How to Craft a Shareholder Agreement for Equity Crowdfunding

No time to read? Let AI give you a quick summary of this article.

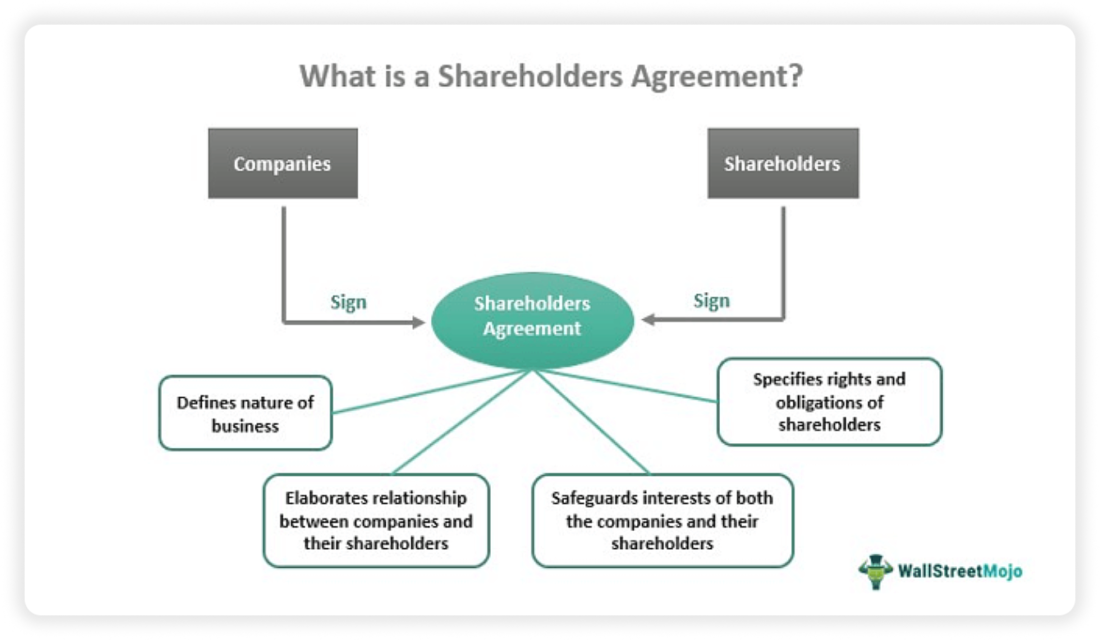

In equity crowdfunding, people invest money in exchange for a share in a company and sign a shareholder agreement to protect the interests of both — the company and investors.

What you will learn in this post:

What is a shareholder agreement in crowdfunding?

A shareholder agreement1 is a legally binding document between a company’s shareholders that specifies the rights, obligations, and protections of shareholders and the company. It covers everything from voting rights and decision-making processes to what happens if someone wants to sell their equity or if the company doesn’t manage to raise money for further operation.

Why is shareholder agreement required?

The main aims of the shareholder agreement are:

- To determine the roles and responsibilities of all parties

- To protect the company and shareholders: it includes such details as information rights, decision-making processes, the process of selling or transferring shares, what happens if a shareholder leaves, if a shareholder decides to open a competing business and all details that need to be considered to protect the stability of the company.

- To prevent legal disputes: When clear expectations are set, and mechanisms to resolve disputes are established, there are fewer risks that conflicts will escalate into lengthy and costly legal disputes.

This is why this document is important when external investors are brought in, as it is the case with equity crowdfunding. It ensures that the company founders remain in control and that investors are protected.

Who signs the shareholder agreement in crowdfunding?

The shareholder agreement is signed by all parties involved:

- Company founders

- New investors

- Existing investors

Normally, a shareholder agreement is signed by all shareholders with voting rights. It ensures that all of them have the same rights and responsibilities. Employees with non-voting shares do not sign the agreement because they would benefit only on their share appreciation or in case of an IPO but they do not participate in making decisions.

A shareholder agreement contains whatever the parties agree on, but the most common provisions are the following.

Key provisions of the shareholder agreement

Voting rights

Normally, shareholders do not make important decisions unless they are directors. But sometimes, they would like to participate in the business development more actively. In such cases, a shareholder agreement may give them a right to veto certain decisions, take part in discussions of major events such as mergers and acquisitions, disposals, business strategy, financing, and others.

Board seats

The board of directors is responsible for managing the company and overseeing its operations. Investors normally want to have enough board representation to control their investments, while founders aim to stay in control of the company. The number of board seats allocated to investors and founders is also specified in a shareholder agreement.

Vesting schedules and dividends

A vesting period is meant to limit the investors’ or founders’ ownership until the vesting period is over (it may last several years3). This incentivizes them to perform well and stay with the company.

The agreement also specified when and how dividends are paid to investors. In most cases, investors are interested in being able to appoint directors and decide on their salaries because this impacts the profit of the business and the size of dividends to investors.

Share sales and transfer

How investors can deal with shares is another important detail. For example, a shareholder agreement may specify what happens if an investor dies or retires from a business, how his shares may be sold, and how their price can be determined.

Share transfer is also regulated by the shareholder agreement. Companies may not want third parties to get involved in a business, this is why in many cases, share transfer is not permitted, or shares can be sold to one of directors or existing shareholders, for example.

There may also be a provision that if a shareholder wants to sell the shares, others may not permit it (first refusal right). The agreement also regulates share transfers among shareholders. These provisions are important to maintain the stability of the business and prevent unwished changes in ownership.

Anti-dilution

If further fundraising rounds are performed and more shares are sold, this may dilute the equity of existing shareholders. To prevent dilution, investors may be allowed to buy new shares at a discount to maintain their ownership equity in the company, or they may be issued additional shares to offset dilution.

Tag and drag provisions

These provisions4 regulate how share sales or transfers may impact minor investors.

The tag provision specifies that if a majority of shareholders decide to sell their shares, the other investors can tag along on that sale. For example, if 60% of shareholders are selling their shares, the other 40% of shareholders can also request to sell their shares at the same conditions. This provision protects minor investors.

The drag provision prevents the minority of shareholders from blocking a sale of a company. If the majority of shareholders decide to sell their shares, they may drag the other investors into the same sale.

Liquidation preferences

This provision determines in which order investors and founders receive their funds back and the amounts to be repaid if the company is liquidated. Normally, investors receive their investments first, before the founders and employees. However, it may also be specified that investors receive their investments after the founders and employees receive repayments of their shares.

Dispute resolution

This clause specifies the process of dispute resolution5, arbitration seat, and confidentiality obligations to the arbitrator and parties, along with other details of arbitrage proceedings. Also, it can be determined which courts have jurisdiction over the parties.

Costs of shareholder agreement for equity crowdfunding

Even though there are templates of how to craft a shareholder agreement6, it is a complex document. Its content may vary depending on the jurisdiction where the company operates, and funds are raised.

This is why the best way is to hire a lawyer who will draft an agreement. The cost of this service depends greatly on the company’s size and structure, as well as on the country in which the company operates. Some legal advising companies charge a subscription fee of around $1,000 + VAT per year for companies planning to fundraise7. The fees include all the contracts and agreements needed for the company, board management, cap table management, and other standard procedures.

Final thoughts

Crafting a shareholder agreement is a crucial step in equity crowdfunding, ensuring clear roles and protections for both the company and its investors. However, managing all the legal and operational aspects of an equity crowdfunding platform can be a complex task.

LenderKit’s white-label crowdfunding software offers a streamlined solution, enabling you to launch a fully-featured, compliant platform quickly and cost-effectively. With LenderKit’s customizable investment software, you can easily integrate shareholder agreements and other key provisions into your platform to meet both regulatory requirements and business needs.

To explore how LenderKit can help you launch a robust equity crowdfunding platform, or to discuss your specific requirements, reach out to our team.

Article sources:

- - YouTube

- Shareholders Agreement - What Is It, Format, Example

- Crafting Shareholder's Agreements to Steer Your Startup's Success

- A Peek Into The Clauses Of A Shareholders Agreement

- How to draft a shareholders agreement | What should you include?

- Business in a Box™ | Business Management Platform

- Pricing | SeedLegals