Crowdfunding for Retail vs Accredited Investors

In 2015, the SEC introduced rules for equity crowdfunding permitting the general public (retail investors) to grow their wealth through funding startups and early-stage promising businesses. Before, businesses could only solicit contributions from accredited investors.

Today, we will look at the differences between the two types of investors.

Next, we will explore the regulations in the UK and US in crowdfunding for retail investors and accredited ones. Finally, you will learn what offerings the platforms market for each kind of investor. So let’s get down to it.

What you will learn in this post:

Investor Type Differences

For starters, let us define each type of investors we’re going to discuss through this article.

The SEC defines an accredited investor as someone earning $200,000 (or $300,000 along with a spouse) in each of the prior 2 years as well as is likely to make the same amount of money in near future; alternatively, an individual’s net worth has to exceed 1 million USD (alone or along with a spouse). The latter amount does not include the home where an investor resides most of the time.

Beyond that, a trust that has at least 5 million USD in total assets can be an accredited investor, too:

- any trust, with total assets in excess of $5 million, not formed specifically to purchase the subject securities, whose purchase is directed by a sophisticated person, or

- any entity in which all of the equity owners are accredited investors.

But that’s not all. Recently, the SEC has adopted long-debated changes to the Rule 501 of Regulation and added new accredited investors categories that are both natural persons and entities. These include persons with professional certifications etc from an accredited institution and “knowledgeable employees” of a certain type.

As for the entities qualifying as accredited investors, the SEC expanded the definition to SEC- and state-registered investment advisers and rural business investment companies, LLCs, private wealth management advisory companies / “family offices”, and “family clients” meeting certain requirements, etc.

At the same time, The Financial Conduct Authority (FCA) in the UK terms an accredited investor as “sophisticated, certified or high net worth investor” and defines him as a person that fulfills both of the following requirements:

- (1) who has a written certificate signed within the last 36 months by a firm confirming he has been assessed by that firm as sufficiently knowledgeable to understand the risks associated with engaging in investment activity in non-mainstream pooled investments; and

- (2) who has signed, within the period of twelve months ending with the day on which the communication is made, a statement in the following terms:

SOPHISTICATED INVESTOR STATEMENT

Regulatory Differences: the USA and the UK

Regulation in the US

In the US, crowdfunding for non-accredited investors has limits depending on the deal amount.

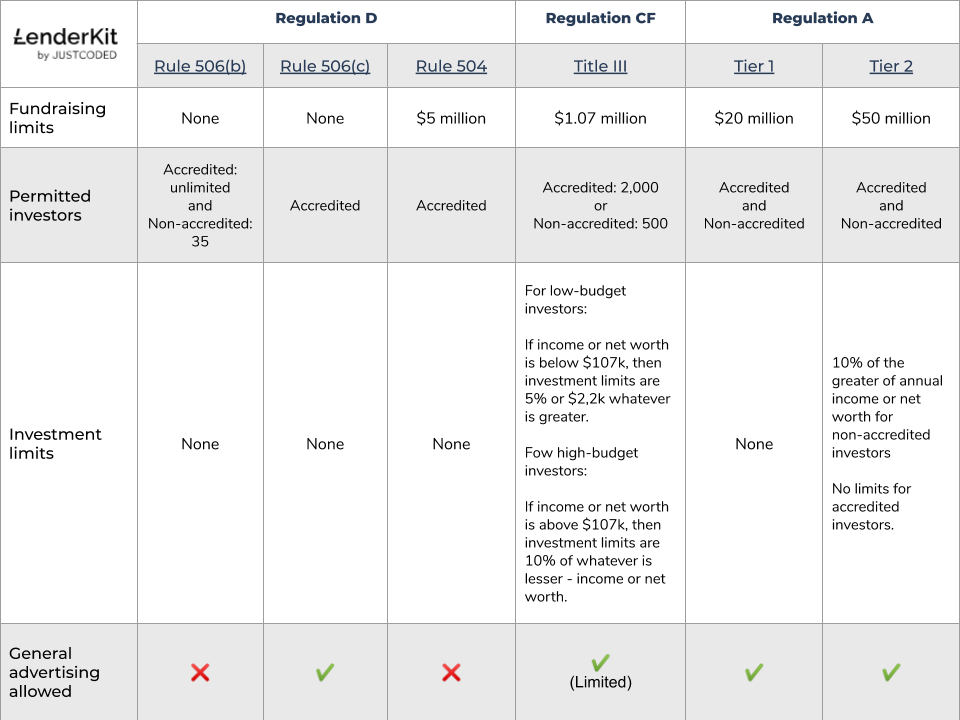

Reg A (Title IV of the JOBS Act)

Under Regulation A+, a non-accredited investor can only invest a maximum of 10% of his annual income or net worth (whichever is greater) per deal in Tier 2 offerings (up to 50 million USD in equity in a 12-month period). As for Tier 1 offerings where companies can offer up to 20 million USD of their equity through crowdfunding in a 12-month period, no restrictions apply to non-accredited investors.

If we speak of an institutional investor, then the permitted investment amount for Tier 2 deals is 10% of the greater of annual revenue or net assets at the financial year end.

506 c (successor of 506 b) under Reg D

Startups can sell their equity to only accredited investors. Therefore, the deals with no raise limits are not available for retail investors.

Reg CF – Title III

Under this specific regulation, a company can raise not more than 1,07 million USD in a 12-month period and is allowed to have retail investors put either / or:

- $2,200 or 5% of net worth or annual income if they make less than $107,000 a year;

- If both annual income and net worth are equal to or exceed $107,000, then 10% of the smaller of their annual income or net worth.

Crowdfunding for accredited investors has no limits in terms of capital they want to put to work.

Additionally, there are 35 state-specific laws that apply to non-accredited investors in the US, too.

The UK’s FCA is less diverse about crowdfunding investment limits. However, the regulator has a 10% of net assets cap on investments for all non-accredited investors specified in COBS 4.7.10 of its Handbook.

Platforms for Different Investor Types

For starters, we will focus on non-accredited backers. There are some platforms for everyday investors on the market.

StREITwise offers opportunities for retail investors to add high-quality real estate projects to their portfolio. The platform structures its current offering as a non-traded real estate investment trust (REIT) under Reg A.

Although individual property investment only available for accredited investors, RealtyMogul has some commercial real estate offerings open to non-accredited investors as well. The platform’s REITs allow retail investors to allocate their capital across multiple real estate projects.

If you are planning to build crowdfunding software for non-accredited investor management, it makes sense to:

- create detailed high-caliber guides and educational resources for backers

- add a knowledge center that has exhaustive info on risks

- make references to regulations and laws so they can learn more about their options.

Accredited investors have better access to deals and some crowdfunding platforms are exclusively made for them.

Fundrise offers several account levels depending on the investing appetites of a user. Core plans, advanced or premium with min investment amounts of 1,000 USD, 10,000 USD, and 100,000 USD respectively are among the offerings of Fundraise.

Crowdstreet has plenty of commercial properties projects to offer to the wealthy. With privately managed accounts, the platform offers a tailored investing approach and a custom-built account with a minimum balance requirement of 250,000 USD.

Perhaps unsurprisingly, crowdfunding software for accredited investor management has its differences. There’s not much need for explanation and hand-holding as these users are not new to investing. HNWIs usually think carefully and do not jump into conclusions; therefore, long-term crisis-resistant investment deals are the most appealing to them.

Exclusivity is another marketing card to play with accredited investors. For example, Fundraise offers “hands-on management” for its clients as well as “conservative approach and extensive underwriting processes”. Old-school ‘slowly but steadily’ works perfectly with the rich when it comes to growing their wealth.

Final thoughts

If you want to build a crowdfunding platform for either of investor types, we’d be happy to help with our white-label or custom-made solution. Years of experience, successfully delivered projects, and industry expertise are what LenderKit’s team has to offer. Drop us a line to schedule a demo and see our solution at work.