The Risks of Managing a Crowdfunding Platform and How to Avoid Them

No time to read? Let AI give you a quick summary of this article.

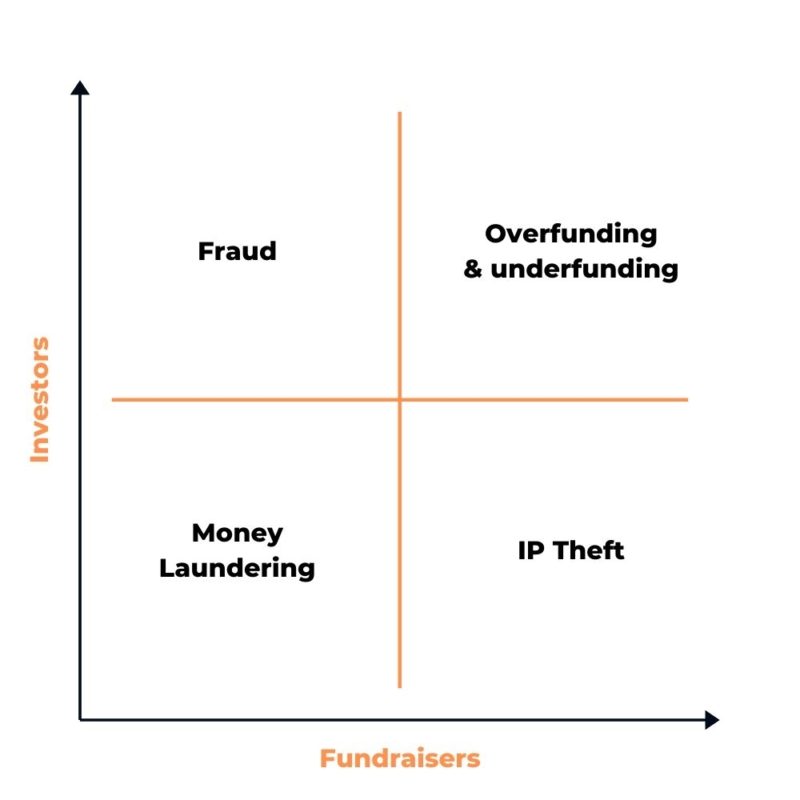

Crowdfunding is a relatively new way of financing in the digital world. With infancy-stage regulations being implemented all across the globe and in various countries separately, there are a lot of crowdfunding risks that you should be aware of.

From debt and equity-crowdfunding risks to donation and reward-based crowdfunding fraudulent activities, there are quite a lot of things to keep in mind when entering the market.

In this article, we aim to review the most popular risks of managing a crowdfunding platform.

What you will learn in this post:

Overfunding: what happens when a campaign exceeds funding goals

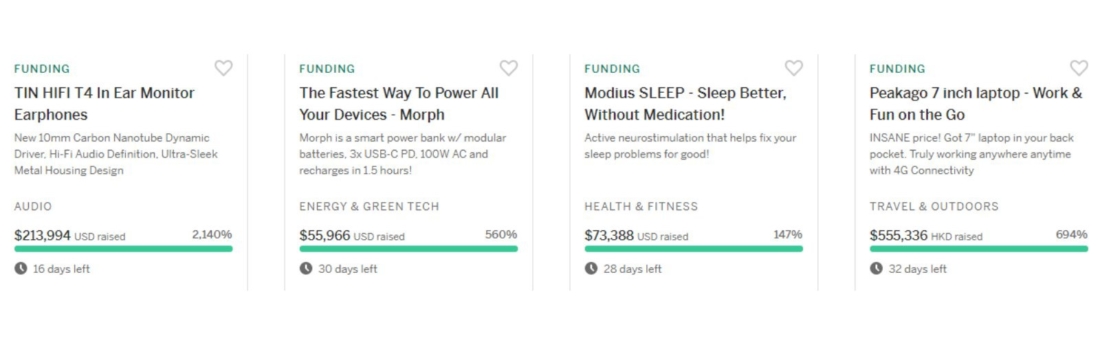

For a crowdfunding platform administrator, having many overfunded campaigns is a nice booster of reputation which helps to build trust and attract more investors and fundraisers.

Overfunded campaigns may become a great asset in your platform’s portfolio. Moreover, promoting certain campaigns on your platform generates additional revenue and encourages healthy competition.

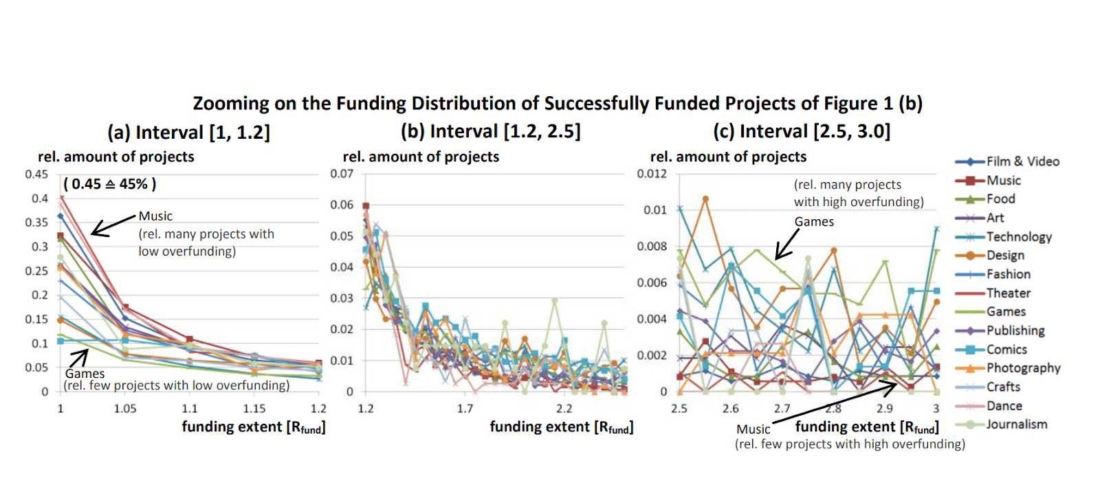

“Overfunding is not a niche phenomenon” – Research Gate2

Many established crowdfunding platforms exercise occasional campaign overfunding to create a dynamic environment for investors and fundraisers.

Allowing or disregarding overfunding on your platform is optional and purely depends on your vision and policies.

For fundraising companies, overfunding means enhanced campaign interest and extra financial success compared to other folks. However, it also means that a company is now obliged to pay back to investors somehow.

If we are talking about equity crowdfunding, then a company should release new equity3, or shares, while current owners get proportionally diluted.

The scale-up company may not be planning to do so just yet.

As an admin of a crowdfunding platform, it’s up to you to set up the rules and enable overfunding on your platform.

If you decide to enable overfunding, you should give fundraisers a choice whether to accept extra funds or reject it and refund pledges to investors.

The risks of overfunding:

- requires more time to manage transactions;

- puts fundraisers at risk of not delivering on the results;

- requires fundraisers to release equity in case of equity crowdfunding;

- increases investors’ expectations.

In case of donation-based crowdfunding, overfunding may even be encouraged as fundraisers are not expected to pay back to investors while investors are donating just to feel good and impactful.

So, allowing overfunding purely depends on the type of your crowdfunding platform.

Overfunding is completely risk-free for donation-based crowdfunding platforms and optional for equity or reward-based ones.

Underfunding: what happens when a campaign doesn’t take off

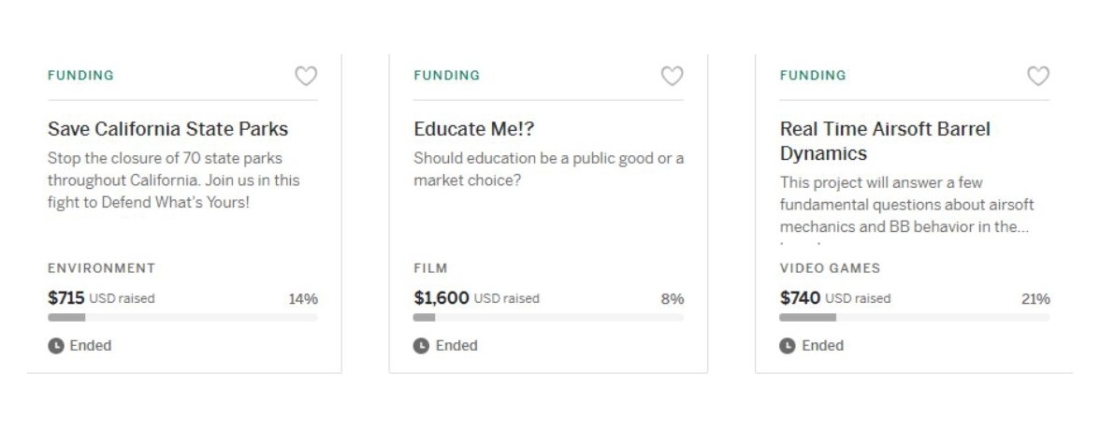

A campaign that failed to take off or reach its goals is not only bad for fundraisers but also for the crowdfunding platform’s reputation unless some risk mitigation policy is in place.

It’s clear that a campaign which fails to get funding looks unattractive to investors and VCs, speaks about poor marketing strategy, idea, luck, or competence of the people behind the venture.

The higher the level of unsuccessful campaigns on your platform, the higher the chance of people claiming “the bad luck when crowdfunding on your platform.”

“As a crowdfunding platform manager, I’m interested in both happy investors and successful fundraisers.” – Anonymous manager

It’s up to you to decide who you want to make happy.

All-or-nothing (AON) is a practice which Kickstarter adheres to and protects investors. If a campaign fails to hit the funding goal, investors get a refund and fundraisers get nothing.

Keep-it-all (KIA) is a practise which Indiegogo offers apart from AON. Keep-it-all is the funding type which protects fundraisers and helps them get some funding which they decide what to do with.

Arguably, one could say that Indiegogo plays it smart, and transfers the responsibility for the campaign’s present and future success on the fundraisers. By letting fundraisers choose the funding style, Indiegogo keeps its hands clean. At the end of the day, investors who chose to fund KIA projects take full responsibility for their actions.

Keep in mind that it’s required by law to notify investors and fundraisers about the risks. The message should be displayed during the registration process and elsewhere on the platform saying that no payments are guaranteed and the capital is at risk.

Intellectual Property Infringement or IP Theft

HuffPost4 draws a line between intellectual property infringement (IPI) and intellectual property theft (IPT). IPI happens when a fundraiser launches a campaign to raise capital for their product while being unaware of the existence of a patent to a similar or the same product.

A company that has patented the product first might be able to sue the fundraiser.

IPT happens when a fundraise launches a campaign disclosing the idea, designs, and business plan, and it all gets stolen, usually, by a counterfeiter.

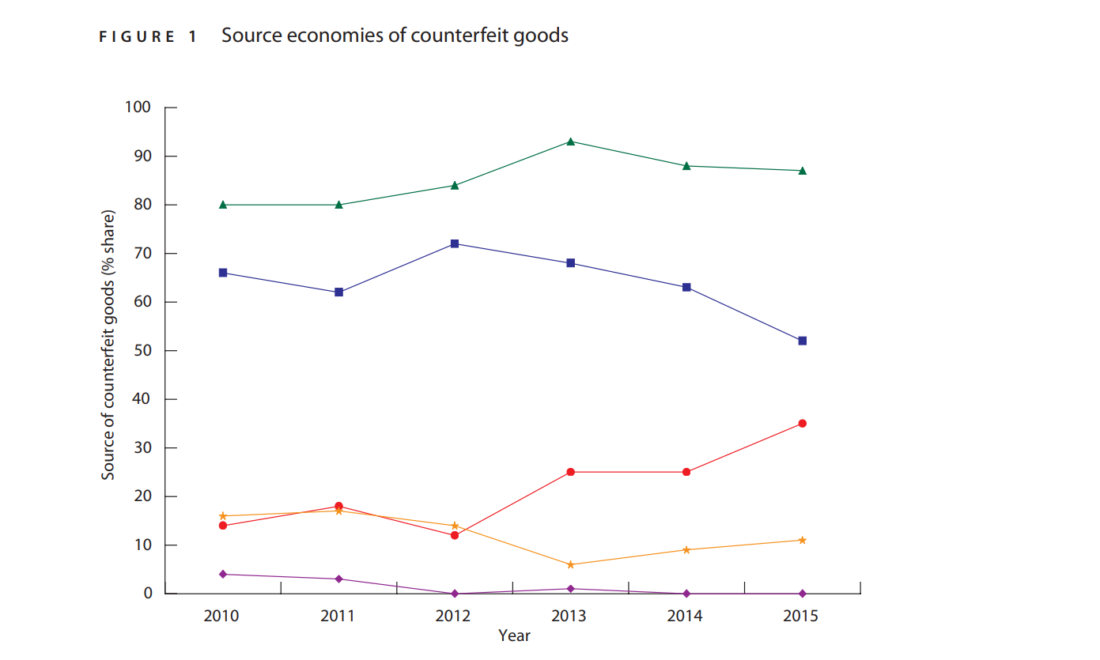

According to news and reports5, the most popular form of crowdfunding IP theft is done by Chinese counterfeit, resulting in around $255-650 billion a year of losses for the US market.

To comply with your country’s regulations, you must inform fundraisers about potential risks of crowdfunding as it requires disclosure of business-sensitive information to attract investors and raise capital.

There is a practice among crowdfunding platforms to showcase only basic information about the fundraiser’s campaign. To view more details, users are required to register either as an investor or fundraiser.

By displaying limited information for non-verified and non-registered users, you can minimize the risks of IP theft on your platform and protect fundraisers.

Usually, platforms require users to pass KYC verification process with some background checks to complete the registration. These crowdfunding risk mitigation activities help to reduce the level of IP theft.

Fraud: who is at risk and what actions to take

The Federal Trade Commission (FTC) has recently released a report on a scam campaign6 run by iBackPack.

iBackPack launched several crowdfunding campaigns on KickStarter and Indiegogo raising over $800,000 in total but failed to ever deliver the product.

The campaign organiser, Monahan, spent all of the capital on personal needs as well as marketing efforts to raise even more.

FTC claims to be taking actions only when there is a real fraud, so apparently, it has reasons to believe that iBackPack was not using the funds properly.

This is just one of the thousands of fraudulent campaigns which left both investors and crowdfunding platform owners unhappy. The problem with fraud is that it puts off investors from using your crowdfunding platform as a financial tool leaving the platform unattractive for fundraisers.

There are multiple ways to fight fraud, but one of the most advanced strategies is through KYC verification procedures.

Technically, it means having an in-house department or a partner who is proficient at KYC checks. For example, at LenderKit, we partner with such KYC providers:

- VixVerify;

- MangoPay;

- LemonWay;

- Goji investments;

Apart from being KYC verification providers, MangoPay, LemonWay, and Goji investments also provide AML verification and payment processing.

Through a pre-built form, we collect the required data about a user and transfer that information to an authorised KYC/AML provider. Here is what the KYC verification process looks like at LenderKit:

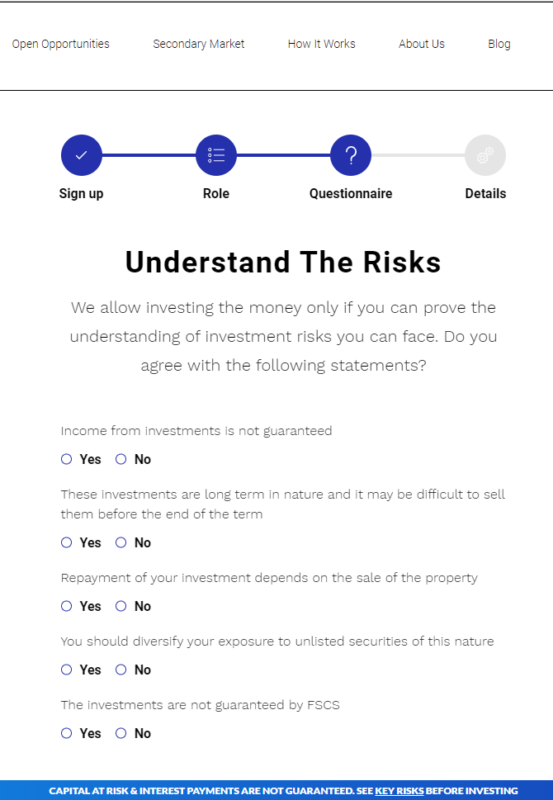

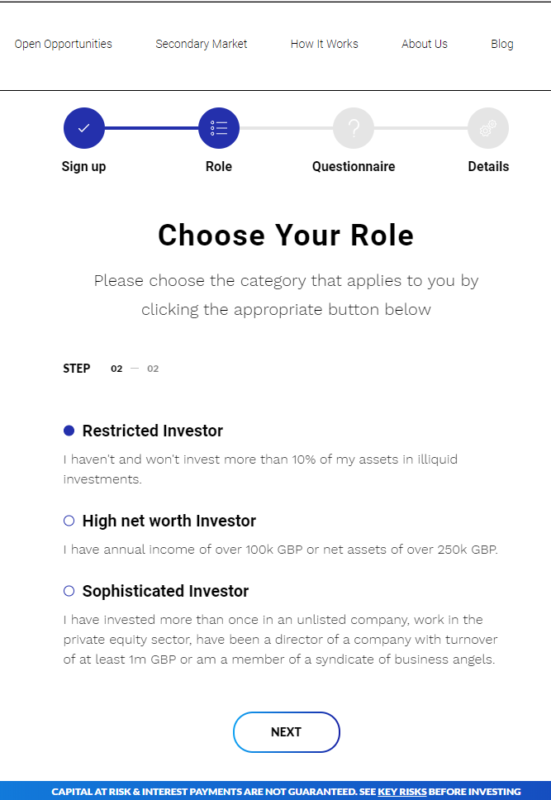

The KYC verification process starts at the registration. Each user should select their role such as an individual investor, corporate investor, or fundraiser, and specify the details of their role, income, etc.

Learn more about LenderKit front-end theme

The next step is the risk notification process which we described at the end of the section “Underfunding.”

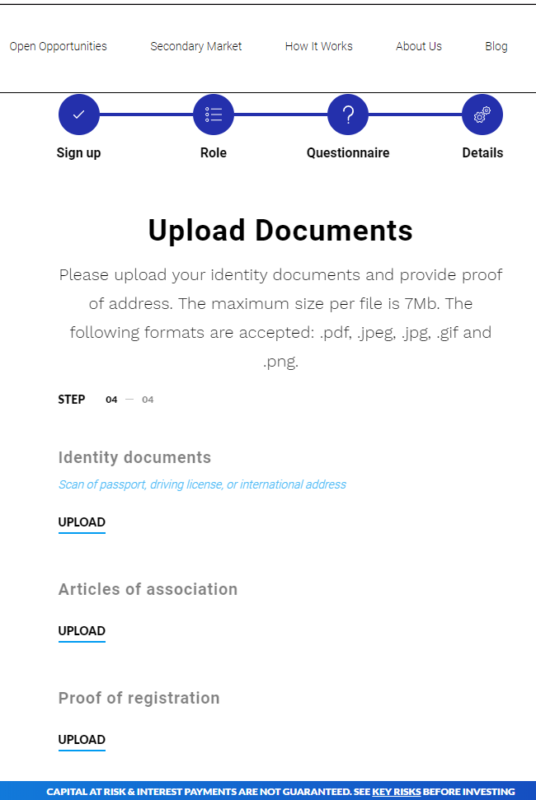

After that, a user provides personal information about themselves, organization, digital and physical addresses and contact information. Finally, a user has to upload all of the required documents such as scan of passport, driving license, or an ID-card, articles of association, and proof of registration to submit the registration form.

The provided information is then reviewed by the admin of the platform, internal lawyer or a KYC provider. Usually, this information is enough to significantly reduce the risks of potential fraud and platform abuse.

Money Laundering: how bad guys use crowdfunding

In 2013-2015, crowdfunding money laundering activities were on the rise according to the FinCEN SAR (Suspicious Activity Report) Technical Bulletin7.

Reward and donation-based crowdfunding became an attractive tool for money laundering. Financial Crimes Enforcement Network (FinCEN) registered 14-38 SAR-filings in 2013 and 2015 respectively.

There are multiple ways money laundering and transactions scams can occur:

- Using stolen credit cards to fund campaigns and top-up wallets, then ask for a refund or withdraw cash to individual bank accounts thus mingling illegal money with legal capital.

- Concealing and cleaning the illegal source of funds through wire transfers, investments on the crowdfunding and P2P lending platforms.

- Running fake crowdfunding campaigns with the intention of funding terrorist activities, political groups, or other propaganda.

Most of the time, crowdfunding sites are used as a layering and mingling tool8 in money laundering to push the money further in the financial chain with the intention of hiding its true nature, according to the ACAMS whitepape9r.

The remedy for the money laundering and transaction fraud lies in incorporating the AML verification step in your registration procedures before any allowing any transactions.

Anti-Money Laundering specialists will check the credit score, intentions, sources of funds, financial reports, individual profiles, digital footprint, and physical transaction histories, etc., to ensure that a particular individual or a group of people is eligible to invest or fundraise on the platform.

As mentioned earlier, MangoPay, LemonWay, and Goji Investments provide KYC/AML verification services and can be integrated through an API with your crowdfunding platform to enable additional security and compliance with the law.

AML check is performed a bank or an authorized and experienced third-party institution which you should find and consult before launching your own crowdfunding platform to avoid further crowdfunding platform management risks.

Final thoughts

To manage a crowdfunding platform confidently and dynamically, you should carefully check investors (background, credit score, income source) and borrowers (business idea, bootstrapped funds, marketing plan, team, etc.) Thorough KYC/AML verification practices might be especially useful for private crowdfunding portals and any crypto-related projects.

Being risk-management-savvy will help you start off on the right foot and enter the market seamlessly, laying a strong foundation for your business success.

If you have any questions regarding crowdfunding platform development services or need advice, contact us at lenderkit@justcoded.com.

Article sources:

- Just a moment...

- Research Gate

- How Does Additional Equity Financing Affect Existing Shareholders?

- IP Theft: Crowdfunding sites are being harvested by Chinese counterfeiters | HuffPost Contributor

- PDF (http://ipcommission.org/report/IP_Commission_Report_Update_2017.pdf)

- FTC Charges Operator of Crowdfunding Scheme | Federal Trade Commission

- PDF (https://www.fincen.gov/sites/default/files/shared/SAR_Stats_2_FINAL.pdf)

- PDF (http://files.acams.org/pdfs/2017/Crowdfunding_The_New_Face_of_Financial_Crime...)

- ACAMS White Papers | ACAMS