Crowdfunding Platform in 4 Months: French AMF Reveals the Framework

No time to read? Let AI give you a quick summary of this article.

Local regulations among the European member states were quite challenging for the past few years. From the lack of clarity, transparency and clear timelines to misleading costs and requirements.

France seems to be one of the first to break the barrier and provide more transparency in the public space.

On June 24, 2024, AMF released an updated overview1 of what it takes to operate a crowdfunding platform in France. The insights turned out to be quite interesting and will help everyone to get a better feel of the requirements, timelines and the overall process of launching and licensing a crowdfunding platform in France.

What you will learn in this post:

Authorization process for French crowdfunding platforms

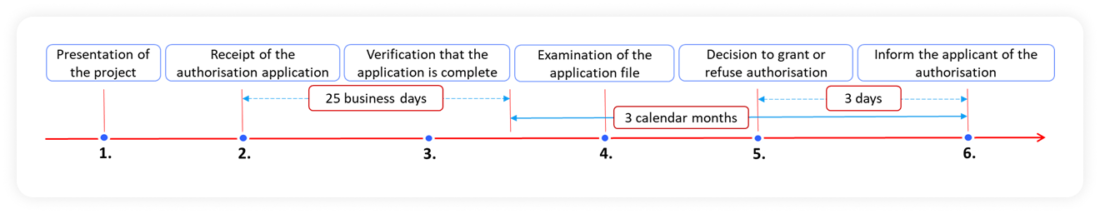

The entire process of applying for the crowdfunding license and getting a response whether your platform was approved or not should take about 4 months.

In an ideal scenario, it takes around 25 days from the project presentation to the verification of the application completeness.

If the application looks good, the authorization for the crowdfunding platform by AMF may be issued within 3 months. Of course, if some documents are missing or some clarifications are needed, the applicant will be informed about it and will be given a deadline to provide the missing files and who knows how long that will take.

Finally, the French crowdfunding regulator notifies the applicant about the decision within 3 days. Thus, the entire process takes around 4 months if everything goes smoothly.

So, the entire crowdfunding authorization process in France consists of six stages:

- Presenting the project to AMF.

- Filing the authorization application.

- AMF verifies the application, and if the applicant’s services include the facilitation of the provision of loans, the AMF notifies the Autorité de Contrôle Prudentiel et de Résolution (ACPR). The ACPR may contact the project owner for clarifications if needed.

- AMF examines the application.

- AMF makes a decision whether alone or in consultation with ACPR if the platform focuses on the provision of loans.

- The regulator approves or rejects the authorization.

Let’s break down each step to see how it works.

Project presentation

At this stage, the applicant contacts the AMF at psfp@amf-france.org to present the crowdfunding platform project. While this stage is not mandatory, it is recommended to ensure that the application file is filled out properly to avoid further difficulties and delays.

If the project is connected with lending, the applicant should also present it to the ACPR2.

Application submission

Once everything is ready, the application should be submitted on the ROSA3 extranet. The AMF will provide a standardized form and a standard application letter which are required for the application submission. When the application is submitted through the ROSA extranet, it will trigger the application completion and examination deadlines.

Communication with the regulators

When the application is filled in and submitted, it is recommended to be in touch with the AMF while the regulator examines the application. In some cases, the AMF may need additional information or clarifications on information in the application.

If the applicant includes the facilitation of loan provision in the list of services, the company also needs to communicate with the ACPR. In this case, the ACPR gives its consent, and only after that, the AMF issues the authorization.

French crowdfunding platform marketing guidelines

Once the authorization is received, the crowdfunding service provider can start its operations. A licensed crowdfunding platform needs to follow established rules that also include marketing communications.

There are clear guidelines4 on how a crowdfunding service provider shall communicate with project owners, investors and other potential users of the platform.

In short, these guidelines can be summarized as “The platform must provide fair, clear, and not misleading information” about:

- The platform itself, costs and fees related to listing a project or investing, and financial risks.

- The selection criteria of projects that are listed on the platform, and the risks associated with them.

- If the platform outsources some services to third parties, information about the services and the third parties shall be provided, too.

The information that a platform gives in the key investment information sheet has to be consistent with the information provided in the platform’s marketing channels.

All the information aimed at users in France shall be written in French, and the marketing information that is used outside France must comply with the rules of the country where this information is used.

The information about an offering should present both benefits and drawbacks with the risks of investing in an offering in a balanced way. It means that it is not acceptable to do the following:

- Presenting advantages in the body of the document, and risks – in a section inserted at the bottom of the document

- Using simplified forms of advertising that mention only one feature of the product being offered.

- Presenting promoting materials that do not specify fees, taxes, payables to investors and project owners, and commissions that may be applicable.

- Using advertising slogans that combine the concepts of performance and security.

There are also requirements for using the typography, especially fonts and colors. For example, the use of bold font or color to highlight the project performance shall be similar to that used to present other project’s or product’s features including risks. The same requirement applies to the use of illustrations and other visuals.

Fees and contributions

All crowdfunding service providers that receive authorization in France pay a contribution to the AMF in the amount of EUR 2,250. The payment is due when the authorization is issued and is made after the receipt of payment advice.

Top crowdfunding platform in France

Considering the smoothness of the crowdfunding platform registration processes in France, there is a good number of crowdfunding platforms that are authorized by the AMF.

Here are some French crowdfunding platform examples that, along with the AMF registration, have a passport to operate in other EU countries:

- Enerfip5 – authorized by the AMF and ACPR, the platform supports projects that contribute to a sustainable energy model with the promotion of carbon-free investments, sustainability, and decentralization of energy production.

- Raizers6 – a real estate crowdinvesting platform that allows to invest in top real estate with only EUR 1,000 and enables lending directly to real estate professionals. The platform has a passport to operate in Belgium, Luxembourg, Italy, Spain, Portugal, and the Netherlands.

- Bricks7 – a real estate platform that allows investing in top-tier real estate via bonds with as little as EUR 10. Along with France, the platform is permitted to operate in the majority of the EU countries.

- October8 – a lending platform that facilitates lending directly to European SMEs. The platform has a passport to operate in Germany, Spain, Italy, and the Netherlands.

- Matis9 – this platform enables investing in the most famous works of contemporary art in the form of club deals. Besides France, the platform is permitted to operate in Belgium, Italy, and Luxembourg.

How to launch a crowdinvesting platform in France with LenderKit

A clear regulatory framework and favorable conditions for the crowdfunding market in France mean that it may be the right time to think about launching a platform there.

To speed up the launching process and cut the costs, you may want to consider white-label crowdfunding software from LenderKit.

Our software comes with a set of pre-built features which allow you to start operations ASAP, but you can also have a fully custom-made or tailored crowdfunding platform with your branding and unique functionality.

If you want to see how our white-label crowdfunding software works, please feel free to fill out the contact form and our sales team will answer your questions or show you the demo.

Article sources:

- Operating as a crowdfunding service provider in France | AMF

- The Autorité de contrôle prudentiel et de résolution – ACPR | Autorité de contrôle prudentiel et de résolution

- Pré-connexion2

- PDF (https://www.amf-france.org/sites/institutionnel/files/private/2023-06/DOC-202...)

- Enerfip | About us

- Real estate crowdfunding: Invest with Raizers

- Bricks | N°1 du crowdfunding Immobilier dès 10€ avec rendement fixe mensuel

- Lenders - October Europe

- Why invest with Matis?