How to Build an Equity Crowdfunding Platform for Non-Accredited Investors

An equity crowdfunding platform for non-accredited investors is a part of an alternative investment class which previously included private equity and VC firms.

The differentiating factor of an equity crowdfunding platform which focuses on non-accredited and sophisticated investors is the size of a deal between investors and startups, regulatory framework, and technical requirements.

There is a huge unsatisfied market of early-stage startups and everyday investors who want to collaborate and generate profits. However, like any other market, it requires research and deep understanding before you build equity crowdfunding software.

Research the equity crowdfunding market in your region

UK, USA, UAE, South America, and a part of Africa are among currently developing and growing crowdfunding markets, according to the 2020 crowdfunding market analysis. Out of all these markets, the UK and the US are the established ones.

If you know what you’re doing and have a plan, then you should probably try to compete on the already-established markets, especially if you have a good team and decent resources. The established market is good because of the following factors:

- Clear regulations

- Good competition which you can analyse, learn from, and outperform

- Proven demand

- Marketing opportunities, etc.

In case you’re just starting out an equity crowdfunding business and need more time to learn the framework, then you should probably enter the growing and emerging markets. There are several reasons of why you should choose an emerging market:

- The country is just forming its regulations

- The market is waiting for new opportunities

- Consumers and “not spoiled” with a variety of choices yet

- Easier to launch fast and become the early bird that gets the client

- Gain marketing and brand power quickly because other solutions don’t exist yet, etc.

Find out about the investment limits for equity crowdfunding platforms in your country

Before you start an equity crowdfunding business for non-accredited investors, you should figure out the investment and fundraising limits and confirm that you’re satisfied with the numbers.

In the USA, the investment limits for non-accredited investors range from $2,000 to $107,000 depending on the annual income or net worth. While the maximum amount a company can raise under securities-based crowdfunding is $1.07M.

In contrast, most of the platforms in the UK work with self-certified sophisticated or high net worth investors which have an income of £100,000 per year or net worth of £250,000. The investors can invest up to 10% of their investable assets. Individuals with lower income or high net worth are categorised as retail investors. According to the latest data, the equity fundraising limit in the UK is €5M. And in Germany, the limit has been increased to €8M.

Why would you care about the investment and fundraising limits?

They are a part of your customer profile. In other words, you can’t target those who don’t match your ideal customer profile (ICP).

Pick a niche to build an equity crowdfunding software around

To make sure your equity crowdfunding platform operates at its highest potential, you should focus on a particular stack of industries. While picking one niche might be too narrow, focusing on several at once is a good way to diversify your platform’s offerings.

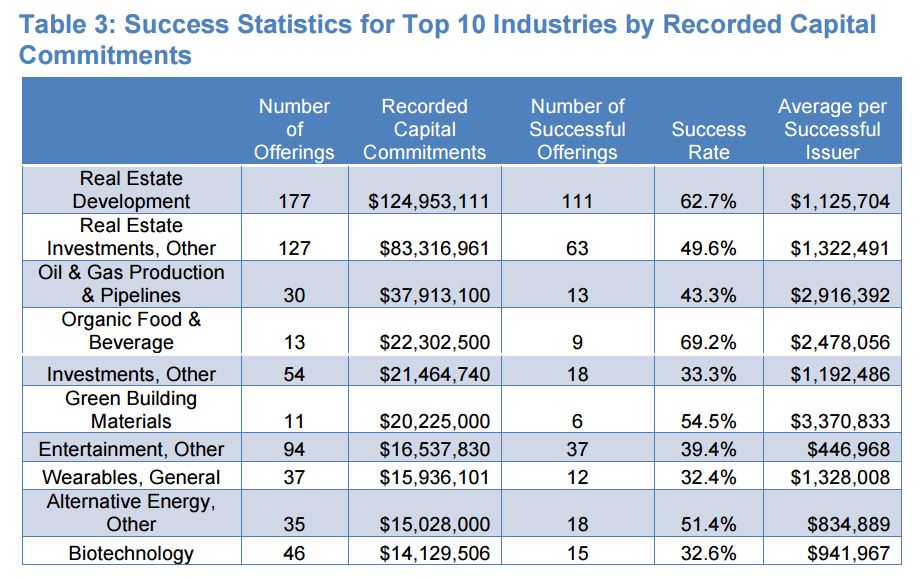

Real estate, technology, food & beverage, green energy, entertainment, SME, in general, are among the top trending industries at the moment, according to StartEngine, an equity crowdfunding platform.

However, this data might be quite tricky, especially, because the platform might have been particularly interested in promoting those industries. That’s why they get the highest traction for those industries.

Based on common sense, real estate, technology, and SME should remain unchanged. However, you should focus on your own area of interest depending on the market you’re operating in.

If you decide to go with a real estate niche, we have several customisable white-label crowdfunding solutions for you including:

- Admin back office for real estate crowdfunding

- Customisable investor and fundraiser portals

- Secondary market

- Transaction management module

- Fees configuration module

- On-demand KYC/AML integration via a third-party tool and much more

If you’re considering a white-label real estate crowdfunding solution, just drop us a line and we’ll make sure to provide you with the best software for your business.

Analyse competitors before you develop an equity crowdfunding portal

There are plenty of equity crowdfunding platforms out there. Which ones should you count your competitors?

You should probably trust the official websites with registered equity crowdfunding platforms in your city, region, or continent. If the platform is listed at the official monetary authority website, then it means that the equity crowdfunding platform is up and running and can actually be relied upon in your research.

Here are a few sites to analyse:

- FINRA – USA

- UK Crowdfunding Association – UK

- Capital Market Authority – UAE

- NCFA – Canada

There you can find a huge variety of equity crowdfunding platforms by industry and asset focus.

Outline the monetisation strategy of an equity crowdfunding platform

When you’re done with the crowdfunding regulatory framework analysis, you should think of your monetisation strategy. How you’ll make money out of your platform is one the most important parts of the whole business idea.

We’ve already broken down how real estate crowdfunding platforms generate revenue, however, we’ll go through some of the major fees and commissions once again.

The basic monetisation strategy of an equity crowdfunding platform looks like this:

- Transactions fees (payouts to investors, fundraisers, securities trading, etc.)

- Management fees (usually 2% of the fund’s net asset value)

- Performance fees (usually 20% of the fund’s profits)

- Exclusive club fees

There can be whatever fees, but these 4 are the most common ones. Usually, it’s even just the transaction fees and “2 and 20” fees (management and performance).

The above-mentioned structure is a common practice among hedge funds, however, the same works for equity crowdfunding platforms.

Find a reliable payment gateway for equity crowdfunding software

Without a crowdfunding payment gateway, it would be practically impossible to work with non-accredited investors as they constitute a large portion of the market and invest small amounts. Managing each transaction manually would be a deal-breaker, that’s why an equity crowdfunding payment gateway is something that you absolutely need.

A payment gateway designed for crowdfunding solves several problems:

- Automates payments

- Provides KYC/KYB (Know your customer/business) verification services

- Provides AML (anti-money laundering)

However, that’s not a differentiating factor for choosing a payment gateway for crowdfunding purposes. What you should be looking for is a different checklist of features:

- Escrow – to pledge and hold investors’ money through a third-party service

- Currency support

- Repayment scheduling

- Transaction limits

- Speed of transactions

- Freezes and blocks policies

- Service fees – the higher their fees, the higher yours and it’s not always good

- KYC refusal fees

- Dispute resolution policies, etc.

Choose a professional equity crowdfunding platform development company

To create an equity crowdfunding platform, you have multiple options which you can choose from:

- White-label crowdfunding software – ready-made solution which is tailored to one particular purpose with limited functionality which might be exactly what you need

- Custom crowdfunding software – a software designed for your specific business requirements. Only the required features like secondary market, ability to add new fields, filter users, set up fees, manage offerings, give account access to your lawyer – anything that works for you.

Both options are good. White-label crowdfunding software is usually a good fit for conducting a few similar deals or pitching investors before building a custom crowdfunding platform.

The benefits of a white-label crowdfunding solution:

- Pre-built features – perfect for entrepreneurs with a non-technical background

- Quick go-to-market

- Ready for testing the waters

- Cost-effective compared to custom software

- Perfect for small scale projects

- Designed for a particular market, etc.

In contrast, a custom solution is the best option if you have already proven that your crowdfunding business is viable and profitable, you have a clear roadmap, and know exactly what you need. In addition to other requirements, you also want your software to belong to you only, you want to be responsible for the data, transactions, and anything else which you’d like to have full control over.

The benefits of a custom crowdfunding solution by LenderKit:

- Fits like a tailored suit – prestigious and comfortable

- Launch and scale in any market

- Full control over the data and software

- Allows for the Exit Strategy – you can sell the business when it grows big or keep it

- Scale to a broker-dealer platform

- Launch faster thanks to the LenderKit core which has most of the fundamental features of a crowdfunding platform

Build a secondary market for an equity crowdfunding portal

When developing equity crowdfunding software for non-accredited or high-net-worth and corporate investors, you should think about having a secondary market. A secondary market can be implemented for both debt and equity platforms and solves the illiquidity problem which is peculiar to long-term investing.

Many platforms like Crowdcube or Seedrs have secondary markets even for non-accredited investors, and you can explore the full guide to secondary market in equity crowdfunding to find how it works.

A secondary market can become an important part not only of your platform’s attractiveness to potential investors but also a part of your monetisation strategy. However, to allow investors to trade their securities you have to have a corresponding license. On a smaller scale though, some platforms provide a simulation of a secondary market and list offerings on behalf of a bulletin board without actually conducting automated operations.

All in all, a secondary market can become a great contribution to your platform’s functionality and services.

Final thoughts

To build an equity crowdfunding platform for non-accredited investors, you need to make sure there’s enough market awareness and that you can rely on the crowd only. Retail investors usually pledge small sums of money, so you need a lot of them to finance the projects on your platform.

If you’re looking to start a successful crowdfunding business and disrupt the old ways of raising capital, check out LenderKit crowdfunding software. You can use our white-label crowdfunding tool out-of-box or have us build a fully-custom platform for your business.

To learn more about LenderKit, check out the online tour or book a demo with our sales rep.