Crowdfunding in Lithuania: Market Overview

No time to read? Let AI give you a quick summary of this article.

The Regulation on crowdfunding service providers1 (ECSP) that was adopted in November 2020 established a common legal framework for crowdfunding across the EU and impacted the crowdfunding market in Lithuania positively. Under the regulation, all crowdfunding service providers shall be licensed and serve as intermediaries between project owners and investors.

What you will learn in this post:

Crowdfunding volumes in Lithuania

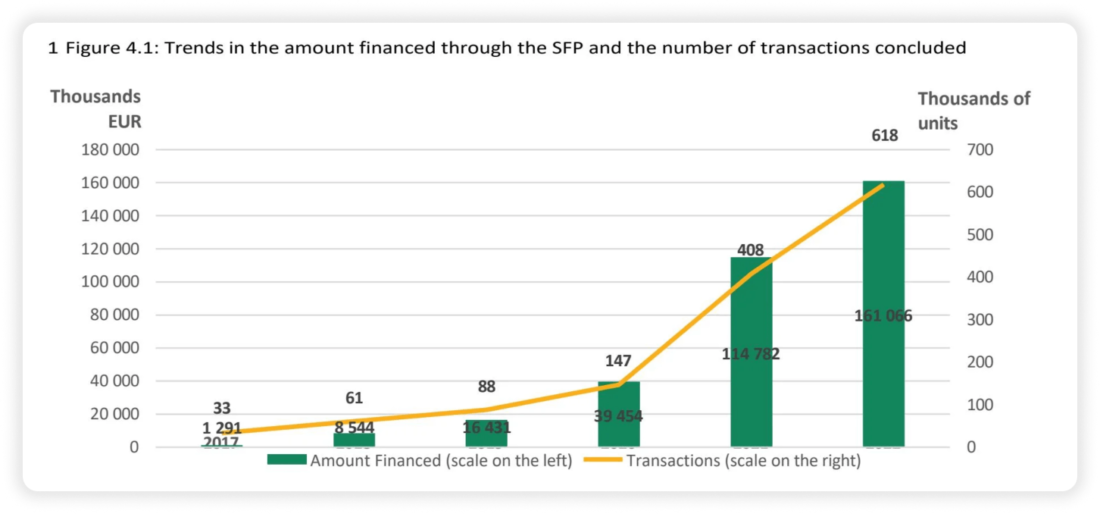

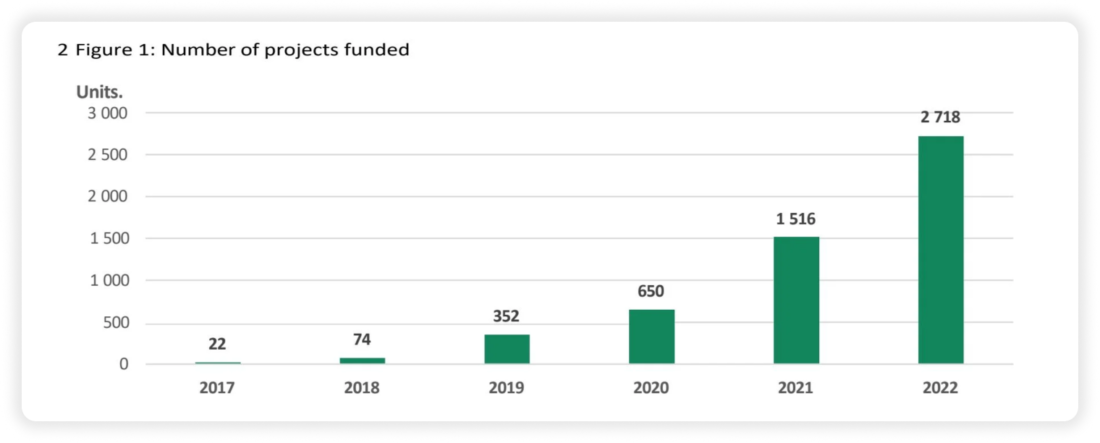

From 2020 to 2022, the amounts financed through crowdfunding platforms grew from around EUR 39M – 161M2, and the number of transactions for the same period increased from around 150,000 to over 600,000.

The growing volume of transactions and the number of projects financed during this period shows that the crowdfunding in Lithuania reacted positively to the establishment of new regulatory norms and became a significant part of the country’s financial landscape.

Thanks to the supportive regulatory environment and a thriving entrepreneurial culture, Lithuania offers all types of crowdfunding models such as:

- Donation-based

- Reward-based

- Equity-based

- Lending-based

Crowdfunding regulations in Lithuania

To obtain a license, investment-based crowdfunding platforms must apply to the Bank of Lithuania, but before submitting an application, the applicant shall pay a fee of EUR 710.

The documents that a platform submits to the Bank of Lithuania need to substantiate that the applicant is compliant with the requirements set out in the Crowdfunding Regulation3 and that the platform is ready to provide crowdfunding services.

After all documents are submitted, the Bank of Lithuania assesses the application for a crowdfunding platform, requests missing documentation if needed, and within three months, gives its decision on whether to issue a license or not. After receiving the license, the crowdfunding platform may start operations.

Best crowdfunding platforms in Lithuania

As of 31 December 2022, 23 platforms2 were registered as crowdfunding service providers in Lithuania. Some of the best are listed below.

InRento

InRento4 is the first licensed buy-to-let investment platform in Europe. It allows users to invest in rental properties with as little as EUR 500.

The platform was launched in 2020, and since then, it has created a pool of almost 4,000 investors who have trusted InRento with over EUR 2.5 mln in combined money deposits.

InRento is regulated by the Bank of Lithuania and allows people from all over the world except the USA and some countries such as North Korea to invest in the offerings. The platform offers an attractive average annual return of over 13%.

InRento offers a secondary market where users can choose whether they want to sell investments with a discount or premium. The fee for selling an investment is 2% of the principal value, and there is no fee for those buying an investment.

FinoMark

FinoMark5 is a peer-to-peer lending platform that allows users to invest in small business debt starting with EUR 25. For now, the platform has helped to finance loans with more than EUR 8,900,000 for over 337 loans issued.

The average loan term is 28 months, and the average loan amount is EUR 26,550. Only 5.35% of loans were terminated, and the average annual return is slightly above 11%.

Only those companies that are registered in Lithuania, have at least 12 months of operation, have a financial performance report, and are small or medium-size enterprises can apply for a loan with the platform.

Debitum Network

Debitum Network6 is a licensed P2P lending platform founded in 2017. With a minimum investment amount of EUR 500 and almost 10% of annual return, it offers profitable investment opportunities to retail investors.

The platform allows retail investors to invest in sustainable business loans with real collateral, thus ensuring investor protection.

Buyback obligation is applied for 100% of the investment assets, and in the case of the platform’s insolvency, funds are protected by the Investor compensation scheme (up to EUR 20,000).

With over 10,000 investors registered with the platform and almost 10,000 business loans funded, the platform offers great opportunities for business owners. The average yield is slightly below 10% which is lower than on the majority of platforms but considering the 0% default rate and a solid investor protection program, Debitum Network offers safe options to generate a passive income for those willing to invest in business loans.

LetsInvest

LetsInvest7 connects well-established real estate developers who have a long-term perspective and investors seeking to invest in promising projects with high interest rates.

The platform offers two membership plans for those willing to generate passive income by investing in real estate:

- Discovery membership: It starts at EUR 500 and includes direct short-time investment (1-2 years) at a pre-agreed interest rate.

- Growth membership: It starts at EUR 50,000 and includes access to non-public offers and early access to new projects, a tailor-made investment plan, the services of a personal portfolio manager, participation in property ownership, and operations at a more complex income structure. Investors can also benefit from renting and selling the property.

Capitalia

Capitalia8 is a crowdfunding platform that offers accessible loans and investment opportunities in the Baltic companies. Capitalia can help business owners with up to EUR 200,000 in business loans for financing working capital or investment, invoice purchasing (up to EUR 200,000), get access to venture capital, and in general attract the most suitable financing at the best conditions.

For investors, the interest rate changes from 6% per annum on the safest loans covered by the EIF guarantee and the platform’s buyback program, and up to 18% for the riskiest projects.

With over 900 investors registered with the platform, projects are funded on average by 5 investors, and each of them invests an average of EUR 3,673.

SAVY

SAVY9 was launched in 2014 and is one of the first P2P lending platforms. Its operations are supervised by the Bank of Lithuania. The advertised average interest rate is 16%, and each one can participate in the most lucrative investment opportunities with just EUR 10.

One can invest for free for six months in three loan types:

- Consumer loans

- Mortgage loans

- Business loans.

After the initial period of 6 months expires, the platform charges a monthly Investor Service Fee of EUR 1.

All investments can be sold quickly on the secondary market provided by the platform.

How to launch a crowdfunding platform with LenderKit

If you want to start a crowdfunding platform in Lithuania check out white-label crowdfunding software offered by LenderKit.

Our investment software is suitable for both P2P lending or equity investing, real estate or startup financing in Lithuania. We have GDPR and ECSP features to facilitate your compliance, third-party payment and KYC integrations to simplify your management, e-sign to streamline document management and more.

LenderKit supports full-cycle crowdfunding campaign management from investor onboarding to payment distributions whether via bank transfers or connectivity with third-party payment systems to automate the process.

Don’t hesitate to reach out to us to see how you can launch an investment platform in Lithuania.

Article sources: