Top 10 Fractional Ownership Platforms

Fractional ownership is becoming a popular investment option because it allows smaller investors to tap into high-value assets that are usually accessible only to a few high-net-worth investors.

Investment type and conditions depend on the fractional ownership investment platform but the idea is the same. An expensive asset is divided into parts (fractions), and these fractions are offered to investors. Further, investors can benefit from owning and using their share of property, getting a share of rental income, or receiving other benefits depending on the platform and the investment conditions.

Here, we will explore the top 10 fractional ownership platforms and the opportunities they offer to investors.

What you will learn in this post:

Luxury Shares

Luxury Shares was launched in 2018 in the USA as the first-of-its-kind platform that allowed investing in fractions of luxury real estate.

Luxury Shares is the first platform that transformed the market of private vacation homes into a liquid and accessible marketplace by allowing individuals to co-own vacation homes all around the world via tokenization.

Here is how it works.

- Luxury Shares select top-tier vacation property

- The property is contracted under the proprietary agreement by Luxury Shares

- The property is tokenized as security tokens

- The property is upgraded by the Luxury Shares specialists

- The property is listed on the Luxury Shares marketplace, investors can buy their fractions.

RealT

RealT is a real estate fractional investment platform launched in 2019 that allows clients to invest in US property. This blockchain-powered real estate investment platform is available for investors all around the globe.

Based on the share of tokens owned, owners can get a share of revenues from the property rent and make property-related decisions.

Each property is handled by a property management company that collects rent, looks for tenants, manages repairs, and distributes profits thus liberating owners from all management hassle.

Ember

Ember is another US-based fractional investment platform that offers fractional ownership of vocational real estate.

The company was launched in 2021 and since then, it has been offering affordable and safe fractional deals to investors all around the world.

Ember takes care of the entire purchasing process: picking second-home property, legal entity formation, bringing co-owners together, and handling escrow and closing procedures. After the purchase is finalized, Ember also takes care of the property management including maintenance and repairs. The expenses are shared by the property owners based on the share of their own.

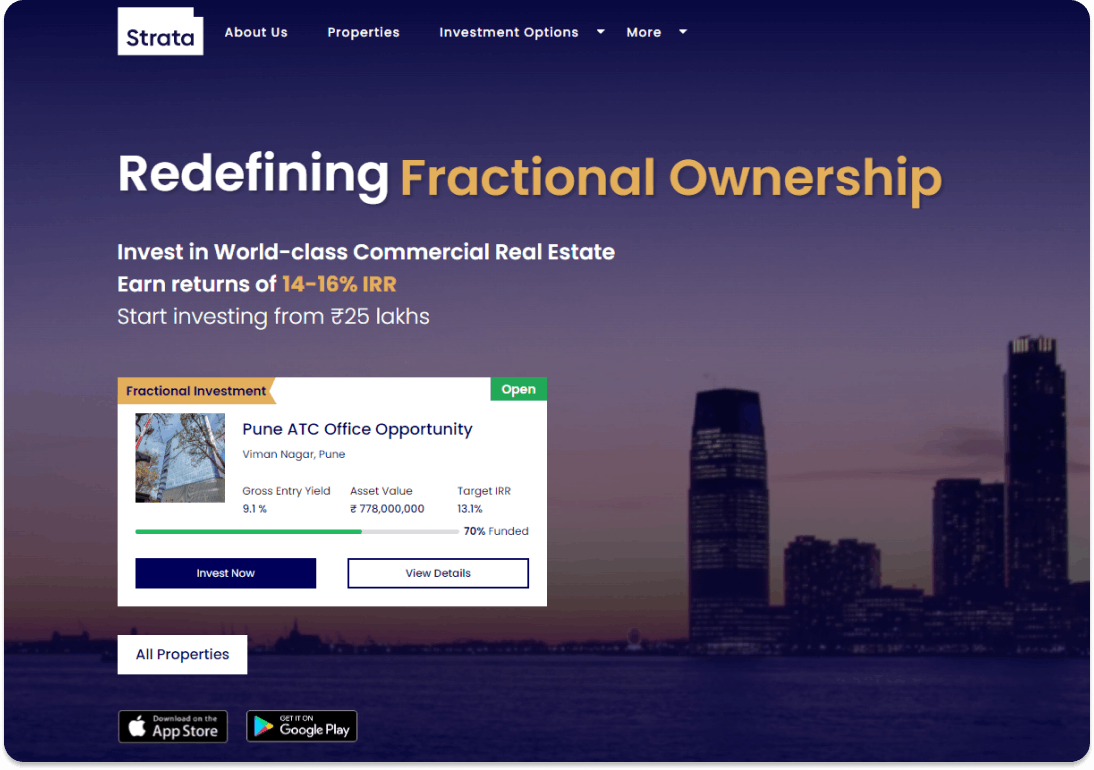

Strata

Strata is an Indian-based fractional ownership platform that allows clients to invest in world-class commercial real estate with only around $30,000 making high-grade commercial real estate accessible to more investors.

The platform identifies the best real estate and creates a Special Purpose Vehicle where funds to buy the property will be purchased, and which later will be managing the property. Investors buy shares and convertible debentures of the SPV.

Returns are distributed monthly. As soon as Strata sees a profitable option to sell the property, voting among investors is conducted, and if 75% of investors vote for selling the property, it will be sold, and the returns distributed among investors based on their fraction.

Strata charges 3% of management fees and 20% on return when the property is sold.

Fraction

Fraction is a fractional investment platform launched in 2018 that enables investing in fractions of anything: art pieces, real estate, or even platforms. Fraction manages all the processes starting from the asset’s initial digitalization and fractionalization, offering the fractions to investors, trading of fractions among investors, and whatever else is needed.

Fraction manages not only fractional investments but also assists companies, administrators, and promoters in managing ownership of co-investment, pooled capital, and similar.

Fractional

Fractional is an investment platform that brings people to co-own property together. Here is how it works:

- You search for property that you want to co-own

- Submit your initial deposit and complete due diligence together with other co-owners

- Sign the agreement designed specifically for the property you are purchasing, pay the remaining balance, and become a co-owner.

All the financial and legal processes are handled by Fractional. The platform also handles a secondary marketplace where co-owners can interact with other investors and buy & sell their shares.

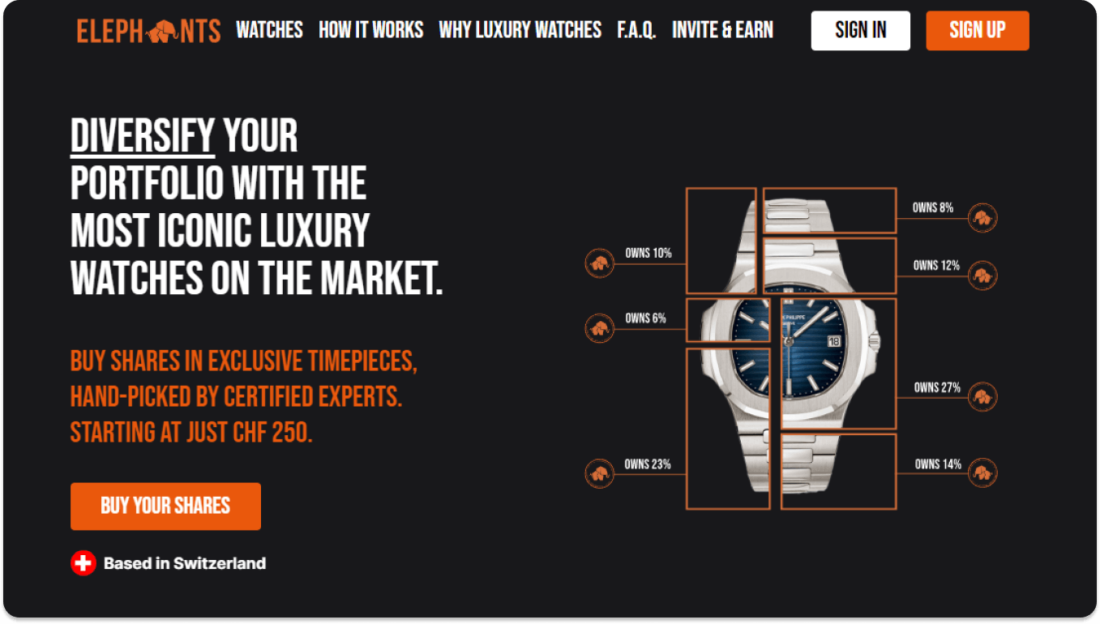

Elephants

Elephants is a unique platform because it fractionalizes real-world highly collectible luxury watches thus enabling retail investors to diversify their portfolios and take part in the market that was earlier accessible only to very few people.

The platform picks only discontinued and unique watches with the highest potential for value growth and further fractionalizes the ownership of the pieces on a blockchain. After that, investors can buy as many fractions as they want in as many items as they want.

The asset is held for 3-7 years, and the company monitors any interesting offers that can bring a profit. Once the watch is sold, the profit is distributed among the investors proportionally to their fraction.

BRXS

BRXS is a fractional ownership platform launched in the Netherlands in 2021. It allows investing in real estate notes with just €100. These notes give the investors the right to receive quarterly interest and repayment along with a profit made when the property is sold.

The rental properties are carefully selected, rented, and managed by the platform.

The platform charges transaction fees when the notes or property are sold, a management fee, and an offering fee. All the fees can vary depending on the property value and the deal but they are all calculated in the returns.

RealX

RealX is an Indian-based real estate fractional investment platform launched in 2017. Its goal is to make investment in property possible irrespective of the wealth of an individual. The platform uses a proprietary blockchain PropChain to digitize and fractionalize real estate to further make investing in it possible with as little as $60.

The day-to-day property management operations are performed by Property Managers, all rents are collected and distributed by RealX. Co-owners only enjoy a proportional share of income from renting the property.

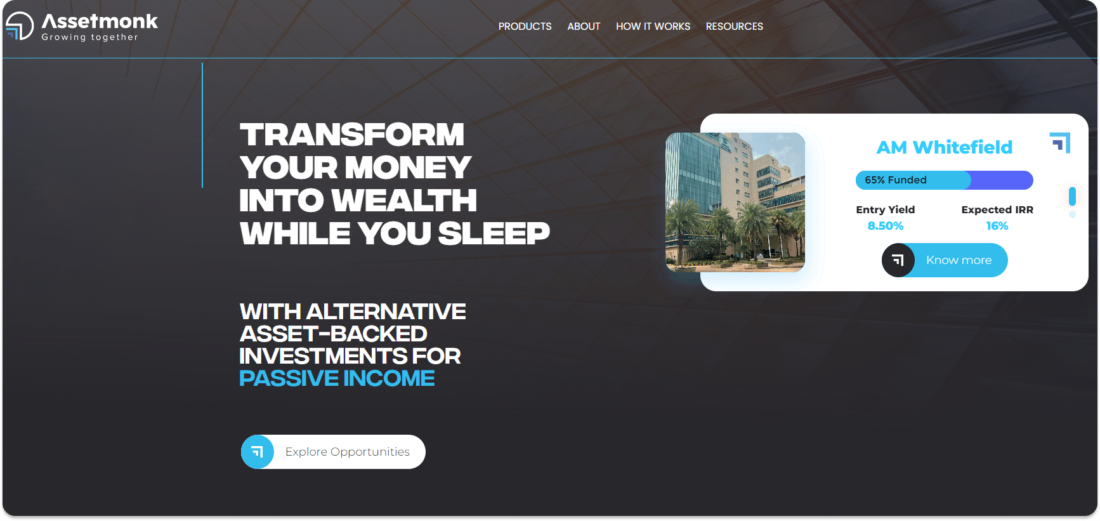

Assetmonk

Assetmonk is an Indian-based fractional investment platform founded in 2019. It allows investing in top-tier commercial real estate such as office spaces for institutional-grade deals, co-living and senior living spaces, and custom solutions.

All investment opportunities are asset-backed and 100% transparent. Through their dashboards, investors can review property documentation, investment performance, and cash flow statements. All the returns are distributed directly to the investor’s bank account.

How to Create a Fractional Ownership Platform with LenderKit

Fractional ownership is growing in popularity and thus, it may be time to think about launching your own fractional investment platform. With LenderKit white label investment software, you can do it faster and more cost-efficiently than if you were developing it from scratch.

LenderKit has several packages that fit early stage startups and established investment companies. The packages come with a rich set of features that support full-cycle investing and campaign management allowing you to manage deals, offerings, and investors, working alone or collaborating with your team.

If you would like to see how it works, please schedule a free demo session with us.