Real Estate Collateral Loans: Investment Platform Guide

Real estate, including residential and commercial property, is frequently used as collateral for loans to protect lenders if a borrower defaults. Homeowners can benefit from real estate equity loans, businesses can expand their operations through real estate lending and rentals, and investors can earn up to 15% interest annually.

Each loan type has its pros and cons and is suitable for a specific type of investor.

What you will learn in this post:

Real Estate Loans

Real estate loans allow you to earn a fixed interest which is paid monthly, quarterly, or at the end of the loan period. Such loans are relatively safe because they are collateralized, in other words, the property is used to guarantee that the loan will be repaid. The collateral property can be any type of real estate that has value and doesn’t depreciate quickly: residential, investment, business, and other real estate types.

If a borrower ever defaults on the loan, such collateral property can be sold, and the lenders could recoup their investments.

Rental Properties

Investing in rental properties works as follows: a company purchases property and sub-lends it to tenants. Investors get a stake in the property and earn their share of monthly rental payments.

When the contract expires, the property can be sold, and investors get their share of return from capital gain, if any.

The main benefit of investing in rental property is the opportunity to earn passive income in the long term. However, if the property is not rented, there is no income.

Real Estate Equity

Finally, by investing in real estate equity, investors get a share in the property. This loan type is used mainly by real estate developers to raise money quickly. After the project is completed, its developer aims to sell it with an additional margin, from which investors receive their share of a capital gain.

When investing in real estate equity, investors commit their money until the project is completed and sold. The high potential of revenue is one of the main benefits of this investment type; however, it comes with high risks in case the project is delayed or its value drops. This is one of the riskiest options of investment in real estate loans, this is why it is not recommended for investors with no or little experience.

Types of Collateral

Before investing in a project, it is important to understand what collateral is offered.

First-rank mortgages are the most common for such types of investments. They are considered a senior lien on the property, which means that in case of any claims against the collateral, the lender has priority. The terms of the first-rank mortgages are based on the property value and the borrower’s income and creditworthiness.

A second-rank mortgage is similar to a first-rank mortgage, but the difference is that it’s an additional mortgage on a home. Home equity loans, when a homeowner uses his equity as collateral, are an example of a second-rank mortgage. In such a case, a lender approves a loan that equals a portion of the equity.

Such loans are more risky for lenders because, in a case of default, the first-rank mortgages are paid first, and only then, the second-rank mortgages are paid.

Interest Rates and Minimum Investment

Interest rates vary greatly depending on the platform and the property type. Usually, lenders can count on an average interest rate of 7-15%.

The minimum investment also depends on the platform. There are lending platforms that enable investors to participate in real estate deals with as little as $50.

Top Real Estate Lending Platforms

The best real estate lending platforms are those that offer a variety of projects secured by first- and second-rank mortgages, profitable interest rates, and low loan-to-value (LTV). Here are some of them.

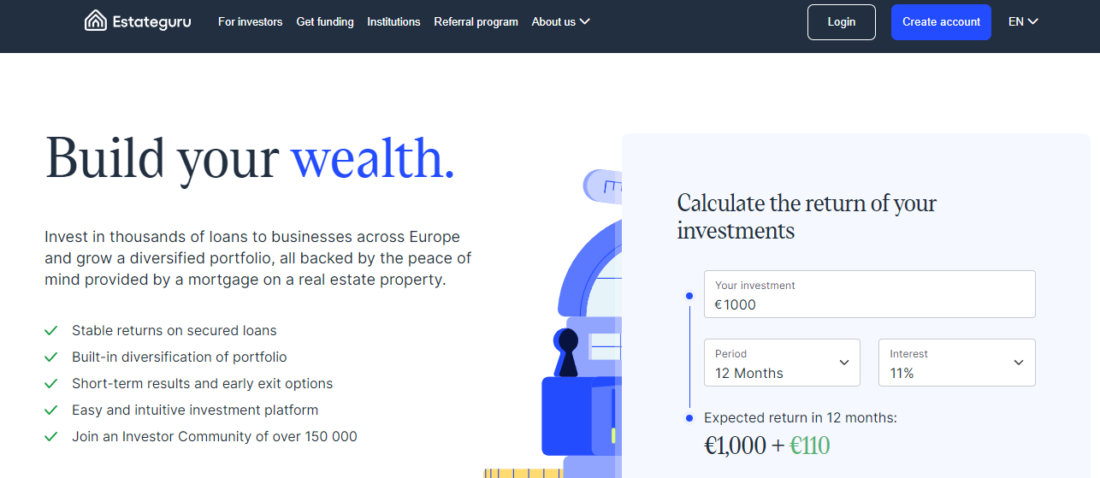

EstateGuru

EstateGuru allows investors to participate in top-tier real estate deals with as little as 50 Euros. All loans are property-backed, 95% are secured by a 1st rank mortgage. The average interest is 10%, and the maximum LTV is 75%.

Since its founding in 2014, the platform has helped property developers access funding easily and rapidly. With over 738 million euros funded, EstateGuru is one of the leading P2P lending platforms that operate in the European market.

Pros

- Secured loans

- An automated investment feature

- Stable returns

Cons

- No instant free withdrawals

- For long-term investments only

- Limited portfolio diversification

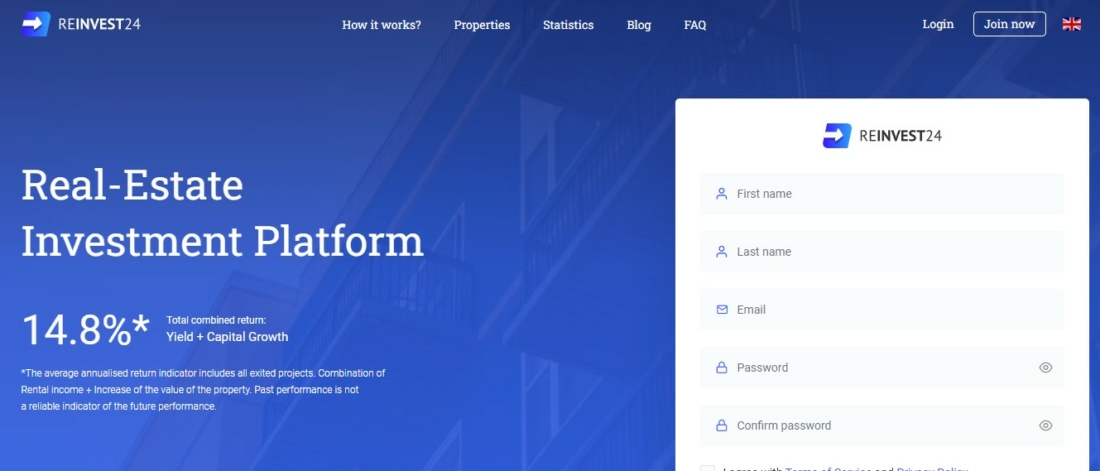

Reinvest24

Reinvest24 is one of the leading real estate lending platforms that offers loans secured by 1st and 2nd-rank mortgages. It allows lenders to invest in rental, real estate backed loans, NPL loans, and development real estate projects with as little as 100 Euros. The availability of trading in secondary markets allows investors to sell their shares in rental deals anytime.

The option of automatic investment is not available.

Pros

- An opportunity to get monthly income from rental payments

- Secured loans

- High yield

Cons

- Low portfolio diversification

- Low transparency

Profitus

Profitus is a real estate investment platform located in Lithuania. It enables investors to tap into promising real estate projects with only 100 Euros, with an average interest of 10%.

All loans are secured by 1st and 2nd-rank mortgages. The maximum LTV is 70%.

Profitus lists real estate development and rental projects and allows investors to benefit from investing in business loans secured by real estate.

Pros

- User-friendly

- Secured loans

Cons

- No secondary markets

- Not many projects

Max Crowdfund

Max Crowdfund is a platform registered in the Netherlands. It allows investing in real estate loans with as little as 100 Euros and earning approx 10% of annual yield.

The platform operates in the European market but focuses on loans in UK & Germany. Even though the maximum LTV is 90% is higher than the one offered by other leading platforms, all loans are backed by a first-rank mortgage, and the platform has a 0% default rate.

The secondary markets and an auto-invest functionality are not available.

Pros

- Low minimum investment

- A focus on the UK market

- Secured loans

Cons

- High LTV

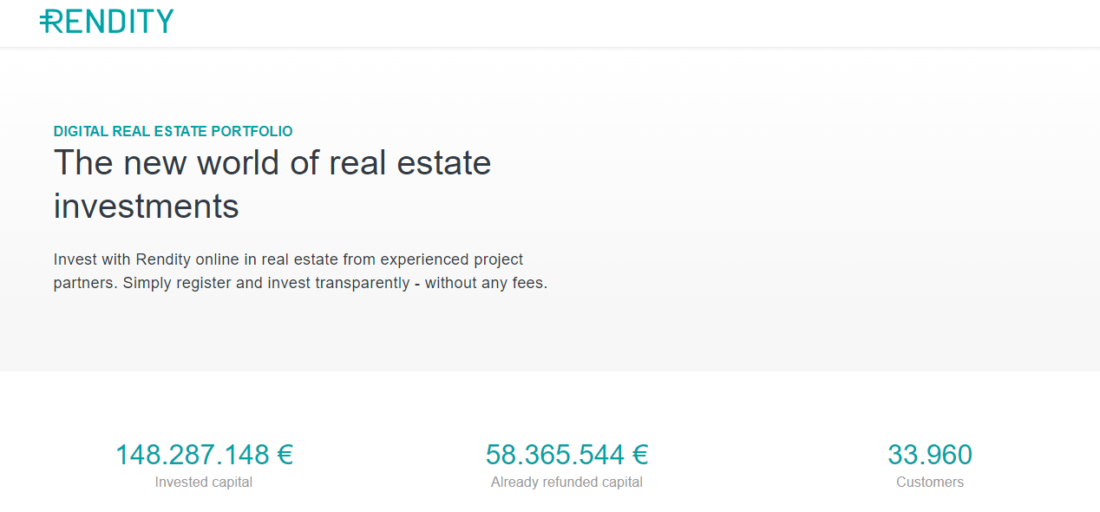

Rendity

Rendity is a real estate investment platform and a financial advisor registered in Austria. With a minimum of 500 euros, investors can invest in real estate development loans and rental property and earn up to 7% of yield. All loans are secured by a mortgage.

Pros

- A wide variety of real estate projects

- Excellent reputation

Cons

- A high minimum investment

- No secondary markets

- Yields are lower than the average

How to Create a Real Estate Lending Platform with LenderKit

Launching a real estate lending platform requires expertise, time, and money. With fully customizable LenderKit white-label real estate crowdfunding software, you can handle it faster and cheaper by providing your customers with all the required functionalities.

Using LenderKit software for real estate loans or crowdfunding management, you can set up a portal for your investors and borrowers where they can manage all that they need: campaigns, payments, investments, connect and top-up wallets, and so on. The user verification process can be automated with a third-party KYC/AML provider, or your team can process all the requests manually.

A pre-built loan calculator enables real estate developers to calculate the loan conditions and apply for a loan directly on your platform. Borrowers can get a quote based on your platform’s conditions and create offerings automatically that are later submitted to your admin for approval.

A powerful back office allows you to automate full-cycle loan management, including permitting investors to trade on secondary markets, integrating CRM and marketing automation solutions, setting up new user roles, and whatever you need to manage your lending business effectively.

To see how the solution works, please schedule a demo session, and if you want to discuss your requirements, you are welcome to contact our sales team.