ESG in Real Estate Crowdfunding: How Does it Work?

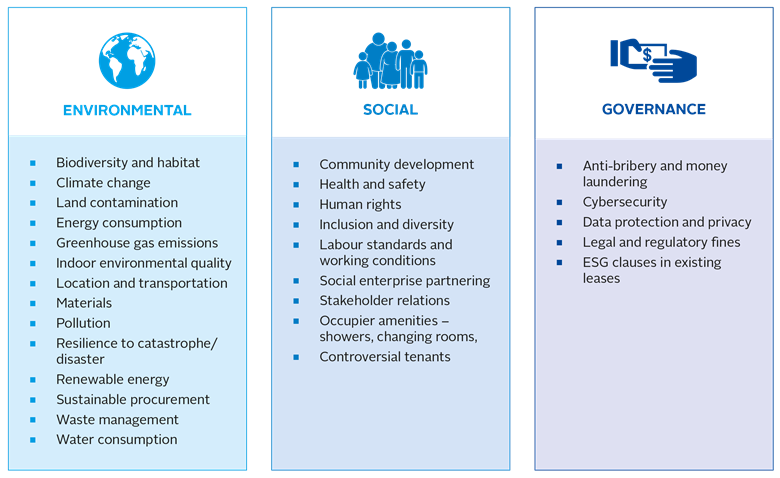

Environmental, Social and Governance (ESG) standards can be applied to the real estate industry.

Since the ESG impact investing principles will be advertised more aggressively, crowdfunding platforms should also prepare and adjust their marketing materials and pages to reflect the industry interests and expectations.

In fact, one of the real estate crowdfunding platforms, EquityMultiple, has already started highlighting the ESG impact on real estate crowdfunding and offering ESG investment opportunities on their platform. This can be the right time for other real estate crowdfunding platforms to catch up.

So, how does ESG translate into the real estate industry? And what projects may crowdfunding platforms focus on to keep up with the trends?

What you will learn in this post:

Environmental sustainability in real estate crowdfunding

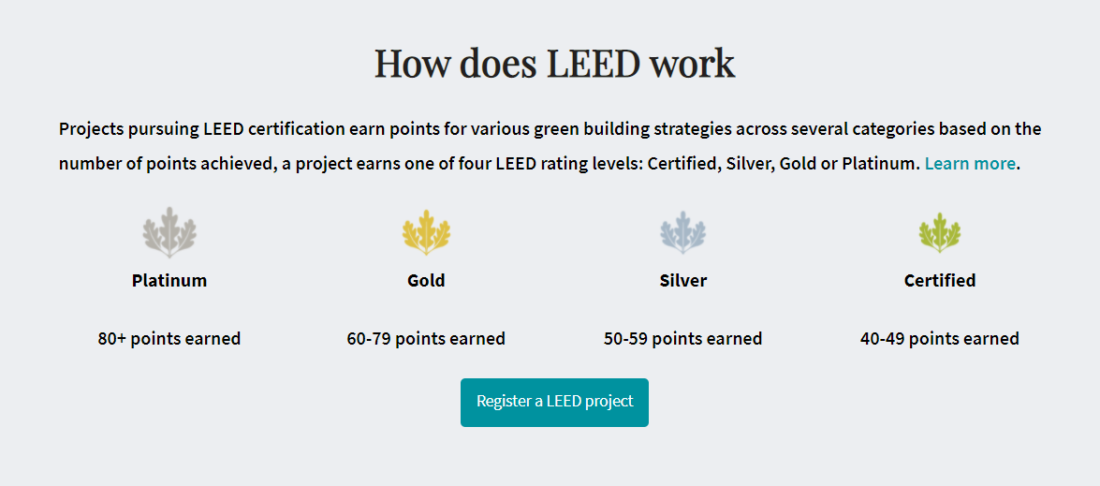

Crowdfunding platforms may explore real estate projects which have obtained the Leadership in Energy and Environmental Design (LEED) certification in the US or BREEAM in the UK for both new and existing buildings to ensure safety and well-being.

LEED helps to measure different aspects of property management such as:

- Water consumption

- Energy use

- Waste management

- Land contamination

- Gas emissions

- Location and transportation

- Indoor environmental quality

- Resilience to catastrophe or disaster, etc.

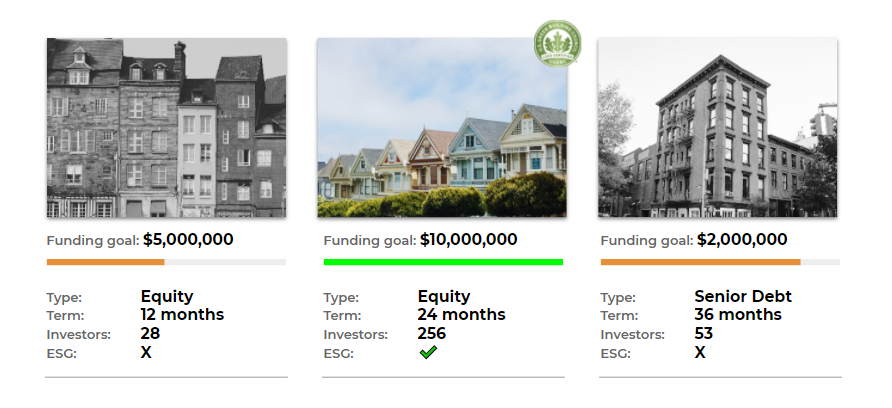

Real estate projects with the LEED or BREEAM certificates are likely to qualify for the ESG impact investing scheme and thus are worth looking into. It’s not that real estate developers were not obtaining any certificates before, it’s probably more about the fact that these should be more aggressively advertised or vividly highlighted on a crowdfunding platform. Consider the example below:

Social impact in real estate crowdfunding

The social aspect of the real estate project is very important too. If you’re in the business of property renovation and want to sell or rent the building, then taking into consideration the social benefits of such a venture can be beneficial.

For example, if you’re renovating an old-style house with rich history and beautiful architecture and want to preserve the heritage of the building. The dilemma here is do you turn the building into a mall, pub, or museum? What would be the most beneficial for the area and also profitable for your business strategy?

Possibly, the best results would be where the goals align with the ESG principles or can be adapted to genuinely fit the impact investing framework.

For the real estate crowdfunding platforms, that also means providing enough room for diverse marketing opportunities on an offering page. Basically, that means modifying the front-end.

Governance in the real estate crowdfunding

The governance aspect means treating fairly all the parties involved in the project. It’s about having clear, measurable and transparent rules and procedures which concern anything from investor and customer communication to employee salaries and corporate culture.

As EquityMultiple says:

When we consider potential sponsor partners, we typically look for steady leadership, happy employees, a good reputation in the market, and decent reviews from tenants.

How to select ESG real estate projects for crowdfunding?

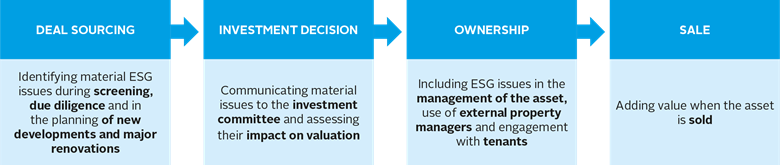

According to the Principles of Responsible Investment (PRI) guide, crowdfunding platforms have to look into 4 key areas including deal sourcing, investment decision-making process, asset ownership and management rules and the asset selling process.

Deal sourcing

The deal sourcing process can be divided into screening and due diligence. The screening manager can sort out the deals that don’t fit the ESG criteria immediately, assess the financial and regulatory risks related to the real estate project.

When passed to the due diligence phase, PRI suggests looking into these aspects:

- Raw data – history of working with tenants, utility bills, debt, building logbook, etc.

- Third-party reports – certification reports, energy audits, etc.

- Independent databases – flood records, geodatabase

Analyzing these data points will allow the due diligence manager to assess the potential ESG compliance of the real estate project and pass it to the investment manager who will organize the project into an individual offering or a portfolio.

Investment decision

There are many things to consider for the ESG crowdfunding project in real estate. The information gathered during the due diligence stage can be documented in the investment memorandum to present to the investors so that they understand the potential risk associated with a particular offering or portfolio.

The impact on valuation should also be taken into account. On one hand, the valuation can be inflated due to the sheer name of the “green building”, but the actual proof of the project being “green” has to be found. On the other hand, the ESG issues may downgrade the value of the project.

The more there are issues with the ESG, the more discounts there may be which indicate that there’s a greater level of risk associated with this particular investment.

Ownership

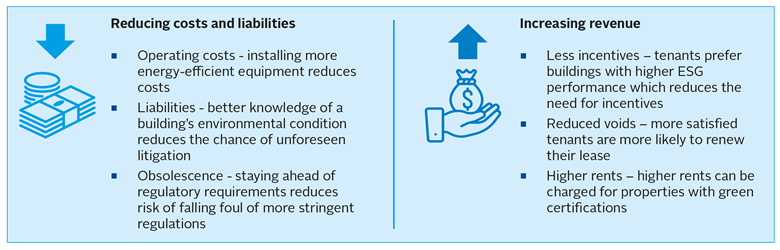

Real estate developers crowdfund for different purposes, so it’s vital to understand how they will manage the property and the crowdfunded money to improve it. The raised capital can be used to reduce costs and liabilities by installing more cost-effective equipment and facilities and/or increasing revenue by finding ways to monetize the real estate project.

Sale

Whether a real estate crowdfunding platform is focused on retail or accredited investors both individual or institutional will depend on how it manages the investments. The investors can invest via a fund or directly, so different flows can be combined in a crowdfunding platform.

ESG crowdfunding software

If you’re looking to start a real estate crowdfunding platform and want to focus on ESG projects, consider LenderKit.

LenderKit is a customisable white-label crowdfunding software for regulated investment businesses worldwide. You can choose one of the ways to collaborate with LenderKit:

- Launch a prototype to pitch to the board of directors, apply to the regulatory sandbox or raise capital for further crowdfunding platform development

- Build a custom real estate crowdfunding platform to stand out on the market, outperform competitors and gain market share

Whether you want to build an equity or debt crowdfunding platform, LenderKit has got you covered.

Check out this video for a quick introduction:

Ready to schedule a live demo and see the crowdfunding software in action? Contact us to discuss your project requirements.