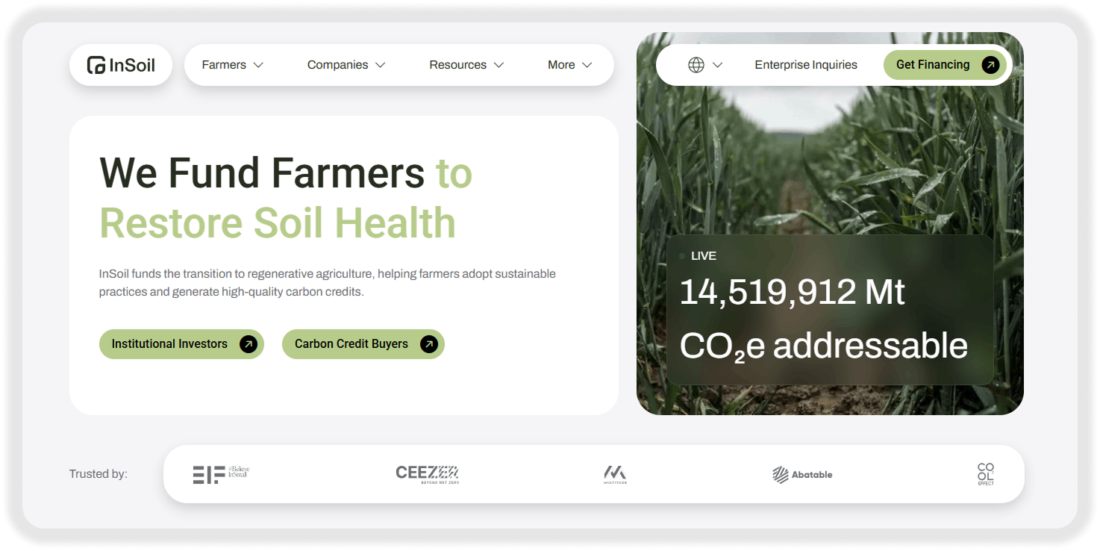

From Loans to Carbon Credits: InSoil Finance Agriculture Crowdfunding Platform Review

No time to read? Let AI give you a quick summary of this article.

Crowdfunding has helped fund startups, real estate and even music careers, but can it help feed the planet?

The short answer is — yes.

Agriculture-focused crowdfunding and investment platforms like InSoil Finance1 are determined to help this vision become reality.

Whether traditional farm loans are still cutting it or not, one thing is clear — agriculture needs new financial roots to keep the momentum.

In a world where food security, climate change and sustainable land use dominate global conversations, a Lithuania-based ECSP‑licensed marketplace is on a mission to transform sustainable agri‑financing.

In this article, we’ll dive deeper into the InSoil platform’s offerings, strategic insights, key lessons from founders, similar platforms and how you can build your own crowdfunding platform with LenderKit.

What you will learn in this post:

InSoil Finance crowdfunding platform review

InSoil1, formerly known as Heavy Finance, was launched in 2020 in Lithuania. Its mission is straightforward but ambitious: provide farmers across Europe with access to capital, while supporting sustainable agriculture and soil regeneration.

The platform operates as a regulated peer-to-peer lending marketplace under the European Crowdfunding Service Providers (ECSP)2 license. It focuses on secured agricultural loans, many of which are backed by heavy machinery, farmland, or, in the case of its innovative Green Loans, future carbon credit revenues.

InSoil aims to facilitate the removal of 1 gigatonne of CO₂ by 20503. This goal positions the platform at the intersection of finance, agriculture, and environmental responsibility.

How it works

InSoil connects investors with farmers and agricultural businesses that need financing. Investors can expect annual returns of approximately 12% to 14%, although actual performance may vary depending on risk levels and loan type.

The platform offers several lending options:

- Secured loans backed by machinery or land

- Green loans linked to projects that enhance soil carbon storage

- Unsecured loans with higher risk profiles

Investors can manage their portfolios manually or use Auto-Invest tools to diversify automatically. A secondary market also exists, which is beneficial for those who wish to exit early.

However, as with all platforms in this space, returns are not guaranteed. InSoil has seen a relatively high rate of delayed or defaulted payments (around 11% of principal default4 and around 18% in delayed payments), depending on the loan segment. While collateral reduces risk, liquidity can still be limited, and investors should approach with realistic expectations.

Key strengths and lessons for platform founders

InSoil provides several useful lessons for others building crowdfunding platforms, particularly in agriculture and sustainable finance.

Regulatory compliance builds trust

InSoil holds licenses from the European Securities and Markets Authority (ESMA)5 and the Bank of Lithuania6. This regulatory foundation adds credibility and investor confidence, something every platform founder should prioritize from the outset.

Specialization creates market differentiation

Rather than offering generic loans, InSoil carved out a niche in sustainable agriculture. Its unique focus is soil health and carbon credit monetization. This specialization positions the platform as both a financial and environmental player.

For founders, the lesson is clear: defining a distinctive, credible niche, especially one that aligns with broader sustainability trends, strengthens your market position.

Product variety and automation improve accessibility

InSoil appeals to a broader investor base because it offers various loan types, collateral options, and automated tools, such as Auto-Invest. Founders should consider providing both flexibility and structure to attract beginners and experienced investors alike.

Transparency drives long-term engagement

InSoil provides detailed loan data, portfolio performance updates, and statistics on defaults and repayments. Open communication about both successes and risks fosters trust, which is vital in alternative finance.

Risk management needs constant refinement

While InSoil uses collateral to mitigate losses, its higher default rates highlight the need for rigorous borrower screening and realistic performance expectations. Founders who enter this space must strike a balance between growth and disciplined risk management.

Similar agriculture crowdfunding platforms

InSoil is not alone in blending crowdfunding, agriculture, and sustainability. Several platforms offer similar models:

LANDE

LANDE7 (Latvia) provides agricultural loans secured by farmland or machinery, with returns around 12% to 14%. It focuses on Eastern Europe. Unlike InSoil, LANDE does not incorporate carbon-credit initiatives or other environmental impact incentives into its model.

Its primary focus remains on providing accessible, secured loans to support agricultural growth rather than integrating sustainability-linked financial products. For investors seeking a straightforward agricultural lending platform without additional ESG complexities, LANDE offers a simpler alternative to InSoil’s more impact-driven structure.

Steward

Steward8 (USA) finances regenerative agriculture. It offers loans with returns ranging from 5% to 10%. Steward’s model is built around strengthening local food systems that promote soil health.

The platform places a strong emphasis on community engagement, transparency, and direct relationships between investors and farmers. For investors or founders seeking to combine financial returns with measurable environmental and social benefits, Steward serves as a proven example of how crowdfunding can drive positive change in agriculture.

MiiMOSA

MiiMOSA9 (France/Belgium) combines debt, equity and reward-based crowdfunding for farmers who wish to transition to more ecological practices.

The platform enables project owners to raise funds for initiatives such as organic farming transitions, renewable energy installations, or biodiversity conservation efforts. The platform primarily operates in France and Belgium. Unlike platforms that focus solely on lending, MiiMOSA offers flexible funding structures tailored to various project types and risk profiles.

Abundance Investment

Abundance Investment10 (UK) offers regulated green bonds for infrastructure, renewable energy, and other environmentally focused projects. The platform allows individuals to invest in initiatives such as wind farms, solar energy installations, and low-carbon infrastructure with accessible minimum investment amounts.

Abundance offers fixed-income opportunities with returns typically ranging from 4% to 9%, depending on project risk and duration. While the platform does not specialise in agriculture, it appeals to investors who prioritise environmental impact across broader sectors. Its strict regulatory compliance under UK financial authorities reinforces credibility and investor confidence.

These platforms demonstrate growing demand for sustainable, agriculture-focused finance. But InSoil’s blend of secured lending and carbon credit mechanisms gives it a distinct market position.

InSoil’s role in the future of agriculture finance

InSoil Finance illustrates how crowdfunding can evolve beyond simple loan facilitation to address critical environmental challenges. Its model combines traditional secured lending with innovative green finance, and offers investors potential for both financial returns and climate impact.

For platform founders, InSoil provides a clear blueprint:

- Build on regulatory credibility

- Focus on a well-defined niche

- Innovate with environmental or social impact

- Prioritize transparency and data-driven operations

- Continuously refine risk management

At the same time, investors must approach platforms like InSoil with an understanding of both opportunities and risks. High returns come with exposure to liquidity constraints and defaults, especially in early-stage or specialized markets.

How to launch a crowdfunding platform with LenderKit

If you are considering launching your own crowdfunding platform in agriculture or any other niche, LenderKit provides a practical, scalable solution.

We offer a ready-made white-label crowdfunding software tailored to meet regulatory standards, automate workflows and support various investment models, including debt and equity crowdfunding.

With the flexible architecture, we can help you build a platform similar to InSoil in weeks or months — not years. Interested to explore our solution and discuss your project requirements? Don’t hesitate to contact us.

Article sources:

- InSoil We Fund Farmers to Restore Soil Health. Get Soil Carbon Credits

- Regulation on European Crowdfunding Service Providers (ECSP) - CrowdfundingHub

- InSoil Finance Remains Focused On Transforming Agriculture Via Sustainable Financing | Crowdfund Insider

- InSoil Finance Review 2025: Loan Performance Good Enough?

- | European Securities and Markets Authority

- Just a moment...

- LANDE

- Funding the Growth of Regenerative Agriculture | Steward

- MiiMOSA

- Abundance Investment