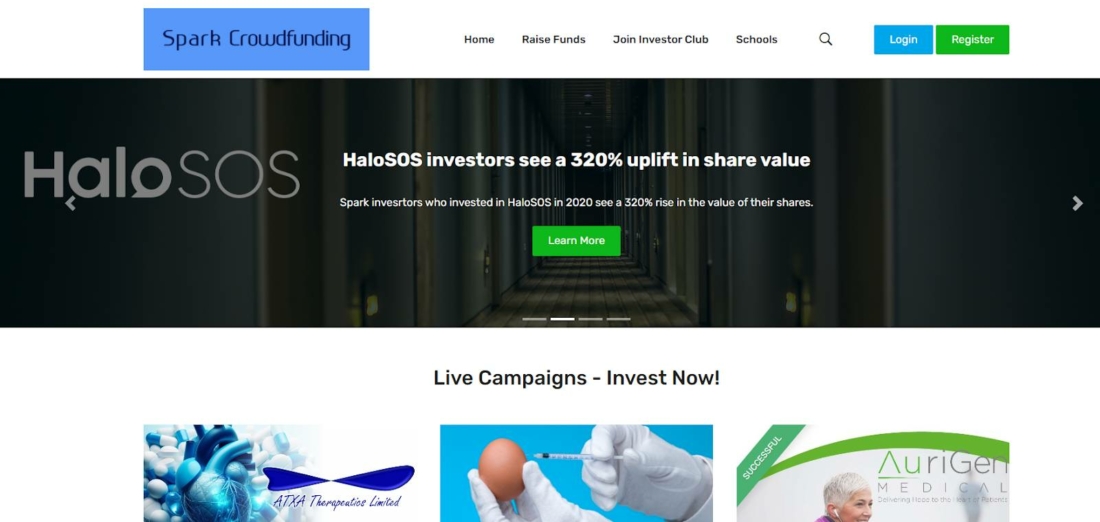

Spark Crowdfunding

Spark Crowdfunding11, the platform that hosted all the mentioned campaigns, is one of the most successful Irish platforms. It is a Dublin-based equity crowdfunding platform that allows Irish-based companies to raise funds from all types of investors.

Everybody can invest with Spark Crowdfunding. One just has to register as an investor, fill in the eligibility questionnaire, and once approved, one can browse available projects and invest in them. The minimum investment is 100 Euros, the maximum is 1 mln Euros.

Spark Crowdfunding has already helped a number of promising startups raise funds, with some of these businesses delivering their investors over 600% ROI12.

The platform charges a payment processing fee which can vary from 0.5% to 2.8% of the investment sum.

The most successful campaigns hosted by Spark Crowdfunding are the following:

- ASX sports trading exchange raised over $500,000 during the first few hours in an equity crowdfunding campaign on Spark Crowdfunding, a local crowdinvesting platform. The total sum raised exceeded $2 mln.

- Akkure Genomics, a company that builds software for clinical trials, raised $1.2 mln from 271 investors on Spark in 2021.

- AuriGen Medical, a company working on developing an innovative minimally-invasive implant raised over 3 mln Euros from 275 investors in 2022.

- Binarii Labs, patented software that allows businesses and individuals to access valuable data and information even if their cloud storage is breached, managed to raise 1,850,000 Euros from 213 investors in 2023.

Lendermarket

Lendermarket13 is another crowdinvesting platform that has been operating in the Irish market for years. It is a P2P lending platform that allows investing in buyback-guaranteed consumer and real estate-backed loans with as little as 10 Euros.

The platform works with individual investors and companies. There are no fees for registering an account on the platform, as well as for depositing and withdrawing funds.

Investors can expect to earn 15% or more from their investment yearly. All loans come with a buyback guarantee. If the loan is more than 60 days overdue, the loan originator buys it back.

The platform is transparent, and the audit reports are available for the public on the Lendermarket website.

Seedrs

Seedrs5 is one of the biggest equity crowdfunding platforms. The platform was launched in 2009 in the UK, and since then, it has helped over 1,300 businesses to raise over 1,2 bln pounds.

The platform allows investors to start with as little as 10 Euros, even though projects posted on the platform may impose their own limitations. Investors who invest with Seedrs can benefit from tax relief.

Crowdfunding software for Irish businesses

The Irish market is very promising for launching a crowdfunding business – all you need is a crowdfunding platform software like LenderKit.

With LenderKit white-label crowdfunding software, you can launch a crowdinvesting platform rapidly, and without excessive expenses compared to custom development. All solutions come with a set of readily available features and are highly customizable to meet your business needs.

You can choose any investment flow like equity or debt, introduce donations or rewards to embrace a wider audience, and you can be confident that your platform will fit the needs of the local market.

To discuss the details, you are welcome to contact our sales team, and if you want to see how the product works, please schedule a demo session.

Article sources:

- Seedrs Shares Insight Into Decision To Base EU Operations In Ireland, Discusses Focus On Nordic Region | Crowdfund Insider

- Statista

- Economic forecast for Ireland - Economy and Finance - European Commission

- Reward-Based Crowdfunding - Worldwide | Market Forecast

- Invest online in startups via equity crowdfunding | Republic Europe

- Just a moment...

- 2023 EIIS Investment Opportunities Opening Soon - Green Crowd Limited

- The EU regulation 2020/150

- Page not found - Maples Group

- Central Bank announces new crowdfunding regulatory regime

- Redirecting...

- Spark Crowdfunding – Equity Crowdfunding Platform in Ireland

- Earn passive income | Lendermarket P2P platform