Key Metrics to Track on a P2P Lending Platform

No time to read? Let AI give you a quick summary of this article.

It is important for any online lending business to track key performance indicators (KPIs) to assess business sutainability and proactively react to any potential changes. From loan managers and marketing team to investors and borrowers, metrics play a crucial role in timely decision making that can enchance financial performance.

In this guide, we’ll talk about the most important and most commonly tracked KPIs by P2P lending platforms and online investment businesses, and how you should incorporate them into your analysis and reporting strategy.

What you will learn in this post:

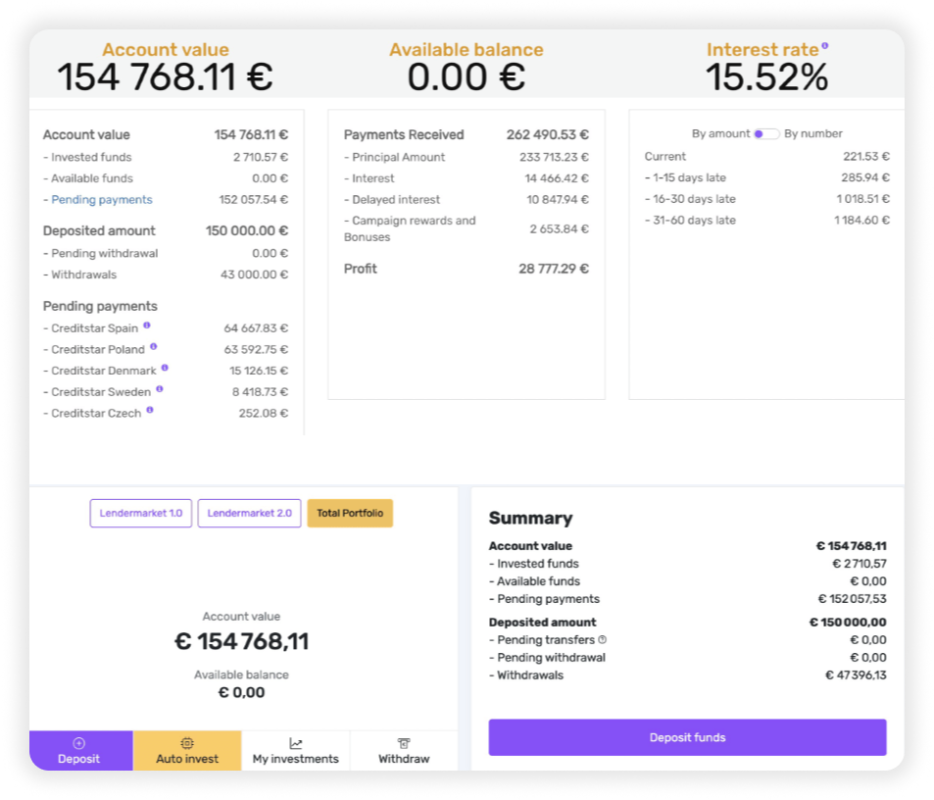

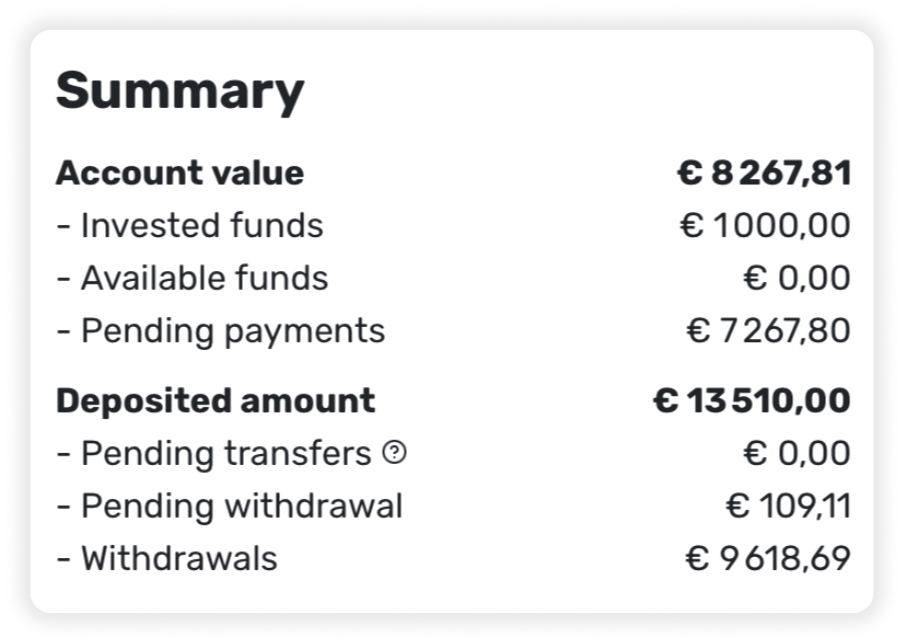

Account Value

Account value is all money held in an account. Here, we also include interests, dividends, and other payments together with money that was allocated for reinvestment. Account value may differ from the available balance value where only funds available for withdrawals are included.

Loan-to-deposit ratio

The Loan-to-Deposit Ratio (LDR) serves as a key performance indicator (KPI) for P2P lending platforms. It measures liquidity by comparing the total loans disbursed to the total deposits received within the same timeframe. The formula for calculating the loan-to-deposit ratio is:

LDR = (Total Loans / Total Deposits) x 100

A high Loan-to-Deposit Ratio (LDR) means the lending business may not have enough liquid funds to meet immediate investor needs. This ratio helps stakeholders evaluate how well the business is performing. An increase in deposits signals that new funds are coming in, allowing the institution to lend more to customers. However, a very low LDR suggests the business isn’t maximizing its earning potential.

Withdrawals

Tracking withdrawals is crucial for a lending business because it helps manage liquidity and ensure sufficient funds are available to meet customer demands. By monitoring withdrawals, the business can anticipate cash flow needs, maintain financial stability, and avoid liquidity crises that could disrupt lending operations. It also aids in assessing customer behavior and planning future lending strategies effectively.

Website visits

Monitoring the website visits helps to assess the marketing efforts of the platform and it provides insights into customer behavior, preferences, and engagement levels. It helps businesses understand how users interact with the site, which pages attract the most attention, and where improvements are needed. This data supports better marketing strategies, increases conversion rates, and enhances overall customer experience.

Number of registered users

Tracking the number of registered users helps assess the effectiveness of marketing campaigns, measure market reach, and forecast potential loan demand. A growing user base indicates increased trust and interest, enabling the business to scale its lending services, improve customer engagement, and optimize revenue generation.

KYC (Know-Your-Customer) verified users

KYC-verified users is an important metric for a P2P lending platform. The more KYC-verified users are, the more reliable is the platform in the matters of regulatory compliance, reduction of fraud risk, and enhancing trust. KYC verification confirms the identity and credibility of users, enabling safer lending practices. It also helps the business maintain accurate customer records, streamline loan approvals, and comply with anti-money laundering (AML) and other legal requirements.

Amount of money added to user accounts

This metric allows to assess the business’s liquidity and funding capacity. A higher inflow of funds means the business can issue more loans, meet withdrawal requests, and expand its lending portfolio. It also reflects customer trust and engagement, as users are more likely to deposit money when they have confidence in the platform’s stability and services.

Investment amount

A higher investment amount means the business can issue more loans, generate more revenue through interest, and expand its operations. It also indicates investor confidence and business growth, helping the company maintain a strong financial position and support long-term sustainability.

Last investment date

This metric helps to track recent investor activity and engagement, and how frequently funds are being added. Regular investments suggest sustained investor trust, while long gaps may indicate declining interest or potential issues that need attention. This metric also helps to forecast cash flow and plan future lending strategies.

Investment frequency

Investment frequency helps to assess the consistency and stability of investor contributions. A higher frequency of investments means a steady flow of funds, which helps maintain liquidity and enables the business to lend more effectively. It also provides insights into market sentiment and can help the business forecast cash flow, plan for future lending needs, and ensure ongoing financial health.

Total loan volume

The total loan volume shows how much money was lent over a specific period. This indicator is important to get a general view of the platform’s activity and success. It also demonstrates the platform’s ability to attract borrowers and lenders.

A high loan volume indicates that the platform’s operations are effective and the market demand for the services offered is high. Along with the current loan volume, one shall pay attention to the dynamics. If the value is growing, it means that the platform is developing its activities and its revenues are growing.

On the other hand, focusing only on this indicator is not correct because a high total loan volume doesn’t mean that all loans are of high quality. It is also usually affected by the general economic situation and lowers in unfavorable conditions.

To improve the total loan volume metric, one may organize marketing campaigns to reach potential borrowers, start collaborations with financial institutions, and even develop an affiliate program to encourage existing clients to bring new lenders and borrowers.

Default rate

A defaulted loan occurs when a borrower fails to meet its legal obligations, which normally results in a delay in repayments or the inability to make repayments at all. A high default rate means that the platform shall implement better risk management criteria (for example, analyze the profiles of defaulted borrowers to determine the most common risk criteria, organize financial guidance services for borrowers to help them manage funds efficiently, etc.) and make adjustments in lending processes.

A default rate of less than 5%2 is considered fine for the lending industry.

Average loan amount

The average loan amount is the average value of all loans issued through a platform over a specific period of time. This indicator helps assess the platform’s lending behavior. It helps borrowers understand their perspectives and set realistic expectations. Investors use this indicator to assess the risk and return potential for different loan amounts. A platform uses it to build offerings based on borrower demand.

This indicator, however, doesn’t reflect individual borrowers’ needs when they request a loan and doesn’t consider seasonal fluctuations in specific markets.

To calculate the average loan amount, sum all the loans issued and divide by their amount.

Return on investment

This metric provides insight into how efficient the platform is when generating income for its investors, and for investors, it helps to assess how much income they can expect. It also shows how healthy the platform is and whether it has perspectives for the future.

On the other hand, this indicator can be impacted by defaulted loans, and sometimes, historical performance isn’t indicative of future trends.

Here is how you calculate return on investment:

Return on investment = (total returns / total investment) * 100

For example, if you have invested $1,000, and your return is $120 per year, your return on investment will be: (120/1,000)*100 = 12%.

To improve this indicator, a platform can organize campaigns to attract high-profile borrowers and diversify loans to minimize risk exposure.

Loan approval rate

The loan approval rate shows the number of loans approved compared with the number of loan applications received. A high approval rate indicates that the platform can attract high-tier investors and demonstrates that it has a broad lending strategy.

On the other hand, elevated approval rates may indicate improper due diligence and lead to increased risks if less-qualified borrowers are accepted. It also doesn’t consider the performance of loans that were approved, for example, it leaves out such an indicator as a default rate.

The loan approval rate is calculated as follows:

(The number of approved loans / the number of loan applications) * 100 = the loan approval rate.

A loan approval rate between 30 and 60%4 is considered normal for the P2P lending sector, but some platforms may have it much higher.

Fees per loan

Fees form the revenue generated by a P2P platform, this is why it is crucial to understand and track this metric if one wants to stay in the market and ensure the platform’s growth. This metric provides insight into the revenue streams and helps to assess the platform’s financial health.

However, it doesn’t show the level of borrower satisfaction, and high fees can also deter borrowers from using that platform.

This metric is calculated as follows.

Fees per loan = total fees collected / total number of loans.

In the P2P lending sector, fees between 1% and 5% are considered normal; however, this also depends on the types of loans the platform deals with.

Investor retention rate

This metric measures the percentage of investors who continue their investment activities through the platform. This indicator helps to assess the platform’s attractiveness and reflects the investors’ trust in the platform’s ability to generate returns for them.

For a platform, it also helps to forecast the future revenues from these investors.

This indicator doesn’t indicate the reasons behind the investors’ attention. Also, a high retention rate doesn’t always mean high investment amounts.

The following formula may be used to calculate the investor retention rate.

Investor retention rate = (the number of investors at the end of a selected period / the number of investors at the beginning of a selected period) * 100

How to launch a P2P lending platform with LenderKit

If you are thinking of launching a P2P lending platform, you have several options:

- You may develop it from scratch, which takes time and is expensive.

- Use a white-label P2P lending software from LenderKit which allows you to launch the platform in no time and build on top of it as your business grows.

LenderKit investment software comes with a set of readily available features and integrations that allow your platform to jump from a prototype to a fully-operational online investment busienss. Our software can further be customized to meet your business needs and regulatory requirements. To discuss details and see how it all works, please contact our team.